Reconciliation Best Practices

advertisement

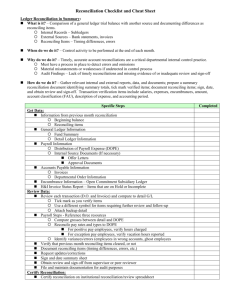

Reconciliation Best Practices May 12, 2015 Tricia Cook Budget & Fiscal Director Research and Economic Development Montana State University What Does “Reconcile” Mean in Accounting Terms? • In accounting, reconcile means to compare two sets of records to make sure they are in agreement • Most common type of reconciliation that most people are familiar with is a bank reconciliation where you compare a bank statement to your own records • At MSU, most of us will be reconciling our departmental financial records to Banner 2 What is the Purpose of Doing Reconciliations? • • • • Verify accuracy of transactions Identify and resolve errors in a timely manner Confirm accuracy of fund balances Maintain integrity of University’s accounting records so the information can be relied on for decision making • Ensure compliance with university, state and federal regulations, circulars and cost accounting standards 3 How Often Should Reconciliations be Done? • Normally, departmental funds should be reconciled monthly • Special circumstances such as very high volume or high risk activity may require more frequent reconciliations • Must balance effectiveness and efficiency 4 Who Reconciles and What is Required? Reconciling should be performed by someone with sufficient knowledge to: • Compare transactions appearing on financial reports to departmental records • Identify, investigate and resolve any unknown or unexpected transactions • Identify and correct coding errors, such as erroneous account codes 5 Who Reconciles and What is Required (cont.)? • Identify expected transactions that have not yet occurred and resolve problems • Report irregularities to appropriate authorities 6 How to Segregate Duties? • “Significant transactions” should not be controlled from start to finish by the same person • Significant transactions are large dollar amounts and transactions that are inherently more risky, such as cash handling and p-card transactions • Separating responsibilities for revenue collection and/or bill payment from reconciling is one way to accomplish segregation of duties • If not possible, strong review procedures are necessary 7 What Departmental Financial Records are Needed? Source documents supporting initiation and approval of transactions • Cash receipts, invoices • P-Card reports, BPAs, Corrections • Purchase Orders, Contracted Services Agreements • Hospitality Forms, Travel Authorizations • CatBooks/AgBooks, Quicken, QuickBooks, etc. 8 What Banner Finance Reports are Used? • Also know as SAIS Finance Reports, MSU SwitchBoard Reports, etc. • https://sais.montana.edu/cgi-bin/msu_sb_v3.pl • Use your Banner User ID and Password to login 9 Finance Reports for Reconciling General Ops Run by fiscal year, index and month • Operating Ledger Summary • Operating Ledger Transactions • Payroll Report Reconcile to the Budget, YTD Expenditures, and Encumbrances on the Operating Ledger Summary 10 Finance Reports for Reconciling General Ops 11 Finance Reports for Reconciling Designated Funds Run by Index, fiscal year and month • Operating Ledger Summary – Banner Form FGIBDST • Operating Ledger Transactions – Banner Form FGITRND • Payroll Report – Banner Form NHIDIST Run by Fund, fiscal year and month • General Ledger – Banner Form FGITBSR 12 Finance Reports for Reconciling Designated Funds (cont.) Reconcile to the Budget (if applicable), YTD Expenditures and Encumbrances on the Operating Ledger Summary Reconcile to the Cash in Treasury and/or the Fund Balance on the General Ledger 13 Finance Reports for Reconciling Designated Funds (cont.) Reconcile to the budget (if applicable), YTD expenditures and encumbrances on the Operating Ledger Summary Reconcile to the Cash in Treasury or the Fund Balance on the General Ledger 14 Finance Reports for Reconciling Designated Funds (cont.) Reconcile to the budget (if applicable), YTD expenditures and encumbrances on the Operating Ledger Summary Reconcile to the Cash Balance or the Fund Balance on the General Ledger 15 Finance Reports for Reconciling Grants Run by Index, fiscal year and month • Inception to Date – Banner Form FRIGITD • Operating Ledger Transactions – Banner Form FRITRND • Payroll Report – Banner Form NHIDIST Reconcile to the Budget, ITD Expenditures and Encumbrances on the Inception to Date report 16 17 Other Helpful Finance Reports Operating Ledger Transactions (FY) Operating Ledger Transactions ITD Operating Ledger Transactions (Month by Month) Payroll Report (FY) Payroll by Index or Org Encumbrance Detail Salary Billed Scholarships 18 19 20 Who Should Review Reconciliations and What is Required? Performed by someone with sufficient responsibility and authority to: • Ensure reconciliations are completed in a timely manner and errors are satisfactorily resolved • Review and evaluate fund activity and balances • Principal investigators should review their grant reports • Department head is ultimately responsible 21 How are Reconciliations Documented? Need to maintain a record of: • When reconciliation was done and by whom • Resolution of any errors • Proof of review by supervisor, principal investigator, department head, or whatever makes sense in your organization 22 Who to Contact with Questions? • Your HR Payroll Tech regarding salary, benefits and payroll encumbrances • UBShelp@montana.edu regarding revenue transactions, BPAs, P-Card transactions, account codes, etc. • The originating department regarding auto-bills • The Budget Office regarding general operating or designated budgets • Your OSP fiscal manager regarding budgets and allowable costs on grants 23 Questions and Discussion?? 24