course factsheet - Invest in South Lakeland

advertisement

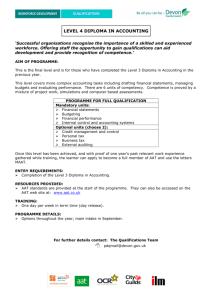

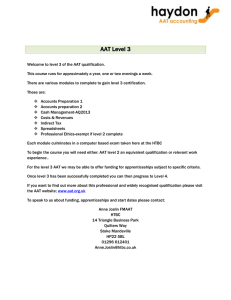

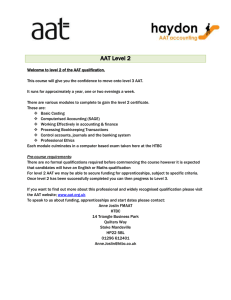

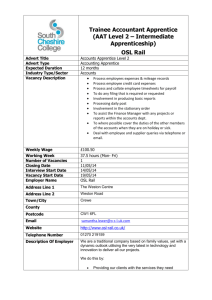

Apprenticeship in Accounting Summary The AAT Apprenticeship program is for you if, you’re in or looking for employment in finance or an accounts department. Your Apprenticeship framework is made up of practical work-based training (with your employer and college assessor) and classroom tuition (one evening and one morning each week). This training supports the theory, knowledge and general skill qualifications in your vocational area. Functional Skills in literacy and numeracy form part of your course. They support your main course as well as developing essential skills that you will need in the workplace and life in general. What are the entry requirements? There are three levels of the apprenticeship with set entry requirements: Apprentice Level 2 A minimum of four GCSEs at grades A – E or an NVQ Level 1, Diploma Level 1 or equivalent qualification. Advanced Apprentice Level 3 An NVQ 2 or other equivalent qualification. Higher Apprenticeship Level 4 Diploma An NVQ 3 in accounting or other equivalent qualification. What subjects will I study? Apprentice Level 2 Certificate This will include: Preparing and recording financial documentation Maintaining and reconciling the cash book Maintaining petty cash records Processing business transactions and extracting a trial balance Maintaining the journal and control accounts Providing basic cost and revenue information Computerised accounting Professional ethics in accounting and finance Working effectively in accounting and finance Key Skills at Level 1 in Application of Number and Level 2 in Communication Advanced Apprentice Level 3 Diploma This will include: Preparing final accounts for partnerships and sole traders Cash management Providing cost and revenue information Preparing and completing VAT returns Spreadsheets Professional ethics in accounting and finance Key Skills in Communication and Application of Number at Level 2 Level 4 Diploma This will include: Drafting financial statements Drafting budgets Measuring financial performance Evaluating accounting systems Credit management Calculating personal tax Key Skills in Communication and Application of Number at Level 2 Functional Skills form part of your course; they support your main course as well as developing essential skills that you will need in the workplace and life in general. Functional Skills can be delivered in a variety of ways including one evening a week classes, distance learning with drop in sessions or on a block of study. How will I learn? Your Apprenticeship framework is made up of practical work-based training (with your employer and college assessor) and classroom tuition (one evening and one morning each week). How will I be assessed? All units include a computer based assessment or project. What opportunities will this lead to? Progression from level 3 and 4 AAT into Chartered Accountancy or Higher Education. How long is the course? Each level usually takes one year to complete. Are there any additional costs? There are books and stationery requirements for study. Book codes and details will be provided at the start of your course. Fees vary and are available on request. AAT Membership Disclaimer To undertake AAT qualifications, students must be a registered member with the AAT and this requires students to meet the AAT’s policy on bankruptcy and criminal background. This is outside the control of Furness College and is your personal responsibility. Further information can be found at www.aat.org.uk. Can I get more information? For more information please contact us: T: 01229 825017 E: info@furness.ac.uk www.furness.ac.uk