Edwin L. Drake

An Age of Big Business

Chapter 19, Section 3

Pgs. 567-571

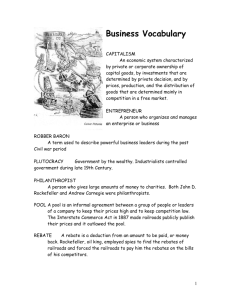

Corporation

A company that sells shares of its business to the public.

Stock

A share in a business.

Shareholder

Someone who owns shares

(stock) in a business.

Dividend

If the business is doing well, a shareholder earns cash payments from the corporation’s profits. These payments are known as dividends.

Horizontal Integration

Combining competing firms into one corporation.

Rockefeller did this by acquiring most of the oil refineries in Cleveland and other cities.

Trust

A group of companies managed by the same board of directors

Monopoly

Almost total control by a single producer.

Vertical Integration

Acquiring companies that provide the equipment and services your company needs.

Carnegie bought iron and coal mines, warehouses, ore ships, and railroads to gain control of steel.

Philanthropy

The use of money to benefit the community.

Philanthropists gave money to found schools, universities, libraries, etc.

Carnegie Hall in NYC

Mergers

The combining of companies

Edwin L. Drake

Drake believed he could find oil by digging a well.

In 1859 he tested his belief in

Titusville,

Pennsylvania and struck oil.

This led to the creation of the petroleum industry.

Drake (right) in front of the historic Drake well.

Factors of Production

Land – all natural resources

Labor – workers need to turn raw materials into goods

Capital – the equipment, buildings, machinery, tools and money needed to produce goods

Raising Capital

One way a company could raise capital was by becoming a corporation .

A corporation is a company that sells shares, or stock, of its business to the public.

People could buy and sell stocks in special markets known as stock exchanges .

John D. Rockefeller

In 1870 Rockefeller organized the

Standard Oil Company of Ohio and set out to dominate the oil industry.

Rockefeller used horizontal integration to create his empire.

He lowered his prices to drive his competitors out of business.

He pressured customers not to deal with rival oil companies.

He persuaded the railroads to grant him rebates in exchange for his business.

Creating a Trust

Rockefeller wanted to gain controlling interest in these other oil companies so that he could gain the right to manage them.

This allowed him to create a monopoly of the oil industry.

The Steel Business

Two new methods of making steel changed the industry.

Bessemer process

Open-hearth process

With these new methods, mills could produce steel at affordable prices and in large quantities.

Pittsburgh, Pennsylvania became the steel capital of the United States.

Andrew Carnegie

Carnegie used vertical integration to become powerful.

He acquired companies that provided the equipment and services he needed.

Bought iron and coal mines, warehouses, ore ships, and railroads

In 1901 he sold his steel company to banker J.

Pierpont Morgan.

Morgan formed the United States Steel Corporation which was the world’s first billion-dollar corporation.

Philanthropy

Philanthropists founded schools, universities, and other civic institutions across the United States.

Carnegie built Carnegie Hall in NYC, the

Carnegie Foundation for the Advancement of Teaching, and more than 2,000 libraries.

Rockefeller established the University of

Chicago and New York’s Rockefeller

Institute for Medical Research.

Lack of Competition

Many Americans admired the efficiencies that large businesses provided.

BUT a lack of competition hurt consumers

Without competition, corporations had no reason to keep their prices low or to improve their goods and services.

Sherman Antitrust Act

Congress passed the Sherman Antitrust

Act in 1890.

The law sought “to protect trade and commerce against unlawful restraint and monopoly”.

The act was too vague and did little to curb the power of big business.