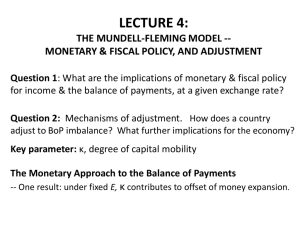

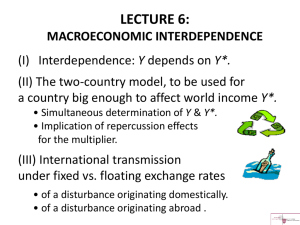

L4 - Harvard University

advertisement

THE KEYNESIAN MODEL Lecture 4: Introduction to Keynesian Model: Derivation; National Saving Identity. Lecture 5: Multipliers for spending & exports; the transfer problem. Lecture 6: Large-country model; International transmission under fixed vs. floating exchange rates Lecture 7: Adjustment of a CA deficit via expenditure-reducing vs. expenditure-switching policies Lecture 8: Monetary factors Imports & exports depend on income: M = Md(E, Y) = 𝑀 + mY X = Xd(E, Y*) =𝑋 assuming E & Y* fixed, for now. => TB = 𝑋 − (𝑀 +mY) TB …and rises in contractions + 0 - Y TB falls in expansions… where slope = -m ≡ - marginal propensity to import as does consumption: Keynesian consumption function C = 𝐶 + cY . ITF220 - Prof. J. Frankel, Harvard University Trade rises inimproved recessions, E.g., the balance US trade balance sharply in expansions in falls the recession of 2008-09 U.S. International Transactions 0 2004-2014 $ MILLIONS PER QUARTER Current Account -50000 -100000 -150000 Goods & Services -200000 -250000 I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III 2004 2005 2006 2007 2008 2009 Seasonally Adjusted Balance on current account (line 1 less line 9) /4/ 2010 2011 2012 2013 Balance on goods and services (line 2 less line 10) ITF220 - Prof. J. Frankel, Harvard University 2014 Determination of equilibrium income in open-economy Keynesian model Y ≡ A + TB ≡ (C + I + G) + (X – M) = (𝐶+cY + 𝐼 + 𝐺) + (𝑋 - 𝑀 - mY). Now solve: Y - cY + mY = 𝐶 + 𝐼 + 𝐺 + (𝑋 - 𝑀) 𝐶+𝐼+𝐺 + 𝑋 − 𝑀 𝑌= 1−𝑐+𝑚 𝐴+𝑋−𝑀 𝑌= 𝑠 + 𝑚 Prof. J. Frankel, Harvard University where 𝐴 ≡ 𝐶+𝐼+𝐺 and s ≡ 1 – c. Derivation of National Saving Identity Income ≡ Output (assuming no transfers) Y ≡ GDP /C + S + T ≡ C/ + I + G + X -M S + (T-G) ≡ I + X – M NS ≡ S + BS ≡ I + TB ITF220 - Prof. J. Frankel, Harvard University National Saving Identity US National Saving, Investment, & Current Account as Shares of GDP, 1949-2009 Trend: Gap widened, as NS fell relative to I ITF220 - Prof. J. Frankel, Harvard University Keynesian Consumption Function: C = 𝐶 + cYd . or, expressed as a saving function: S = Yd - C = Yd - 𝐶 - cYd . = - 𝐶 + sYd where s ≡ 1 – c. }I ITF220 - Prof. J. Frankel, Harvard University Closed economy: NS – I = 0 Fiscal Expansion 1 < Closed-economy multiplier 1/s < ∞ ITF220 - Prof. J. Frankel, Harvard University Open economy: NS – I = TB =X–M Imports: M = Md(E, Y), or = 𝑀+mY for simplicity Exports: X = Xd(E), or = 𝑋 for simplicity. => TB = 𝑋 − (𝑀+mY ) Prof. J. Frankel, Harvard University Open economy Fiscal Expansion slope = s G ΔY = 1 𝑠+𝑚 Δ𝐺 < Prof. J. Frankel, Harvard University 1 Δ𝐺 𝑠 End of Lecture 4: Introduction to the Keynesian Model ITF220 - Prof. J. Frankel, Harvard University Appendix -- Puzzle: Why did global trade collapse in the 2008-09 global recession? (more than usual) 2009 Bussière, Callegari, Ghironi, Sestieri & Yamano, 2013, "Estimating Trade Elasticities: Demand Composition and the Trade Collapse of 2008-2009." ITF220 - Prof. J. Frankel, Harvard University One answer: There is a marginal propensity to import out of investment, greater than the marginal propensity to import by consumers. And investment fell much more than consumption in 2008-09. Bussière, Callegari, Ghironi, Sestieri & Yamano, 2013, "Estimating Trade Elasticities: Demand Composition and the Trade Collapse of 2008-2009." ITF220 - Prof. J. Frankel, Harvard University