Strategic Objective Key Performance Areas

advertisement

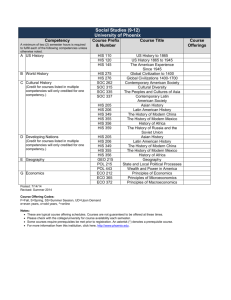

STRATEGIC PLAN AND APP PRESENTATION TO PORTFOLIO COMMITTEE 02 JULY 2014 PRESENTATION OUTLINE • • • • • • • • • • • • Introduction Programmes and their functions Organisational structure Strategic context Vision and mission Strategic objectives Approach to implementation Key performance areas Budget overview Capacity of the Department SWOT Analysis Conclusion 2 INTRODUCTION The Department is required by legislation to develop a Strategic Plan that outlines the objectives to be pursued by the Department over the MTSF period The Strategy development was informed by the following principles: Coordination and coherence with government overarching policy frameworks Identifying clear outcomes to be pursued by the Department Delivering in the constrained economic environment Focusing on cross-cutting outcomes within the Department and Government The Strategy has been presented to the Executive Authority and extensively discussed with senior management The focus is now on the implementation through the Annual Performance Plan 3 INTRODUCTION Who is DPE The DPE through the Minister is the shareholder representative for government, with oversight responsibility for eight State Owned Companies (SOC) The 8 SOC are Eskom, Denel, SAFCOL, Broadband Infraco, Alexkor, Transnet, South African Airways (SAA), and South African Express Airways (SAX) The mandate of the Department is embedded in the founding legislation of the SOC and PFMA The mandate of the Department is to ensure that the SOC within its portfolio are directed to serve Government’s strategic objectives as outlined in the NDP and further articulated in the New Growth Path, and the Industrial Policy Action Plan. 4 PROGRAMMES’ FUNCTIONS PROGRAMME 1: ADMINISTRATION •The purpose of the programme is to: • Provides strategic management, corporate management and administrative support to the Department, which enables the Department to meet its strategic objectives, and • Over and above the administration function, the programme also comprises of units that are critical for the development of systems, plans and processes that will aid the Department in executing its mandate and enhancing coordination in the delivery of its plans. PROGRAMME 2: LEGAL AND GOVERNANCE •The purpose of the programme is to: • Provides legal services and corporate governance systems, and facilitates the implementation of all legal aspects of transactions that are strategically important to the Department and the SOC, and • Ensure alignment with Government’s strategic intent by, amongst others, monitoring key risk factors that may affect the achievement of key performance indicators contained in the shareholder compacts. 5 PROGRAMMES’ FUNCTIONS PROGRAMME 3: PORTFOLIO MANAGEMENT AND STRATEGIC PARTNERSHIPS •The purpose of Programme is to: • Align the corporate strategies of the SOC with Government’s strategic intent, and monitor and benchmark their financial and operational performance and capital investment plans • Contribute to the implementation of overarching economic, social and environmental policies focused on building strategic partnerships between SOC, strategic customers, suppliers and financial institutions •The programme comprises of the following sub-programmes: • • • • • Energy and Broadband Enterprises is responsible to oversee Eskom and Broadband Infraco Manufacturing Enterprises is responsible to oversee Alexkor, SAFCOL and Denel Transport Enterprises responsible is to oversee Transnet, SAA and SAX Strategic Partnerships’ main role is to develop innovative models to ensure financial sustainability of SOC; as well as project oversight for infrastructure projects Economic Impact and Policy Alignment aims to build the capacity to monitor national economic policies to determine areas in which the SOC can make strategic contributions 6 ORGANISATIONAL STRUCTURE 7 STRATEGIC CONTEXT 700000 • New Growth Path • National Infrastructure Plan (SIPs) • Industrial Policy Action Plan 100000 0 2013 Medium Term Strategic Framework of the new administration 200000 2012 • Private sector 2011 National Development Plan 300000 2010 • Public Corporations 2009 The Strategic Plan is informed by this overarching objective as outlined in the: Government 2008 • 400000 2007 The government has develop a suite of policy interventions targeted to accelerate growth, and ensure that its inclusive (Investment driven growth) 2006 • 500000 2005 While significant progress has been made to transform the economy, there are major structural constraints that exist 2004 • 600000 2003 This has resulted in slower employment growth and the economy’s ability to absorb more people into the labour market has been limited 2002 • Investments in the economy 2001 The South African economy remains constrained and growth over the past 5 years has been low 2000 • 8 VISION AND MISSION VISION: To drive investment, productivity and transformation in the Department’s portfolio of State Owned Companies (SOC), their customers and suppliers so as to unlock growth, drive industrialisation, create jobs and develop skills. MISSION To provide decisive strategic direction to the SOC, so that their businesses are aligned with the national growth strategies arising out of the NDP KEY OUTCOMES TO BE SUPPORTED •Unlock economic growth and employment •Industrialisation •Transformation •Regional Development 9 DPE STRATEGIC OBJECTIVES • • • • • • Review the shareholder oversight to ensure alignment of SOC to developmental outcomes Promote good corporate governance Build internal capacity to enhance Department’s ability to execute its strategic plan and fulfill its mandate Stabilise our SOC looking at strengthening of balance sheets and funding options Drive economic infrastructure investment to enhance the capacity of the economy with emphasis on the Strategic Integrated Projects Leverage SOC procurement spend to support industrialisation and transformation 10 APPROACH TO IMPLEMENTATION • The Department has clearly defined its objectives over the MTSF period Agreed strategic objective s Linking projects to objectives Implementation Framework (Roadmap) Strategic capabilities Implementation to be driven at the top Enhanced coordination and collaboration • Key strategic initiatives or areas defined within the current fiscal framework • Engagement with Executive Authority to ensure alignment • To achieve the objectives, the Department would need to enhance coordination and collaboration with other Departments and state entities • Ensuring that the Department is appropriately resourced to execute the strategy 11 KEY PERFORMANCE AREAS Strategic Objective Objective 1: Review the shareholder oversight to ensure alignment of SOC to development outcomes Key Performance Areas Issues to Address Government Shareholder Management Bill developed Strengthening of legislation that foregrounds Department’s mandate Review Logical Planning, Monitoring and Evaluation Framework (LPMEF) Streamline the logical planning framework Enhance Isibuko Dashboard Enhance compliance to current legislative framework Enhance rapid access to accurate information Modernisation of the oversight function 12 KEY PERFORMANCE AREAS Strategic Objective Key Performance Areas Objective 2: Promote good governance Enhance compliance with legislation Improve level of compliance within the Department and its SOC to PFMA provisions Business Processes Mapped, re- engineered and automated Integrate business processes Annual Plan for public participation programme Taking DPE to the people and ensure increased accountability Provincial engagements Coherence of SOC Plans to provincial economic development strategies Issues to Address Improve efficiency within the organisation Enhancing inter-governmental relations 13 KEY PERFORMANCE AREAS Strategic Objective Objective 3: Build internal capacity to enhance Department’s ability to execute its Strategic Plan and fulfill its mandate Key Performance Areas Human Resources Plan Issues to Address Continuous repositioning of DPE as an employer of choice Maintaining vacancy rate below 10 percent DPE Competency Model Define critical capabilities Re-alignment of talent development initiatives DPE Leadership Framework Mentorship and Coaching Enhance the learning culture within the organisation Culture & Diversity Management Accelerate implementation of actions identified in the Climate survey Review values and define organisational identify and culture 14 KEY PERFORMANCE AREAS Strategic Objective Key Performance Areas Objective 4: Stabilise our SOC looking at strengthening of balance sheets and funding options Funding strategy for SOC developed There is a need to assist SOCs mobilize additional funding from outside the state Monitor implementation of the Long Term Turnaround Strategy (LTTS) There is a need to ensure commercial and financial sustainability of the stateowned airlines by 2017 Issues to Address Enhanced monitoring SAFCOL Strategy developed Improve financial viability of the company Expansion of operations through vertical integration Land Claims Model Alexkor Strategy developed Refocusing of the company Sustainability of the Pooling and Sharing JV Diversification and revenue growth 15 KEY PERFORMANCE AREAS Strategic Objective Objective 5: Drive economic infrastructure investment to enhance the capacity of the economy with emphasis on the SIPs Key Performance Areas Monitor delivery of the build programme focusing on key projects outlined in the MTSF Issues to Address Invest in capacity and ensure that it enhances efficiency and overall competitiveness of the economy Timely delivery of projects within budget Implementation of Africa Strategy Coordinate investment activities of SOC into the continent Promoting regional development Develop Private Sector Participation Framework Augment investing capacity of the SOC Develop a Project Management Framework and Process for Mega Projects oversight Project life cycle mapping Define, Select, Plan, Implement, Evaluate 16 KEY PERFORMANCE AREAS Strategic Objective Objective 6: Leverage SOC procurement spend to support industrialisation and transformation Key Performance Areas Issues to Address Establishment of Maintenance, Repair and Operations (MRO ) Hub for the airlines industry Promote locally manufactured components (maintenance, repair and operations) SAA/SAX aircraft acquisition Promote acquisition from local advanced manufacturing entities Special Development Zone (SDZ) for manufacturing of timber and timberframe products Need to establish downstream enterprises in partnership with SAFCOL 17 KEY PERFORMANCE AREAS Strategic Objective Objective 6: Leverage SOC procurement spend to support industrialisation and transformation Key Performance Areas Issues to Address Review procurement rules to aggressively implement the Competitiveness Supplier Development Program (CSDP) Maximise the spend on domestic products and services Develop SOC Transformation Strategy, Plan and Measurement Tool Economic transformation objectives not fully met by SOC Develop a DPE Transformation Plan to achieve the 75 percent expenditure target on domestically produced products and service Enhance demand for domestic products and services Support development of industrial capabilities Better leverage SOC procurement expenditure 18 KEY PERFORMANCE AREAS Strategic Objective Objective 6: Leverage SOC procurement spend to support industrialisation and transformation Key Performance Areas Issues to Address Develop M&E tool for Youth Empowerment Program Enhance alignment of SOC Youth Intervention to the national youth development agenda Optimise SOC training facilities and enhance partnership with other Departments Increase training capacity of SOC to lead in the delivery of Skills Accord commitments Develop a tool to measure SOC Contribution to economic growth and job creation Develop Guidelines for SOC Corporate Social Investment (CSI) Support implementation of the National Skills Development Strategy Maximise contribution towards developmental outcomes CSI programmes and impact by SOC not fully understood and consolidated Alignment with developmental goals 19 BUDGET OVERVIEW Components R’000 2013/14 Actual 2014/15 Forecast 2015/2016 Budget 2016/17 Budget Compensation of employees 127 771 149 600 159 500 169 900 Good and services 144 697 110 200 119 800 115 700 272 468 259 800 279 300 285 600 Total • The Department's budget has decreased from R1.4 billion in 2012/13 to R259 million in 2014/15. However it continues to increase by 9.9% to 2016/17. The decrease from R1.4 billion was the result of transfers to the SOC's. • Over the medium term, Compensation of Employees is expected to increase from R149.6 million in 2014/15 to R169.9 million in 2016/17 as a result of the expansion of the establishment over this period • Goods and Services including Payments for Capital Assets is expected to increase from R110 million in 2014/15 to R115.7 million in 2016/17 to support the increased establishment 20 STRENGTHENING CAPACITY 250 Staff Complement 200 150 Total posts 100 Filled posts 50 0 09/10 10/11 11/12 12/13 13/14 Total posts 168 185 189 210 220 Filled posts 140 163 168 185 216 Vacancy Rate (%) 12 10 8 6 4 2 Rate • The Department has also succeeded in reducing its vacancy rate from 11.9% in March 2013 to 1.8%. • The increased scope requires the Department to enhance its capacity 14 0 • The structure of the Department increased from 168 in 2009 to 210 in the 2012/13 financial year and will increase to 227 over the MTEF period 11/12 12/13 13/14 11 12 1.8 • The Department still faced with challenges in respect of retention of specialists skills 21 SWOT The Department must leverage its Strengths and Opportunities to overcome threats and weaknesses Weaknesses Strengths Dedicated and competent workforce Shareholder management model not finalised Overseeing companies that are the corner stone of the economy Lack of common view on shareholder oversight Internal Duplication of effort among some units Strong financial management systems and practices ‘Assets ‘ Lack of clarity on roles and responsibilities S W Opportunities Position DPE as an “activist” shareholder representative ‘Liabilities Threats O T Not all enabling sector policies and legislations are in place Drive industrialisation and localization Burden on fiscus (financial sustainability of SOC) Drive SOC transformation Slow economic growth Drive new built programme Absence of a clear legislative framework setting out the DPE’s shareholder mandate Stimulate economic growth through infrastructure rollout programme External 22 CONCLUSION •The SONA has re-emphasised the Government’s commitment to address the developmental challenges •The NDP provides the long term vision and the Department will ensure alignment of SOC activities to support the achievement of the vision •Over the medium term, implementation of actions aligned to the NDP contained in the NGP and IPAP to deliver on the radical socio-economic transformation programme •The Department continues to improve its oversight mechanisms to ensure implementation of MTSF targets by SOC •The Department will work with SOC and DFIs to improve its project management capacity to improve monitoring of the build programme •The resourcing of the Department remains a challenge that needs to be addressed as the scope continues to expand 23