Empirical Financial Economics

advertisement

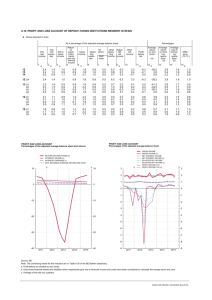

Empirical Financial Economics 3. Semistrong tests: Event Studies Stephen Brown NYU Stern School of Business UNSW PhD Seminar, June 19-21 2006 Outline Efficient Markets Hypothesis framework Standard Event Study approach Brown/Warner Systems Estimation issues Asymmetric Information context FFJR Redux Efficient Markets Hypothesis ln pt E[ln pt | it ] E[ln pt | t ] which implies the testable hypothesis ... E[ln pt E (ln pt | t )] zt 0 where zist part of the agent’s information set it In returns: E[rt E[rt | t )] zt 0 wher rt ln pt ln pt e Examples Random walk model Serial covariance = E[rt E(rt )] rt 0 Assumes information set is constant Event studies Average residual = E[rt E (rt )] t 0 For event dummy t 1 (event) Time variant risk premia models E (rt ) 0 ( X t ) 11 ( X t ) K K ( X t ) zt includes X Important role of conditioning information Efficient Markets Hypothesis E[rt E[rt | t )] zt 0 Tests of Efficient Markets Hypothesis What is information? Does the market efficiently process information? Estimation of parameters What determines the cross section of expected returns? Does the market efficiently price risk? Standard Event Study approach EVEN T rt1 u01 u11u21 … EVEN T rt2 u02 u12u22 … EVEN T rt3 u03 u13u23 … 0 EVEN T EVEN T u04 u14u24 … u05 u15u25 … 5 10 15 20 25 30 rt4 t Orthogonality condition Event studies measure the orthogonality condition E[rt E[rt | t )] zt 0 using the average value of the residual u t [ri ,ti E (ri ,ti | ti , rM ,ti )] zt where zt 1is good news andzt 1 is bad news If the residuals are uncorrelated, then the average residual will be asymptotically Normal with expected value equal to the orthogonality condition, provided that the event zt has no market wide impact Fama Fisher Jensen and Roll Cumulat ive residuals around st ock split Cumulat ive average residual - Um 0 .4 0 .35 0 .3 0 .25 0 .2 0 .15 0 .1 0 .0 5 0 -30 -20 -10 0 10 20 Mont h relat ive t o split - m 30 Brown and Warner Model for observations: rjt j j rMt jt Raw returns j , j 0 j rj , j 0 Mean adjusted returns j 0, j 1 Market adjusted returns , OLS Market Model j j v (multiple models) Also considered quantile regressions, multifactor models Block resampled bootstrap procedure rt1 rt2 rt3 rt4 0 5 10 15 20 25 Choose securities at random 30 t Block resampled bootstrap procedure EVENT(chosen at random) EVENT(chosen at random) rt2 EVENT(chosen at random) rt3 EVENT(chosen at random) EVENT(chosen at random) 0 5 rt1 10 15 20 25 Choose ‘event dates’ at random 30 t rt4 Block resampled bootstrap procedure EVENT(chosen at random) Estimation period EVENT(chosen at random) Test period Test period rt2 EVENT(chosen at random) Estimation rt3 Test period EVENT(chosen at period random) EVENT(chosen at random) Estimation period Test period 0 5 rt1 10 15 Test period 20 25 30 t Check if sufficient data exists around ‘event date’ rt4 Basic result Actual level of Abnormal Performance at day “0” Method 0 0.005 0.01 0.015 6.4% 25.2% 75.6% 99.6% Market Adjusted return 4.8 26.0 79.6 99.6 Market Model 4.4 27.2 80.4 99.6 Mean adjusted return Loss of power when event date uncertain Method Days in Event period Level of abnormal performance 0 0.01 0.02 Mean adjusted return 11 1 4.0% 6.4 13.6% 75.6 37.6% 99.6 Market Adjusted return 11 1 4.0 4.8 13.2 79.6 32.0 99.6 Market Model 11 1 2.8 4.4 13.2 80.4 37.2 99.6 Misspecification when events coincide Level of abnormal performance Method 0 0.01 0.02 Mean adjusted return Clustering Nonclusteri ng 13.6% 4.0 21.2% 13.6 29.6% 37.6 Market Adjusted return Clustering Nonclusteri ng 4.0 4.0 14.4 13.2 46.0 32.0 Market Model Clustering Nonclusteri 3.2 2.8 15.6 13.2 46.0 37.2 Schipper and Thompson Analysis rjt j j rMt jt j jt The best linear unbiassed estimator of j ˆ j 2 sM s j sM s jM 2 2 2 sM s sM is j M j 1 M where is the difference in average return between announcement and non announcement periods, and is the regression coefficient of the event dummy on the market However, event study procedure assumes = 0 Systems estimation interpretation r11 1 rM 1 11 r1t 1 rMt 1t rm1 0 r mt 1 11 0 1 1 1t 1 rM 1 m1 m m1 m 1 rMt mt m mt o R X , with error covariance matrix r Gain from systems estimation 11I t I m1 t 1m I t It mm I t GLS estimator is ˆ [ X ' 1 X ]1 X ' 1R No gain in efficiency if ( diagonal) Events differ in calendar time All events occur at same time ) X ( I m X Gain in efficiency if constant across securities Is this reasonable? Sons of Gwalia example Claim AssayReport ( oz/ton) Operations a A h, dig for gold s ,value to corporation | s s e l , don ' t dig Market observes decision s, but not assay report Market equilibrium requiresE[ ] E[ | s] p(s) 0 s Event study implication E ( | s ) s E ( | s) a a E ( | h) , E ( | l ) A 1 A a a s E[ | s] p(s) h A A l 1 A (1 A) 0 This implies that h l which gives the return model rjt j j rMt [d ht I ht dlt I lt ] jt How do we getd ht , dlt ? Justification for corporate finance event study application Gwalia will dig if assay report is high enough s h if t ' z jt sl if t ' z jt A standard Probit model Taylor series expansion justification for cross section regression of excess returns on firm characteristics FFJR Redux Cumulat ive residuals around st ock split Cumulat ive average residual - Um 0 .4 0 .35 0 .3 0 .25 0 .2 0 .15 0 .1 0 .0 5 0 -30 -20 -10 0 10 20 Mont h relat ive t o split - m 30 Original FFJR results Cumulat ive residuals around st ock split Cumulat ive average residual - Um 0 .4 0 .35 0 .3 0 .25 0 .2 0 .15 0 .1 0 .0 5 0 -30 -20 -10 0 10 20 Mont h relat ive t o split - m 30