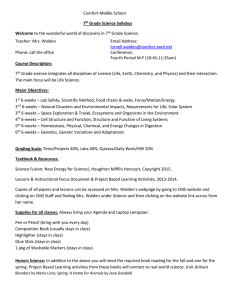

Accounting I Fall Syllabus 2014 Tolleson Course Description: A

advertisement

Accounting I Fall Syllabus 2014 Tolleson Course Description: A study of accounting principles as applied to vouchers, books of original entry, controlling accounts, adjusting and closing entries, financial statements, controls, and accounting concepts. 1st 6-Weeks: Opening Procedures: Check Student Schedules Seating Charts Student Inventory Supply List Internet Access Form Lab Rules Syllabus Introduction to Class Check out Books Check out Workbooks FBLA Information Unit 1 Chapters Covered: Ch. 1 You and the World of Accounting Ch. 2 The World of Business and Accounting Unit 2 Chapters Covered Chapter 3 Business Transactions and the Accounting Equation Chapter 4 Transactions that Affect Assets, Liabilities, and Owner’s Equity Chapter 5 Transactions that Affect Revenue, Expenses, and Withdrawals 2nd 6-Weeks Chapter 6 Recording Transactions in a General Journal Chapter 7 Posting Journal Entries to General Ledger Accounts Mini Practice Set 1: Canyon.com Web Sites Chapter 8 The Six-column Work Sheet Chapter 9 Financial Statements for a Sole Proprietorship 3rd 6-Weeks Chapter 10 Completing the Accounting Cycle for a Sole proprietorship Chapter 11 Cash Control and Banking Mini Practice Set 2: In-Touch Electronics Chapter 12 Payroll Accounting Chapter 13 Payroll Liabilities and Tax Records Final Exam Materials Needed: Pencil (only) No Ink allowed in class Calculator Eraser Highlighter "The only way to get out of the "Rat Race" is to prove your proficiency at both accounting and investing, arguably two of the most difficult subjects to master."