Economics for Today 2nd edition Irvin B. Tucker

advertisement

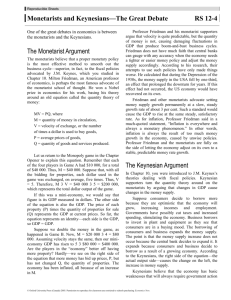

Chapter 26 Monetary Policy • Key Concepts • Summary • Practice Quiz • Internet Exercises ©2002 South-Western College Publishing 1 What are the three schools of economic thought? • Classical • Keynesian • Monetarist 2 What is the Keynesian view of money? People who hold cash or checking account balances incur an opportunity cost in foregone interest or profits 3 According to Keynes, why would people hold money? • Transactions demand • Precautionary demand • Speculative demand 4 What is the transactions demand for money? The stock of money people hold to pay everyday predictable expenses 5 What is the precautionary demand for money? The stock of money people hold to pay unpredictable expenses 6 What is the speculative demand for money? The stock of money people hold to take advantage of expected future changes in the price of bonds, stocks, or other nonmoney financial assets 7 How does a change in interest rates affect speculative demand? As the interest rate falls, the opportunity cost of holding money falls, and people increase their speculative balances 8 What is the demand for money curve? A curve representing the quantity of money that people hold at different possible interest rates, ceteris paribus 9 How do interest rates affect the demand for money? There is an inverse relationship between the quantity of money demanded and the interest rate 10 What gives the demand for money a downward slope? The speculative demand for money at possible interest rates 11 What determines interest rates in the market? The demand and supply of money in the loanable funds market 12 16% 12% 8% Interest Rate The Demand for Money Curve A B 4% Billions of dollars 500 MD 1,000 1,500 2,000 13 Increase in the quantity of money demanded Decrease in the interest rate 14 The Equilibrium Interest Rate 12% 8% MS Interest Rate 16% E 4% Billions of dollars 500 Surplus Shortage MD 1,000 1,500 2,000 15 Bond prices fall and the interest rate rises People sell bonds Excess money demand 16 Bond prices rise and the interest rate falls People buy bonds Excess money supply 17 Why do bond prices fall as interest rates rise? Bond sellers have to offer higher returns (lower price) to attract potential bond buyers, or else they will go elsewhere to get higher interest returns 18 Why do bond prices rise as interest rates fall? Bond sellers are put in a better bargaining position as interest rates fall (higher price); potential buyers cannot go elsewhere to get higher interest returns so easily 19 How can the Fed influence the equilibrium interest rate? It can increase or decrease the supply of money 20 16% 12% 8% Interest Rate Increase in the Money Supply MS1 MS2 Surplus E1 E2 MD 4% Billions of dollars 500 1,000 1,500 2,000 21 16% 12% 8% Interest Rate Decrease in the Money Supply MS2 MS1 Shortage E2 E1 MD 4% Billions of dollars 500 1,000 1,500 2,000 22 Decrease the interest rate Money surplus and people buy bonds Increase in the money supply 23 Increase in the interest rate Money shortage and people sell bonds Decrease in the money supply 24 In the Keynesian Model, what do changes in the money supply affect? Interest rates, which in turn affect investment spending, aggregate demand, and real GDP, employment, and prices 25 Change in the money supply Keynesian Change in Change in interest prices, real GDP, Policy rates & employment Change in the aggregate demand curve Change in investment 26 16% 12% 8% Interest Rate Expansionary Monetary Policy MS1 MS2 Surplus E1 E2 MD 4% Billions of dollars 500 1,000 1,500 2,000 27 16% 12% 8% Interest Rate Investment Demand Curve A B I 4% Billions of dollars 1,000 1,500 28 When will businesses make an investment? When the investment projects for which the expected rate of profit equals or exceeds the interest rate 29 155 150 Price Level Product Market AS E2 E1 full employment AD2 AD1 Billions of dollars 6.0 6.1 30 What is the Classical economic view? The economy is stable in the long-run at full employment 31 How did the Classical economists view the role of money? They believed in the equation of exchange 32 What is the equation of exchange? An accounting number of times per year a dollar of the money supply is spent on final goods and services 33 What is the velocity of money? The average number of times per year a dollar of the money supply is spent on final goods and services 34 Money Prices MV = PQ Velocity Quantity 35 What is the Monetarist Theory? That changes in the money supply directly determine changes in prices, real GDP, and employment 36 Change in the quantity of money Change in Monetarist Change in the money prices, real GDP, Policy supply & employment Change in the aggregate demand curve 37 What is the Quantity Theory of Money? The theory that changes in the money supply are directly related to changes in the price level 38 What is the conclusion of the Quantity Theory of Money? Any change in the money supply must lead to a proportional change in the price level 39 Who are the Modern Monetarists? Monetarist argue that velocity is not unchanging, but is nevertheless predictable 40 According to the Monetarist, how do we avoid inflation and unemployment? We must be sure that the money supply is at the proper level 41 Who is Milton Friedman? In the 1950’s and 1960’s, he was a leader in putting forth the ideas of the modernday monetarists 42 What does Milton Friedman advocate? The Federal Reserve should increase the money supply by a constant percentage each year to enhance full employment and stable prices 43 How do the Keynesians view the velocity of money? Over long periods of time, it can be unstable and unpredictable 44 The Velocity of Money 7 6 5 4 3 2 1 Year 40 50 60 70 80 90 00 45 What is the conclusion of the Keynesians? A change in the money supply can lead to a much larger or smaller change in GDP than the monetarists would predict 46 What is the crux of the Keynesian argument? Because velocity is unpredictable, a constant money supply may not support full employment and stable prices 47 What is the conclusion of the Keynesian argument? The Federal Reserve must be free to change the money supply to offset unexpected changes in the velocity of money 48 What are the main points of Classical economics? 49 • Economy tends toward a full employment equilibrium • Prices & wages are flexible • Velocity of money is stable • Excess money causes inflation • Short-run price & wage adjustments cause unemployment • Monetary policy can change aggregate demand & prices • Fiscal policies are not necessary 50 What are the main points of Keynesian economics? 51 • The economy is unstable at less than full employment • Prices & wages are inflexible • Velocity of money is stable • Excess demand causes inflation • Inadequate demand causes unemployment • Monetary policy can change interest rates and level of GDP • Fiscal policies may be necessary 52 What are the main points of the Monetarists? 53 • Economy tends toward a full employment equilibrium • Prices & wages are flexible • Velocity of money is predictable • Excess money causes inflation • Short-run price & wage adjustments cause unemployment • Monetary policy can change aggregate demand & prices • Fiscal policies are not necessary 54 What is the crowding-out effect? Too much government borrowing can crowd out consumers and investors from the loanable funds market 55 What is the Keynesian view of the crowding-out effect? The investment demand curve is rather steep (vertical), so the crowding-out effect is insignificant 56 What is the Monetarist view of the crowding-out effect? The investment demand curve is flatter (horizontal), so the crowding-out effect is significant 57 Key Concepts 58 Key Concepts • What are the three schools of economic thought? • What is the Keynesian view of money? • How can the fed influence the equilibrium interest rate? • In the Keynesian model, what do changes in the money supply effect? • What is the Classical economic view? 59 Key Concepts cont. • How did the Classical economists view the role of money? • What is the equation of exchange? • What is the velocity of money? • What is the quantity theory of money? • What is the conclusion of the quantity theory of money? • Who are the modern monetarists? 60 Key Concepts cont. • According to the monetarist, how do we avoid inflation and unemployment? • Who is Milton Friedman? • What does Milton Friedman advocate? • What is Classical economists? • What is Keynesian economists? • What is monetarism? 61 Summary 62 The demand for money in the Keynesian view consists of three reasons why people hold money: (1) Transactions demand is money held to pay for everyday predictable expenses. (2) Precautionary demand is money held to pay unpredictable expenses. (3) Speculative demand is money held to take advantage of price changes in nonmoney assets. 63 The demand for money curve shows the quantity of money people wish to hold at various rates of interest. As the interest rate rises, the quantity of money demanded is less than when the interest rate is lower. 64 16% 12% 8% Interest Rate The Demand for Money Curve A B 4% Billions of dollars 500 MD 1,000 1,500 2,000 65 The equilibrium interest rate is determined in the money market by the intersection of the demand for money and the supply of money curves. The money supply (M1), which is determined by the Fed, is represented by a vertical line. 66 An excess quantity of money demanded causes households and businesses to increase their money balances by selling bonds. This causes the price of bonds to fall, thus driving up the interest rate. 67 16% 12% 8% Interest Rate The Equilibrium Interest Rate MS E 4% Billions of dollars Surplus Shortage MD 500 1,000 1,500 2,000 68 An excess quantity of money supplied causes households and businesses to reduce their money balances by purchasing bonds. The effect is to cause the price of bonds to rise, and, thereby, the rate of interest falls. 69 The Keynesian view of the monetary policy transmission mechanism operates as follows: First, the Fed uses its policy tools to change the money supply. Second, changes in the money supply change the equilibrium interest rate, which affects investment spending. Finally, a change in investment changes aggregate demand and determines the level of prices, real GDP, and employment. 70 Monetarism is the simpler view that changes in monetary policy directly change aggregate demand and thereby prices, real GDP, and employment. Thus, monetarists focus on the money supply, rather than on the rate of interest. 71 The equation of exchange is an accounting identity that is the foundation of monetarism. The equation (MV = PQ) states that the money supply multiplied by the velocity of money is equal to the price level multiplied by real output. 72 The velocity of money is the number of times each dollar is spent during a year. Keynesians view velocity as volatile but monetarists disagree. 73 The quantity theory of money is a monetarist argument that the velocity of money (V) and the output (Q) variables in the equation of exchange are relatively constant. Given this assumption, changes in the money supply yield proportionate changes in the price level. 74 The monetarist solution to an inept Fed tinkering with the money supply and causing inflation or recession would be to have the Fed simply pick a rate of growth in the money supply that is consistent with real GDP growth and stick to it. 75 Monetarists’ and Keynesians’ views on fiscal policy are also different. Keynesians believe the aggregate supply curve is relatively flat, and monetarists view it as relatively vertical. Because the crowding out effect is large, monetarists assert that fiscal policy is ineffective. Keynesians argue that crowding out is small and that fiscal policy is effective. 76 END 77