Introduction to Compensation

advertisement

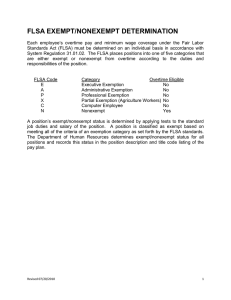

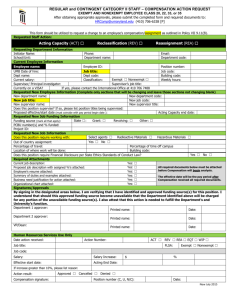

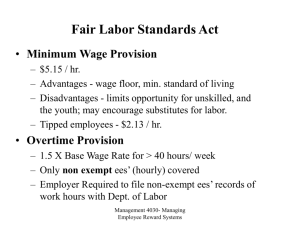

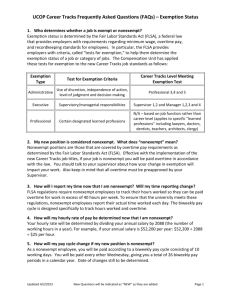

Introduction to Compensation Agenda • • • • • • Marquette University’s compensation philosophy What is the Fair Labor Standards Act (FLSA)? Definition and differences between exempt or nonexempt How is exemption status determined by Human Resources Implications of noncompliance with the FLSA Administrative guidelines to create a brand new position and requesting job reevaluations Total Compensation Philosophy • Align with Marquette’s mission • Meet the following objectives: • • • • • Mission driven Internally equitable & externally competitive Performance based Valid & reliable Consistent • Compensation Program • • • • Ten compensable factors used to classify positions Broadband structure Band placement is determined by PEQ evaluation Placement within the band is determined by the market What do you know about… FLSA? Fair Labor Standards Act (FLSA) • Enacted in 1938 • Federal law which governs minimum wage, overtime pay, recordkeeping, and child labor. • The Wage and Hour Division of the US Dept. of Labor enforces the FLSA. • Almost every employee in the US is covered under FLSA. • Covers • • • • • Overtime Minimum Wage Child Labor Equal Pay Recordkeeping FLSA Continued • Employees are entitled to be paid at least the Federal minimum wage ($7.25 p/hour) as well as 1 ½ their regular rate of pay for all hours worked over 40 in a workweek, unless an exemption applies. • The most common FLSA minimum wage and overtime exemption applies to exempt employees who must perform executive, administrative, or professional duties. Exempt and nonexempt • Employees who qualify as "exempt" are exempt from overtime regulations (and minimum wage laws), whereas "nonexempt" employees must be paid for every hour of overtime they work. • Non-exempt employees are normally required to account for hours and fractional hours worked. • Exempt employees must meet three tests for each exemption: salary level, salary basis, and job duties. *All Business (11/7/2004) Exempt and nonexempt Cont. • Exempt and nonexempt status has little to do with job titles and whether an employee is salaried or receives an hourly wage. • The legal definition of "exempt" and "nonexempt" has more to do with an employee's level of responsibility. • In general, the more responsibility and independence or discretion an employee has, the more likely the employee is to be considered exempt. Nonexempt Requirements • Time worked recordkeeping • • • • • • • • • • Time and day of week when workweek begins Hours worked each day Total hours worked each workweek Basis on which wages are paid (i.e., per hour, piecework) Regular hourly pay rate Total daily or weekly straight-time earnings Total overtime earnings Additions to or deductions from wages Total wages paid each pay period Date of payment and pay period covered by payment Exempt Requirements • Three Tests for Exemption • Salary level—minimum of $455 per week or $23,660 annually. • Salary basis—regularly receives a predetermined amount of compensation each pay period. • Job duties • Executive: primary duty is management. • Administrative: performance of work directly related to general business operations and exercises discretion. • Professional: learned (requires advanced knowledge), outside sales (making sales away from employer’s place), highly skilled computer employees, creative (performance of work in an artistic or creative field). Examples of nonexempt and exempt • Nonexempt • Service maintenance employees • Office coordinators/associates • Nurses • Exempt • Professors • Business Operations Managers • Lawyers Common FLSA Violations • Compensatory time off • Failure to pay for unauthorized hours worked • Failure to pay for all recorded hours • Inaccurate records Implications of noncompliance with the FLSA • Department of Labor representatives investigate wages, hours, and other employment practices. • Burden of proof is on the employer. • If violations are found, the employer may be subject to: • Pay back wages • In 2007, the Wage and Hour Division recouped over $220 million in back wages¹ • Fines • Up to $10,000 • Civil money penalty of up to $1,000 for each such violation • Liquidated damages • Attorney’s fees and costs • 1. Automatic Data Processing, 2008 How does HR classify positions? 1. Review job—what is the primary purpose of the position and how do the duties fit with the purpose of the position? 2. Utilize resources—organization charts, compare to similar university (and/or external) positions and other educational institutions 3. Department of Labor and WI Department of Workforce Development guides and articles 4. May seek advice from third party agency or legal counsel Position Procedures • Creating a brand new position • Must receive verbal approval from the Dean, Provost or VP. • Requesting department sends a Job Evaluation Request form, completed Position Evaluation Questionnaire (PEQ), and a Job Description to Human Resources. • Human Resources will assign the job classification (according to FLSA requirements), position code, and market salary range. • Requesting job reevaluations • Can be made for individual position or whole department/college . • Requests can be made after 12 months or if significant changes to the position have been made. • Requesting department sends a Job Evaluation Request form, completed PEQ, and an updated Job Description to Human Resources. • Human Resources will review classification and changes. Questions…. Resources • Compensation Program Resources http://www.marquette.edu/hr/CompensationProgramResources.shtml • UPP 4-01: Compliance with the FLSA http://www.marquette.edu/upp/hr.shtml • UPP 4-10: Flextime http://www.marquette.edu/upp/hr.shtml • US Department of Labor http://www.dol.gov/whd/flsa/index.htm Contact Information Jennifer Burns Compensation Manager 414.288-7935 Jennifer.burns@marquette.edu Lynn Mellantine Assistant Director 414.288.3430 lynn.mellantine@marquette.edu