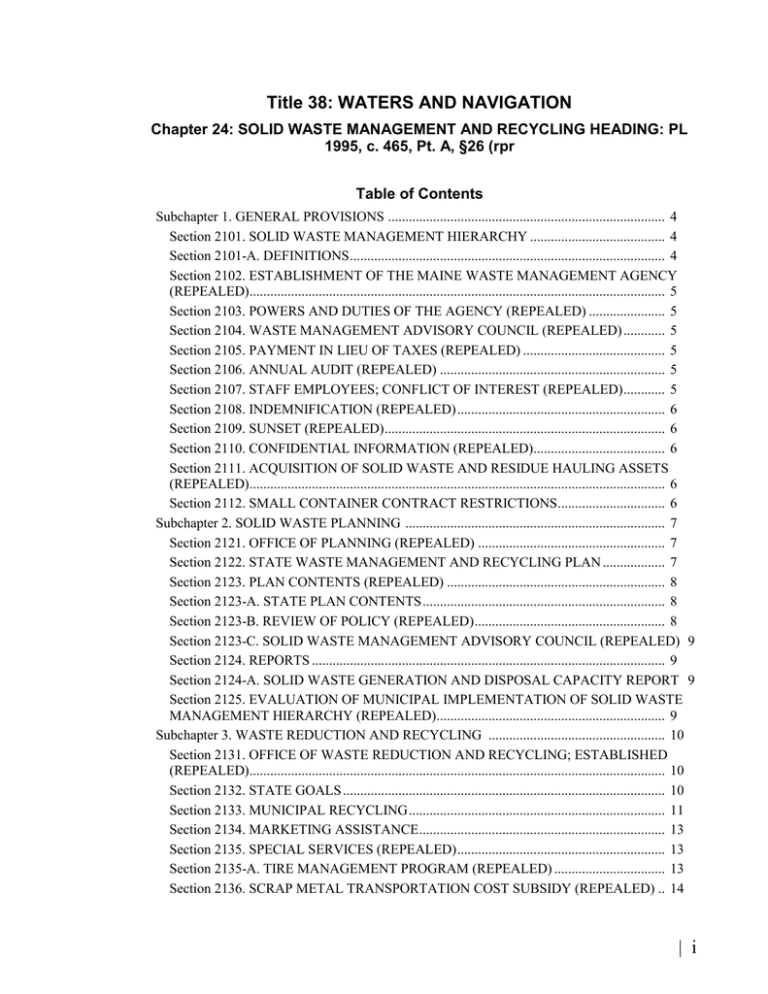

Ch. 24 MS-Word - Maine Legislature

advertisement