E-Commerce Companies - New York University

advertisement

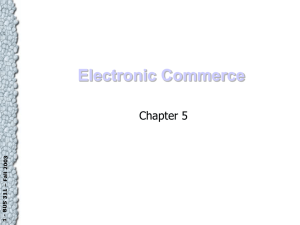

Evaluation of Business Models Professor Joshua Livnat, Ph.D., CPA 311 Tisch Hall New York University 40 W. 4th St. NY NY 10012 Tel. (212) 998-0022 Fax (212) 995-4230 jlivnat@stern.nyu.edu Web page: www.stern.nyu.edu/~jlivnat 1 Overview – The underlying logic for an E-Commerce company. – A five-step process to assess the business model. – Classifications of E-Commerce companies. – Various business models. – Implications of the business model. – Long-term viability of business models. 2 The Underlying Logic • “Old Economy” contains market failures or transaction costs: – Examples: • Information is not freely available, and is costly to gather and process. • Markets may be too fragmented and too dependent on local population (personal items for sale). • The “New Economy” company eliminates or reduces market failure or transaction cost. 3 The Underlying Logic • Note: The deficiency in the “old” economy is actually the opportunity for the “new” economy company. • However, for the opportunity to be profitably exploited: – It should be significant. – The company should have adequate resources. – The company should have the ability to generate revenues from customers. – The company should be able to deter competition, or differentiate itself from its competitors. 4 Sellers’ Transaction Costs • Order Taking Costs: – Reduce physical facilities and number of employees dedicated to process orders by accepting and processing orders electronically. • Recording Costs: – Avoid the manual data recording process by connecting the users electronically and allowing them to enter the data themselves. • Display Costs: – Eliminate stores, employees in these stores, and paper catalogues, by maintaining a virtual store. • Mailing Costs: – Reduce physical mail sent to customers by sending E-mail instead. • Marketing costs: – Replace mass marketing channels by direct marketing to relevant customers only. 5 Buyers’ Transaction Costs • Transportation Costs: – Avoid waste of time and money spent on travel to a physical store. • Timing of Transactions: – Buyers do not need to change their schedule according to the opening hours of the business. Web access to the entity’s virtual site is available 24 hours a day, seven days a week. • Information Gathering Costs: – Avoid the costly activity of gathering information, by using information on the Web and Shopbots. • Information Processing Costs: – Buyers can save time and effort in understanding and processing information, or by using online software and tools. 6 Other Benefits of E-commerce • Personalization: – By identifying customers, it is possible to offer each individual customer a personalized service and special offerings. • Price Transparency: – The Web allows consumers to compare prices more efficiently and more effectively, anywhere and at any time. • Market Making: – The Web allows the creation of efficient new markets by the ability to aggregate cheaply many buyers and sellers from different locations and time zones. • Network Externalities: – The larger is a network the more valuable it may be to its members, rather than a smaller network. 7 The Five-Step Process • What market failures or transaction costs are addressed by the business model? • How effective can the E-Commerce firm be in reducing the market failures or transaction costs? • Will the E-commerce company be able to expropriate benefits from customers? • What are the necessary resources to conduct the business? • Can competitors erode profits? 8 Application Egreetings Network, Inc. (EGRT) • EGRT is in the E-Card business: – Customer selects a card from an online selection of cards. – Customer personalizes the card. – Customer specifies a recipient. – EGRT delivers the card, which can be opened by the recipient. – EGRT also notifies the customer that the E-Card was sent. • Compare EGRT to paper card companies. 9 EGRT – Transaction Costs • Buyers (customers) save the following transaction costs: – – – – Transportation to a physical store. Timing of transaction (24/7). Mailing costs. EGRT retains recipient’s address, so there is lower data-entry costs. 10 EGRT – Transaction Costs • EGRT saves the following transaction costs (as compared to a paper card company): – Display costs (no need for a retailer). – Order-taking costs (no need to communicate with a retailer). – Data-entry costs (customer enters the data directly). – Inventory costs (no need for physical inventory). – Printing costs (same card can be used by more than one customer). 11 EGRT – Transaction Costs • Marketing costs: – Savings through personalization (customer tastes). – Complementary products. • No network externalities. • No price transparency. • No creation of a new market. 12 EGRT – Ability to Generate Revenues • Customers are willing to pay for paper cards. They should also be willing to pay for E-Cards. • However, the marginal cost of an E-Card is very low! • Fixed costs of content and systems are high. • Competition may drive the price of an E-Card to zero. – Over 100 E-Card companies! 13 EGRT – Ability to Generate Revenues • Revenues: • • • • 1997 $ 505,000 1998 317,000 1999 3,100,000 2000 (6 mon.) 5,900,000 • Converted from fee-paying customers to free service in November 1998. • Advertising revenues in 1999 and 2000! • E-commerce sales negligible in 1999. 14 5000000 4500000 4000000 3500000 3000000 2500000 2000000 1500000 1000000 500000 Reach '9 S 9 ep '9 N 9 ov '9 9 Ja n '0 0 M ar '0 M 0 ay '0 0 Ju l' 00 Ju l ay '9 9 99 M ar ' M '9 9 '9 8 Ja n N ov '9 8 0 ep 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 S Reach E-Greeting Traffic Unique Visitors 15 EGRT – Traffic and Expenses • In December 1999, a high traffic month: – 21 million visitors – 184 million web pages viewed – 10 million E-Cards sent • Spent about $50 million through the end of 1999. • Selling and marketing $20 million 1997-9. • Operations and development (R&D) $15 million in 1997-9. 16 EGRT - Content • Gibson supplied 34% of cards and held 20% of equity. • In March 2000, Gibson was purchased by American Greetings, which has its own ECard business. • NBC owns stock in return for advertising. EGRT can use NBC shows in content. 17 EGRT - Resources • Raised $60 million through preferred shares in 1999. • Raised $54 million in issuance of common stock in December 1999. • Had about $58 million cash and liquid assets as of the most recent public filing (6/30/2000). 18 EGRT - Survival • EGRT generates most of its revenues from advertising. • Can it survive for the long run on advertising? • Which companies are likely to generate higher advertising rates? • Does EGRT have a comparative advantage in E-commerce? 19 20 Summary • Understand well the current business model. • Assess the opportunities for changes and transformation in the business model. • Assess long-term revenue sources for the Ebusiness. • Assess long-term costs to operate the business. • Is the business viable? Can competitors erode profits? 21