Class 4: States and Markets

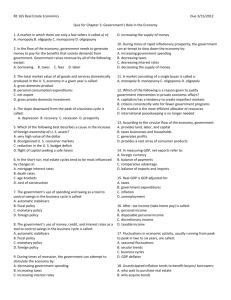

advertisement

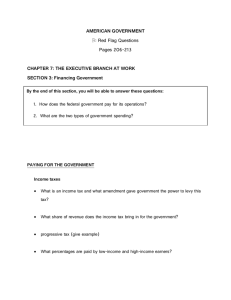

States and Markets 1 Sociology 2, Class 4 Copyright © 2008 by Evan Schofer Do not copy or distribute without permission Announcements • I’m signing add cards… • Today’s class • Wrap up “States and Markets” • Next week: Economic globalization In The News In the News: IMF Report • IMF says US crisis is 'largest financial shock since Great Depression' – America's mortgage crisis has spiraled into "the largest financial shock since the Great Depression" and there is now a one-in-four chance of a full-blown global recession over the next 12 months, the International Monetary Fund warned today. – "The financial shock that erupted in August 2007, as the US sub-prime mortgage market was derailed by the reversal of the housing boom, has spread quickly and unpredictably to inflict extensive damage on markets and institutions at the heart of the financial system," it said. – President George Bush has already signed off a $150bn tax rebate package to kick-start the economy, and the Federal Reserve has backed an emergency buyout of investment bank Bear Stearns, but the IMF said this may still not be enough: "Room may need to be found for some additional support for housing and financial markets." – http://www.guardian.co.uk/business/2008/apr/09/useconomy.subprimecr isis?gusrc=rss&feed=networkfront The Guardian, 4.9.08. Econ Basics: Definitions • Gross Domestic Product (GDP) • “gross” means “total” – Definition: The total economic value of goods & services produced within a country • Note: GDP is often measured “per capita,” which gives a sense of wealth per person • Examples: GDP in 2004 (CIA World Factbook) – United States: $13,800,000,000,000 – trillions! • $46,000 per capita – Brazil: $1,800,000,000,000; 1.8 trillion, $9,700 per cap – Liberia: $1,500,000,000 – 1.5 billion, $500 per capita. Econ Basics: Definitions • Economic Growth: An increase in GDP – Growth means: more production, more profits, more wealth, more jobs, more income, more consumption, more everything! – Growth is generally considered a good thing • But, environmentalists foresee ecological limits • Recession: A period of decline in GDP • Fewer jobs, less consumption, etc… • Depression: A period of severe and protracted decline in GDP • Massive unemployment, poverty, hunger; political unrest. Econ Basics: Growth • Why do economies grow? • Long term growth comes from: – New technologies • Example: Machines allow people to produce more goods – Increased skills and efficiency of labor force • Example: Highly educated workers can get more done – Investment • Example: Money spent to build more factories • Short term growth can be sped up by: – Greater consumption by people, firms, governments • Spending $$ creates demand, speeds up economy. GDP = Prosperity? • Question: What is the relationship between GDP growth and prosperity? • Answer: It depends on who you ask – Political conservatives and proponents of free market argue that growth is the best route to prosperity • Claim: In the long run, the poor are better off in a fast growing economy, even if the rich get most of the reward • Imagery: Rather than divide the “pie” evenly, the pie needs to grow so everyone’s piece gets bigger… – Political liberals and socialists have generally stressed the value of social equality • Plus, other concerns like the environment. Econ Basics: Business Cycles • Issue: Economic growth isn’t always smooth • Capitalist economies are prone to cycles of “boom” and “bust” – the “business cycle” – In good times, everyone gets optimistic, builds a lot of factories… economy and jobs boom • Unemployment is very low, wages and prices go up – Eventually, economic capacity becomes too great • More is produced than people are willing to buy • Firms have layoffs or go bankrupt, unemployment goes up, prices go down. Econ Basics: Business Cycles • Issue: If unemployment goes too high then consumption drops • Without consumer spending, economy can go into a deflationary spiral… • Ex: The Great Depression… • In general, governments use policies to avoid extreme cycles • Example: Unemployment insurance – Provides money to the unemployed to avoid a downward spiral • Example: Setting interest rates – We’ll discuss this later. States and Markets • Issue: How is the state related to markets? • Marx was right about some things: • We all depend on the economy for our well being! • States cannot exist and function without resources from the economy • Historically, states have tried to generate economic growth • Either for the collective good, or in order to wage war. States and Markets • Question: Can markets exist without states? • What do you think? What does capitalism require? • Answer: No! (at least not on a large scale) • Capitalism requires: – – – – – Private property – protected by laws, police, courts Legal systems – to enforce private property, contracts Infrastructure – roads, ports, etc… National defense Regulation of markets • People disagree about how much… but most favor some degree of regulation to prevent huge disasters, fraud, etc… States and Markets • Question: Why do states try to affect markets? • 1. To change economic behavior • Encourage growth • Change distribution of wealth • To “smooth out” the business cycle • 2. To affect society more broadly – E.g., via incentives or government spending • Reduce environmental degradation, reduce discrimination, improve medical care, etc… • In short: To achieve things that markets don’t always do by themselves: “Collective goods”. States and Markets • Question: How can states affect markets? – 1. Fiscal policy – taxes and spending – 2. Monetary (money) policy – printing & lending money – 3. Laws and Regulations – 4. Direct ownership of production • I’ll discuss examples of each… Fiscal Policy: Taxes • Fiscal Policy: Government policy regarding taxation, public revenues, or public debt • Taxes generate revenue for the state • What does the government tax? – – – – – Individual income Corporate income Transactions (sales tax, taxes on trade) Property owners Activities that require fees (e.g., driving, fishing, etc) • By taxing some things more than others, states can affect social and economic behavior. Fiscal Policy: Taxes • 1. Government can control economy by setting the overall tax rate – Highest federal income tax rate in US is around 35% • Actual taxes paid are lower due to credits, loopholes, etc. – Low taxes can create short term growth • By increasing spending, consumption – Low taxes also can increase investment, increasing long term growth – Higher tax rates support more government services • And allow greater redistribution of wealth in society. Fiscal Policy: Taxes • 2. Government can use taxes as incentives – High taxes on cigarettes may reduce consumption – Tax breaks for “clean energy” may increase usage – High taxes on imported goods reduce trade • 3. Government can tax to redistribute wealth – Government can target groups: • Wealthy vs. poor, old vs. young, people vs. companies – “Progressive” tax system = shifts $ toward poor – “Regressive” tax system = shifts $ toward rich • Ex: Sales taxes & flat taxes tend to be regressive. Examples: Bush Tax Cuts • 2001: Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) – Reduced income tax rates (percentage people must pay) – Dividend tax rate reduction • Dividends = profits given to investors – Goals: Encourage people to spend, invest: speed up the economy… – Reaction from economists: Mixed. • Cuts mostly benefits the rich, who may not spend the extra $$ (which stimulates the economy) • Very costly (government already has budget deficit). Fiscal Policy: Spending • Government can also affect economy by adjusting how it spends money • Budget deficits occur when the government spends more than it earns in taxes in a year • The government can do this by borrowing money… • Result: the national debt increases • Budget surpluses occur when the government spends less than it earns • Current national debt: 9,400,000,000,000 • Over 31,000 per person • Large government debt can harm the economy. Fiscal Policy: Spending Fiscal Policy: Spending Fiscal Policy: Spending • Government spending can “jump-start” the economy • State may spend directly, or give money to people – Keynes: “Government should spent against the wind” • Example: “New Deal” spending, war spending helped create jobs and economic growth • But, consistent high government spending can harm economic growth • High deficits, debt can lead to inflation • Example: “stagflation” in 1970s. Monetary Policy • The government also acts as a bank: • The “Federal Reserve Bank” is a bank set up by the government to store a reserve of money • Also called “The Fed”; general term: “central bank” – The Fed lends money to other banks • Who in turn, lend to people and companies • The “Fed” uses its stores a pool of money to: – 1. Prevent financial disasters • Example: The “run” on banks in the Great Depression • Rescuing Bear Sterns in 2008 – 2. To adjust the economy • Prevent boom/bust cycles via “monetary policy”. The Fed and Interest Rates • What are “interest rates” and why do they matter? • Interest rates are like rates on a credit card, car loan, or student loan • If rates are high, you will buy or spend less – Because you’ll have to pay a LOT of interest later… • If rates are low, you can buy more now • Critical issue: The Fed chooses the interest rate it will charge to lend money – The Fed is so big that other banks follow its rates • Thus, the Fed effectively sets rates for the whole economy. Monetary Policy • The impact of the “Fed’s” rate policies: • Low rates stimulate the economy • Also called “expansionary” or “loose” monetary policy • Encourages people to spend, companies to invest • Downside: higher inflation • High rates slow the economy • “Tight,” “contractionary,” or “conservative” monetary policy • High interest payments mean that businesses and people are less likely to borrow, spend, invest. Laws and Regulations • States affect markets by imposing laws and regulations of many kinds – Competitiveness laws: prevent monopolies or limit what monopolies can charge • Ex: Prevent price gouging – Consumer protection laws • Ex: FDA prevents unsubstantiated drug claims – Laws regulating markets • Protect against fraud, volatility – Regulating particular industries • Prices, access to markets, etc. Laws and Regulations • States affect markets by imposing laws and regulations of many kinds • Example: Subsidies to agriculture • US gives 12 billion a year to farmers • Keeps industry stable – fewer bankruptcies – Issue: This harms farmers in poor countries… – Issue: US farmers don’t have to be as efficient • Note: There is a trade-off: stability vs. efficiency • Ex: Regulation stabilized airlines, but reduced competition; deregulation had the opposite effect. Regulating Wages and Prices • Example: The federal gov’t minimum wage – The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments. Covered workers are entitled to a minimum wage of not less than $5.15 an hour. • Source: http://www.dol.gov/esa/whd/flsa/ – Note: California has another minimum wage law, raising it to $8.00. Regulating Wages and Prices • The minimum wage also reflects a trade off • Minimum wage laws are a big benefit to workers • But, the US economy would be more “competitive” if corporations could pay workers less • The fact that wages in China are under $1 / hour means that US companies are less competitive • Question: What might happen of wages were “deregulated”? • Question: What if the minimum wage was increased to $20/hr? State Ownership • Finally, governments can own factories, railroads, electric power plants, etc. – or anything else. • Definition: Nationalization = when a business or industry is taken over by the government • Example: airport security screeners after 9/11 • Definition: Privatization: when a governmentrun business is sold to private owners • Examples: many prisons, even some schools • Heavy industries in Britain, Russia. State Ownership • Advantages of nationalized industries: – Highly stable – no bankruptcies • Tax money can keep them afloat in hard times – Works in collective interests (usually) • Not driven by greed; nicer to workers (usually) • Disadvantages • No competition – This can lead to inefficiency, failure to innovate – Though examples of efficient national industries can be found • Also, state firms can become corrupt. Keynesianism vs. Free Markets • The Keynesian state: – Fiscal Policies: High taxes, high spending • To support health care, welfare, keep full employment – Monetary policy: Expansionary (low interest rates) • Low interest rates keeps unemployment low – But, inflation tends to be high – Regulation: Expanded, elaborate • Industries and markets are stabilized, controlled – Ownership: Many industries are nationalized • “Private sector” is smaller. Keynesianism vs. Free Markets • The “Free Market” state: – Fiscal Policies: Low taxes, low spending • Minimal government; Money controlled by people, firms – Monetary policy: Conservative (higher interest rates) • Inflation is kept low. Less effort made to keep unemployment low. (Workers experience more “pain”) – Regulation: Minimal • Industries are free to do as they wish – Ownership: Industries are “privatized” • Government keeps out of business. Economic Globalization • Important economic changes: • 1. Growth of international trade • 2. Increase of Foreign Direct Investment • Ex: building factories in another country • 3. Increased international capital mobility • Movement of money across national borders • 4. Growth of multi-national corporations • Each has an effect on the ability of states to control their economies. Economic Globalization • Globalization has strong implications for the ability of states to control markets • • • • For instance: Globalization reduces states options for fiscal policy Globalization reduces effectiveness of monetary policy Globalization harms economies that try to regulate or nationalize industry • In short: Globalization tightens the “golden straightjacket”!