Chapter 28 Notes 2012

advertisement

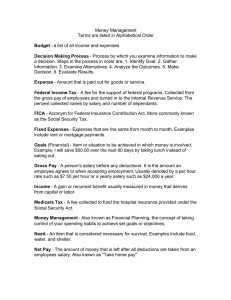

Chapter 28 Planning For The Future What you? does money mean to What are values? Values are a belief of what is desirable, worthwhile, and important to us What do you value? List what you would save if you could put only three items that are meaningful to you in a treasure chest. Who influences values? Values can be influenced by family, friends, teachers, religious affiliations, work/career, media, and law… What do you value? People have different values which guide their decisions. These decisions may have an affect on their lifestyle and financial situation. For example, if a person values financial security, he/she may focus on saving, investing, and/or finding a good job What type of lifestyle do you dream about? Setting Goals To reach your desired lifestyle you will need to do some planning and goal setting setting goals allows you to focus on items that you identify as important. Goals can be… Short-term goals can be achieved in less than one year. Long-term goals can be reached in more than one year. Why are goals important: Having goals allows us to become better than we are today. Successful people have goals Goals motivate and inspire people Goals guide people as they live their lives Without goals we have nothing to work towards SMART GOALS Specific Measurable Attainable Realistic Timely To Achieve Financial Goals We need to manage our money MONEY MANAGEMENT ○ To process of getting the most from your $$$ BUDGETING ○ A Plan of how I hope to spend my money ○ Steps in Planning a Budget 1. 2. 3. 4. 5. 6. Set Financial Goals Estimate Income Budget for Fixed Expenses Budget for Variable Expenses Record what you Spend Review Spending and Savings Patterns 2. Estimate Income: Any money your receive (on a regular basis) Investments, Salary, ??? GROSS INCOME (salary) Earned In come Net Income Income less (-) deductions ○ Examples: Taxes, Insurance, 401-K, Social Security 3. Budget for Fixed Expenses Fixed Expenses Rent, Car, Loans 4. Budget for Variable Expenses Variable Expenses Cable, Phone, Groceries, Entertainment??? 6. Record what you Spend Write down what you spend during the month Check what you spend against your budget A difference between budgeted amount and actual is called a budget variance Surplus – Deficit - 7. Review Spending and Saving Patterns Saving… Big Purchases Big Ticket Items Retirement Budgeting is a continual process… Average Household Expenses 6% 4% Housing Transportation 10% 33% Other Food 13% Personal Insurance and Pensions 15% Health Care 19% Apparel & Services Income Income = the actual amount of money you earn or receive during a given period An employee may be paid: Weekly Biweekly=every two weeks Twice a month; 15 and 30th Once a month Commission Income Wage/Rate=paid hourly US minimum wage is $7.25 IL minimum wage is $8.25 per hour Salary - receiving the same gross pay each pay period Example: $50,000 per year Gross Pay Gross Pay is the total amount you earned for a specific time Number of hours worked * wage (rate per hour) = gross pay Example: 30 hours worked * $8 per hour=$240 gross pay Net Pay Net Pay (take home pay) Gross pay-deductions=net pay In US net pay = about 30 % less than gross pay So you make $62,000 a year how much are you really making??? Estimate about: $43,400 W-4 An employer gets the federal income tax information when an employee gets hired and must fill out a W-4 Form= lists number of withholding allowances you want You will claim “0”or “1”on your forms The more you claim the less the government takes out Example you have 5 children you need more money to take care of them Deductions Gross pay is reduced by Deductions = amounts that are taken out of your pay before you receive your pay check MANDATORY DEDUCTIONS Federal Income Tax State Tax % of gross income ○ IL is 5 % ○ Some dates do not have state tax (Washington, Florida, Nevada, Alaska etc…) FICA (Federal Insurance Contribution Act) ○ Social Security 4.2% ○ Medicare 1.45% Other Deductions from your paycheck Pension Retirement 401 K 403 B Health Insurance Union Dues Savings Donations; charity W-2 Form By January 31st an employee must receive (from each employer) W-2 Form= summary of your total earnings and withholdings from your job NEED THIS TO DO YOUR TAXES!!! Lists: Total earnings from all sources Federal income tax withheld Social security tax withheld Medicare tax withheld 1040 EZ By April 15 each person who has worked must file an income tax return: 1040 EZ (FORM TO DO YOUR TAXES) Single or married No dependents Taxable income of less than $100,000 Earned no more than $1500 in interest Average Salaries for Graduates Category 2012 Average Salary 2011 Average Salary Percent Change Engineering Computer Science $61,913 $59,221 $59,591 $57,046 3.9% 3.8% Business Health Sciences Communications Math & Sciences Education Humanities & Social Sciences $53,850 $49,196 $43,717 $42,471 $40,668 $36,988 $51,708 $47,336 $41,988 $41,370 $38,581 $36,252 4.2% 3.9% 4.1% 2.7% 5.4% 2.0% Overall $44,455 $42,987 3.4% Source: National Association of Colleges and Employers (NACE). The data represent accepted starting salaries (not salary offers), derived from the U.S. Bureau of Labor Statistics, the U.S. Census Bureau and a master set of data developed by Job Search Intelligence. Data for the January 2013 report were retrieved in November 2012, and reflect the final results for the class of 2012.