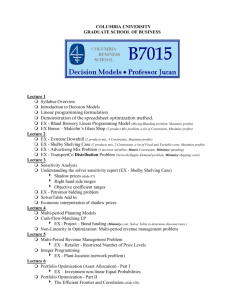

lecture11solvency

advertisement

Non-life insurance mathematics

Nils F. Haavardsson,

University of Oslo and DNB Forsikring

Agenda

•

•

•

•

The motivation

The sources of risk

Portfolio liabilities by simple approximation

Portfolio liabilities by simulation

The main driver of financial regulation is to avoid

bankruptcies and systemic risk

Protecting policy holders across the EU

Optimizing capital allocation by aligning capital requirements to actual

risk

Create an equal and consistent regulatory regime across the EU

Create regulations that are consistent with the ones in comparable

industries (particularly banking)

Create an improved «platform» for proper regulation and supervision,

based on increased transparency, more data and better documentation

SCR

Standard model

Adj

Market

BSCR

Health

Interest

rate

SLT

Health

Equity

Mortality

H CAT

Default

Non-SLT

Health

Premium

Reserve

16

Longevity

Property

43

Spread

Disability

Morbidity

Currency

Lapse

Concentration

Lapse

Op

Life

Non-life

Mortality

Premium

Reserve

Longevity

Lapse

Disability

Morbidity

NL CAT

Intang

Lapse

Expenses

Nat Cat

Revision

NP Reins.

Mass

accident

30

Expenses

Accident

conc.

Revision

L CAT

Man made

Pandemic

NL CAT

other

https://eiopa.europa.eu/Publications/Standards/A__Technical_Specification_for_the_Preparatory_Phase__Part_I_.pdf

Solvency

• Financial control of liabilities under nearly

worst-case scenarios

• Target: the reserve

– which is the upper percentile of the portfolio

liability

• Modelling has been covered (Risk premium

calculations)

• The issue now is computation

– Monte Carlo is the general tool

– Some problems can be handled by simpler,

Gaussian approximations

10.2 Portfolio liabilities by simple

approximation

•The portfolio loss for independent risks become Gaussian as J tends to infinity.

•Assume that policy risks X1,…,XJ are stochastically independent

•Mean and variance for the portfolio total are then

E ( ) 1 ... J and var( ) 1 ... J

and j E ( X j ) and j sd ( X j ). Introduce

1

1

2

( 1 ... J ) and ( 1 ... J )

J

J

which is average expectation and variance. Then

d

1 J

2

X

N

(

,

)

i

J i 1

as J tends to infinfity

•Note that risk is underestimated for small portfolios and in

branches with large claims

Normal approximations

Let be claim intensity and z and z mean and standard deviation

of the individual losses. If they are the same for all policy holders,

the mean and standard deviation of Χ over a period of length T

become

E(Χ ) a0 J , sd(Χ ) a1 J

where

a0 T z and a1 T z2 z2

Poisson

Some notions

The rule of double variance

Examples

Random intensities

Let X and Y be arbitrary random variables for which

( x) E (Y | x)

and

2 var(Y | x)

Then we have the important identities

E (Y ) E{ ( X )}

Rule of double expectation

and

var(Y ) E{ 2 ( X )} var{ ( X )}

Rule of double variance

8

Poisson

Some notions

The rule of double variance

Examples

Random intensities

Portfolio risk in general insurance

Z1 Z 2 ... Z where , Z1 , Z 2 ,... are stochastic ally independen t.

Let E ( Z1 ) Z where var( | ) Z2

Elementary rules for random sums imply

E ( | N ) N z and var( | N ) N z2

Let Y

and

x in the formulas on the previous slide

var( ) var{ E ( | N )} E{sd ( | N )}2

var( z ) E ( z2 )

z2 var( ) z2 E ( )

JT ( z2 z2 )

9

Poisson

Some notions

The rule of double variance

Examples

Random intensities

This leads to the true percentile qepsilon being approximated by

qNO a0 J a1 J

Where phi epsilon is the upper epsilon percentile of the standard normal distribution

and

a0 T z and a1 T z2 z2

10

Fire data from DNB

0.10

0.05

0.00

Density

0.15

0.20

0.25

density.default(x = log(nyz))

0

5

10

N = 1751 Bandwidth = 0.3166

15

Normal approximations in R

z=scan("C:/Users/wenche_adm/Desktop/Nils/uio/Exercises/Branntest.txt");

# removes negatives

nyz=ifelse(z>1,z,1.001);

mu=0.0065;

T=1;

ksiZ=mean(nyz);

sigmaZ=sd(nyz);

a0 = mu*T*ksiZ;

a1 = sqrt(mu*T)*sqrt(sigmaZ^2+ksiZ^2);

J=5000;

qepsNO95=a0*J+a1*qnorm(.95)*sqrt(J);

qepsNO99=a0*J+a1*qnorm(.99)*sqrt(J);

qepsNO9997=a0*J+a1*qnorm(.9997)*sqrt(J);

c(qepsNO95,qepsNO99,qepsNO9997);

The normal power approximation

ny3hat = 0;

n=length(nyz);

for (i in 1:n)

{

ny3hat = ny3hat + (nyz[i]-mean(nyz))**3

}

ny3hat = ny3hat/n;

LargeKsihat=ny3hat/(sigmaZ**3);

a2 = (LargeKsihat*sigmaZ**3+3*ksiZ*sigmaZ**2+ksiZ**3)/(sigmaZ^2+ksiZ^2);

qepsNP95=a0*J+a1*qnorm(.95)*sqrt(J)+a2*(qnorm(.95)**2-1)/6;

qepsNP99=a0*J+a1*qnorm(.99)*sqrt(J)+a2*(qnorm(.99)**2-1)/6;

qepsNP9997=a0*J+a1*qnorm(.9997)*sqrt(J)+a2*(qnorm(.9997)**2-1)/6;

c(qepsNP95,qepsNP99,qepsNP9997);

Percentile

Normal

approximations

Normal power

approximations

95 %

99 %

99.97%

19 025 039 22 962 238 29 347 696

20 408 130 26 540 012 38 086 350

Portfolio liabilities by simulation

• Monte Carlo simulation

• Advantages

– More general (no restriction on use)

– More versatile (easy to adapt to changing

circumstances)

– Better suited for longer time horizons

• Disadvantages

– Slow computationally?

– Depending on claim size distribution?

An algorithm for liabilities

simulation

•Assume claim intensities

for J policies are stored on file

1 ,..., J

•Assume J different claim size distributions and payment functions

H1(z),…,HJ(z) are stored

•The program can be organised as follows

•Assume log normal distribution for claim size

0 for (i in 1 : Number_of_ simulation s)

1 {

2 Number_of_e vents - rpois(1, number_of_ events_per _year)

3 Z_per_event - rlnorm(Num ber_of_eve nts, theta, sigma)

4 simulations [i] - sum(Z_per_ event)

5 }

An algorithm for liabilities

simulation using mixed distribution

•Assume p is given, representing the likelihood of being in the extreme right tail

•With likelihood 1-p non-parametric sampling from the data in the normal range is used

•With likelihood p sampling from a distribution selected for the extreme right tail is used.

•The program can be organised as follows

•Assume Weibull distribution for claim size in the extreme right tail

0

1

2

3

4

5

6

7

8

Not_extreme _Z - z[z Extreme_pe rcentile]

for (i in 1 : Number_of_ simulation s)

{

Number_of_n ormal_even ts - rpois(1, number_of_ normal_eve nts_per_ye ar)

Z_per_ normal_eve nt - sample(Not _extreme_Z , Number_of_ normal_eve nts, replace T)

Number_of_ extreme_ev ents - rpois(1, number_of_ extreme_ev ents_per_y ear)

Z_per_ extreme_ev ent - rweibull(N umber_of_e xtreme_eve nts, aphahat, betahat)

simulations [i] - sum(Z_per_ normal_eve nt) sum(Z_per_ extreme_ev ent)

}

Experiments in R

1. Find the claim size distribution

1a. Try Gamma

1b. Weibull

2. Simulate portfolio liability using Monte Carlo

3. Simulate portfolio liability using normal approximation

4. Compare the results

18

An algorithm for liabilities

simulation

•Assume claim intensities

for J policies are stored on file

1 ,..., J

•Assume J different claim size distributions and payment functions

H1(z),…,HJ(z) are stored

•The program can be organised as follows (Algorithm 10.1)

0 Input : j jT ( j 1,.., J ), claim size models, H1 ( z ),..., H J ( z )

1 * 0

2 For j 1,..., J do

3

Draw U* ~ Uniform and S * log( U* )

4

Repeat whi le S * j

5

Draw claim size Z *

6

* * H j ( z )

7

Draw U * ~ Uniform and S * S * log( U* )

8

Return *

Monte Carlo theory

Suppose X1, X2,… are independent and exponentially distributed with mean 1.

It can then be proved

Pr( X 1 ... X n X 1 ... X n 1 )

n

n!

e

(1)

for all n >= 0 and all lambda > 0.

•From (1) we see that the exponential distribution is the distribution that

describes time between events in a Poisson process.

•In Section 9.3 we learnt that the distribution of X1+…+Xn is gamma

distributed with mean n and shape n

•The Poisson process is a process in which events occur continuously and

independently at a constant average rate

•The Poisson probabilities on the right define the density function

Pr( N n)

n

n!

e , n 0,1,2,...

which is the central model for claim numbers in property insurance.

Mean and standard deviation are E(N)=lambda and sd(N)=sqrt(lambda)

An algorithm for liabilities

simulation

•Assume claim intensities

for J policies are stored on file

1 ,..., J

•Assume J different claim size distributions and payment functions

H1(z),…,HJ(z) are stored

•The program can be organised as follows (Algorithm 10.1)

0 Input : j jT ( j 1,.., J ), claim size models, H1 ( z ),..., H J ( z )

1 * 0

2 For j 1,..., J do

3

Draw U* ~ Uniform and S * log( U* )

4

Repeat whi le S * j

5

Draw claim size Z *

6

* * H j ( z )

7

Draw U * ~ Uniform and S * S * log( U* )

8

Return *