Nakornthon

advertisement

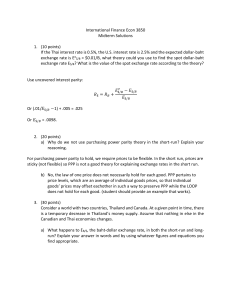

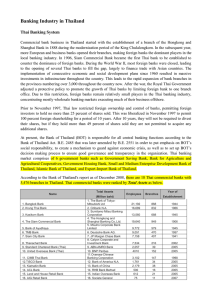

NAKORNTHON BANK Thailand: Background The Past • Currency Crisis The Present & Future • Public Sector vs. Private Sector • Legal System Reform – bankruptcy code – foreclosure • Parliamentary Conflict • Privatization Program NAKORNTHON BANK Nakornthon Situation • Capital • Ownership Nakornthon Bank Stock Price 120 100 80 60 40 20 0 Jan-92 Jan-93 Jan-94 NAKORNTHON BANK Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Banking System Re-capitalization • Tier One – Bank issues preferred shares in exchange for tradeable government bonds – NPL’s fully provisioned • Tier Two – Bank exchanges subordinated debentures for non-tradeable, convertible government bonds – NPL’s provisioned in accord with LCP 2000 – negative arbitrage NAKORNTHON BANK Banking System Re-capitalization • Foreign Capital – foreign banks: • ABN Amro purchased 75% of Bank of Asia • Thai Danu 50.1% owned by Development Bank of Singapore • Sanwa increasing stake in Siam Commercial NAKORNTHON BANK Strategic Partners •Bank of Nova Scotia (Canada) •Standard Chartered (United Kingdom) •United Overseas Bank (Singapore) Main concerns: Strategic fit: Stability of regional economy Seeking branch network throughout Thailand Overstaffing/high operating costs NON-PERFORMING LOANS Build upon limited operations in Thailand & global network Good management/reputation NAKORNTHON BANK Cash Flow Projections • Assumptions: – Re-capitalization • Government assistance vs. foreign partner – Loan loss provision and NPL’s – Interest Rates • Deposits • Loans – Thai Baht vs. U.S. Dollar NAKORNTHON BANK WACC => 11.65% • Tax Rate of 28% • $60 MM (2.3 bil baht) in U.S. denominated debt at 8% – This debt expires in 2003 and 2005, but will have to be rolled-over • 4 bil baht in Thai Government bonds at 11% – This is a ten year note starting at the time of re-capitalization • • • • 2.1 bil baht in equity need to maintain Tier I capital requirements Risk free rate of 5.5% Market risk premium 19.4% for Thailand using EHV method NTB beta from Thai stock market is 1.01, signaling parity with the overall Thai market – The average beta for Thai banks is 1.45 NAKORNTHON BANK Nakornthon Valuation (000’s Thai Baht) Terminal Value Discounted Cash Flow TOTAL VALUE Less Restructure Cost USD Equivalent NAKORNTHON BANK 852,248 THB 1,243,244 THB 2,095,402 THB (17,212,282 THB) ($491,779,000)