Financial Accountability Training

advertisement

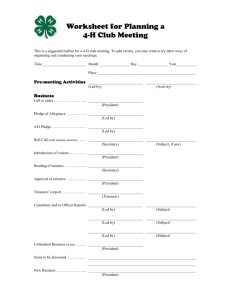

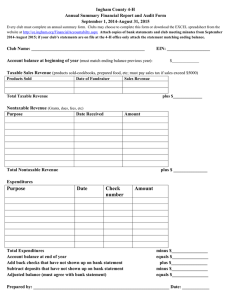

Financial Accountability Update & Review Ingham County 4-H Clubs August 19, 2008 Why practice financial accountability in 4-H clubs??? • Ensures public accountability for funds raised in the name of 4-H • IRS requirements have increased reporting requirements for non-profit groups including 4-H • Use of appropriate financial management practices by 4-H clubs and groups is an important learning experience for 4-H members Background for MSU Extension Accountability Policy • In 2000, MSUE experienced several potential embezzlements by volunteers in MSUE programs. As a result of this experience and the subsequent investigation, a Financial Accountability Policy was developed for MSU Extension Offices. • In 2006, new IRS policies required more extensive reporting by non-profit groups & Pension Protection Act of 2006 also added new reporting requirements. MSU Extension Financial Guidelines • A policy was adopted for all MSUE Offices in May, 2003 to be in place by December, 2003. This policy was revised in 2007. In order for offices to comply with the policy, all MSUE sponsored groups will need to provide documentation of activity. • 4-H clubs and groups (councils, boards and committees) are the largest segment of sponsored groups for MSUE. Record Keeping • Good record keeping is the key to effective internal controls • Records should include: cash received, where money came from, and payments made • Club should keep running total of assets using check register or “Record of Club Finances” from the Treasurer’s Book • Keep records for at least 5 years in case of an audit Treasurer’s book • Reproducible documents for club financial reporting • Detailed guidelines and instructions for club treasurer & leaders EIN & Bank accounts • All groups are now required to have an EIN, regardless of whether or not they maintain a treasury. This number must be provided to the county Extension Office. • If you maintain a treasury, you must also report this number to the bank. • Club accounts should have at least 3 signatories: treasurer & 2 unrelated adult leaders Clubs with multiple bank accounts • Combined total determines if > $2500 • Submit bank statements from all accounts • Reports – All combined into 1 report – Individual report for each separate account IRS Form 990, e-postcard • All 4-H clubs and groups are now required to file an IRS 990 epostcard if they do not have more than $25,000 in gross income. County Extension offices are responsible for filing this document with the IRS annually. • Groups with more than $25,000 in gross income for 3 consecutive years must file IRS Form 990. Creating a club budget • A written plan to raise and spend money for 1 year. • The members of the club/group approve the budget at the beginning of the year. A budget allows clubs to approve payment of items included in the budget. • If the club/group does not have a budget, or items arise that are not a part of the budget, each item must be presented to members for approval before payment is made. • An annual budget accomplishes two things. – All expenditures of club funds are made with full approval of the club/group. – It is a great way for members to learn how money flows in and out of an organization. Receiving Funds • A pre-numbered, carbon copy receipt should be written for all money received and become part of the club’s records • Receipts for dues & project fees • Receipts for fundraisers • Non-cash donations should also be acknowledged in writing • Deposit all funds promptly Membership fees form • A record of all fees paid by members throughout the year. • A receipt should be written for each date fees are collected • Individual receipts not necessary when using membership fee form 2008-2009 Membership Fees Record 4-H Club: Record the amount and date paid under each column. Identify each project column (ex. Project 1 shooting sports, Project 2 cooking). Add additional project columns as needed. 4-H Member's Name Participation Fee Club dues paid Fair fees paid Project Fee Paid Project Fee Paid Project Fee paid Paying bills • Any payments should be made in response to a formal written bill or invoice. • A request for payment form should be used for non-budgeted items. • A payment voucher, including an itemized invoice or receipt clearly stating what was billed, with the check number and date of the check on it should be maintained as a permanent part of the treasurer’s records. • Clubs without a checking account should purchase checks or money orders from the bank to use in paying bills and making reimbursements—never use cash Monthly Treasurer’s Report • Informs members of the group’s financial activity for the past month. • Must be presented to the group during monthly meeting. • Club votes to receive the treasurer’s report and place on file for audit after it is reviewed and verified that it is reconciled with the monthly bank statement. • Next month’s bills presented for approval • A copy is filed with the secretary minutes, the original is filed with the treasurer’s permanent records. Meeting minutes • 4-H clubs should meet 6 or more times during the 4-H year. • Minutes record the proceedings of the club business. • ALL financial transactions should be recorded in the meeting minutes. Bank statements • If your club fundraises more than $2500 OR maintains a bank balance of more than $2500 per year all bank statements must be sent directly to the county extension office. • Clubs with less than $2500 should attach a copy to monthly treasurer’s report. Club reporting checklist 4-H Club Checklist for Accountability 4-H Club Year September 2008-August 2009 • Record for clubs to track reports submitted • Clubs over $2500 required to submit monthly • Clubs under $2500 highly encouraged to submit monthly This checklist is a tool for 4-H clubs to keep track of records submitted to the County Extension office. Each time you submit a report to the County Extension office record the date submitted on this record. All 4-H clubs and entities are responsible for reporting their financial records to the County Extension office. 4H clubs with multiple bank accounts should submit reports that include bank statements from each account (savings, checking, money market, etc.). Cirlce the type(s) of bank statements submitted each month. If you club does not hold a meeting during the month indicate on the form "no meeting". Failure to submit required documentation may lead to suspension of club privleges including use of the 4-H name and emblem. Club Inventory Record 2007-08 Annual Financial Report 2007-08 Audit Form 2007-08 Club Budget for 2008-09 September Bank Statement Savings Treasurer's Report Meeting Minutes October Bank Statement Savings Treasurer's Report Meeting Minutes November Bank Statement Savings Treasurer's Report Meeting Minutes December Bank Statement Savings Treasurer's Report Meeting Minutes January Bank Statement Savings Treasurer's Report Meeting Minutes February Bank Statement Savings Treasurer's Report Meeting Minutes March Bank Statement Savings Treasurer's Report Meeting Minutes Checking CD April Bank Statement Savings Treasurer's Report Meeting Minutes Checking CD May Bank Statement Savings Treasurer's Report Meeting Minutes Checking CD June Bank Statement Savings Treasurer's Report Meeting Minutes Checking CD July Bank Statement Savings Treasurer's Report Meeting Minutes Checking CD August Bank Statement Savings Treasurer's Report Meeting Minutes Checking CD Application Fundraiser 1 Fundraiser 2 Fundraiser 3 Club Inventory Record 2008-09 Annual Financial Report 2008-09 Audit Form 2008-09 Club Budget for 2009-10 Report Checking CD Checking CD Checking CD Checking CD Checking CD Checking CD Financial audit • Prior to submitting the annual financial report, 4-H clubs and groups need to conduct a review of the groups financial records and money management practices. Club inventory record • A running inventory of the club’s belongings • Must be completed by all clubs and groups Annual Summary Financial Report • Submit the annual financial report to the county extension office by: October 15th • Report covers period of 4-H year: September 1August 31 • Attach copy of beginning and ending bank statements to report—balance should match report • Transactions should be listed individually • Report form as a cover sheet – Excel program – Quicken/Quickbooks Fund Raising • All fundraising activities must be approved by MSUE staff prior to being held and include an educational component. • Fund raising activity reports must be submitted to the Extension office within 10 days of the fundraiser. • Fundraisers should benefit the good of the total group; all money raise using the 4-H name must be used ONLY for 4-H activities • 4-H clubs are discouraged from holding fundraisers that involve games of chance Sales tax • Clubs sell tangible items in excess of $5000 in one year are required to pay sales tax • Clubs may use the 4-H tax exempt number for educational purchases for their club • Groups owing sales tax should submit a check to MSU Extension with your financial summary report. Volunteer and member roles and responsibilities • MSU Extension Financial Accountability Policy depends on cooperation of countybased volunteer groups. MSU Extension staff roles and responsibilities • MSUE staff are required to investigate any questions related to the management or use of funds by 4-H clubs and groups. • Financial records of 4-H groups must be turned into the Extension office for review when requested. Outcomes • Following these financial management practices demonstrates that MSUE, 4-H and all of it’s sponsored groups are good stewards of the funds that have been entrusted to us by donors and supporters. • The organization and it’s sponsored groups are now in a stronger position to demonstrate effective systems of financial accountability and internal control to potential donors/funders. • Use of appropriate financial management practices by 4-H clubs and groups is an important learning experience for 4-H members Questions & Discussion