File - LPS Business DEPT

advertisement

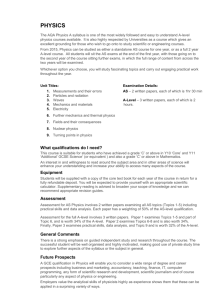

IAS 38 IAS 38 Intangible Assets IRFS 3 Goodwill Mr. Barry A-level Accounting Year 13 IAS 38 Definition • Intangible ASSETS are defined by IAS 38 as non-monetary assets without physical substance. They must be: – Identifiable – Controlled as a result of a past event – Able to provide future economic benefits Mr. Barry A-level Accounting Year 13 Internally generated goodwill • MAY NOT BE RECOGNISED AS AN ASSET – as cannot be measured reliably. Mr. Barry A-level Accounting Year 13 Research & Development Costs • Research – does not meet the criteria for recognition under IS 38, they should be written off as an expense as incurred. • Development- may qualify provided that strict criteria is met : (a) the technical feasibility of completing the intangible asset so that it will be available for use or sale (b) Its intention to complete the intangible asset and use or sell it (c) Its ability to use or sell the intangible asset Mr. Barry A-level Accounting Year 13 (d) How the intangible asset will generate future economic benefits. Entity should demonstrate the existence of a market for the output (e) The ability to measure the expenditure attributable to the intangible asset during its development reliably. Mr. Barry A-level Accounting Year 13 Revaluations • Revalued upwards to a FV = revaluation surplus. • if a revaluation surplus is a reversal of a revaluation decrease =- recognised as income. • downward revaluation =expense against income, unless the asset has previously been revalued upwards. A revaluation decrease should be first charged against any previous revaluation surplus in respect of that asset. Mr. Barry A-level Accounting Year 13 Amortisation period & method An intangible asset with a finite useful life should be amortised over its expected useful life: (a) start when the asset is available for use (b) Should cease at the earlier of the date the asset was classified as held for sale in accordance with IFRS 5 and the date that the asset is derecognised. (c) Method should reflect the pattern of consumption or use S/L. (d) charge = profit or loss account Mr. Barry A-level Accounting Year 13 Disposals / retirements of intangible assets • Should be eliminated from the Balance sheet • gain or loss = treated as income or expense Mr. Barry A-level Accounting Year 13 Summary • Intangible asset recognised if, and only if, it is probable that future economic benefits will flow to the entity and the cost can be measured reliably. • An asset is initially recognised at cost and subsequently carried at either cost or revalued amount. • Costs that do not meet the recognition criteria should be expenses in the period • Intangibles with a finite useful life should be amortised over its useful life. • Intangible with indefinite useful live should not be amortised. Mr. Barry A-level Accounting Year 13 IFRS 3 Goodwill Goodwill and Fair Values Mr. Barry A-level Accounting Year 13 What is Goodwill? • Created by good relationships between a business & customers: – Building a reputation – Responding promptly and helpfully – Personality of staff Mr. Barry A-level Accounting Year 13 Issue • cost of business combination < the net assets acquired • Difference is called GOODWILL and is measured under IFRS 3 as: Mr. Barry A-level Accounting Year 13 Accounting Treatment Goodwill Purchased (IFRS 3) Positive Capitalise and test annually for impairment Mr. Barry Internally Generated (IAS 38) Ignore Negative Reassess and then credit any remainder to IS A-level Accounting Year 13 Impairment Testing • Impairment tests are conducted in accordance with IAS 36 Impairment of Assets • Recognise in income statement in the year in which the impairment arises. • Normal accounting entry – – Debit Income Statement – Credit Asset • With the impairment loss Mr. Barry A-level Accounting Year 13