Oct-26 - X-Squared Radio

advertisement

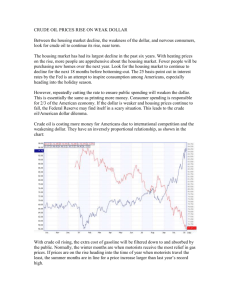

The solar wind is a paltry 352 km/sec and the proton count is 2.9, so not much to report there, but the activity for solar cycle 24 is not done for sure. There was an X3 on Oct. 24th (2140 UT), an X1 on Oct 25th (1709 UT), and an X2 on Oct. 22nd (1059 UT). All three of these explosions produced strong HF radio blackouts over the dayside of Earth. In each case, communications were disturbed over a wide area for approximately one hour. Such blackouts may be noticed by amateur radio operators, aviators, and mariners. Usually, strong flares are accompanied by massive CMEs--billion-ton clouds of electrified gas that billow away from the blast site. So far, however, none of the eruptions from AR2192 has produced a major CME. Without a series of CMEs to rattle our planet's magnetic field, there have been no geomagnetic storms nor any widespread auroras. Earth-effects have been limited to radio blackouts. Now, today, Giant sunspot AR2192 is growing again, which means high solar activity is unlikely to subside. NOAA forecasters estimate an 85% chance of M-class flares and a 45% chance of X-flares during the next 24 hours. For the third day in a row, Earthorbiting satellites detected an X-class solar flare. The X2-category blast came from giant sunspot AR2192. More Banker Witnesses Refusing to Breathe Back on January 26, a 58-year-old former senior executive at German investment bank behemoth Deutsche Bank, William Broeksmit, was found dead after hanging himself at his London home, and with that, set off an unprecedented series of banker suicides throughout the year which included former Fed officials and numerous JPMorgan traders. Following a brief late summer spell in which there was little if any news of bankers taking their lives, as reported previously, the banker suicides returned with a bang when none other than the hedge fund partner of infamous former IMF head Dominique Strauss-Khan, Thierry Leyne, a French-Israeli entrepreneur, was found dead after jumping off the 23rd floor of one of the Yoo towers, a prestigious residential complex in Tel Aviv. Just a few brief hours later the WSJ reported that yet another Deutsche Bank veteran has committed suicide, and not just anyone but the bank's associate general counsel, 41 year old Calogero "Charlie" Gambino, who was found on the morning of Oct. 20, having also hung himself by the neck from a stairway banister, which according to the New York Police Department was the cause of death. We assume that any relationship to the famous Italian family carrying that last name is purely accidental. Here is his bio from a recent conference which he attended: Charlie J. Gambino is a Managing Director and Associate General Counsel in the Regulatory, Litigation and Internal Investigation group for Deutsche Bank in the Americas. Mr. Gambino served as a staff attorney in the United Securities and Exchange Commission’s Division of Enforcement from 1997 to 1999. He also was associated with the law firm of Skadden, Arps, Slate Meagher & Flom from 1999 to 2003. He is a frequent speaker at securities law conferences. Mr. Gambino is a member of the American Bar Association and the Association of the Bar of the City of New York. As a reminder, the other Deutsche Bank-er who was found dead earlier in the year, William Broeksmit, was involved in the bank's risk function and advised the firm's senior leadership; he was "anxious about various authorities investigating areas of the bank where he worked," according to written evidence from his psychologist, given Tuesday at an inquest at London's Royal Courts of Justice. And now that an almost identical suicide by hanging has taken place at Europe's most systemically important bank, and by a person who worked in a nearly identical function - to shield the bank from regulators and prosecutors and cover up its allegedly illegal activities with settlements and fines - is surely bound to raise many questions. The WSJ reports that Mr. Gambino had been "closely involved in negotiating legal issues for Deutsche Bank, including the prolonged probe into manipulation of the London interbank offered rate, or Libor, and ongoing investigations into manipulation of currencies markets, according to people familiar with his role at the bank." He previously was an associate at a private law firm and a regulatory enforcement lawyer from 1997 to 1999, according to his online LinkedIn profile and biographies for conferences where he spoke. But most notably, as his LinkedIn profile below shows, like many other Wall Street revolving door regulators, he started his career at the SEC itself where he worked from 1997 to 1999. "Charlie was a beloved and respected colleague who we will miss. Our thoughts and sympathy are with his friends and family,” Deutsche Bank said in a statement. Going back to the previous suicide by a DB executive, the bank said at the time of the inquest that Mr. Broeksmit “was not under suspicion of wrongdoing in any matter.” At the time of Mr. Broeksmit’s death, Deutsche Bank executives sent a memo to bank staff saying Mr. Broeksmit “was considered by many of his peers to be among the finest minds in the fields of risk and capital management.” Mr. Broeksmit had left a senior role at Deutsche Bank’s investment bank in February 2013, but he remained an adviser until the end of 2013. His most recent title was the investment bank’s head of capital and risk-optimization, which included evaluating risks related to complicated transactions. A thread connecting Broeksmit to wrongdoing, however, was uncovered earlier this summer when Wall Street on Parade referenced his name in relation to the notorious at the time strategy provided by Deutsche Bank and others to allow hedge funds to avoid paying short-term capital gains taxes known as MAPS (see How RenTec Made More Than $34 Billion In Profits Since 1998: "Fictional Derivatives") From Wall Street on Parade: Broeksmit’s name first emerged in yesterday’s Senate hearing as Senator Carl Levin, Chair of the Subcommittee, was questioning Satish Ramakrishna, the Global Head of Risk and Pricing for Global Prime Finance at Deutsche Bank Securities in New York. Ramakrishna was downplaying his knowledge of conversations about how the scheme was about changing short term gains into long term gains, denying that he had been privy to any conversations on the matter. Levin than asked: “Did you ever have conversations with a man named Broeksmit?” Ramakrishna conceded that he had and that the fact that the scheme had a tax benefit had emerged in that conversation. Ramakrishna could hardly deny this as Levin had just released a November 7, 2008 transcript of a conversation between Ramakrishna and Broeksmit where the tax benefit had been acknowledged. Another exhibit released by Levin was an August 25, 2009 email from William Broeksmit to Anshu Jain, with a cc to Ramakrishna, where Broeksmit went into copious detail on exactly what the scheme, internally called MAPS, made possible for the bank and for its client, the Renaissance Technologies hedge fund. (See Email from William Broeksmit to Anshu Jain, Released by the U.S. Senate Permanent Subcommittee on Investigations.) At one point in the two-page email, Broeksmit reveals the massive risk the bank is taking on, writing: “Size of portfolio tends to be between $8 and $12 billion long and same amount of short. Maximum allowed usage is $16 billion x $16 billion, though this has never been approached.” Broeksmit goes on to say that most of Deutsche’s money from the scheme “is actually made by lending them specials that we have on inventory and they pay far above the regular rates for that.” It would appear that with just months until the regulatory crackdown and Congressional kangaroo circus, Broeksmit knew what was about to pass and being deeply implicated in such a scheme, preferred to take the painless way out. The question then is just what major regulatory revelation is just over the horizon for Deutsche Bank if yet another banker had to take his life to avoid being cross-examined by Congress under oath? For a hint we go back to another report, this time by the FT, which yesterday noted that Deutsche Bank will set aside just under €1bn towards the numerous legal and regulatory issues it faces in its third quarter results next week, the bank confirmed on Friday. In a statement made after the close of markets, the Frankfurt-based lender said it expected to publish litigation costs of €894m when it announces its results for the JulySeptember period on October 29. The extra cash will add to Deutsche's already sizeable litigation pot, where the bank has yet to be fined in connection with the London interbank rate-rigging scandal. It is also facing fines from US authorities over alleged mortgage-backed securities misselling and sanctions violations, which have already seen rivals hit with heavy fines. Deutsche has also warned that damage from global investigations into whether traders attempted to manipulate the foreign-exchange market could have a material impact on the bank. The extra charge announced on Friday will bring Deutsche's total litigation reserves to €3.1bn. The bank also has an extra €3.2bn in so-called contingent liabilities for fines that are harder to estimate. Clearly Deutsche Bank is slowly becoming Europe's own JPMorgan - a criminal bank whose past is finally catching up to it, and where legal fine after legal fine are only now starting to slam the banking behemoth. We will find out just what the nature of the latest litigation charge is next week when Deutsche Bank reports, but one thing is clear: in addition to mortgage, Libor and FX settlements, one should also add gold. Recall from around the time when the first DB banker hung himself: it was then that Elke Koenig, the president of Germany's top financial regulator, Bafin, said that in addition to currency rates, manipulation of precious metals "is worse than the Libor-rigging scandal." It remains to be seen if Calogero's death was also related to precious metals rigging although it certainly would not be surprising. What is surprising, is that slowly things are starting to fall apart at the one bank which as we won't tire of highlighting, has a bigger pyramid of notional derivatives on its balance sheet than even JPMorgan, amounting to 20 times more than the GDP of Germany itself, and where if any internal investigation ever goes to the very top, then Europe itself, and thus the world, would be in jeopardy. At this point it is probably worth reminding to what great lengths regulators would go just to make sure that Deutsche Bank would never be dragged into a major litigation scandal: recall that the chief enforcer of the SEC during the most critical period following the great crash of 2008, Robert Khuzami, worked previously from 2002 to 2009 at, drumroll, Deutsche Bank most recently as its General Counsel (see "Robert Khuzami Stands To Lose Up To $250,000 If He Pursues Action Against Deutsche Bank" and "Circle Jerk 101: The SEC's Robert Khuzami Oversaw Deutsche Bank's CDO, Has Recused Himself Of DB-Related Matters"). The same Khuzami who just landed a $5 million per year contract (with a 2 year guarantee) with yet another "law firm", Kirkland and Ellis. One wonders: if and when the hammer falls on Deutsche Bank, will it perchance be defended by the same K&E and its latest prominent hire, Robert Khuzami himself? But usually it is best to just avoid litigation altogether. Which is why perhaps sometimes it is easiest if the weakest links, those whose knowledge can implicate the people all the way at the top, quietly commit suicide in the middle of the night... The Ebola Rockola (Part Two) With Ebola now turning up in two large American cities, and the White House's new "Ebola czar" still declining to appear before Congress, a House member tracking the response to the disease says the Obama administration continues to put politics before public health. "It is infuriating," Rep. Blake Farenthold, of the Comittee on Oversight and Government Reform, told "MidPoint" host Ed Berliner on Newsmax TV on Friday. n an interview that ranged from travel bans to the behavior of an Ebola-infected New York physician, the Texas Republican also blasted President Barack Obama and his new Ebola czar, Democratic political operative Ron Klain. "They're more interested in politics than dealing with a health care crisis," said Farenthold. "He should have been at the hearing today," Farenthold said of Klain, who on Friday skipped a hearing on Ebola chaired by Rep. Darrell Issa's Oversight and Government Reform panel. "We need a medical doctor, not a spin doctor." It was Klain's second noteworthy absence since being named point man on the crisis. Vote: Do You Approve of Obama’s Job Performance? Vote Here Now. But Farenthold also signaled that Congress is basically stuck with him. "We've got to make the best of it," he said. "But if he's going to coordinate all of government, he needs to coordinate with Congress, who signs the checks." Farenthold said he wants to hold the administration to its promise to treat Ebola — which has now spread from western Africa to episodes in Dallas and New York — with "an overabundance of caution." He said one cautionary measure is to ban commercial flights between the United States and the west African countries — Guinea, Sierra Leone, Liberia — hit hardest by an infectious disease that has already killed more than 4,500 people, according to official estimates. Farenthold proposed a workaround: military fights. "it's not like we don't have any airplanes in the military," he said. "There's C-130s. There are a ton of military airplanes we can send relief workers, equipment and doctors in. We don't need to let tourists from these countries come on commercial airliners with innocent folks." A critic of the administration's initial plan to set up Ebola screening for passengers at five U.S. airports, regardless of whether travelers from western Africa landed at one of the five, Farenthold credited the White House with changing course and instead ordering all commercial air travel from Ebola-affected countries through those five hubs. "They're trying," he said, adding that "funneling everyone from the affected countries to the five airports is a step in the right direction. But I don't think it's enough. "I think we ought to follow the lead of some of our European allies and just say, look, no travel there on commercial air. And if you need to get in and out for humanitarian or military reasons, we've got military transports or charter flights that can do that," he said. Farenthold also questioned the decision-making of Craig Spencer, the New Yorker and Doctors Without Borders aid worker who returned from treating Ebola patients in Guinea on Oct. 17, and developed the disease six days later. Health officials are racing to retrace Spencer's movements, which reportedly included a subway train ride and a bowling alley excursion in one of the world's most densely populated cities. According to reports, Spencer developed fever on Thursday morning and went to a hospital, where he remains in isolation, and had been taking his temperature daily — in keeping with protocols coordinated between Doctors Without Borders and the U.S. Centers for Disease Control and Prevention (CDC). "The issue is what are the protocols for someone coming back from that area, and there are conflicting reports," said Farenthold. "But I certainly think taking public transportation within the first 21 days, getting on a crowded subway in New York, would be questionable behavior." "I would be spending as much time as possible in my home, and getting takeout delivered, rather than going out in public," he said. Farenthold said he took heart from news that the second Dallas nurse infected with Ebola has also been declared free of the virus. Three Dallas infections, beginning with a dying Liberian man, were the first U.S.-based Ebola cases in history and triggered a national uproar over the federal government's tardy response to the disease's unprecedented spread. "I think we are learning from our mistakes," said Farenthold. "We see a lot of government finger-pointing — one agency pointing the finger at the other, or the CDC saying the nurses violated protocol — right before they changed the protocol. You've got nobody willing to accept responsibility. "But we have moved forward … and I think that's something that's going to be — is — one of the key factors in keeping Americans safe and limiting the spread of this disease," he said. Christie Takes Action – The FAA has yet to respond “The public in New Jersey needs to know we are prepared and we’re ready to deal with whatever comes,” Christie said Wednesday, according to WCBS. “We’re constantly reviewing our protocols and our approaches to make sure that we’re doing it in the best possible way that we can.” Travelers displaying Ebola symptoms at Newark's airport would be taken to one of three New Jersey hospitals. The New York City-area airport is one of five in the U.S. that will monitor people coming from West Africa, the epicenter of the Ebola epidemic, for 21 days. There have not been any people diagnosed with Ebola in New Jersey so far. Ebola has become a driving issue ahead of the November midterm elections, with candidates from both sides of the aisle urging the federal government to pass tougher protections against the deadly virus that has ravaged West Africa. Federal health officials say it is nearly impossible for most Americans to catch Ebola. Only one person has died from the virus in the U.S., and two nurses who treated that patient and contracted the virus appear to be recovering. Christie did not add his name to a growing list of politicians who have called for a travel ban on passengers from West Africa because he said there are no direct flights from the region to the U.S. But the New Jersey governor did say that President Barack Obama should consider a visa ban on people from such countries. U.S. Sen. Marco Rubio, RFla., another possible 2016 GOP presidential candidate, said he would sponsor a bill to temporarily ban visas for people from Liberia, Guinea and Sierra Leone. "There are no direct flights from these countries to the United States, so what you’d need to really do is do a visa suspension,” Christie said, according to NJ.com. “That’s a significant step,” Christie said, “One that I think should be considered, but that’s ultimately going to be the decision of the president of the United States.” police officers tasked with working the scene around the Manhattan apartment of Dr. Craig Spencer, diagnosed with Ebola yesterday, were caught on camera tossing the gloves and masks they used for their protection into public trash cans. One video (above via the Daily Mail) shows two police officers discarding first the crime scene tape used to block off the potentially infected area, then removing their protective gloves and masks and tossing them into an open-top public waste bin. The video does not show whether or not the officers had entered Spencer’s apartment. Earlier reports said that those who did enter were wearing hazmat suits, so it is likely that they did not. Regardless of their proximity to the patient’s apartment, the incident raises concern about the degree to which the city is prepared to handle the deadly virus and how closely safety protocol is being followed by those involved. Civil Forfeiture Goes the Next Step: Bank Accounts with too much money in them The Internal Revenue Service has been seizing money from the bank accounts of individuals and businesses with no proof, or even charges filed, that they are guilty of any crime. Now, the IRS claims that it will stop — but will it? Using a law, the Civil Asset Forfeiture Reform Act of 2000, that allows the feds to seize money from suspected gangsters, drug dealers and terrorists, the IRS has put innocent people into bankruptcy and massive debt and taken the money a military father saved from his paychecks to put his kids through college, solely by tracking the amounts that people put into their bank accounts. FAX BLAST SPECIAL: Audit The I.R.S When no criminal activity is charged, The New York Times reports, the IRS often negotiates to return only part of the seized money, leaving impoverished citizens with little option but to either accept the IRS’ offer or continue a lengthy and very expensive legal battle to try to get their legitimately earned money back. The problem has been growing. The Institute for Justice estimates that from just 114 seizures in 2005, the IRS made 639 seizures in 2012, and in only 20 percent of the cases were any criminal charges ever pursued. Under the Bank Secrecy Act, banks report transactions larger than $10,000 to federal authorities, but also report a pattern of regular, smaller deposits which appear designed to get around the act. This alone can be enough to trigger a seizure, the Times reports, and banks filed over 700,000 “suspicious” reports last year. One involved a 27-year-old Long Island candy and cigarette distribution company, BiCounty Distributors, which made daily cash deposits, usually under $10,000. When the IRS seized $447,000 from the company, it refused to return it, despite the fact that there was no crime to prosecute, and instead offered a partial settlement. The company is now $300,000 in debt and attorney Joseph Potashnik told the Times, “I don’t think they’re (the IRS) really interested in anything. They just want the money.” Army Sgt. Jeff Cortazzo was saving up for his daughters’ college education when the IRS seized $66,000 of his money – it cost him $21,000 to get the remainder back. Richard Weber, the chief of Criminal Investigation at the IRS, said in a written statement in response to the Times story, “After a thorough review of our structuring cases over the last year… IRS-CI will no longer pursue the seizure and forfeiture of funds associated solely with ‘legal source’ structuring cases unless there are exceptional circumstances justifying the seizure and forfeiture and the case has been approved at the director of field operations (D.F.O.) level.” Income Inequality Police We learned last week that new Federal Reserve Chair Janet Yellen is not so much our nation’s central banker as class warrior in chief. In a widely publicized speech Ms. Yellen parroted all of the left’s talking points on the divide between rich and poor. “The extent of and continuing increase in inequality in the United States greatly concern me,” she lectured. “It is no secret that the past few decades of widening inequality can be summed up as significant income and wealth gains for those at the very top and stagnant living standards for the majority.” Actually, that’s a factually dubious claim given that the 1980s and 1990s saw wide gains for the middle class and even those at the bottom of the income pyramid. Middle income families saw a more than 30% inflation-adjusted rise in income in those years. From 1982-1997 those who started out as poor actually saw faster income gains than those who started out as rich, according the U.S. Treasury Department study on income mobility. Upward mobility defined that era of broad-based prosperity. Ms. Yellen also failed to note that the income gap is widening today because this has been the slowest recovery from a recession since the 1930s. Compared the other economic recoveries since 1960, Our national output is about $1.6 trillion (in inflationadjusted dollars) behind; and compared to the Reagan recovery in the 1980s, we’re now $2.2 trillion behind, according to the Joint Economic Committee of Congress. SPECIAL: Join the Tea Party REVOLUTION! The Obama Regime must be dismantled! Ms. Yellen never mentions that Obamanomics has made inequality much worse. Almost all of the income gains under Barrack Obama have gone to the top 5% in income. Her silence on this point shouldn’t be too surprising because she has supported most of Obama’s economic policies. She has also been a cheerleader of the Fed’s easy money policies which have benefited those at the top and almost no one else. She never spoke out against the nearly $8 trillion in debt spending since the end of 2008, the big tax increase on investment in 2013, the expansion of welfare benefits, and other policies that have backfired. One could argue the best way to reduce inequality is to repeal everything that President Obama has done since he entered office. The real estate bust also exacerbated inequality, she concludes. “Since housing accounts for a larger share of wealth for those in the bottom half of the wealth distribution, their overall wealth is affected more by changes in home prices,” she says. “Homeowners in the bottom half of households by wealth reported 61 percent less home equity in 2013 than in 2007. The next 45 percent reported a 29 percent loss of housing wealth, and the top 5 lost 20 percent.” Again, this is because of federal housing policies at FHA, Fannie Mae, and Freddie Mac that encouraged mortgages to people who couldn’t afford them. Ms. Yellen conveniently failed to mention the role the Federal Reserve that she runs played in allowing unqualified borrowers easy access to mortgage loans to purchase homes at prices inflated by the Federal Reserve’s monetary policies. According to Ms. Yellen, “Public funding of education is another way that governments can help offset the advantages some households have in resources available for children.” But if money were the answer the problem, districts in Washington, D.C., Chicago, Los Angeles, and NYC would be leading the way in performance. After all, these districts spend more than the national average. Why do they have some of the worst schools with the highest dropout rates? Yellen is correct to point out the failures of our public education system. Young adults from economically challenged backgrounds are certainly being deprived of opportunities which could propel them forward. School choice programs to allow the poor and minorities better education options are working and should be expanded, but Ms. Yellen dared not take on the teacher unions. It wasn’t all bad. At one point she noted: “it appears that it has become harder to start and build businesses.” That’s for sure. The United States has steadily dropped in the rankings of economic freedom, as our colleagues at the Heritage Foundation has documented. But Ms. Yellen ignored most of the ideas that truly will ignite growth and raise incomes for the poor. Marriage, the dignity of work, income tax cuts to promote investment here, cutting our corporate tax, replacing welfare with work, preparing our workers with the skills they need to fill millions of unfilled jobs. These are the “values rooted in our nation’s history,” to borrow a phrase from the Fed chief, that could allow the poor to rise up. This might have been an occasion for Ms. Yellen to use her new perch as Fed chief to boldly challenge the whole litany of tired liberal talking points on inequality. She could have warned that when we focus on economic fairness and not growth, we get neither – as the Obama years have demonstrated. That’s so disappointing because we’ve tried all of these ideas for five years, and we still have record income inequality. The nation’s Fed chief ought to be a loud and clear voice for growth – not class envy The $600 Trillion Time Bomb Do you want to know the real reason banks aren't lending and the PIIGS have control of the barnyard in Europe? It's because risk in the $600 trillion derivatives market isn't evening out. To the contrary, it's growing increasingly concentrated among a select few banks, especially here in the United States. In 2009, five banks held 80% of derivatives in America. Now, just four banks hold a staggering 95.9% of U.S. derivatives, according to a recent report from the Office of the Currency Comptroller. The four banks in question: JPMorgan Chase & Co. (NYSE: JPM), Citigroup Inc. (NYSE: C), Bank of America Corp. (NYSE: BAC) and Goldman Sachs Group Inc. (NYSE: GS). Derivatives played a crucial role in bringing down the global economy, so you would think that the world's top policymakers would have reined these things in by now – but they haven't. Instead of attacking the problem, regulators have let it spiral out of control, and the result is a $600 trillion time bomb called the derivatives market. Think I'm exaggerating? The notional value of the world's derivatives actually is estimated at more than $600 trillion. Notional value, of course, is the total value of a leveraged position's assets. This distinction is necessary because when you're talking about leveraged assets like options and derivatives, a little bit of money can control a disproportionately large position that may be as much as 5, 10, 30, or, in extreme cases, 100 times greater than investments that could be funded only in cash instruments. The world's gross domestic product (GDP) is only about $65 trillion, or roughly 10.83% of the worldwide value of the global derivatives market, according to The Economist. So there is literally not enough money on the planet to backstop the banks trading these things if they run into trouble. Compounding the problem is the fact that nobody even knows if the $600 trillion figure is accurate, because specialized derivatives vehicles like the credit default swaps that are now roiling Europe remain largely unregulated and unaccounted for. Tick…Tick…Tick To be fair, the Bank for International Settlements (BIS) estimated the net notional value of uncollateralized derivatives risks is between $2 trillion and $8 trillion, which is still a staggering amount of money and well beyond the billions being talked about in Europe. Imagine the fallout from a $600 trillion explosion if several banks went down at once. It would eclipse the collapse of Lehman Brothers in no uncertain terms. A governmental default would panic already anxious investors, causing a run on several major European banks in an effort to recover their deposits. That would, in turn, cause several banks to literally run out of money and declare bankruptcy. Short-term borrowing costs would skyrocket and liquidity would evaporate. That would cause a ricochet across the Atlantic as the institutions themselves then panic and try to recover their own capital by withdrawing liquidity by any means possible. And that's why banks are hoarding cash instead of lending it. The major banks know there is no way they can collateralize the potential daisy chain failure that Greece represents. So they're doing everything they can to stockpile cash and keep their trading under wraps and away from public scrutiny. What really scares me, though, is that the banks think this is an acceptable risk because the odds of a default are allegedly smaller than one in 10,000. But haven't we heard that before? Although American banks have limited their exposure to Greece, they have loaned hundreds of billions of dollars to European banks and European governments that may not be capable of paying them back. According to the Bank of International Settlements, U.S. banks have loaned only $60.5 billion to banks in Greece, Ireland, Portugal, Spain and Italy – the countries most at risk of default. But they've lent $275.8 billion to French and German banks. And undoubtedly bet trillions on the same debt. There are three key takeaways here: There is not enough capital on hand to cover the possible losses associated with the default of a single counterparty – JPMorgan Chase & Co. (NYSE: JPM), BNP Paribas SA (PINK: BNPQY) or the National Bank of Greece (NYSE ADR: NBG) for example – let alone multiple failures. That means banks with large derivatives exposure have to risk even more money to generate the incremental returns needed to cover the bets they've already made. And the fact that Wall Street believes it has the risks under control practically guarantees that it doesn't. Seems to me that the world's central bankers and politicians should be less concerned about stimulating "demand" and more concerned about fixing derivatives before this $600 trillion time bomb goes off. Why Oil is Going Down in Price The U.S. Gulf Coast—home to the world's largest concentration of petroleum refineries—is suddenly awash in crude oil. The U.S. Gulf Coast—home to the world's largest concentration of petroleum refineries—is suddenly awash in crude oil. Russell Gold has details on MoneyBeat. Photo: Getty Images. So much high-quality U.S. oil is flowing into the area that the price of crude there has dropped sharply in the past few weeks and is no longer in sync with global prices. In fact, some experts believe a U.S. oil glut is coming. "We are moving toward a significant amount of domestic oversupply of light crude," says Ed Morse, head of commodities research at Citigroup. Related Shell Drops Louisiana Plant Unthinkable five years ago, the abundance of petroleum reflects surging output from oil fields in West Texas and North Dakota, as well as new pipeline routes to move crude to the refining and petrochemical complexes that line the coasts of Texas and Louisiana. And the glut on the Gulf Coast is likely to grow. In January, the southern leg of TransCanada Corp.'s Keystone pipeline is set to begin transporting 700,000 barrels a day of crude from the storage tanks of Cushing, Okla., to Port Arthur, Texas. The ramifications could be far-reaching, including lower gasoline prices for American drivers, rising profits for refineries and growing political pressure on Congress to allow oil exports. But the glut could also hurt the very companies that helped create it: independent drillers, who have reversed years of declining U.S. energy production but face lower prices for their product. Globally, the surge in supply and tumbling prices are attracting notice. On Monday, a delegate to the Organization of the Petroleum Exporting Countries said Saudi Arabia is selling oil to the U.S. for less than it would fetch in Asia. Nonetheless, the Saudis have continued to ship crude to refineries they own in Texas and Louisiana, according to U.S. import data, further driving down prices. The strongest indication of a glut is the falling price of "Louisiana Light Sweet," a blend purchased by refiners along the Gulf Coast. Typically, a barrel of Louisiana Light Sweet costs a dollar or two more than a barrel of crude in Europe. But on Wednesday, a barrel of Louisiana crude fetched $9.46 less than a barrel of comparable-quality crude in England. With growing crude flows from North Dakota, Texas and other parts of the country, refineries can force U.S. oil producers to offer large discounts. "It's definitely a buyer's market," says Judith Dwarkin, chief energy economist at ITG Investment Research. Mark Papa, executive chairman of EOG Resources Inc., one of the largest U.S. crude producers, says the fat profit margins that energy producers raked in earlier this year are over. "It was kind of like found money and it wasn't going to last," he says. To be sure, Mr. Papa doesn't expect such a glut that "we end up with a ruination of oil prices," he says, the way natural-gas overproduction has caused that fuel's price to remain near multiyear lows. Some industry officials argue that U.S. light crude will simply displace more "heavy" imported oil. But many Gulf Coast refineries are set up to turn the more viscous crude into diesel fuel, and converting their facilities to process additional light oil wouldn't be easy. U.S. drivers are finally benefiting from the surge in U.S. oil production. While up from recent lows, a gallon of gas cost, on average, 12.2 cents less in the week ended Monday than it had a year earlier, according to the Energy Information Administration. "We're awash in cheap energy," says Paul Smith, the chief risk officer at Mobius Risk Group, an energy adviser in Houston. Refiners like Valero Energy Corp. and Marathon Petroleum Corp. can buy up cheap U.S. crude and beat global refineries in the diesel market. U.S. refiners have increased exports 22% between June and October, and they now control about 20% of the global market for traded diesel, jet fuel and other products, according to Bernstein Research energy analysts. San Antonio-based Valero, the nation's largest oil refiner, all but stopped importing lightweight crude to the Gulf Coast and Memphis a year ago because there was so much U.S. product available, says spokesman Bill Day. It is also shipping crude from Texas and Louisiana all the way up to its refinery in Quebec because the price of Gulf Coast oil is so low. The surge in U.S. oil production has been swift. From virtually no output five years ago, the Bakken Shale formation in North Dakota will pass one million barrels a day this month, according to federal data. The Eagle Ford Shale deposit, in South Texas, passed the one-million-barrel mark in May and is nearing 1.3 million barrels a day. Both giant oil fields were unleashed by the combination of two technologies—horizontal drilling to position wells to run through layers of petroleum-rich rock, and hydraulic fracturing to break up dense geological formations. "Not one person saw this coming," says Paul Sankey, an energy analyst at Deutsche Bank. He says he expects growing production to eventually push prices of West Texas Intermediate crude, the U.S. benchmark, below $80 a barrel, down from $97.38 Thursday. The industry "will start screaming" for Congress to lift the export moratorium, he says. Adam Bedard, a market analyst for High Sierra Energy, a subsidiary of NGL Energy Partners LP, agrees that pressure will rise on the federal government to loosen crude-oil export restrictions, which date back to the 1973 OPEC oil embargo. Oil storage in the Gulf region appears to be filling up, he says. "It's like someone built a superhighway where there wasn't one before.” The Price of Oil as a Weapon of the Cold War The drop in prices is providing a boost to the U.S. economy and U.S. consumers, but it could put a dent in revenues in countries such as Russia, Iran, and Iraq, where oil exports play an enormously important role in supporting economic growth and government finances. Europe, meanwhile, is only partially benefiting from the decline in prices because the euro has been weakening, making it relatively more expensive for Europeans to purchase oil, which is priced in dollars. (NASDAQ) While it isn't unusual for oil prices to fall this time of year -- between the summer driving season and the winter heating season -- deeper factors are at play this year. Here are four of the most important. 1. Global oil production is growing, led by the United States. Thanks to shale oil drilling largely in North Dakota and Texas, U.S. crude oil production has climbed to 8.5 million barrels a day, its highest level since 1986. Including natural gas liquids, U.S. oil output is nearly even with Saudi Arabia. Production of "tight" oil -from the fracking of shale -- has gone from a marginal slice of U.S. output to nearly 4 million barrels a day since 2010. North Dakota is producing more than Libya. One symbol of this surge came last weekend, when energy giant Conoco loaded an oil tanker in Alaska and had it set sail for South Korea, the first cargo of Alaska North Slope crude to go to Asia in over a decade. (An exception to the ban on U.S. crude oil exports allows some exports from Alaska.) It was the first in what Citigroup's head of global commodities research, Edward Morse, says will "become an armada" of about 100,000 barrels a day. The industry is also increasing pressure on the Obama administration to allow oil exports from ports along the Gulf of Mexico. Russia's oil production is growing, too. The country's output is approaching its postSoviet high of 11.48 million barrels a day, reached in 1987. Russia produced 10.64 million barrels of crude and condensate in January, according to Russian data quoted by Bloomberg News. Prices have also been driven down by a recovery in production in Libya, where civil war has intermittently shut down the country's oil wells. But Libya is currently producing 925,000 barrels a day, a 14-month high, according to Argus Global Markets, a respected industry newsletter. 2. World consumption is anemic. China's oil consumption, up about 2 percent since last year, isn't growing as fast as expected. U.S. vehicle fuel efficiency requirements, set by the Obama administration in 2009, are working. As a result, motor fuel consumption is mostly flat. European economies, meanwhile, are weak. Combined with the weak euro -- which is near its all-time low -- that means Europeans are less inclined to use energy. and a strong U.S. dollar means that other countries won't feel the full benefit of lower oil prices. 3. The drop in prices will inflict economic and political damage. That might not be such a bad thing. Crude oil and oil products made up 46 percent of Russia's budget revenues in the first eight months of this year. At a time when the West is trying to sanction Russia for its incursions in Ukraine, a 10 to 20 percent drop in oil prices could prove powerful. Still, it's still a far cry from the 1980s, when Saudi Arabia produced enough oil to flood the market and drive prices down so far that many experts say it sped up the fall of the Soviet Union. That's not going to happen now, but Russia could be squeezed a bit. Iran, whose oil exports are limited by sanctions related to its refusal to limit its nuclear program and open it up to greater international scrutiny, will also suffer a setback. Iran's oil minister Bijan Namdar Zangeneh late last month called on the Organization of the Petroleum Exporting Countries to keep oil prices from falling any further. “Given the downward trend of the oil prices, the OPEC members should make efforts to offset their production to keep the prices from further instability,” Zangeneh said according to Shana, a news agency supported by Iran's oil ministry. Countries hoping for an OPEC rescue are counting on Saudi Arabia, the swing producer. It's hard to tell what Saudi Arabia is thinking. It cut production by 400,000 barrels a day in August; it could do that again. OPEC doesn't have a formal meeting again until Nov. 27, but discussions are still going on. The drop in oil prices also squeezes U.S. domestic producers and could make some shale oil prospects less attractive. Saudi Arabia might be hoping that U.S. shale oil in North Dakota or Canada's oil sands -- where costs can run high and transportation expensive -- is shut down first. 4. Caution is wise, because a rebound in oil prices is easy to imagine. Before 2008, the average annual price of West Texas Intermediate crude oil -- a U.S. benchmark -- was never more than $66 a barrel. It briefly fell below $90 a barrel on Thursday, down about $14 since late June. But that's still high by historic standards, and it could go back up again for three reasons. First, at this time of year, many refineries shut down for repairs and maintenance. When they come back on line, prices could recover. Second, there can be a bit of irrational exuberance. The United States has made huge strides in slashing oil imports, but it's still a big net oil importer. Finally, consumption bounces back when prices drop and economies recover. U.S. total oil consumption rose 2.5 percent in 2013, the largest increase since 2004. Adam Sieminski, administrator of the federal Energy Information Administration, has warned that world petroleum consumption will climb 38 percent between 2010 and 2040, almost entirely because of growth outside the Organization of Economic Cooperation and Development countries. That could mean much higher prices. Interstellar Christopher Nolan writes, directs, and produces another stunning masterpiece. He is a British-American film director, screenwriter, and producer. He created several of the most successful films of the early 21st century, and his eight films have grossed over $3.5 billion worldwide.[2] Having made his directorial debut with Following (1998), he gained considerable attention for his second feature, Memento (2000). The acclaim of these independent films afforded Nolan the opportunity to make the big-budget thriller Insomnia (2002), and the more offbeat production The Prestige (2006); both were well-received critically and commercially. He found further popular and critical success with The Dark Knight trilogy (2005–2012) and Inception (2010). In his latest epic motion picture, Intersellar, a wormhole (which can theoretically connect widely separated regions of spacetime) is discovered, explorers and scientists unite to embark on a voyage through it, transcending the normal limits of human space travel. [6] Among the travellers is a widowed engineer, Cooper (McConaughey), who must decide whether or not to leave his two children behind to join the voyage and attempt to save humanity from an environmentally devastated Earth[7] by finding a new habitable planet in another galaxy. Interesting factoid. Dr. Kip Thorne wrote a book called Black Holes and Time Warps. He designed, and you paid for the construction of two matching LIGO’s; one in Hanford Washington and the other in Livingston, Louisiana. I have personally visited both facilities and spoken with the directors and staff engineers. The late Carl Sagan, a Thorne contemporary, write a book that became a movie by the same title; Contact. Matthew McConaughey starred in both movies. The movie cost about $165 million to make, requiring a dual studio deal to get it done. Nolan’s propensity to utilize characters that are often emotionally disturbed and morally ambiguous, facing the fears and anxieties of loneliness, guilt, jealousy, and greed let the everyday person relate to his movies. By grounding "everyday neurosis – our everyday sort of fears and hopes for ourselves" in a heightened reality, Nolan makes them more accessible to a universal audience. But, I see an overall trend in really successful movies to do two things. First, they provide an image of hope that somewhere on Earth is a man of steel. I mean someone who is incorruptible and powerful enough to stop all the bad guys from killing and all the greedy guys from raping the planet and its inhabitants. The other is a possibility of global escape. Sure, each person wishes for a frontier to which they can run to make a new life of bounty for themselves without anyone else redistributing their success. But, I mean the whole of society wants an assurance that there is something after this. An afterlife, without all the religion. A bountiful and challenging new world to which we, or our children can be transported to begin again. I know, good planets are hard to find, but there is in this movie the chance of finding it and getting there. Let’s go watch it together. November the World will Turn…? The Republicans are going to recapture the Senate, picking up more seats than most any forecaster expects. And the House GOP is going to add to its majority. But then comes the big story: The beginning of a new conservative revolution. The idea that nothing much will change if the GOP captures the whole Congress is just plain wrong. The politics and policies in Washington are about to change in a major way. Obama may still be president. But he is going to be immediately confronted with a flood of new bills that will change the debate on tax reform, energy, healthcare, education, international trade, and regulations. Obama will no longer be able to hide behind Harry Reid, who has stopped all voting on these matters. And Mitch McConnell, as Senate majority leader, will be able to move forward the reform ideas of his caucus and House policy leaders like Paul Ryan, Jeb Hensarling, Kevin Brady, and many others. Obama’s head will spin with all the new paperwork on his desk. He may even have to cut back on his golf game. Of course, because of his left-wing ideology, Obama may veto everything. But if he does, he’s setting up a new Republican agenda for the 2016 presidential race. Either Hillary Clinton completely jumps the Obama ship, or she’s pulled way left by the Democratic Party’s Bill de Blasio/Elizabeth Warren/Sandinista wing. Either way she’s in trouble. Tax Reform understand which approach is being used. The tax-inclusive rate will always be lower than the tax-exclusive rate, and the difference grows as the rates rise. At a rate of 1 percent the difference is negligible, but a 50 percent tax-exclusive rate corresponds to a 33 percent tax-inclusive rate—a 17-percentage-point difference. total sales tax rate that households would face would likely be significantly higher than the federal rates indicated above, because existing state sales tax would be added. In addition, most or all state income taxes would probably be abolished in the absence of a federal income tax system, since the state income tax systems depend on the federal system for reporting of income and other information. Today’s state income taxes would likely be converted to sales taxes, adding considerably to the combined sales tax rate. Oil Access and the Keystone Pipeline This is low hanging fruit that has already been fought out politically, and the Republicans know the battle field, but you do not know what it all means. Money, that’s what. Not really a better deal on oil, because it is hard to get and hard to extract and hard to pump. The proposed northern extension of the nearly 2,000-mile Keystone XL pipeline would connect Canada’s tar sands to refineries along the Gulf of Mexico, moving almost the equivalent of America’s total import of similar crude from Venezuela. This would seem to be a positive for the U.S. If most of that oil actually stayed in the U.S. The Keystone XL is designed to promote exports of Canadian tar sands oil and its refined products to non-U.S. markets, especially China and Latin America. China is now the largest foreign investor in Canada’s tar sands, representing 52 percent of all foreign investment since 2003. Ironically, the XL pipeline may increase gasoline prices for Americans and reduce national energy security – not bolster it, as promoters claim (Public Citizen). Of course, the pipeline would still make huge profits and there would still be significant jobs in the U.S. during construction and refining. But the U.S. would carry the greatest share of the risk while getting the smallest share of the benefits (Kevin Grandia). And then there’s the properties of this oil itself that enter into the risk portion of the analysis. Compared with conventional crude, heavy oil extracted from tar sands has to be at higher temperatures and pressures in order to flow. And still the tar sands have to be boiled to separate the heavy oils, and then diluted with light hydrocarbons and methane to flow. Since this mixture is the most viscous, sulfurous and acidic form of oil produced today, it may just be a bit hard on the pipelines. Again, riskier to the United States. Which may be no problem at all if the pipelines are installed as designed, with epoxy coatings and other corrosion-reducing technologies. But we keep installing crappy pipe and cutting corners. All in all, the cost/benefit is not in America’s favor. The tar sands are also a contentious issue within Canada (John Richardson, Esquire). Building a pipeline that takes the tar sand crude to the Canadian Pacific Coast is meeting fierce citizen resistance. The Canadian government is employing rather draconian tactics in squashing this opposition, including destroying scientists careers if they discuss scientific results that do not support the tar sands development (Thomas Homer-Dixon). This is a different kind of cost to that country. I’m not sure why Canada doesn’t just build refineries near the tar sands and then move the refined products to the coast where new port facilities would be built to handle the super-tankers from China. It would be a lot more lucrative for Canada in the long-run, and less environmentally risky. But it would require more up-front capital and construction and take a bit longer than using our refineries. Freedom will one Day Expire Shortly after being elected secretary-general of the International Telecommunication Union (ITU) at a high-level meeting in South Korea Thursday, Zhao Houlin told Seoul’s official news agency that while everyone supports the idea of freedom of speech, what constitutes censorship is open to differing interpretations. “We [at the ITU] don’t have a common interpretation of what censorship means,” the Yonhap agency quoted Zhao as saying. “A country can ask people not to watch pornography, and some consider this as also kind of censorship. We have not got a common definition.” Asked about China’s rigidly-enforced censorship of politically sensitive material, Zhao replied, “Some kind of censorship may not be strange to other countries.” China is infamous for curbing access to online material it deems subversive, using sophisticated technology both to block it and to track down and ultimately punish cyber dissidents. Zhao, the ITU’s deputy secretary-general since 2006, was the only candidate nominated for the top post, and received 152 votes from the 156 countries present and voting at the conference. In his acceptance speech, he thanked “all Chinese friends who have worked hard to promote my candidature over the last two years.” The newly elected International Telecommunication Union chief, Zhao Houlin of China, speaks to media in Busan, South Korea on Thursday, October 23, 2014. (Photo: ITU/Flickr) For the next four years, Zhao will head an agency which repressive regimes like China, Russia, Cuba and Iran have sought to use to promote international – that is, U.N. – control over the Internet, an effort opposed by liberal democracies. The battle played out at an ITU-organized information summit in Tunisia in 2005, and again at the ITU-convened World Conference of International Telecommunications (WCIT) in Dubai in 2012. The Dubai event ended with countries deeply divided over a raft of proposals to revise a longstanding binding global telecommunications treaty, some of which critics said would stifle Internet innovation and growth, and open the door to repressive measures by governments opposed to online free speech. In the end the U.S., Europeans and other mostly Western democracies refused to sign the new treaty agreement. Under the current, so-called “multi-stakeholder model,” a not-for-profit body called the Internet Corporation for Assigned Names and Numbers (ICANN) has since the late 1990s been responsible for overseeing Web domains and assigning protocol addresses. The Commerce Department’s National Telecommunications and Information Administration (NTIA) has oversight of ICANN. Supporters say the system has worked, and has been largely free of U.S. government interference. But the likes of China and Russia are opposed to what they view as unacceptable U.S. control. Last March, the Obama administration announced that when NTIA’s contract expires in Sept. 2015 it plans to relinquish its oversight of ICANN, opening the way for proposals for a new stewardship mechanism which the administration stipulated must “maintain the openness of the Internet.” The Commerce Department sought to allay concerns that this would lead to U.N. control, with assistant secretary Lawrence Strickling telling reporters, “I want to make it clear that we will not accept a proposal that replaces the NTIA’s role with a governmentled or intergovernmental solution.” ‘Under the auspices of U.N. institutions’ Autocratic governments are continuing to push back, and the current three-week ITU policy-making conference in the South Korean city of Busan is the latest arena. In a policy statement delivered there (translation provided by the Heritage Foundation), Russian delegate Nikolay Nikiforov said Moscow believes rules governing information and communication technologies “should be developed under the auspices of U.N. institutions.” “They should be based on adherence to the principles of non-interference in the internal affairs of states and their equal rights in the management of the Internet, the sovereign right of states to control the Internet in the national information space …” In the U.S. policy statement in Busan, coordinator for international communications and information policy Daniel Sepulveda, voiced hope that the conference would move ahead in a spirit of consensus, but also cautioned against any efforts to stifle free expression or innovation online. “This specialized agency of the United Nations exists to encourage and enable the deployment of telecommunications over air and wire and to ensure that those networks are interoperable and secure,” he said. “We are not here to dictate or control how people use that connectivity to express themselves, organize, or create and operate the services that are enriching the lives of the 2.7 billion people connected to the Internet today.” In an article last month Sepulveda and two other State Department officials involved in cyber and human rights policy predicted that Internet governance would arise in Busan. “There are some actors who want to radically change the existing multi-stakeholder approach to Internet governance by centralizing control over the Internet under an intergovernmental organization, effectively giving governments sole authority over the choices that affect the Internet’s design and operation,” wrote Sepulveda, Christopher Painter and Scott Busby. They gave three reasons to oppose this: --The Internet’s dynamism would be diminished, due to slow decision-making processes in intergovernmental institutions; --Stakeholders in civil society, academia and industry would be left out of Internet policymaking; and --“Intergovernmental controls would inevitably encourage repressive regimes to attempt to introduce censorship or content controls.” Lois Lerner: Valerie’s Private Assassin Sunday on Fox News Channel's "MediaBuzz," Bob Woodward said there are, "lots of unanswered questions," about the Obama administrations involvement in the IRS scandal surrounding the targeting conservative groups for extra scrutiny. Woodward said, "The reality now in my view that in the Obama administration, there are lots of unanswered questions about the IRS, particularly. If I were young, I would take Carl Bernstein and move to Cincinnati where that IRS office is and set up headquarters and go talk to everyone."