Taxation and Efficiency: Lecture Notes & Problems

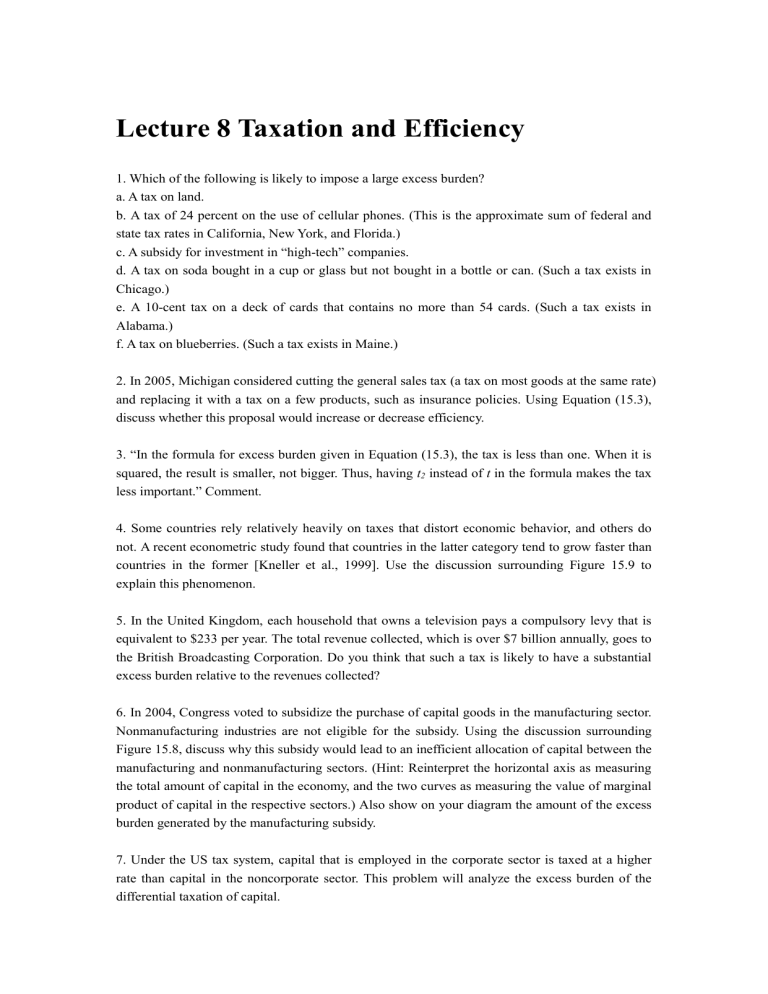

Lecture 8 Taxation and Efficiency

1. Which of the following is likely to impose a large excess burden? a. A tax on land. b. A tax of 24 percent on the use of cellular phones. (This is the approximate sum of federal and state tax rates in California, New York, and Florida.) c. A subsidy for investment in “high-tech” companies. d. A tax on soda bought in a cup or glass but not bought in a bottle or can. (Such a tax exists in

Chicago.) e. A 10-cent tax on a deck of cards that contains no more than 54 cards. (Such a tax exists in

Alabama.) f. A tax on blueberries. (Such a tax exists in Maine.)

2. In 2005, Michigan considered cutting the general sales tax (a tax on most goods at the same rate) and replacing it with a tax on a few products, such as insurance policies. Using Equation (15.3), discuss whether this proposal would increase or decrease efficiency.

3. “In the formula for excess burden given in Equation (15.3), the tax is less than one. When it is squared, the result is smaller, not bigger. Thus, having t

2

instead of t in the formula makes the tax less important.” Comment.

4. Some countries rely relatively heavily on taxes that distort economic behavior, and others do not. A recent econometric study found that countries in the latter category tend to grow faster than countries in the former [Kneller et al., 1999]. Use the discussion surrounding Figure 15.9 to explain this phenomenon.

5. In the United Kingdom, each household that owns a television pays a compulsory levy that is equivalent to $233 per year. The total revenue collected, which is over $7 billion annually, goes to the British Broadcasting Corporation. Do you think that such a tax is likely to have a substantial excess burden relative to the revenues collected?

6. In 2004, Congress voted to subsidize the purchase of capital goods in the manufacturing sector.

Nonmanufacturing industries are not eligible for the subsidy. Using the discussion surrounding

Figure 15.8, discuss why this subsidy would lead to an inefficient allocation of capital between the manufacturing and nonmanufacturing sectors. (Hint: Reinterpret the horizontal axis as measuring the total amount of capital in the economy, and the two curves as measuring the value of marginal product of capital in the respective sectors.) Also show on your diagram the amount of the excess burden generated by the manufacturing subsidy.

7. Under the US tax system, capital that is employed in the corporate sector is taxed at a higher rate than capital in the noncorporate sector. This problem will analyze the excess burden of the differential taxation of capital.

Assume that there are two sectors, corporate and noncorporate. The value of marginal product of capital in the corporate sector, VMP

C

, is given by VMP

C

= 100 - K

C

, where K

C

is the amount of capital in the corporate sector, and the value of the marginal product of capital in the noncorporate sector, K n

, is given by VMP n

= 80 – K n

, where K n

is the amount of capital in the noncorporate sector. Altogether there are 50 units of capital in society. a. In the absence of any taxes, how much capital is in the corporate sector and how much in the noncorporate sector? (Hint: Draw a sketch along the lines of Figure 15.9 to organize your thoughts.) b. Suppose that a unit tax of 6 is levied on capital employed in the corporate sector. After the tax, how much capital is employed in each sector? What is the excess burden of the tax?

8. In an effort to reduce alcohol consumption, the government is considering a $1 tax on each gallon of liquor sold (the tax is levied on producers). Suppose that the supply curve for liquor is upward sloping and its equation is Q = 30000 P (where Q is the number of gallons of liquor and P is the price per gallon). The demand curve for liquor is Q = 500000 - 20000 P . a. Draw a sketch to illustrate the excess burden of the tax. Next use algebra to calculate the excess burden. Show graphically the excess burden generated by the $1 unit tax. (Hint: Compare the losses of both consumer and producer surplus to tax revenues.) b. Suppose that each gallon of liquor consumed generates a negative external cost of $0.50. How does this affect the excess burden associated with the unit tax on liquor?