Technological Progress

advertisement

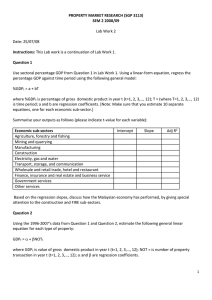

Technological Progress Chapter 6 Students should be expected to: Use the rule of 70 to calculate how fast a variable doubles. Use the Cobb-Douglas production function to calculate labor productivity growth as a function of technology growth and the average productivity of capital. Calculate the steady-state capital productivity as a function of capital fundamentals. Calculate the growth rate of labor productivity when capital productivity is at a steady state. Describe the dynamics of labor and capital productivity, real wages and returns to capital over the different stages of growth. Why was productivity growth so fast in Asia? Some of the fastest economic growth has occurred in East Asia during the post-war period. Reason for this growth has been attributed to the rapid increases in the utilization of the factors of production. Does this matter for the future? Average Growth GDP per capita 1966-1990 Rule of 70 If GDP is growing at G% per year, then GDP doubles every 70/G years. South Korea growing at a rate of 7% per year will double every 10 years. USA growing at a rate of 2% per year will double every 35years. In 1960 no obvious signs that this region would perform so well East Asian economies tended to have extremely high investment rates And increases in labor per person. Growth Breakdown 1966-90 for Asian Dragons Main explanation for large increase in output is a large increase in inputs Singapore financed huge capital accumulation by compulsory pension scheme 50 40 30 Employee 20 Employers 1990 1988 1986 1984 0 1982 10 Central Provident Fund Contributions % of Wages East Asian Growth: Myth or Miracle East Asian economies were able to achieve very high (miraculous) increases in standard of living. East Asian economic growth was achieved through rapid capital accumulation and relatively average technology/TFP growth. What is the implication for the future? Exogenous Growth We assume that the technology level grows over time as a natural and costless by-product of economic activity. Assume a constant growth rate of technology: Z t 1 Z t gZ Zt Growth Rate of Productivity The growth rate of productivity in the Cobb-Douglas case is a weighted average of capital per worker growth and technology growth. 1 gdpt (kt ) (Zt ) g GDP t a g (1 a ) g k t k t Labor Productivity Growth Rate This implies that the growth rate of output and the growth rate of capital is a function of the average productivity of capital. K t 1 (1 d ) K t I t (1 d ) K t sGDPt K t 1 s GDPt dK t g K t 1 K t 1 GDPt GDPt k K s d gt 1 gt 1 n s (d n ) Kt Kt Kt g GDP t 1 GDPt a s (d n) (1 a) g Z Kt Implications If the growth rate of capital per worker is faster than the growth rate of technology, the growth rate of capital per worker will be higher than the growth rate of labor productivity. This, in turn, will imply that capital productivity (the ratio of output to capital) will fall. This will in turn imply that labor productivity growth & capital per worker growth will slow down. Capital Productivity & Growth gk ggdp gZ [gdp/k]SS GDP K Two Phases of Growth Transition Path – Emerging economy with high capital productivity experiences capitalinvestment led growth in which the growth rate of labor productivity is increasing faster than the world frontier of technology. Along the transition path, capital is growing faster than output and capital productivity is falling. During much of the post-war period, Korea was on its transition path. Two Phases of Growth pt. 2 Balanced Growth Path – On the balanced growth path, labor productivity and capital per worker are each growing at the same rate as the world technology frontier. During the post-war period, the US was on its balanced growth path. All balanced growth paths should increase at the same rate (the growth rate of world technology frontier, gZ). However the positions of labor productivity on the growth path may be different. US and Brazil Since the early 1970’s, the US and Brazil have grown at roughly the same rate. US labor productivity have been maintained at a level approximately 3 times the level in Brazil. Capital productivity has been roughly constant in Brazil (though this has had more ups and downs than in the US). Capital productivity has stayed at a higher level in Brazil than the US. Labor Productivity Labor Productivity (logged) 11.2 10.8 10.4 10.0 9.6 9.2 8.8 8.4 50 55 60 65 70 75 Brazil 80 85 USA 90 95 00 Capital Productivity 0.9 0.8 0.7 0.6 0.5 Brazil 0.4 USA 0.3 0.2 0.1 19 89 19 87 19 85 19 83 19 81 19 79 19 77 19 75 19 73 19 71 19 69 19 67 19 65 0 Capital Productivity and Labor Productivity Holding technology constant, there is a negative relationship between capital productivity and labor productivity. gdpt kt ( Zt ) 1 gdpt 1 kt gdpt 1 ( Zt ) gdpt gdpt kt 1 Zt Holding tech. constant, if you have a high ratio of machines to workers, capital productivity will be low and worker productivity high. If you have a high ratio of workers to machines, the reverse will be true. Balanced growth path capital productivity We can solve for capital productivity along the balanced growth path. g Z s[ gdp ]SS (d n) (1 ) g Z k (d n g Z ) gdp gdp SS SS s[ ] ( d n) [ ] k k s Different countries are likely to have different investment growth rates and labor force growth rates. Thus, they will have different capital productivity levels. Determinants of Long-term Capital Productivity Investment Rates: When economies invest a high percentage of their output, they can “support” a high level of capital per worker. To maintain a steady level of capital per worker, investment must be done in every period to replace depreciated equipment and equip new workers. If investment levels are high, a high level of depreciated capital can be replaced. A high ratio of capital to labor implies a low level capital productivity and a relatively high level of labor productivity. Factor Prices How do real wages and real capital rental rates behave over the long-term? Factor prices (under Cobb-Douglas) are proportional to average productivity. Real wages are proportional to labor productivity. Along the transition path, real wages will grow faster than technology but slower than real capital per worker. Along the balanced growth path, real wages will grow at the same rate as technology. Capital productivity will fall along the transition path due to diminishing returns to capital. Along the balanced growth path capital returns will remain constant as capital productivity is constant. Will poor countries catch up with rich countries? If all countries share the same technology, Zt, countries will converge to a balanced growth path along which they will grow at the same rate. The position of that balanced growth path is determined by capital productivity which is determined in steady-state by investment and population growth rates. If a poor country has the same s and n, it will catch up with the rich countries! World Technology Frontier? There are two problems with the modeling of Z as some common level of technology available in the world which drives the long-run growth path. 1. As a matter of theory, we haven’t really explained longterm growth. Long-term growth occurs through the costless (and exogenous magic of) technology. This might be important since: Some countries on the balanced growth path seem to have grown at different rates (for example, US labor productivity growth has been faster over the 20th century than British. There have been long periods of relatively slow technology growth in developed countries, such as the productivity slowdown of 1975-1995. Where does technology growth come from? In OECD, a substantial share of GDP goes to investment in Research and Development. The production of this sector goes to producing technology growth. Knowledge is different than other capital in that it is non-rival. Because one person is using knowledge puts no limit on its use by others. Governments issue patents to reward inventors to give an incentive to R&D. Rich and Large Countries More Likely to Spend on R&D R&D per Capita, 1997 (US$, PPP) 900 800 700 600 500 400 300 200 100 0 EU North Total US UK Turkey Sweden Spain Portugal Poland Norway New Netherlands Mexico Korea Japan Italy Ireland Iceland Hungary Greece Germany France Finland Denmark Czech Rep. Canada Belgium Austria FDI How does technology advance in developing economies? Imitation Foreign Direct Investment by R&D intensive multi-national corporations. Close to 50% of China’s exports are produced by multi-national corporations. FDI to China CN: BoP: FA Balance: Direct Investm ent USD m n 50000 45000 40000 35000 30000 25000 20000 15000 10000 5000 0 -5000 -10000 1982 1984 1986 Net 1988 1990 1992 Abroad 1994 1996 1998 In Reporting Economy 2000 2002 Technology Differences Across Countries Empirical studies show that different countries have very different levels of TFP. Why is technology that different countries use so different in efficiency. Difference in Education levels that allow for different levels of technology adoption. Restraints on competition which do not allow or encourage adoption of new technology. Regulations Productivity Slowdowns and Acceleration Over long periods of time, the rate of technology growth will accelerate or slowdown. During 1950’s and 1960’s most countries in the world enjoyed very fast labor productivity growth. During 1970’s and 1980’s, productivity growth slowed down dramatically in every country in the world. After 1995, technology growth began to accelerate in the USA and other developed economies. Why might technology growth vary across time. During Industrial age, economies have experienced major technological breakthroughs referred to as macroinventions. (steam power, assembly line, electrical grid). These inventions offer opportunities for exceptional advances in productivity. IT: Macroinventions Information technology (computers, etc.) are the current macroinvention being exploited. Often takes substantial number of years between macro-tech breakthroughs and efficient utilization. Solow Paradox: In mid-1990’s Nobel Laureate Robert Solow said “Computers show up everywhere except the data”/ Source: Dale Jorgenson, Harvard Economic Growth in the Information Age Sources of U.S. Labor Productivity Growth 3.0 2.5 Annual Contribution (%) 2.0 1.5 1.0 0.5 0.0 1977-1989 1989-1995 1995-2000 -0.5 Labor Quality Non-IT Capital Deepening IT Capital Deepening TFP Midterm Exam Thursday, May 4th 6:30-8:30pm Room 3007 Prices and Quantities, Financial Concepts, Production Functions, Capital Accumulation, Technological Progress, Money and Prices