Transformation - Expectations of rating analysts - Sa-Dhan

advertisement

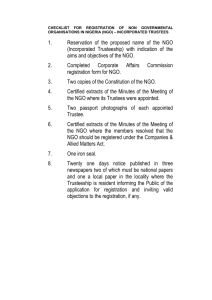

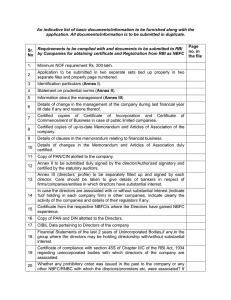

Sa-Dhan, Goa, March 24, 2010 Transformation of an MFI – Expectations of rating analysts Micro-Credit Ratings International Ltd 602 Pacific Square, 32nd Milestone NH8, Gurgaon 122001 INDIA www.m-cril.com Tel: +91 124 230 9497, 426 8707 Fax: +91 124 230 9520 Ratings Credit Rating: evaluates MFI’s creditworthiness Areas of evaluation are Governance, strategy and external environment Management and systems Financial performance Social Rating: a judgement on key elements of MFI’s social performance organisational effectiveness in putting mission into practice in line with accepted social values Transformation - Key Improvements • • • Transformation to a well regulated legal form • Prudential norms of RBI • Regular reporting to and monitoring by RBI and RoC Board of Directors – increased representation of non-executive Directors/ nominee Directors Improvements in CAR, fund mobilisation and growth rates Comparison of performance of NBFC MFIs and NGO MFIs (as on 30 September 2008) Portfolio growth rate* Debt-Equity Ratio Capital to Risk Weighted Assets Ratio Average number of lenders NGOs NBFCs 16.6% 99.8% 11.9 6.6 5.4% 15.5% 6 12 *annualised growth rate for the six months period ending 30-Sep-2008 Concerns - Accounting Fair representation of MFI’s profitability & sustainability is a key objective of credit ratings • • Post transformation of an MFI - the new NBFC coexists with the earlier NGO Benefits of relatively higher profits in one over the other: NGO (Society, Trust or Sec-25 company) NBFC Tax savings (if it holds exemption under section 12A) 1. Better equity valuations for NBFC 2. Transfer of remaining net worth from NGO Contd.. • Allocation of common expenses - Logical allocation policies and disclosure help improve ratings • Salaries of the senior management • Rent of office premises • Depreciation on fixed assets • Field staff salaries – if the branch network is common • Inter-company transactions (such as loans & advances) • • should be at arm’s length & with proper disclosure Creation of Goodwill & other intangible assets • • proper disclosure on its need and valuation ignore intangible assets for computing certain ratios for the sake of comparison Mutual Benefit Trusts • A common conduit to transfer net worth from an NGO to NBFC • Model ‘per-se’ in accordance with ‘Trust’ and ‘Cooperative’ principles • Intends to share the surpluses and capital gains among the members • MBTs should have • • • • proper and verifiable details of members documents evidencing their consent clearly interpreted rules for the distribution of benefits and decision making should not be used as a mean to mobilise deposits Social Rating - Concerns • Members’ awareness on • • • their membership in the MBTs benefits and rights accruing to them limitation w.r.t liquidity/withdrawal of their funds • Capital gains from the sale of MBT’s shares – are members passed on the benefits? • Adequate representation of members among the trustees - will be a step in right direction • Increased focus on margins and equity valuations – need a balance between financial and social objectives Thank You!