lecture after debenture 17

RECAP Debenture

• Definition

• Kinds

• Power to reissue redeemed debenture in certain cases

• Register of debenture holders

• Trust, Trust deed and trustees

Mortgages

And

Charges

Introduction

• Whenever, a company obtains a loan and provides its assets to the lender as a security for the repayment of loan or other obligations, this activity is called the creation of the mortgage/charge on the assets of the company. The particulars of the charge are required to be reported to the

Registrar concerned in the manner provided under the Companies Ordinance, 1984 (the

Ordinance)

Introduction …

• The particulars of mortgage/charge are required to be reported to the Registrar concerned within 21 days from the date of its creation alongwith relevant documents. Similarly any modification in the particulars of the mortgage/charge is also required to be reported to the Registrar within the said period.

• As soon as the loan is repaid, it is the responsibility of the company to get the mortgage/charge vacated.

This process is called the satisfaction of

mortgage/charge. Again, the time frame for reporting the satisfaction of mortgage/charge to the registrar is 21 days from the date of its satisfaction.

Definitions

• Modes of giving security for borrowing

Charges

Charges means encumbrance (a legal claim), lien (a right to retain possession of property till the repayment of a debt) or a claim.

Mortgage

A mortgage is an interest in land created by written instrument providing security for the performance of a duty or the payment of a debt.

Hypothecation

Hypothecation means the pledge of a property as security or collateral for a debt. Generally physical transfer or transfer of the title does not take place in hypothecation

Pledge

Contract act defines pledge as a bailment of goods as security for the repayment of a debt or performance of a promise.

Types Of Charges

Following are types of charges a) Floating charges

A company can deal with the property in the ordinary courses of business unless charge is crystallized (i.e the company goes into the liquidation or receiver is appointed.)

Following are the major elements of a floating charge:

I. It is a charge on a class of assets present or future

II. Class of assets may change from time to time

III. Until some further step is taken, the company may ordinarily carry on business.

b) Fixed Charges

A fixed charges is a mortgage of specific property and prevent the company from realizing that property i.e

disposing it without the consent of the holders of the charge. A charge holder must be paid first whatever is due to him in order to get the property free of charge.

Distinction between Fixed Charge

& Floating Charge

Fixed Charge

Floating Charge

1.Fixed charge is created on specific and ascertained assets of the company.

1.Floating charge relates to all assets of a company present or future.

2.Assets which are subject to fixed charge can not be changed except with the consent of charge holder

2.Assets under floating charge may in the ordinary course of a business be changed from time to time.

3.Fixed charge is a legal charge.

4.At the time of winding up of a company status can not be changed.

3.Floating charges is an equitable charge.

4.At the time of wind up it will automatically become fixed charge.

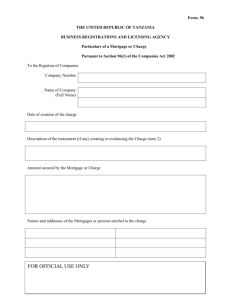

Registration of Mortgage & Charge:

[SECTION – 121]

Following mortgages and charges shall be registered with the registrar within 21 days of their creation.

1 A mortgage or charge for the purpose of securing any issue of debentures.

2. A mortgage or charge on any immoveable property wherever situated or any interest their in

3 A mortgage or charge on any book debt of the company

(money that a company has not yet received from customers who owe it money , as recorded in the company's accounts : A company is able to charge its book debts as security for a loan.

4. mortgage or charge on the undertaking or property of the company including stock in trade.

5. A mortgage or charge on a ship or any share on a ship

6. A mortgage or charge on a good will on a patent or license under a patent or a trade mark or on a copy right

7. A mortgage or charge or other interest based on agreement for issuing of any instrument in the nature of redeemable capital

Failure to registrar any charge within the prescribed time

• . What if the charge is not registered in time?

• If a charge is not registered in time, then it is void against the liquidator or administrator and any creditor of the company. This means that the debt for which the charge was given will remain payable, but it will be unsecured.

• If a company fails to deliver a charge, and no interested party has registered it, then the company and every officer of the company who is in default are liable to a fine. If the default continues, they are liable to a daily default fine.

Property Acquired Subject to a Charge :

[SECTION-122]

• If a company acquires a property which is subject to charge from a person who had no obligation to get the charge registered with the registrar of companies, the company shall get the charge registered within 21 days of the acquisition of the property .

• In case of default the company and every officer who is in default shall be fined upto Rs 2000/-

Register of Mortgage And Charges

By Registrar [SECTION -125]

• The registrar is required to keep a register in respect of each company in the prescribed form containing the following particulars of mortgages and charges

1. Data of creation of each mortgage or charge

2. Amount secured against such mortgage or charge

3. Short particulars of the property mortgage or charge

4. The names of mortgagees or persons entitled to the charge

By Company (SECTION-135)

A) A company is required to keep a register of mortgage at its registered office .

B) The company shall enter in the register of mortgages and charges:

I.

All mortgages and charges affecting property of the company

II.

All floating charges on the undertaking or on any property of the company c) Such register shall give:

I.

A short description of the property mortgaged or charged

II.

The amount of mortgage or charge

III. The names of mortgagee

Certificate of Registration

[SECTION-127]

• The registrar shall give a certificate under his hand of the registration of any mortgage or charge registered stating the amount thereby secured .

• The certificates shall be the conclusive evidence that requirements of the ordinance regarding registration of mortgage or charge have been complied with.

Duty of Company and Right of interested party as regards registration

• It shall be the duty of the company to get register any mortgage or charge created and of the issue of the series

of debentures requiring registration .

• However any person interested in the mortgage or charge is entitled to get the charge registered at his own .

• He is entitled to recover the cost of such registration from the company [section 129(1)(2)]

• It is the company’s duty to get registered any modification to the charge registered earlier [section 129 (3)]

Rectification of register of mortgages and charges [SECTION- 131]

The register of mortgage and charges can be rectified by the commission in the following circumstances:

I.

If there has been omission to register a mortgage or charge within in 21 days of its creation

II. If there has been omission or misstatement of any particular with respect any mortgage or charge

III. if there has been an accidental or due to inadvertence or some other sufficient cause omission to give intimation to the registrar about the payment or

satisfaction of debt for which a mortgage or a charge was created.

• A certified copy of the order of the commission requiring rectification shall be filed with registrar by the company or by the person on whose application it is passed within 21 days from such order

Satisfaction of charge

• What should the company do when the charge is paid off (or ‘satisfied’)?

• On the one hand it is in the company’s own interest and on the other hand it is the requirement of law that the company should inform the registrar concerned that the charge has been fully satisfied so that the stake holders i.e. investors and lenders should know that all of the debt has been paid off.

The particulars of satisfaction of mortgage/charge shall be submitted to the registrar concerned on prescribed form 17 within 21 days from the date of satisfaction/repayment.

Satisfaction Of Charge[section -132]

• Whenever company pays or satisfies a charge in full it shall with in 21 days of such satisfaction inform the registrar of such satisfaction

• On receipt of such notice the registrar shall call upon the person in whose favour charge was register to show cause as to why the satisfaction of charge may not be registered. Such person shall be required to respond within 14 days of such notice

• If no cause is shown the registrar shall order that memorandum of satisfaction be entered in the register and shall also furnish a copy to the company if so required by the company.

• If a cause is shown the registrar shall record a note of it in the register and inform the company about.

Power of Registrar to make entries of satisfactions and release in the absence of

Intimation from Company [section 133]

• If the registrar has evidence with out being informed by the company that charge has been settled either wholly or partly or part of the property or undertaking charge has ceased to be the property of the company he may enter in the register a memorandum of satisfaction of charge either whole or in part

Particulars in case of series of debentures entitling holders pari passue[SECTION 123]

• Where a series of debenture containing any charge to the benefit of which the debenture holders of that series are entitled pari passue ( side by side; at the same rate or on an equal footing ) is created by a company it shall be sufficient for the purpose of section 121 if these are filed with the registrar within 21 days after execution of deed containing the charge or if there is no such deed after the execution of any debentures of the series the following particulars namely:

1. The total amount secured by the whole series

2. The dates of resolutions authorizing the issue of the series and the date of the covering deed if any by which security is created or defined

3. A general description of the property charged

4. The names of the trustees if any for the debentures holder

Particulars in case of Commission ETC. on debentures [section 124]

Where any commission allowance or discount has been paid or made either directly or indirectly by the company to any person in any consideration of his subscribing or agreeing to subscribe whether absolutely or conditionally for any debenture, the particulars required to be filed for the registration under section 121 and 123 shall include particulars as to the amount or rate percent of the

commission discount or allowance so paid or made but an omission to do this shall not affect the validity of debentures issued:

Provided that deposit of any debentures as security for any debt of the company shall not for the purpose of this section be treated as issue of the debentures at discount .

Copy of instrument creating mortgage or charge to be kept at registered office [Section 130]

• Every company shall cause a copy of every instrument creating any mortgage or charge requiring registration under section 121 and of every instrument evidencing modification of the terms and conditions thereof to be kept at registered office the company:

• Provided that in the case of a series of uniform debentures a copy of one such debenture shall be sufficient.

Right to Inspect copies of Instruments creating

Mortgages and Charges and Company Registrar of Mortgages [Section 136]

1. The copies kept at the registered office of the company in pursuance of section 130 of instruments creating any mortgage or charge or modification of the terms and conditions requiring registration under this Ordinance with the registrar, and the register of mortgages and charges kept in pursuance of section 135 shall be open at all reasonable time to the inspection of any creditors of the company without fee and register of mortgages shall also be open to the inspection for any other person on payment of such fee not exceeding the amount prescribed for each inspection as the company may fix .

(2) If inspection of the said copies or register is refused, the company shall be liable to a fine not exceeding five hundred rupees and a further fine not exceeding fifty rupees for everyday after the first during which the refusal continues and every officer of the company who knowingly authorizes or permits the refusal shall incur the like penalty and in addition to a above penalty the registrar may by order compel an immediate inspection of the copies or register.