The following is a December 31, 2011, post

advertisement

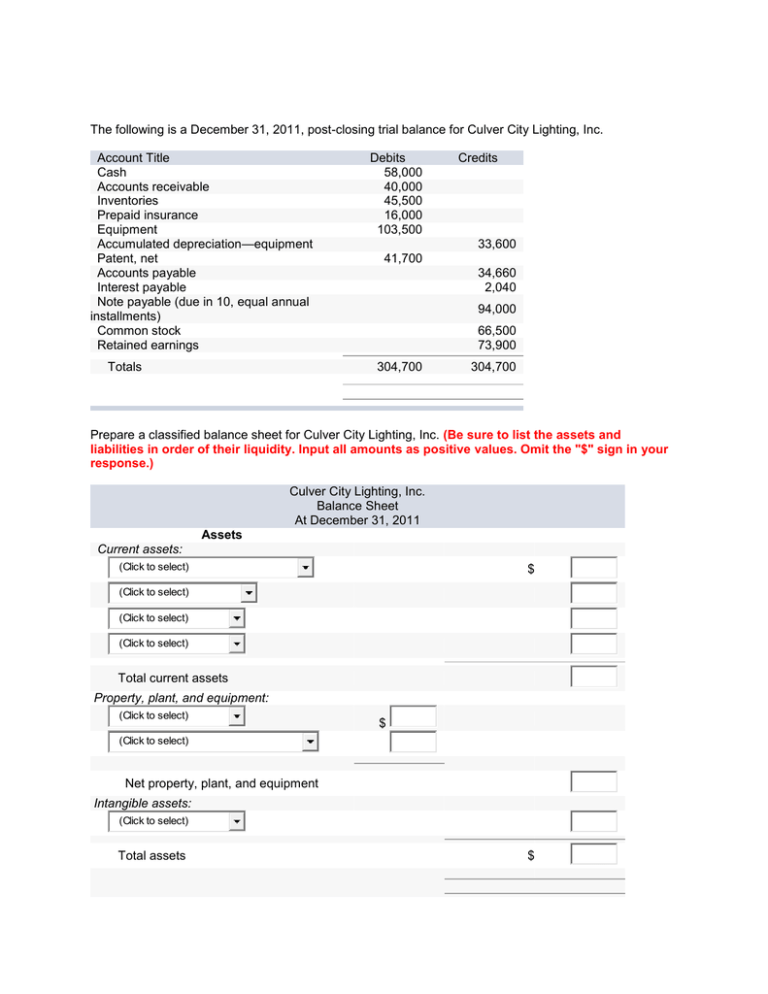

The following is a December 31, 2011, post-closing trial balance for Culver City Lighting, Inc. Account Title Cash Accounts receivable Inventories Prepaid insurance Equipment Accumulated depreciation—equipment Patent, net Accounts payable Interest payable Note payable (due in 10, equal annual installments) Common stock Retained earnings Totals Debits 58,000 40,000 45,500 16,000 103,500 Credits 33,600 41,700 34,660 2,040 94,000 66,500 73,900 304,700 304,700 Prepare a classified balance sheet for Culver City Lighting, Inc. (Be sure to list the assets and liabilities in order of their liquidity. Input all amounts as positive values. Omit the "$" sign in your response.) Culver City Lighting, Inc. Balance Sheet At December 31, 2011 Assets Current assets: (Click to select) $ (Click to select) (Click to select) (Click to select) Total current assets Property, plant, and equipment: (Click to select) $ (Click to select) Net property, plant, and equipment Intangible assets: (Click to select) Total assets $ Liabilities and Shareholders' Equity Current liabilities: (Click to select) $ (Click to select) (Click to select) Total current liabilities Long-term liabilities: (Click to select) Shareholders' equity: (Click to select) $ (Click to select) Total shareholders' equity Total liabilities and shareholders' equity $ You have been asked to review the December 31, 2011, balance sheet for Champion Cleaning. After completing your review, you list the following three items for discussion with your superior: 1.An investment of $38,000 is included in current assets. Management has indicated that it has no intention of liquidating the investment in 2012. 2.A $140,000 note payable is listed as a long-term liability, but you have determined that the note is due in 10, equal annual installments with the first installment due on March 31, 2012. 3.Unearned revenue of $66,000 is included as a current liability even though only two-thirds will be earned in 2012. 1. Determine the appropriate classification of each of these items. (Omit the "$" sign in your response.) 2. Amount Classification 1. Investment $ 2. Next year's installment $ Balance 3. Unearned revenue Balance $ $ $ (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) For each of the following note disclosures, indicate whether the disclosure would likely appear in (A) the summary of significant accounts policies or (B) a separate note: Note disclosures (1) Depreciation method (2) Contingency information (3) Significant issuance of common stock after the fiscal year-end (4) Cash equivalent designation (5) Long-term debt information (6) Inventory costing method A/B (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) The following are the typical classifications used in a balance sheet: a. b. c. d. e. Current assets Investments and funds Property, plant, and equipment. Intangible assets Other assets f. g. h. i. Current liabilities Long-term liabilities Paid-in-capital Retained earnings Required: For each of the following balance sheet items, use the letters above to indicate the appropriate classification category. (If the item is a contra account, select the appropriate letter with a minus sign.) 1. (Click to select) Equipment 10. (Click to select) Inventories 2. (Click to select) Accounts payable 11. (Click to select) Patent 3. (Click to select) Allowance for uncollectible accounts 12. (Click to select) 4. (Click to select) Land, held for investment 13. (Click to select) 5. (Click to select) Note payable, due in 5 years 14. (Click to select) 6. (Click to select) Unearned rent revenue 15. (Click to select) Common stock 7. (Click to select) Note payable, due in 6 months 16. (Click to select) Building, in use 8. (Click to select) Income less dividends, accumulated 17. (Click to select) Cash 9. (Click to select) Investment in XYZ Corp., long-term 18. (Click to select) Taxes payable Land, in use Accrued liabilities Prepaid rent The following balance sheet for the Los Gatos Corporation was prepared by a recently hired accountant. In reviewing the statement you notice several errors. LOS GATOS CORPORATION Balance Sheet At December 31, 2011 Assets Cash Accounts receivable Inventories Machinery (net) Franchise (net) Total assets Liabilities and Shareholders’ Equity Accounts payable Allowance for uncollectible accounts Note payable Bonds payable Shareholders’ equity Total liabilities and shareholders’ equity $ 39,700 75,000 55,000 117,000 30,100 $ 316,800 $ 45,000 4,688 58,100 107,500 101,512 $ 316,800 Additional information: 1. Cash includes a $19,850 bond sinking fund to be used for repayment of the bonds payable in 2015. 2. The cost of the machinery is $140,600. 3. Accounts receivable includes a $18,750 note receivable from a customer due in 2014. 4. The note payable includes accrued interest of $5,282. Principal and interest are both due on February 1, 2012. 5. The company began operations in 2006. Income less dividends since inception of the company totals $67,675. 6. 48,250 shares of no par common stock were issued in 2006. 96,500 shares are authorized. Required: Prepare a corrected, classified balance sheet. (Be sure to list the assets and liabilities in order of their liquidity. Input all amounts as positive values. Omit the "$" sign in your response.) LOS GATOS CORPORATION Balance Sheet At December 31, 2011 Assets Current assets: (Click to select) $ (Click to select) (Click to select) Total current assets Investments: $ Total investments Property, plant, and equipment: (Click to select) (Click to select) Net property, plant, and equipment Intangible assets: (Click to select) Total assets $ Liabilities and Shareholders' Equity Current liabilities: (Click to select) $ (Click to select) (Click to select) Total current liabilities Long-term liabilities: (Click to select) Shareholders’ equity: (Click to select) (Click to select) Total shareholders’ equity $ Total liabilities and shareholders' equity $ The 2011 balance sheet for Hallbrook Industries, Inc. is shown below. HALLBROOK INDUSTRIES, INC. Balance Sheet December 31, 2011 ($ in 000s) Assets Cash Short-term investments Accounts receivable Inventories Property, plant, and equipment (net) Total assets Liabilities and Shareholders’ Equity Current liabilities Long-term liabilities Paid-in capital Retained earnings Total liabilities and shareholders’ equity $ 240 210 240 320 980 $1,990 $ 410 380 790 410 $ 1,990 The company’s 2011 income statement reported the following amounts ($ in 000s): Net sales Interest expense Income tax expense Net income $4,790 230 290 350 Required: Determine the following ratios for 2011 (Round your answers to 2 decimal places): 1. Current ratio 2. Acid-test ratio 3. Debt to equity ratio 4. Times interest earned ratio times