Coase

advertisement

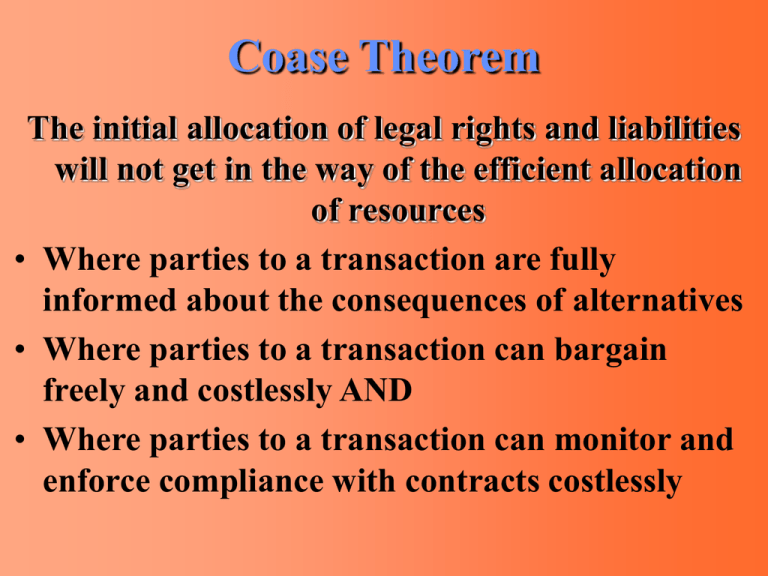

Coase Theorem The initial allocation of legal rights and liabilities will not get in the way of the efficient allocation of resources • Where parties to a transaction are fully informed about the consequences of alternatives • Where parties to a transaction can bargain freely and costlessly AND • Where parties to a transaction can monitor and enforce compliance with contracts costlessly That Means: • It doesn’t matter who owns what, the person who can use IT best (measured in terms of willingness and ability to pay) will end up with IT • It doesn’t matter who is responsible for the design, manufacture, or sale of a product, its attributes will be efficient It Doesn’t Mean: That the distribution of income or wealth will be the same regardless of the prior distribution of rights and liabilities (The distribution of income or wealth after a transaction depends on the distribution of wealth (assets or rights minus liabilities or obligations) prior to the transaction) Solution Annualized Cost of Spark arrester = $3000 Annualized Cost of Fire Damage = $4500 Annualized Cost of Spark arrester = $3000 Annualized Cost of Fire Damage = $1500 Does it Matter who is Liable for damages? NO What Happens if Railroad is Liable? • If fire damage = $4500, Railroad Co. buys spark arrester • If fire damage = $1500, Railroad Co. pays damages to farmers What Happens if Farmer is Liable? • If fire damage = $4500, farmer buys spark arrester for Railroad Co. • If fire damage = $1500, farmer stands ready to put out fires caused by train Moral Hazard (term comes from insurance industry) The WASTEFUL behavior induced when people do not bear the full consequences of their actions IN THE TRAIN/FARMER EXAMPLE, WHICH ASSIGNMENT OF LIABILITY WAS MORE LIKELY TO CREATE A MORAL HAZARD? Farmer or Railroad Co.? Asymmetric Information Costs • Search cost -- the cost of obtaining full knowledge of the THING being transacted including the consequences of its use and its alternatives • Bargaining cost -- the cost of reaching a mutually satisfactory contract • Monitoring and enforcement costs -- the cost of insuring compliance with contractual terms In the information asymmetries, market incentives together with either public provision of information or — in the case of information asymmetries — reassignment of liability, public certification, or enforced disclosure will often produce more efficient outcomes than will a regulatory program that restricts the range of goods and services made available, enforces maintenance standards, or establishes maximum levels of exposure to health and safety hazards. Where participants in private market transactions err only because information is absent, public provision of information will be more efficient than regulation. This follows from the observation that public provision of information can meet economic objectives without removing alternatives from the market that some consumers or workers would prefer. Kinds of Product Liability (all theories of product liability require the injury to be related to product use -- reflect changing reality about who is best located to make knowlegeable choices about net benefits) • Caveat Emptor • Negligence • Strict Liability – Voluntary and knowing assumption of the risk (known and avoidable danger) – Contributory negligence (not just misuse) – Disclaimers • Absolute Liability Damages (no right without a remedy) • Economic Losses (replacement cost, out of pocket expenses) • Compensation for Pain and Suffering • Punitive Damages Regulatory Optimum