An Overview of Welfare Reform

advertisement

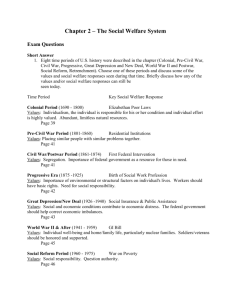

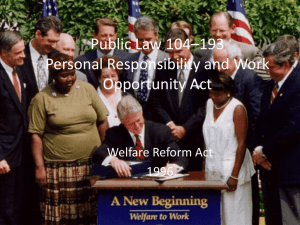

Session 1 Overview and History of Welfare Reform Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 1 Overview of the Aid to Families with Dependent Children Program (AFDC) • Established in 1935 as part of the Social Security Act • Shared cost program between federal government and states • Originally intended primarily for widows, AFDC increasingly served never-married mothers • States had discretion primarily over setting income eligibility limits and benefit levels • Activity requirements were weak and generally focused on education and training rather than work • States were not allowed to time limit beneficiaries • Beginning in early 1990s, states increasingly used waivers to try new approaches to reducing welfare dependence Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 2 Poverty Rates for Children in the U.S. Have Been Higher than Those for Other Age Groups 35 30 65 years and over 20 Under 18 years 16.2 15 18 to 64 years 10.2 10 9.4 5 00 20 98 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 82 19 80 19 78 19 76 19 74 19 72 19 70 19 68 19 66 0 19 Percent in Poverty 25 Year Source: U.S. Census Bureau Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 3 Two Views of Poverty • The poor are victims of their circumstances and do not have opportunities to advance • The poor are responsible for their circumstances and do not take advantage of available opportunities • The emphasis of antipoverty policy in the U.S. has shifted between these two views • The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 emphasizes the second view Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 4 The Measurement of Poverty • The Census Bureau uses a set of money income thresholds that vary by family size and composition to determine who is poor • The poverty thresholds do not vary geographically; they are updated annually for inflation but they have not kept pace with rising real incomes • In determining who’s poor the Census Bureau counts money income before taxes and does not include non-cash benefits, the EITC, or work-related expenses. The National Academy of Sciences has recommended changes to deal with these and other issues. The thresholds in 2000 were: 1-person under 65 $8,959 3-person family (adult and 2 children) 13,874 4-person family (adult and 3 children) 17,524 Source: U.S. Census Bureau Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 5 Countries that Spend More on Social Welfare (as percent of GDP) Have Lower Child Poverty Rates Cash and noncash social expenditures exclude health, education, and social services, but include all forms of cash benefits and near-cash housing subsidies, active labor market program subsidies, and other contingent cash and near-cash benefits. Nonelderly benefits include only those accruing to household heads under age 65. Source: Institute for Research on Poverty (IRP), University of Wisconsin-Madison Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 6 Government Benefits Lift Children Out of Poverty Work Pays Better than Welfare $20,000 Annual Family Income (2000 dollars) $18,000 2000 Poverty Threshold for a Single-Parent, Two-Child Family EITC $16,000 Food Stamps $14,000 EITC $12,000 Food Stamps $10,000 $8,000 Food Stamps $6,000 $4,000 Net Earnings Net Earnings Full-time, minimum-wage job Full-time job at $7.50 an hour TANF $2,000 $0 $0 Source: Sawhill/Thomas Brookings (2002) Annual Family Earnings (2000 dollars) Source: Center on Budget and Policy Priorities; U.S. Census Bureau Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 7 Political Background to the 1996 Welfare Reform Legislation Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 8 Characteristics of the AFDC Caseload • Majority are racial and ethnic minorities • 4 percent of mothers in 1995 worked full-time, and another 5 percent worked part-time • Total expected duration of all Awelfare spells@ was 13 years; more than 76 percent were expected to stay on for more than 5 years total Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 9 Efforts at Comprehensive Welfare Reform Usually Failed • Nixon’s Family Assistance Plan (1969-1972)-failed to pass Congress • Carter’s Program for Better Jobs and Incomes (1977)--failed to pass Congress • Reagan’s 1981 Budget Act changes--moderate cutbacks • Reagan’s New Federalism (1982)--never introduced in Congress • Family Support Act (1988)--incremental reform Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 10 Why Did Welfare Reform Legislation Pass in 1996 After Many Previous Failures • Dramatic caseload increases after 1988 fostered perception that program was “out of control” • Public opinion – Public opinion had not united around all of the proposals in PRWORA: public had shifted to overwhelming support for work requirements for custodial parents, while remaining more divided on “hard time limits” and family caps – Republicans in Congress were not trusted more than President Clinton on welfare reform issues in 1996 – The AFDC program was very unpopular because seen as anti-work and anti-family. The public was willing to accept almost any alternative to the status quo Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 11 Why Did Welfare Reform Legislation Pass in 1996 After Many Previous Failures Cont. • Social Science knowledge and evaluation studies – increased policymaker concern about intergenerational transmission of welfare receipt and length of welfare spells – gave support to “work first” approaches • Budgetary considerations: Republicans needed to find budget savings (especially from cuts in Food Stamps and benefits to legal immigrants) in order to finance tax cut and budget balancing promises in the Contract with America • State experiments under waivers increased confidence in innovative capacity of states Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 12 Why Did Welfare Reform Legislation Pass in 1996 After Many Previous Failures Cont. • Critical role for political bargaining: – Bill Clinton promised to “end welfare as we know it” – Republicans in Congress committed to welfare reform by Contract with America – Moderate Democrats in Congress followed President Clinton to the right in order to avoid being seen as more liberal than President Clinton on welfare issues Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 13 Session 2 A Primer on the Major Programs Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 14 Overview of the 1996 Welfare Reform Law • Temporary Assistance for Needy Families • Non-marital Births • Supplemental Security Income for Children • Child Support Enforcement • Welfare for Non-citizens • Child Care • Food Stamps Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 15 Five Components of TANF 1. End Cash Entitlement 2. Block Grant Funding 3. Work Requirements 4. Sanctions 5. 5-Year Time Limit Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 16 Purposes of TANF 1. Provide assistance to needy families with children 2. End welfare dependency by promoting job preparation, work and marriage 3. Prevent non-marital pregnancies 4. Encourage formation and maintenance of two-parent families Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 17 Provisions in Welfare Reform Law Designed to Reduce Non-marital Births • • • • • • • • • • • • • • Congressional findings on the negative effects of non-marital births Three of four TANF purposes address family formation Performance bonuses tied to purposes of law Illegitimacy reduction bonus Require teens to attend school Require teens to live at home or other supervised setting Abstinence education Child support enforcement Paternity establishment National goals to prevent teen pregnancy States establish numerical goals for reducing non-marital births Annual ranking of states on non-marital pregnancy ratios by HHS Allow family cap Allow reduction in cash benefits for non-marital births Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 18 Elements of the Work Support System • Earned Income Tax Credit (EITC) • Food Stamps and Child Nutrition • Medicaid and SCHIP • Child Care • Housing • Child Tax Credit • Child Support Enforcement • Workforce Development & Job Advancement Services • State Income Supplements Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 19 Support for Working Families Increases Dramatically, 1984-1999 51.7 Billions of 1999 Dollars 50 Child Care SCHIP 40 30 Child Tax Credit Medicaid EITC 20 10 5.6 0 Spending in 1999 under: 1984 Law 1999 Law Source: Congressional Budget Office Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 20 Session 3 How States Have Responded Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 21 Under TANF States Have Discretion To: • Set eligibility limits and benefit levels for cash benefits (as before) • Define who receives various benefits and services • Set income supplements for working families • Offer other “carrots” • Set stricter “sticks” than those in federal law • Spend funds on a variety of services other than cash benefits • Save block grant funds for economic downturns Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 22 States Have Very Different Resources Under the TANF Block Grant Prepared by The Brookings Welfare Reform & Beyond Initiative, Spring 2002 23