On technical analysis

advertisement

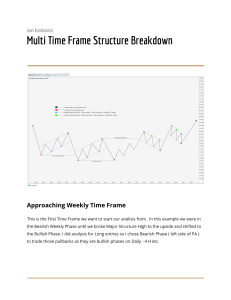

On technical analysis Technical analysis: The concept Technical analysts believe that, in the long run, prices move towards their fundamentals. The flow of information is random, however, the market is slow to respond, thus, generating recurring patterns. It pays to exploit these patterns before others can identify them, provided we can recognize them as they emerge. Recurring patterns tend to self-destruct. Technical analysis: Classification • Charting • Sentiment Indicators • Flow of Funds Indicators • Market Structure Indicators • Miscellaneous Charting The Dow Theory: Primary trends, intermediate trends, minor trends, support levels, and resistance levels are analyzed to produce buy or sell signals. The wisdom behind the Dow Theory On January 31st,1901 Charles H. Dow wrote in the Wall Street Journal: "A person watching the tide coming in and who wishes to know the exact spot which marks the high tide, sets a stick in the sand at the points reached by the incoming waves until the stick reaches a position where the waves do not come up to it, and finally recede enough to show that the tide has turned. This method holds good in watching and determining the flood tide of the stock market." The Six Commandments 1. The Averages Discount Everything. • An individual stock's price reflects everything that is known about the security 2. The Market Is Comprised of Three Trends: Primary trend, Secondary trends, and Minor trends. 3. Primary Trends Have Three Phases. • The First phase is made up of aggressive buying by informed investors in anticipation of economic recovery and longterm growth. • The Second phase is characterized by increasing corporate earnings and improved economic conditions • The Third phase is characterized by record corporate earnings and peak economic conditions 4. The Averages Must Confirm Each Other. • Ex: The Industrials and Transports must confirm each other in order for a valid change of trend to occur. 5. The Volume Confirms the Trend. 6. A Trend Remains Intact Until It Gives a Definite Reversal Signal. Source: equis.com A classic buy signal Follow the movements of a stock or market index 4. Break up (above the bounce high) 2. Bounce 3. Pullback 1. Market low Buy signals: Variations Follow the movements of a stock or market index 4. Break up (above the bounce high) 2. Bounce 1. Market low 3. Pullback A classic sell signal Follow the movements of a stock or market index 1. Market high 3. Bounce 2. Pullback 4. Break down Sell signals: Variations Follow the movements of a stock or market index 3. Bounce 1. Market high 2. Pullback 4. Break down The Dow Theory: Support and Resistance “Think of security prices as the result of a head-to-head battle between a bull (the buyer) and a bear (the seller). The bulls push prices higher and the bears push prices lower. The direction prices actually move reveals who is winning the battle.” Source: equis.com More on “support” and “resistance” levels... Source: equis.com More on “support” and “resistance” levels... Japanese candlesticks: Bullish signals Long white (empty) line Morning star Hammer Piercing line Bullish engulfing lines Bullish doji star Japanese candlesticks: Bearish signals Long black (filled-in) line Bearish engulfing lines Hanging Man Evening star Dark cloud cover Shooting star Voo-doo investing Sentiment Indicators Trin Trin = Vol(declining)/Vol(advancing)][Number(declining)/Number(advancing)] If 1 market is bearish (reported in the Wall Street Journal) Odd-lot ratio odd-lot-ratio = odd-lot buys/odd-lot sales Odd-lot traders are believed to miss key market turning points; hence when they buy it is likely that the bull market has already missed its course. A ratio > 1 is a bearish signal. (reported in the Wall-Street Journal) Barron's Confidence Index BCI= avg yield on high grade bonds/avg. yield on top ten intermediate grade bonds; An increase in the index signals a bull market, a decrease of the index signals a bear market; The index is always less than one Put/Call ratio PCR= outstanding put options/outstanding call options A ratio over one signals a bearish market Mutual fund cash positions Measure the sentiment among investors who are believed to be poor market timers. An increase in these cash positions shows the funds concerned about falling markets, hence, sending a Flow of Funds Indicators Short Interest could be an indicator of future latent demand for stock, or it could signal "informed" selling by institutional investors. Market Structure Indicators Moving averages They signal a bear market when they go above current market prices, or a bull market when going below current market prices. Market breadth It measures the extent to which movements in the market index is representative of the individual stock price movements. MB = Number of advancing - Number of declining. Relative strength It measures the extent to which a security has outperformed its industry or the market. Miscellaneous The Superbowl Rule: In a year that an original NFL team wins the Superbowl the mrket is likely to rise for the rest of the year. The opposite is true when a AFC team wins the Superbowl. The Presidential Cycle Rule: In the second year of the presidential term, the market is likely to fall, and in the third year it is likely to rise. The Hemline Indicator: The market index tends to rise and descend with the hemline of women's dresses. Etc. The Value Line Enigma Each week, Value Line Investment Survey reviews almost 1,700 traded companies. Stocks are ranked into five groups, according to their expected price appreciation: group 1: the best expected performers group 5: the worst expected performers The ranking is done with a use of a formula that takes into account: Earnings momentum Stock's relative price Relative strength The Value Line Enigma: The Devil is in the details Between 1965 and 1990, the groups performed as predicted. The average annual return of group 1 stocks was 22%. $1,500,000 (dividends and transaction costs excluded). Initial investment: $10,000 1965 1990 The Value Line Enigma: The Devil is in the details The Value Line Centurion Fund which manages a portfolio made of group 1 stocks has underperformed group 1 by 1,100 bp ! The Value Line Enigma: Possible reasons for underperformance High turnover = high transaction costs (the portfolio has to be rebalanced every week): - bid-ask spread - brokerage fees Fund overhead However, (transaction costs + fund overhead) don’t add up to the difference The Value Line Enigma: More on possible reasons for underperformance Measuring performance against prediction assumes the stock is purchased on Wednesday at close, yet the fund re-balances the portfolio on Friday and the readers read the survey on Friday morning. Group 1 stock stock price Group 1 stock stock price Group 1 is being re- The survey reaches the public Group 1 is being re- evaluated The survey reaches the public evaluated Wed Thu Fri The VL Centurion Fund rebalances its portfolio Sat Sun Mo Tue Wed Thu Fri The VL Centurion Fund rebalances its portfolio The bulk of the price increase in group 1 stocks takes place between Thursday and Friday. More on possible reasons for underperformance The US Postal Service could be moving fast in some parts of the country; hence some readers might get their subscription on Thursday. Smart investors anticipate the change in ranking in advance. They know the formula and watch closely group 2 stocks. If earning reports come in better than expected, some of them will move up. On Friday morning, everyone will want to buy into the same stocks, thus pushing the price very high. A dramatization A stock sells for $ 10 on Wednesday at close. Value Line forecasts it will rise in value over the next weeks or so. However, the information does not reach the market effectively until Friday morning. At the opening bell, there are hundreds of buy orders for that stock. As a result, the stock goes to $ 14. Visualization The survey reaches the public $14 Some early birds figure out group 1 $10 Wed Thu Fri Sat A dramatization: Summary Did the stock rise as predicted? Yes, one-week return = 40% Did investors make a good return? No, the majority of them bought at $ 14, (minus transaction costs) Some early birds made a return of 27% (minus transaction costs) Etc. To learn more: http://www.equis.com/ [[]] http://www.stockcharts.com/education/What/MarketAnalysis/dowtheory1.html#intro

![[Volman]Understanding Price Action Practical Analysis of the 5-minute time frame(rasabourse.com)](http://s2.studylib.net/store/data/026097647_1-0e1fce76bf07db7914ec0e6443d1d489-300x300.png)