Federal Tax Research

advertisement

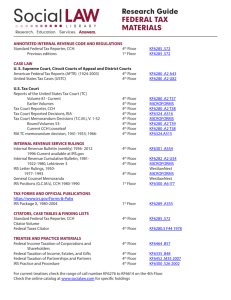

Federal Tax Law Research Strategies and Techniques Paul D. Callister, JD, MSLIS Director of the Leon E. Bloch Law Library & Associate Professor of Law UMKC School of Law Thinking About Legal Research Problems The Problem Tax Practicum Professor Wiseman Research Problem Fall, 2004 Facts: Client received a $3,000,000 judgment in an employment discrimination case. Client’s attorney (“Attorney”) received $1,000,000 out of this amount, and was paid directly by defendant (and therefore, client only received $2,000,000). Client reported income of $2,000,000 on his tax return. IRS assessed a deficiency claiming income was understated by $1,000,000. Client thought this would be moot since he would receive a $1,000,000 deduction for Attorney's fees. The IRS told him that the deduction would do him no good since he would be subject to the alternative minimum tax (AMT). Client lives in Missouri and the case was litigated in Missouri. Questions: 1. Does Client have any arguments to exclude the $1M paid directly to Attorney? 2. How does the AMT come into play? 3. Should a determination from the IRS be appealed? Has the Supreme Court ruled or granted cert on this issue? 4. Is there any pending legislation on the AMT issues? If so, should we be doing any lobbying on this issue? 5. Have any IRS personnel or members of Congress made any speeches or public comments on these issues? In researching these issues, you should know/learn the following and write down your approach: 1. Find out background information about (a) exclusion from income of litigation awards and (b) deduction for attorney’s fees and (c) AMT. a. Assume you don’t know the code section—how do you find the relevant statutes and authority? b. Assume you know the code section (hint: one of sections is §61). How do you find background information and authority on the issue? c. Identify the sources of background information (editorial comments, treatises, periodicals, IRS information, etc.) d. Know how to find the documents identified in (c), above. 2. Find the IRC and Treas. Regs. for AMT in: i. CFR, IRC, CCH, RIA, CCH online, RIA online, two other internet sources 3. Find cases (Tax Court and Fed.) and any IRS documents relevant to these questions. (Describe how to find these documents both online and from print materials.) 4. Are there any law review articles or any other periodical articles on these issues? If so, find the article online and in print material (if it is in our library). 5. Have there been any comments in Tax Notes on this subject? 6. What BNA portfolios discuss these issues? Were they helpful in finding authority and explanation? How? 7. Is there any discussion of these issues in the NYU Tax Institute in the past four years? If so, where? 8. How do you find out if there is any pending legislation related to these issues? If there is pending legislation, what is its status? 9. How do you find out if there are any regulation projects related to these issues? How do you find out if there are any new regulations within the past year related to these issues? Solving Tax Problems Working the Problem Need to Know Example Parties Who are we representing (i.e., which side of the issue are we on–buyer or seller, plaintiff or defendant, etc.)? What legal entities are involved (any trusts, corporations, partnerships, etc.)? What Descriptive Words of Facts Descriptive Words of Legal Issues Besides the terms "Attorney Fees" and "AMT," what other terms should I be using? Do you think that the best subject heading to describe the problem would fall under "exculsions from income" or "deductions"? Specific Sources to For my research on AMT and "deductions," is be Used there a specific treatise or loose-leaf service I should use? Where Applicable Do you want me to research federal law within the Jurisdictions Eight Circuit? In Missouri? When Time Periods When did the litigation take place? When were the fees to be paid? When are the fees included in income? Your Answer Who How do I . . . 1. . . . find a sample limited liability company operating agreement in print? On Westlaw? In print On Westlaw 2. . . . find a sample contract of sale for a restaurant business in print? On lexis? In print On Lexis 3. . . . determine the minimum filing requirements for a small private placement offering in California? In print CCH Blue Sky Law Reporter On Lexis On Westlaw 4. . . . form a corporation in Nevada? What kind of search? Legal Information Institute--Listing by Jurisdiction wwwsecure.law.cornell.edu/states/listing.html LexisOne State Resource Locator www.lexisone.com/legalresearch/legalguide/states/states_reso urces_index.htm 5. . . . find a sample Illinois revocable trust in print? On Lexis? On Westlaw? On the Web? On Lexis On Westlaw LexisOne Forms http://www.lexisone.com/ legalresearch/legalguide/ online_forms/forms_center _index.htm Findlaw Forms http://forms.lp. findlaw.com/ 6. . . . use looseleaf services like CCH Standard Federal Tax Reporter and BNA’s Tax Portfolios? Online? On Lexis On Westlaw On CCH On RIA 7. . . . understand the “control group rules” under IRC § 1563? On RIA On CCH On Lexis 8. . . . find out if there are tax consequences if a client sells a home within a year after moving there (as a result of a neighbor abusing his child)? On Lexis On CCH On RIA 9. On CCH . . . . understand Qualified Domestic Relations Orders (QDROs) and how to draft them? On RIA On Lexis 10. On CCH . . . research all relevant tax cases similar to the Federal Second Circuit case, Caplin v. US? On RIA On Lexis On Westlaw 11. . . . find Form 706 (federal estate tax return)? Find the equivalent state return in Maine? http://www.IRS.gov 12. On CCH . . . find private letter rulings? On RIA On Lexis On Westlaw 13. . . . find tax rates and the “Applicable Federal Rate”? http://www.IRS.gov The End