Chapter 8

Managing a Retailer’s Finances

Copyright ©2005 by South-Western, a division of Thomson Learning. All rights reserved.

0

Learning Objectives

• Describe the importance of a merchandise budget and

know how to prepare a six-month merchandise plan.

• Explain the differences among and the uses of these

three accounting statements: income statement,

balance sheet, and statement of cash flow.

• Explain how the retailer is able to value inventory.

1

The Merchandise Budget

LO 1

• Merchandising is the planning and control of the

buying and selling of gods and services to help the

retailer realize its objectives.

• Merchandise budget is a plan of projected sales for an

upcoming season, when and how much merchandise

is to be purchased, and what markups and reductions

will likely occur.

• Gross margin is the difference between net sales and

cost of goods sold.

2

Five Major Merchandising Decisions

LO 1

• What will be the anticipated sales for the department, division, or

store?

• How much stock on hand will be needed to achieve this sales

plan, given the level of inventory turnover expected?

• What reductions, if any, from the original retail price must be

made in order to dispose of all the merchandise brought into the

store?

• What additional purchases must be made during the season?

• What gross margin ( the difference between sales and cost of

goods sold) should the department, division, or store contribute

to the overall profitability of the company?

3

Four Rules in Preparing the Merchandise Budget

LO 1

• Always be prepared in advance of the selling season.

• The language of the budget must be east to

understand.

• Must be planned of a relatively short period of time (six

months is the norm used by most retailers).

• Flexible enough to permit changes.

4

Determining the Merchandise Budget

LO 1

• Determining Planned Sales

• Determining Planned BOM and EOM Inventories

• Determining Planned Retail Reductions

• Determining Planned Purchases at Retail and Cost

• Determining the Buyer’s Planned Gross Margin

5

Sample Six-Month Merchandise Budget

LO 1 Exhibit 8.1

6

Sample Six-Month Merchandise Budget

LO 1 Exhibit 8.1

7

Sample Six-Month Merchandise Budget

LO 1 Exhibit 8.1

8

Sample Six-Month Merchandise Budget

LO 1 Exhibit 8.1

9

Two-Seasons Department Store, Dept.353, SixMonth Merchandise Budget

LO 1 Exhibit 8.2

10

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned Sales for the Month

(Planned Sales Percentage for the Month )

X (Planned Total Sales)

= (Planned Sales for the Month)

11

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned BOM Stock for the Month

(Planned Sales for the Month ) X

(Planned BOM Stock-to-Sales Ratio for the Month)

= (Planned BOM Stock for the Month)

12

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned Retail Reductions

for the Month

(Planned Sales for the Month ) X

(Planned Retail Reduction Percentage for the Month)

= (Planned Retail Reduction for the Month)

13

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned EOM Stock for the Month

(Planned BOM Stock for the Following Month )

= (Planned EOM Stock for The Current Month)

14

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned Purchases at Retail

for the Month

(Planned Sales for the Month ) + (Planned Retail

Reductions for the Month) + (Planned EOM Stock for

the Month) - (Planned BOM Stock for the Month) =

(Planned Purchases at Retail for the Month)

15

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned Purchases at Cost

for the Month

(Planned Purchases at Retail for the Month )

X (100% Planned Initial Markup Percentage)

= (Planned Purchases at Cost for the Month)

16

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned Initial Markup

for the Month

(Planned Purchases at Retail for the Month ) X

(Planned Initial Markup Percentage) =

(Planned Initial Markup for the Month)

OR

(Planned Purchases at Retail for the Month) (Planned Purchases at Cost for the Month) =

(Planned Initial Markup for the Month)

17

Determining Planned Sales: Formulas for the SixMonth Budget

LO 1: Exhibit 8.3

Determining Planned Gross Margin

for the Month

(Planned Initial Markup for the Month) - (Planned

retail Reductions for the Month) = (Planned Gross

Margin for the Month)

18

How to Figure: Planned Sales for the Month

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

10. Planned Sales Percentage for February 15%

Planned Sales for the period $500,000

2. Planned Sales for the month of February $75,000

19

How to Figure: Planned Sales for the Month

LO 1

(Planned Sales Percentage for the Month )

X (Planned Total Sales)

= (Planned Sales for the Month)

15%

=

X

500,000

75,000

20

How to Figure: Planned BOM Stock for the Month

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

2. Planned Sales for February $75,000

9. Planned BOM Stock-to-Sales Ratio for February 3

1. Planned BOM Stock for the Month of February

$225,000

21

How to Figure: Planned BOM Stock for the Month

LO 1

(Planned Sales for the Month )

X (Planned BOM Stock-to-Sales Ratio for the Month)

= (Planned BOM Stock for the Month)

75,000

=

X

3

225,000

22

How to Figure: Planned Retail Deduction for the

Month

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

2. Planned Sales for February $75,000

11. Planned Retail Deduction Percentage for February

10%

23

How to Figure: Planned Retail Deduction for the

Month

LO 1

(Planned Sales for the Month )

X (Planned Retail Reduction Percentage for the

Month)

= (Planned Retail Reduction for the Month)

75,000

=

X

10%

7,500

24

EOM Stock…BOM Stock

LO 1

Stock-to-Sales Ratio depicts the amount of stock to

have at the beginning of each month to support the

forecasted sales for that month.

25

EOM Stock…BOM Stock

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

4. Planned EOM Stock for February $300,000

1. Planned BOM Stock for March $300,000

26

EOM Stock…BOM Stock

LO 1

(Planned BOM Stock for the Following Month )

= (Planned EOM Stock for The Current Month)

300,000

=

300,000

27

How to Figure: Planned Purchases at Retail for

the Month

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

2. Planned Sales for February $75,000

3. Planned Retail Deduction for February $7,500

4. Planned EOM Stock for February $300,000

1. Planned BOM Stock for February $225,000

5. Planned Purchases at Retail for February $157,500

28

How to Figure: Planned Purchases at Retail for

the Month

LO 1

(Planned Sales for the Month )

+ (Planned Retail Reductions for the Month)

+ (Planned EOM Stock for the Month)

- (Planned BOM Stock for the Month)

= (Planned Purchases at Retail for the Month)

75,000

+

+

300,000

=

7,500

-

225,000

157,500

29

How to Figure: Planned Purchases at Cost for the

Month

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

5. Planned Purchases at Retail for Month of February

$157,500

Planned Initial Markup Percentage 45%

30

How to Figure: Planned Purchases at Cost for the

Month

LO 1

(Planned Purchases at Retail for the Month )

X (100% - Planned Initial Markup Percentage)

= (Planned Purchases at Cost for the Month)

157,500

X

=

(100 - 45%)

86,625

31

How to Figure: Planned Initial Markup for the

Month, First Formula

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

5. Planned Purchases at Retail for February $157,500

Planned Initial Markup Percentage 45%

7. Planned Initial Markup for February $70,875

32

How to Figure: Planned Initial Markup for the

Month, First Formula

LO 1

(Planned Purchases at Retail for the Month )

X (Planned Initial Markup Percentage)

= (Planned Initial Markup for the Month)

157,500

X

=

45%

70,875

33

How to Figure: Planned Initial Markup for the

Month, Second Formula

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

5. Planned Purchases at Retail for February $157,500

6. Planned Purchases at Cost for February $86,625

7. Planned initial Markup for February $70,875

34

How to Figure: Planned Initial Markup for the

Month, Second Formula

LO 1

(Planned Purchases at Retail for the Month)

- (Planned Purchases at Cost for the Month)

= (Planned Initial Markup for the Month)

157,500

-

=

86,625

70,875

35

How to Figure: Planned Gross Margin for the

Month

LO 1

Figures to calculate this formula are taken from Exhibit

8.2, Two-Seasons Department Store, Dept. 353, SixMonth Merchandise Budget.

3. Planned Retail Reduction for February $7,500

7. Planned Initial Markup for February $70,875

8. Planned Gross Margin for February $63,375

36

How to Figure: Planned Gross Margin for the

Month

LO 1

(Planned Initial Markup for the Month )

- (Planned Retail Reductions for the Month)

= (Planned Gross Margin for the Month)

-

70,875

=

7,500

63,375

37

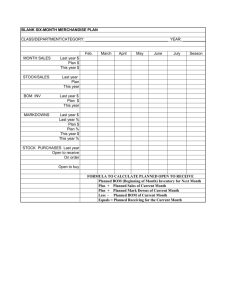

Blank Six-Month Merchandise Budget

LO 1

Six-Month

Merchandise

Budget

Date_____________________

Season____________________

Spring/Summer

Feb

Mar

Apr

May

Jun

Jul

Seasonal

Fall/ Winter

Aug

Sep

Oct

Nov

Dec

Jan

Total

1. Planned BOM Stock

2. Planned Sales

3. Planned Retail Reductions

4. Planned EOM Stock

38

Blank Six-Month Merchandise Budget

LO 1

Six-Month

Merchandise

Budget

Date_____________________

Season____________________

Spring/Summer

Feb

Mar

Apr

May

Jun

Jul

Seasonal

Fall/ Winter

Aug

Sep

Oct

Nov

Dec

Jan

Total

5. Planned Purchases @ Retail

6. Planned Purchases @ Cost

7. Planned Initial Markup

8. Planned Gross Margin

39

Blank Six-Month Merchandise Budget

Six-Month

Merchandise

Budget

LO 1

Date_____________________

Season____________________

Spring/Summer

Feb

Mar

Apr

May

Jun

Jul

Seasonal

Fall/ Winter

Aug

Sep

Oct

Nov

Dec

Jan

Total

9. Planned BOM

Stock/Sales Ratio

10. Planned Sales Percentage

11. Planned Retail Reduction

Planned Total Sales for the Period

____________________

Planned Total Retail Reduction Percentage for the Period ____________________

Planned Initial Markup Percentage for the Period

____________________

Planned BOM Stock for ________________

____________________

40

Blank Three-Month Merchandise Budget

LO 1

Three-Month

Merchandise

Budget

Date_____________________

Season____________________

Spring/Summer

February

Fall/ Winter

August

March

September

April

October

Seasonal

Total

1. Planned BOM Stock

2. Planned Sales

3. Planned Retail Reduction

4. Planned EOM Stock

41

Blank Three-Month Merchandise Budget

LO 1

Three-Month

Merchandise

Budget

Date_____________________

Season____________________

Spring/Summer

February

Fall/ Winter

August

March

September

April

October

Seasonal

Total

5. Planned Purchases @Retail

6. Planned Purchases @ Cost

7. Planned Initial Markup

8. Planned Gross Margin

42

Blank Three-Month Merchandise Budget

Three-Month

Merchandise

Budget

LO 1

Date_____________________

Season____________________

Spring/Summer

February

Fall/ Winter

August

March

September

April

Seasonal

October

Total

9. Planned BOM

Stock/Sales Ratio

10. Planned Sales Percentage

11. Planned Retail Reduction

Planned Total Sales for the Period

____________________

Planned Total Retail Reduction Percentage for the Period ____________________

Planned Initial Markup Percentage for the Period

____________________

Planned BOM Stock for ________________

____________________

43

Retail Accounting Statements

LO 2

• Income Statement

• Balance Sheet

• Statement of Cash Flow

44

Income Statement

LO 2

• Income Statement is a financial statement that provides a

summary of the sales expenses for a given time period, usually a

month, quarter, season, or year.

• Gross Sales are the retailer’s total sales including sales for cash

or credit.

• Returns and Allowances are the refunds of the purchase price or

downward adjustments in selling prices due to customers

returning purchases, or adjustments made in the selling price due

to customer dissatisfaction with the product or service

performance.

45

Income Statement

LO 2

• Net Sales is the gross sales less returns and

allowances.

• Cost of Goods Sold is the cost of merchandise that

has been sold during the period.

• Operating Expenses are those expenses that a retailer

incurs in running the business other than the cost of

the merchandise.

46

Income Statement

LO 2

• Operating Profit is gross margin less operating

expenses.

• Other Income or Expenses includes income or

expense items that the firm incurs which are not in the

course of its normal retail operation.

• Net Profit is operating profit plus or minus other

income or expenses.

47

Graphic Presentation of the Income Statement

LO 2

Gross

Sales

Returns &

Allowances

Net

Sales

Cost of

Goods

Sold

Gross

Margin

Operating

Expenses

Operating

Profit

48

Retailers’ Basic Income Statement Format

LO 2: Exhibit 8.5a

Gross Sales

- Returns and Allowances

Net Sales

- Cost of Goods Sold

Gross Margin

- Operating Expenses

Operating Profit

± Other Income or Expenses

Net Profit Before Taxes

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

49

Sample Income Statement

LO 2: Exhibit 8.5b

50

Sample Income Statement

LO 2: Exhibit 8.5b

51

Balance Sheet

LO 2

Balance Sheet identifies and quantifies all of the firm’s

assets and liabilities at a particular point in time.

Asset is anything of value that is owned by the retail

firm.

Current Assets are assets that can be easily converted

into cash within a relatively short period of time

(usually a year or less).

Accounts and/or Notes Receivable are amounts that

customers owe the retailer for goods and services.

52

Balance Sheet

LO 2

Prepaid Expenses are those items for which the

retailer has already paid, but the service has not been

completed.

Retail Inventories comprise merchandise that the

retailer has in the store or in storage and is available

for sale.

Noncurrent Assets are those that cannot be converted

to cash in a short period of time (usually 12 months) in

the normal course of business.

53

Balance Sheet

LO 2

Goodwill is an intangible asset, usually based on

customer loyalty, that a retailer pays for when buying

an existing business.

Total assets equal current assets plus noncurrent

assets plus goodwill.

Liability is any legitimate financial claim against the

retailer’s assets.

Current Liabilities are short-term debts that are

payable within a year.

54

Balance Sheet

LO 2

Accounts Payable are amounts owed vendors for

goods and services.

Long-Term Liabilities are debts that are due in a year

or longer.

Total Liabilities equal current liabilities plus long-term

liabilities.

Net Worth (owner’s equity) is total assets less total

liabilities.

55

Graphic Presentation of the Balance Sheet

LO 2

Current Assets

Current

Liabilities

Long Term

Liabilities

Fixed Assets

Net Worth

56

Retailers’ Basic Balance Sheet Format

LO 2: Exhibit 8.6a

Current Assets

Cash

Accounts Receivable

Inventory

Prepaid Expenses

Total Current Assets

Noncurrent Assets

Building (less depreciation)

Fixtures and Equipment

(less depreciation)

Total Noncurrent Assets

Goodwill

Total Assets

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

57

Retailers’ Basic Balance Sheet Format

LO 2: Exhibit 8.6a

Current Liabilities

Accounts Payable

Payroll Payable

Current Notes Payable

Taxes Payable

Total Current Liabilities

Long-term Liabilities

Long-term Notes Payable

Mortgage Payable

Total Long-term Liabilities

Net Worth

Capital Surplus

Retained Earnings

Total Net Worth

Total Liabilities and

Net Worth

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

$____________

58

Retailers’ Basic Balance Sheet Format

LO 2: Exhibit 8.6b

59

Statement of Cash Flow

LO 3

• Statement of cash flow

lists in detail the sources and type of all revenue (cash

inflows) and the use and type of all expenditures (cash

outflows) for a given time period.

60

Retailing Truism

Cash “in” must always exceed cash “out” (if you want

to stay in business).

61

Sample Cash Flow Statement

LO 2: Exhibit 8.7a

62

Typical Cash Inflow and Outflow Categories

LO 2: Exhibit 8.7b

Cash Inflow

Cash sales

Collecting accounts receivable

Collecting notes receivable

Collecting other debts

Sales of fixed assets

Sale of stock

Cash Outflows

Paying for merchandise

Rent expenses

Utilities expenses

Wages and Salary expenses

Advertising expense

Insurance premiums

Taxes

Interest expenses

Supplies and other expenses

Purchase of other assets

Paying off accounts payable

Paying off notes payable

Buying back company stocks

Paying dividends

63

Inventory Valuation

LO 3

• Accounting Inventory System

• Inventory Pricing Systems

64

Accounting Inventory System

LO 3

• Cost Method is an inventory valuation technique that

provides a book valuation of inventory based solely on

the retailer’s cost of merchandise including freight.

• Retail Method is an inventory valuation technique that

values merchandise at current retail prices, which is

then converted to cost based on a formula.

65

Steps for Using the Retail Method of Inventory

Valuation

LO 3

• Calculation of the cost complement.

• Calculation of reductions from retail value.

• Conversion of the adjusted retail book inventory to

cost.

66

Retail Method of Inventory Valuation Example

LO 3

Cost

Retail

$25,000

45,000

Inventory at Beginning of Period

$14,000

Purchases During the Period

30,000

Transportation Costs

1,000

Additional Markups

5,000

Merchandise Available for Sale

45,000

75,000

Cost to Retail Ratio and Percentage 45,000 / 75,000 = 60%

Net Sales

45,000

Markdowns

5,000

Total Reductions

50,000

Ending Inventory at Retail

$25,000

Ending Inventory at Cost ($25,000 X .60) $15,000

67

Advantages of the

Cost Method of Inventory Valuation

LO 3

• Accounting statements can be drawn up at any time.

Inventories need not be take for preparation of these

statements.

• Physical inventories using retail prices are less

subject to error and can be completed in a shorter

amount of time.

• The retail method provides an automatic, conservative

valuation ending inventory as well as inventory levels

throughout the season.

68

Inventory Available for Whitener’s

Sporting Goods Sale, Fall Season

LO 3: Exhibit 8.8

Cost

Beginning Inventory

Net Purchases

Additional Markups

Freight-in

Total Inventory Available

for Sale

$199,000

70,000

1,000

$270,000

Retail

$401,000

154,000

5,000

$560,000

69

Whitener’s Sporting Goods Sale, Ending Book

Value at Retail, Fall Season

LO 3: Exhibit 8.9

Cost

Inventory Available for Sale at Retail

Less Reductions:

Sales

$145,000

Markdowns

12,000

Discounts

$ 2,000

Total Reductions

Ending Book Value of Inventory

at Retail

Retail

$560,000

159,000

$401,000

70

Whitener’s Sporting Goods, Stock Shortage (overage)

Adjustment Entry, Fall Season

LO 3: Exhibit 8.10

Cost

Ending Book Value of Inventory at Retail

Physical Inventory (at retail)

Stock Shortages

Adjusting Ending Book Value of Inventory at Retail

Retail

$401,000

398,000

3,000

$398,000

71

Whitener’s Sporting Goods

Income Statements August 1-January 31

LO 3: Exhibit 8.11

Cost

Sales

Less Cost of Goods Sold:

Beginning Inventory (at Cost)

$200,000

Purchases (at Cost)

70,000

Goods Available for Sale

$270,000

Ending Inventory (at Cost)

191,836

Cost of Goods Sold

Gross Margin

Less: Operating Expenses

Salaries

$ 30,000

Utilities

1,000

Rent

19,000

Depreciation (Fixtures + Equipment)

2,200

Total Operating Expenses

Net Profit Before Taxes

Retail

$145,000

78,164

$66,836

52,200

$14,636

72

Inventory Pricing Systems

LO 3

• FIFO stands for first in, first out and values inventory

based on the assumption that the oldest merchandise

is sold before the more recently purchased

merchandise.

• LIFO stands for last in, first out and values inventory

based on the assumption that the most recently

purchased merchandise is sold first and the oldest

merchandise is sold last.

73

Effect of Inventory Pricing System on Gross

Margin

LO 3

LIFO

FIFO

Net sales

$8,400

$8,400

Less: Cost of goods sold

$4,500

$4,500

4,000

4,000

Goods available

$8,500

$8,500

Ending inventory

4,500

4,900

Cost of goods sold

4,000

3,600

$4,400

$4,800

Beginning Inventory

Gross Margin

74

Question to Ponder

• Retailers are given a choice as to whether to use the

LIFO or FIFO method. Given such a choice, would it

make a difference in the selection of a method if the

retailer were privately owned versus being a publicly

traded company?

75

76