TAKEOVERS, MERGERS AND BUYOUTS

advertisement

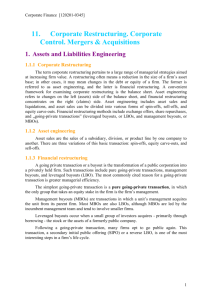

TAKEOVERS, MERGERS AND BUYOUTS + • http://www.youtube.com/watch?v=vdjigFRQh7g • Listen to the explanations of the words: restructuring, takeover, merger, buyout Learn Business English Conversation 93 (restructuring, merger, buyout, takeover) [www.keepvid.com].mp4 • • • • • • Restructuring means: a)___________________________ b) __________________________ c) __________________________ Takeover is _____________________________. It is also called a _______________________ A merger is ________________________________ GROWTH OF COMPANIES 1. invest in R&D 2. diversify new products enter new markets 3. take over other companies 4. merge with another company reinforcing reducing competition company’s position rationalizi ng production reasons for taking over or combining with other companies take over = buy = acquire (part-ownership) MERGERS company too big to buy to merge = combine the two companies to form a single new one TAKEOVER a) RAID buying as many of a company’s stocks on the stock market demand increases the stock price rises b) TAKEOVER BID public offer to buy the stocks at a certain price during a limited period of time a) friendly bid / friendly takeover (the board agrees) b) hostile bid / hostile takeover (the board does not agree) INVESTMENT BANKS - large mergers / acquisitions departments - analyze the value of listed companies - earn high fees TAKEOVERS 1. horizontal integration acquiring a competitor in the same field of activity: a) a larger market share b) reduces competition 2. Vertical integration taking over a business involved in the supply chain to achieve cost savings: a) backward integration – acquiring suppliers of raw materials b) forward integration – taking over distributors or retail outlets BUYOUTS takeovers large conglomerates (different firms) inefficient undervalued on the stock market market capitalization lower than assets financiers – corporate raiders private equity funds RAIDERS – LEVERAGED BUYOUTS leveraged = financed by borrowed capital issue bonds borrow money buy the companies asset-stripping (sell off the subsidiaries / assets) pay back the bonds earn profit LEVERAGED BUYOUTS (LBOs) • Takeovers using borrowed money against the security of the shares to be bought • Leverage means having a large proportion of debt compared to equity capital • Buying companies in order to strip assets HISTORY OF LBOs v 1960s – conglomerates v 1980s - recession - companies with good earnings but low stock prices - assets were worth more than their market price (less dividend) - central management not efficient Targets for buyouts § Companies with huge cash reserves § Companies with successful subsidiaries § Companies in fields not sensitive to a recession (food/tobacco) http://www.youtube.com/user/businesssalereport?blend=23&ob=5#p/a/u/0/0lvnfteI9yE Find out why growing through acquisition is a perfect way to grow. The aims are: to conquer __________________________ to acquire __________________________ quickly to secure ___________________________people to cut ____________________of failure and finally to focus on ________________ and _______________________. http://www.youtube.com/watch?v=yWHpsCH7ad0&feature=related Why should companies beware of the merger? http://www.youtube.com/watch?v=QEfxnoXX21s&feature=related Answer the following questions: • What is a merger? • Why do companies merge? • What is the example for a horizontal merger? What does their combining bring? • What is the example for a vertical merger? Why is this combination good? FIND THE WORDS THAT MEAN THE FOLLOWING: 1. To expand into new fields. _________________ 2. Buying another company’s shares on the stock exchange, hoping to persuade enough other shareholders to sell to take control of the company. _________________ 3. A public offer to a company’s shareholders to buy their shares at a particular price during a particular period. _______________ 4. To merge or take over other firms producing the same type of goods or services. _____________________ 5. A merger with or the acquisition of one’s suppliers. ___________________ 6. Joining with firms in other stages of the production or sale of a product. _______________ 7. A merger with or the acquisition of one’s marketing outlets. ___________ 8. A large organisation formed by joining together a group of companies with different business activities. __________________ 9. Takeovers using borrowed money. ______________ 10. Selling off the assets of poorly performing or under-valued companies. ______________ 11. Bonds that are considered to be risky but which pay a high rate of interest. FILL IN THE BLANKS: A company that wants to grow or __________can launch a _________, simply buy a large quantity of another company’s shares on the _____________. This will immediately increase the __________price, and may persuade other shareholders to sell for the raider to take _________ of the company. It is also possible to make a __________ bid: a public _______ to a company’s shareholders to buy their shares. A _________takeover has the consent of the board of the company whose shares are being acquired. A __________ takeover bid is against the wishes of the board of directors. A company can attempt to find a _______________– another buyer whom they prefer. A company that wants to grow or diversify can launch a raid, simply buy a large quantity of another company’s shares on the stock exchange. This will immediately increase the share price, and may persuade other shareholders to sell for the raider to take control of the company. It is also possible to make a takeover bid: a public offer to a company’s shareholders to buy their shares. A friendly takeover has the consent of the board of the company whose shares are being acquired. A hostile takeover bid is against the wishes of the board of directors. A company can attempt to find a white knight – another buyer whom they prefer.