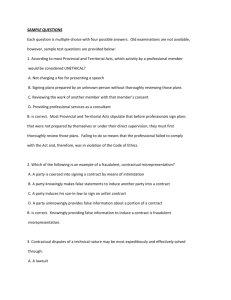

Lecture 18

advertisement

Econ 522 Economics of Law Dan Quint Fall 2015 Lecture 18 Logistics Second midterm is Wednesday Exam is cumulative – includes property and contract law, but not tort law No class next week (either day) – happy Thanksgiving! HW4 not due until December 10 – I’ll post after midterm 1 Recapping Last week in tort law, we considered the incentives created by different liability rules for… Precaution by injurers Precaution by victims Activity levels of injurers Activity levels of victims And what changes when these rules are implemented with errors Natural to ask… 2 Does it all really matter? Gary Schwartz, Reality in the Economic Analysis of Tort Law: Does Tort Law Really Deter? Reviews a wide range of empirical studies Finds: tort law does affect peoples’ behavior, in the direction the theory predicts… …but not as strongly as the model suggests Gary Schwartz, Reality in the Economic Analysis of Tort Law: Does Tort Law Really Deter? Reviews a wide range of empirical studies Finds: tort law does affect peoples’ behavior, in the direction the theory predicts… …but not as strongly as the model suggests Most academic work either… took the model literally, or pointed out reasons why model was wrong and liability rules might not affect behavior at all Schwartz: the truth is somewhere in between Gary Schwartz, Reality in the Economic Analysis of Tort Law: Does Tort Law Really Deter? “Yet between the economists’ strong claim that tort law systematically deters and the critics’ response that tort law rarely if ever deters lies an intermediate position: tort law, while not as effective as economic models suggest, may still be somewhat successful in achieving its stated deterrence goals. …The information [in various studies] suggests that the strong form of the deterrence argument is in error. Yet it provides support for that argument in its moderate form: sector-by-sector, tort law provides something significant by way of deterrence.” Gary Schwartz, Reality in the Economic Analysis of Tort Law: Does Tort Law Really Deter? “Much of the modern economic analysis, then, is a worthwhile endeavor because it provides a stimulating intellectual exercise rather than because it reveals the impact of liability rules on the conduct of real-world actors. Consider, then, those public-policy analysts who, for whatever reason, do not secure enjoyment from a sophisticated economic proof – who care about the economic analysis only because it might show how tort liability rules can actually improve levels of safety in society. These analysts would be largely warranted in ignoring those portions of the law-and-economics literature that aim at finetuning.” Gary Schwartz, Reality in the Economic Analysis of Tort Law: Does Tort Law Really Deter? Worker’s compensation rules in the U.S. Employer is liable – whether or not he was negligent – for economic costs of on-the-job accidents Victim still bears non-economic costs (pain and suffering, etc.) “…Worker’s compensation disavows its ability to manipulate liability rules so as to achieve in each case the precisely efficient result in terms of primary behavior; It accepts as adequate the notion that if the law imposes a significant portion of the accident loss on each set of parties, these parties will have reasonably strong incentives to take many of the steps that might be successful in reducing accident risks.” Relaxing the assumptions of our model 9 Our model thus far has assumed… So far, our model has assumed: People are rational Injurers pay damages in full They don’t run out of money and go bankrupt There are no regulations in place other than the liability rule There is no insurance Litigation is costless We can think about what would happen when each of these assumptions is violated 10 Assumption 1: Rationality Behavioral economics: people systematically misjudge value of probabilistic events Daniel Kahneman and Amos Tversky, “Prospect Theory: An Analysis of Decision under Risk” 45% chance of $6,000 versus 90% chance of $3,000 Most people (86%) chose the second 0.1% chance of $6,000 versus 0.2% chance of $3,000 Most people (73%) chose the first But under expected utility, either u(6000) > 2 u(3000), or it’s not So people don’t actually seem to be maximizing expected utility And the “errors” have to do with how people evaluate probabilities 11 Assumption 1: Rationality People seem to overestimate chance of unlikely events with well-publicized, catastrophic events Freakonomics: people fixate on exotic, unlikely risks, rather than more commonplace ones that are more dangerous 12 Assumption 1: Rationality People seem to overestimate chance of unlikely events with well-publicized, catastrophic events Freakonomics: people fixate on exotic, unlikely risks, rather than more commonplace ones that are more dangerous How to apply this: accidents with power tools Could be designed safer, could be used more cautiously Suppose consumers underestimate risk of an accident Negligence with defense of contributory negligence: would lead to tools which are very safe when used correctly But would lead to too many accidents when consumers are irrational Strict liability would lead to products which were less likely to cause 13 accidents even when used recklessly Assumption 1: Rationality Another type of irrationality: unintended lapses “Many accidents result from tangled feet, quavering hands, distracted eyes, slips of the tongue, wandering minds, weak wills, emotional outbursts, misjudged distances, or miscalculated consequences” 14 Assumption 2: Injurers pay damages in full Strict liability: injurer internalizes expected harm done, leading to efficient precaution But what if… Harm done is $1,000,000 Injurer only has $100,000 So injurer can only pay $100,000 But if he anticipates this, he knows D << A… …so he doesn’t internalize full cost of harm… …so he takes inefficiently little precaution Injurer whose liability is limited by bankruptcy is called judgment-proof 15 Example of judgment-proofness (from old final exam) Owner of an oil tanker Any accident would be an environmental catastrophe, doing $50,000,000 of harm Upgraded navigation system would cost $225,000, and reduce likelihood of an accident from 1/100 to 1/500 Precaution reduces expected harm from $500,000 to $100,000, costs $225,000, so efficient to take precaution If company would be forced to pay $50,000,000 after an accident, then under strict liability, would choose to buy new nav system Suppose the business is only worth $5,000,000 If there’s an accident, pay the $5,000,000 and go out of business Now nav system reduces expected damages from $50,000 to $10,000 – not worth the cost 16 So judgment-proof business would take too little precaution Assumption 3: No regulation What stops me from speeding? If I cause an accident, I’ll have to pay for it Even if I don’t cause an accident, I might get a speeding ticket Similarly, fire regulations might require a store to have a working fire extinguisher Regulations supply additional incentive to take precaution 17 Continuing the example of judgment-proofness from before… We saw, if business is only worth $5,000,000, liability does not create enough incentive to upgrade nav system Now suppose government passes regulation requiring modern navigation systems on all oil tankers If business doesn’t upgrade, 1 in 5 chance of being caught by safety inspector and having to pay a $1,000,000 fine Now, combining liability with regulation… Upgrade: cost of new nav system is $225,000, expected damages are $10,000 private cost is $235,000 Don’t upgrade: expected damages are $50,000, expected government fine is $200,000 private cost is $250,000 Liability + regulation gives enough incentive to take precaution, even though either one alone would not be enough 18 Assumption 3: No regulation When liability > injurer’s wealth, liability does not create enough incentive for efficient precaution Regulations which require efficient precaution solve the problem Regulations also work better than liability when accidents impose small harm on large group of people 19 Assumption 4: No insurance We assumed injurer or victim actually bears cost of accident When injurer or victim has insurance, they no longer have incentive to take precaution But, insurance tends not to be complete 20 Assumption 4: No insurance Insurance reduces incentive to take precaution Moral hazard Insurance companies have ways to reduce moral hazard Deductibles, copayments Increasing premiums after accidents Insurers may impose safety standards that policyholders must meet 21 Assumption 5: Litigation costs nothing If litigation is costly, this affects incentives in both directions If lawsuits are costly for victims, they may bring fewer suits Some accidents “unpunished” less incentive for precaution But if being sued is costly for injurers, they internalize more than the cost of the accident So more incentive for precaution 22 An example from Polinsky, “An Introduction to Law and Economics” I hit you with my car and did $10,000 worth of damage We both know I was negligent But courts aren’t perfect If we go to trial, 80% chance I’ll be found liable, 20% I won’t If I’m held liable, damages are correctly set at $10,000 So on average, if we go to trial, you expect to recover $8,000 But if we go to trial, we both have to hire lawyers Suppose this costs us each $3,000 Now your expected gain from going to trial is $8,000 – 3,000 = 5,000 And my expected cost is $8,000 + 3,000 = 11,000 23 Why does costly litigation matter? Under strict liability… We said injurers internalize cost of accidents efficient precaution But this assumes cost of being sued = damage done If courts are unpredictable and litigation is costly, private cost of being sued for damages could be > or < cost of accident Which could lead to too much or too little precaution But also… If we can’t settle out of court and cases go to trial… …then social cost of an accident includes both the harm done, and the resources expended during the trial! If trial costs $6,000, then social cost of the accident isn’t $10,000, but $16,000 – which increases the efficient level of precaution 24 With costly litigation comes possibility of “nuisance suit” Nuisance suit – lawsuit with no legal merit, purely meant to extract an out-of-court settlement Suppose trial costs $10,000 for plaintiff but $50,000 for defendant If case goes to trial, plaintiff will get nothing Threat points are -10,000 and -50,000 Gains from cooperation if settlement reached are 60,000 If gains are split evenly, defendant pays settlement of $20,000, even though case had no merit 25 Who pays the costs of a trial? In U.K., loser in a lawsuit often pays legal expenses of winner Discourages nuisance suits But also discourages suits where there was actual harm that may be hard to prove In U.S., each side generally pays own legal costs But some states have rules that change this under certain circumstances 26 Who pays the costs of a trial? Rule 68 of Federal Rules of Civil Procedure “At any time more than 10 days before the trial begins, a party defending against a claim may serve upon the adverse party an offer [for a settlement]… If the judgment finally obtained by the offeree is not more favorable than the offer, the offeree must pay the costs incurred after the making of the offer.” “Fee shifting rule” Example I hit you with my car, you sue Before trial, I offer to settle for $6,000, you refuse If you win at trial, but damages are only $5,000… …then under Rule 68, you would have to pay me for all my legal expenses after I made the offer 27 Who pays the costs of a trial? Rule 68 does two things to encourage settlements: Gives me added incentive to make a serious settlement offer Gives you added incentive to accept my offer But not actually as generous as it sounds Not all expenses are covered Asymmetric Plaintiff is penalized for rejecting defendant’s offer Defendant is not penalized for rejecting offer from plaintiff 28 A clever (but unrealistic) way to reduce litigation costs At the start of every lawsuit, flip a coin Heads: lawsuit proceeds, damages are doubled Tails: lawsuit immediately dismissed Expected damages are the same same incentives for precaution But half as many lawsuits to deal with! 29 Perfect Compensation 30 Perfect compensation Perfect compensatory damages (D = A) Returns victim to original level of well-being (Works like insurance) And sets correct incentive for injurers But in some cases, hard to determine level Might be no price at which you’d be willing to give up a leg Certainly no price at which a parent would be indifferent toward losing a child 31 Perfect compensation Recommended jury instructions, Massachusetts: “Recovery for wrongful death represents damages to the survivors for the loss of value of decedent’s life. There is no special formula under the law to assess the plaintiff’s damages… It is your obligation to assess what is fair, adequate, and just. You must use your wisdom and judgment and your sense of basic justice to translate into dollars and cents the amount which will fully, fairly, and reasonably compensate the next of kin for the death of the decedent. You must be guided by your common sense and your conscience on the evidence of the case…” And from California: “…You should award reasonable compensation for the loss of love, companionship, comfort, affection, society, solace or moral support.” 32 One other odd feature of compensatory damages… Most people would rather be horribly injured than killed Which means killing someone does more damage than injuring someone But compensatory damages tend to be lower for a fatal accident than an accident which crippled someone When someone is badly injured, may require huge amount of money to compensate them In wrongful-death case, damages compensate victim’s loved ones, but no attempt to compensate victim So these damages tend to be smaller 33 What’s a life worth? 34 What’s a life worth? Assessing damages in a wrongful death lawsuit requires some notion of what a life is worth Safety regulators also need some notion of what a life is worth Kip Viscusi, The Value of Risks to Life and Health Regulation Estimated cost per life saved Airplane cabin fire protection $ 200,000 Car side door protection standards $ 1,300,000 OSHA asbestos regulations $ 89,300,000 EPA asbestos regulations $ 104,200,000 Proposed OSHA formaldehyde standard $72,000,000,000 Regulators need to decide “where to draw the line” 35 Kip Viscusi, The Value of Risks to Life and Health Let w be starting wealth, p probability of death There might be some amount of money M such that p u(death) + (1 – p) u(w+M) = u(w) Breaks down when p = 1 not because can’t equate death with compensation, but because second term vanishes If we can find M, we can “solve for” u(death)! Ask a bunch of people how much money they would need to take a 1/1000 chance of death? Do a lab experiment where you expose people to a risk of death? Better idea: impute how much compensation people require from the real-life choices they make 36 Kip Viscusi, The Value of Risks to Life and Health Lots of day-to-day choices increase or decrease our risk of death Choose between Volvo and sports car with fiberglass body Take a job washing skyscraper windows, or office job that pays less Buy smoke detectors and fire extinguishers, or don’t “Hand Rule Damages” Hand Rule: precaution is cost-justified if cost of precaution < reduction in accidents X cost of accident Suppose side-curtain airbags reduce risk of fatal accident by 1/1000 If someone pays $1,000 extra for a car with side-curtain airbags, it must mean that $1,000 < 1/1000 * value of their life or, implicitly, they value their life more than $1,000,000 37 Kip Viscusi, The Value of Risks to Life and Health Viscusi surveys lots of existing studies which impute value of life from peoples’ decisions Many use wage differentials How much higher are wages for risky jobs compared to safe jobs? Others look at… Decisions to speed, wear seatbelts, buy smoke detectors, smoke cigarettes Decision to live in very polluted areas (comparing property values) Prices of newer, safer cars versus older, more dangerous ones Some used surveys to ask how people would make tradeoffs between money and safety Each paper reaches some estimate for implicit value people attach to their lives 38 What does Viscusi find? 39 ie sn e Sm r & ith Lee th Th & (1 a G Ar ler ilbe 991 rt no & ) ul Ro (19 d & sen 84) Ni (1 D cho 976 illi ng ls (1 ) ha 9 m 83) Bu (19 tle 85 ) r G Bro (19 e wn 83 M g M a ar ) in oor x e (19 e t. & 80 Ps & V al. ) (1 ac is 99 Kn har cus sp i (1 1) ie sn ou 98 er lo 8) C s ou & L ( si e 19 ne et h 82 au (1 ) 99 D et 1) illi al n Vi ( sc gha 19 us m 88) i( 19 (19 78 85 ) S m , 19 ith 79) O ( 19 ls 76 o ) Vi n ( sc 19 us 8 1 M i( ) oo re Sm 198 ith & 1) M oo Vi s ( 19 r Kn e & cus 74 Vi i (1 ) ie sn s 98 e cu 8) Vi r & si H Le (19 er scu zo si et 88 h ) & g & M (19 S o 9 Le chl ore 1) ot ig tm (19 h Le & F an 89 ( ol ig so 198 h & m 7 Fo (1 ) ls om 984 ) Le ( 19 84 ig M h ) oo re Ga (19 & ren 87) M oo Vi sc (19 re us 8 8 & Vi i (1 ) sc 9 us 9 0 ) i( 19 90 ) Implicit value of life Kn What does Viscusi find? 24 studies based on wage differentials 20,000,000 15,000,000 10,000,000 5,000,000 0 40 What does Viscusi find? 7 studies using other risk-money tradeoffs Nature of Risk, Year Component of the Monetary Tradeoff Implicit Value of life ($ millions) Highway speed-related accident risk, 1973 Value of driver time based on wage rates 0.07 Automobile death risks, 1972 Estimated disutility of seat belts 1.2 Fire fatality risks without smoke detectors, 1974-1979 Purchase price of smoke detectors 0.6 Mortality effects of air pollution, 1978 Property values in Allegheny Co., PA 0.8 Cigarette smoking risks, 1980 Estimated monetary equivalent of effect of risk info 0.7 Fire fatality risks without smoke detectors, 1968-1985 Purchase price of smoke detector 2.0 Automobile accident risks, 1986 Prices of new automobiles 4.0 41 What does Viscusi find? 6 studies based on surveys Nature of Risk Survey Methodology Implicit Value of Life ($ millions) Improved ambulance service, post-heart attack lives Willingness to pay question, door-to-door small (36) Boston sample Airline safety and locational life expectancy risks Mail survey willingness to accept increased risk, small (30) U.K. sample, 1975 Job fatality risk Willingness to pay, willingness to accept change in job risk in mail survey, 1984 3.4 (pay), 8.8 (accept) Motor vehicle accidents Willingness to pay for risk reduction, U.K. survey, 1982 3.8 Automobile accident risks Interactive computer program with pairwise auto risk-living cost tradeoffs until indifference achieved, 1987 Traffic safety Series of contingent valuation questions, New Zealand survey, 1989-1990 0.1 15.6 2.7 (median) 9.7 (mean) 1.2 42 What does Viscusi find? Wide range of results Most suggest value of life between $1,000,000 and $10,000,000 Many clustered between $3,000,000 and $7,000,000 Even with wide range, he argues this is very useful: “In practice, value-of-life debates seldom focus on whether the appropriate value of life should be $3 or $4 million… However, the estimates do provide guidance as to whether risk reduction efforts that cost $50,000 per life saved or $50 million per life saved are warranted.” “The threshold for the Office of Management and Budget to be successful in rejecting proposed risk regulations has been in excess of $100 million.” C&U: NHTSA uses $2.5 million for value of traffic fatality Current: EPA $9.1 MM, FDA $7.9 MM, Transpo Dept $6 MM 43 More twists on liability (probably won’t get to) 44 Vicarious Liability Vicarious liability is when one person is held liable for harm caused by another Parents may be liable for harm caused by their child Employer may be liable for harm caused by employee Respondeat superior – “let the master answer” Employer is liable for torts of employee if employee was acting within the scope of his employment 45 Vicarious Liability Gives employers incentive to... be more careful who they hire be more careful what they assign employees to do supervise employees more carefully Employers may be better able to make these decisions than employees… …and employees may be judgment-proof 46 Vicarious Liability Vicarious liability can be implemented through… Strict liability rule: employer liable for any harm caused by employee (as long as employee was acting within scope of employment) Negligence rule: employer is only liable if he was negligent in supervising employee Which is better? It depends. If proving negligent supervision is too hard, strict vicarious liability might work better But an example favoring negligent vicarious liability… 47 Joint and Several Liability Suppose you were harmed by accident caused by two injurers Joint liability: you can sue them both together Several liability: you can sue each one separately Several liability with contribution: each is only liable for his share of damage Joint and several liability: you can sue either one for the full amount of the harm Joint and several liability with contribution: the one you sued could then sue his friend to get back half his money 48 Joint and Several Liability Joint and several liability holds under common law when… Defendants acted together to cause the harm, or… Harm was indivisible (impossible to tell who was at fault) Good for the victim, because… No need to prove exactly who caused harm Greater chance of collecting full level of damages Instead of suing person most responsible, could sue person most likely to be able to pay 49