Supplier Market Analysis

Personal Finance

Ece Yavuzbaş

Gökçe Uz

Tevfik Kumru

Kemal Pınarbaşı

1

2

Outline

Definition

Benefits

Financial position

Adequate protection

Tax planning

Investment and accumulation goals

Retirement planning

Estate planning

Personal Budget

Software Programs

It’s not your salary that makes you rich, it’s your spending habits.

Charles A. Jeffe

3

4

Definition of

Personal Finance

Personal finance is defined as the way in which an individual or a family makes decisions in relation to their financial portfolio.

Personal financial plan: a plan that specifies your financial goals and describes the spending, financing, and investing plans that are intended to achieve those goals

5

Benefits of

Personal Finance

• Personal Financial Planning may not help you to earn more money, but it will help you to use your money more wisely.

• As part of your personal financial plan, think about what is important to you.

What do you want to accomplish?

6

Benefits of

Personal Finance

• Budgeting

• Savings

• Investment

• Risk Management

• Cash-flow management

7

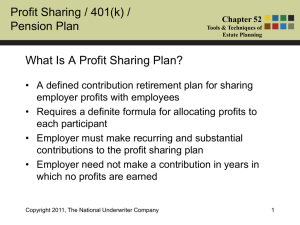

Components

• Financial position

• Adequate protection

• Tax planning

• Investment and accumulation goals

• Retirement planning

• Estate planning

8

Financial Position

Financial planning needs to understand what his/her/their financial situation is.

Household assets

Household liabilities

Household cash flow

9

Financial Position

Develop and implement a budget

Calculate your net worth (wealth) using a balance sheet

Develop a personal income statement and use it to analyze your spending

Introduce budgeting software: Quicken,

Mint.com and others

10

Adequate Protection

Protected in event of an emergency must also be in place

Natural disasters and death

Buying insurance for each of these areas

Risk Allocation

Tax Planning

Certainties: Taxes and Death

Income

Value of Assets

Single largest expense in a household

Tax deductions

Credits

11

Impacts of Taxes

Goals Budget

Estate

Planning

Retirement

Planning

Taxes

Investing

Cash

Management

Savings and Debt

Insurance

12

Investment and accumulation goals

Planning how to accumulate enough money for large purchases

Major reasons to accumulate assets include purchasing a house or car, starting a business

,paying for education expenses and saving for retirement

Major risk to the households, the rate of price increases over time or inflation

Investment and accumulation goals

Financial planners suggest regular savings in a variety of ınvestments

The investment portfolio has to get a higher rate of return

Investors risk attitudes vary from person to person

These types of financial goals require careful planning and secure investments.

Retirement planning

Personal finance involves planning for your or your families retirement

You need to know how much money do you need to be retired and how do you finance this retirement

Private Pension

Private pension

Private pension

This is a long-term investment that are used by intermediaries instead of you

When you come retirement age, you obtain a sum of money

Payments are deposited to the Takasbank.They

are under the control of government

You can see your fund fluctuations on web site.

Retirement companies

Advantages of the private pension

A small amount of contribution is paid each month

You can earn more money with less money

You can determine the degree of risk

You don’t need to pay an other fee when devolved into another company

Funds are conducted by professional portfolio managers

The allocation of funds can be changed six times a year

There is no loss of money

Disadvantages of the private pension

To be long-term investment

You have to pay operating expenses like 8%

Fund operating deductions are made

If you exit the system less than 10 years,10% is interrupted

When you evaluating the savings at exchange,you have to pay a tax for earning per tl to the government.however ıf you evaluate the saving at private pension companies, government don’t get a tax from you.

Estate Planning

• Estate planning involves planning for what will happen when you die, and planning for the tax due to the government at that time.

• Estate planning typically attempts to eliminate uncertainties over the administration of a probate and maximize the value of the estate by reducing taxes and other expenses.

21

Personal Budget

A personal budget is a finance plan that allocates future personal income towards expenses, savings a and debt re-payment.

22

Cash Flow Trade Off’s

Key Cash Management tradeoffs:

1. The Risk-Return trade off

2. The Spending-Investment Risk trade off

3. The Time Expended-Return trade off

23

Softwares 24

25

Conclusion

How can people protect themselves against unforeseen personal events, as well as those in the external economy?

How can family assets best be transferred across generations (bequests and inheritance)?

How does tax policy (tax subsidies and/or penalties) affect personal financial decisions?

How does credit affect an individual's financial standing?

How can one plan for a secure financial future in an environment of economic instability?

26

Thank You For Your

Attention

Do you have any question?