(PPT, Unknown)

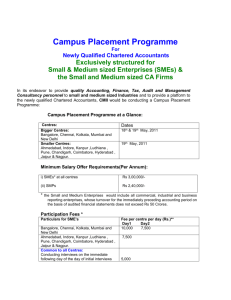

advertisement

Presentation on Committee on Public Finance and Government Accounting The Institute of Chartered Accountants of India (Set up by an Act of Parliament by the Chartered Accountant Act, 1949) The ICAI Mission ICAI will leverage technology and infrastructure and partner with its stakeholders to: Impart world class education, training and professional development opportunities to create global professionals Develop an independent and transparent regulatory mechanism that keeps pace with the changing times Ensure adherence to the highest ethical standards Conduct cutting edge research and development in the areas of accounting, assurance, taxation, finance and business advisory services Establish ICAI members and firms as Indian multinational service providers. The ICAI Second Largest Accounting Body Worldwide Functions Education and Examination of Accountancy Regulation of the Profession of Accountancy Enhancing the level of Accounting and Financial Reporting Prescription of Auditing and Assurance Standards Continuing Professional Education Financial Report review Monitoring quality through Peer Review Conducting Post Qualification Courses Exercise Disciplinary Jurisdiction Input on Policy matters to Government, Regulators, etc. The ICAI's Network * Organizational - Regional Offices 5 - Decentralized 13 Offices - Branches 146 - Overseas Chapters 21 * Membership - 2,26,551 members - 48% members in practice * Students - 10,00,000 approx. students Shri Pranab Mukherjee, President of India, 2013 “I am happy to note that various initiatives taken by ICAI to play a greater role in economic development and to uphold public confidence. The profession has moved much beyond performing merely accountancy functions, and has been contributing by giving inputs to the Government and various regulators in the areas of financial markets, taxation, corporate laws, economic laws, banking, insurance, reforms in the government accounting and has truly added value to the process of economic and social development in the country.. With the formulation of Indian Accounting Standards which are IFRS compliant, the India has got a definite edge over the countries of the world, because everyone recognizes your talent in this profession”. The ICAI- Major role in National Perspective Provides input to: • • • • • • • • Comptroller and Auditor General of India Central Board of Direct taxes Central Board of Excise & Custom Securities & Exchange Board of India Department Of Central & State Government. Insurance Regulatory Development Authority Ministry of Corporate Affairs, Govt. of India Reserve Bank of India Brief on Committee on Public Finance and Government Accounting The Committee has been constituted to extend professional excellence of Chartered Accountants in the area of Public Finance and Government Accounting. It is one of the technical Committee of ICAI. The Committee is focusing not only in the areas of financial reporting, accounting and auditing but is also laying emphasis on issues on Public Finance and Government Accounting and is thus striving to create resources/outcomes of utility to society at large. The Committee assist in developing robust mechanism for channelizing adequate resources to ensure appropriate sectoral allocation for inclusive growth and economic development. Strives to provide awareness about the benefits and necessity of accounting reforms in Government sector. Principal objectives of Committee on Public Finance and Government Accounting The principal objectives of the Committee interalia includes to review, analyze, recommend measures and assist Centre and State Government, Civic Bodies and PSU’s in: Policy Assessment, Planning and Execution Public Finance Structure to develop a robust mechanism for channelising adequate resources towards inclusive growth and economic development. Technical support in fostering economic reforms. Accordingly, the Committee has functional focus on different policies and developmental schemes at Central & State Level. The Committee also undertakes and organizes training programmes, seminars, and workshops for Government Offices, bureaucrats and persons involved in machinery of public delivery system. Thrust areas of the Committee To review, analyze, assist, recommend and suggest measures to the Local, State & Central Government, Public Sector Undertakings and other organizations in the areas of : Reforms in Government accounting system to ensure proper utilization and control over public finance. Maximizing utility of public funds in order to augment and vitalize the economic growth and benefits to the end beneficiaries. Framework for public private partnership, e-governance, sustainability development etc. Broadening the tax base and increasing tax mobilization. Fiscal policy, public revenue & expenditure, public debt, allocation of resources, distribution of income & wealth for economic stabilization. Cont… Thrust areas of the Committee To form taskforce as required at Regional / State level. To interact with: IFAC/ CAPA/ SAFA Universities, research and training institutes UNO, World Bank, ADB, Ford Foundation, Canadian International Development Agency, DFID and other funding and professional institutions to forge linkages within and outside the country for undertaking collaborative research and exchange of information and publications. Conduct research relating to aspects of public finance as may relate to broader economic and fiscal policies. Our Core Competencies Accounting Research Training/Workshop/ Seminar Policy Reforms SYNERGIES WITH VARIOUS GOVERNMENT BODIES & REGULATORS TRAINING PROGRAMMES FOR THE OFFICIALS OF VARIOUS GOVERNMENT ORGANISATIONS ADVISORY INPUTS ON ACCRUAL ACCOUNTING Cont…. TRAINING PROGRAMMES FOR THE OFFICIALS OF VARIOUS GOVERNMENT ORGANISATIONS Joint State Summit with Centre for Taxation Studies, Govt. of Kerala Officials of the Dept. of PE, Ministry of Heavy Industries & Public Enterprises VAT officials of Trade & Taxes Department of Government of Delhi Senior officers of C&AG of India Officers of Superintendent of taxes, Govt. of Mizoram Officials of Survey of India, Officers of Public Enterprises Department, Govt. of Assam and Officials of Finance Dept., Govt. of Tamil Nadu State level Public Enterprises (SLPES) of Andhra Pradesh/ Madhya Pradesh/ Himachal Pradesh/ Karnataka Panchayat Secretaries Autonomous Bodies... Cont…. ADVISORY Technical inputs provided to C&AG, CGA, RBI, SEBI, CBDT, CBEC, IRDA etc… Observation Report on Convergence of Resources of the State Meghalaya Offered ICAI services on Tax Administration Reform Commission. Expert Group advisory to Dept. of Public Enterprise, Govt. of India on The Revised Schedule-VI under the Companies Act. Spearheaded XBRL revolution in the country with active participation of Ministry of Corporate Affairs (MCA), SEBI, IRDA and RBI. Submitted the inputs to Ministry of Finance, Govt. of India on the Economic Survey 2012-13. Nodal agency for facilitating wide dissemination of converged accounting standards. Implementation of an Accrual Based Double Entry Accounting System in Kerala State Insurance Department (KSID)... Cont…. INPUTS ON ACCRUAL ACCOUNTING Provided to: Staff in the Postal Accounts Offices on PAN India basis Officials of Municipal Corporation Greater Mumbai Govt. officials of UT of Lakshadweep Officials of Agartala Muncipal Council, Tripura Officials of Kohima and Dimapur Muncipal Council, Nagaland Officials of Finance Department, Govt. of Mizoram Officials of Employees of State Insurance Corporation (ESIC) Officials of Survey of India, Hyderabad... AREAS WHERE ICAI CAN WORK TOGETHER Help to make less dependent on budgetary resources by studying present avenues of resource mobilization. To introduce systems for Outcome based Budgeting through pilot basis. Research and Development in Public Finance and Government Accounting System to ensure proper utilization and control over Public Finance. To provide Technical inputs to the Central, State & Local Government in the areas of Policy assessment, planning and execution in public finance. Collaboration with Comptroller & Auditor General of India (CAG), Controller General of Accounts (CGA) and various Ministries for developing a mechanism of improving the Government Accounting System. Cont…. AREAS WHERE ICAI CAN WORK TOGETHER To assist the government in reorganizing the department/ministry of public enterprises to make it an effective instrument of PSE monitoring and control. Enhancing the accountability and transparency in public service delivery mechanism. To explore the possibility of entering into Memorandum of Understanding (MoUs) with different government departments for capacity building of these departments to carry out accounting reforms. To undertake and organize training programmes, Seminars, Workshops and Summits and harnessing technology to deliver better services through Webcasts, Video Lectures to enhance understanding of issues concerning Public Finance & Government Accounting. Cont…. AREAS WHERE ICAI CAN WORK TOGETHER To suggest checks and balances for monitoring periodical review/ audit of end use of funds. Enhancing the role of members of the Institute of Chartered Accountants of India in Public Finance and Government Accounting. Help in developing strategies to control operations and maintenance expenditure in key departments. To help in Budgetary Control Framework. To help in development of Accounting Manual. To help in Reforms and Control over Public Finance Studies. To help in Conversion from Cash to Accrual Accounting. JOIN HANDS WITH US The Institute of Chartered Accountants of India (Set up by an Act of Parliament) Secretariat, Committee on Public Finance and Government Accounting ICAI Bhawan , A-29, Sector 62, Noida, Uttar Pradesh-201309 Website: www.icai.org, E-mail id: pfc@icai.in, cpf_ga@icai.in Ph.No.: 0120-3045950/ 3045968