The optimal quantity of a public good

advertisement

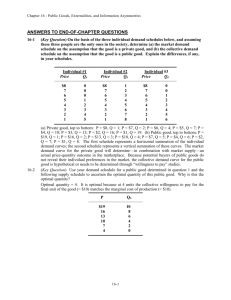

Page 1 of 15 ECON 1023 SPRING 2012 Instructor: Gibson Nene LECTURE NOTES: CHAPTER 5: Public Goods and Externalities Source: Microeconomics Brief Edition, First Edition by McConnell, Brue and Flynn. Efficiently Functioning Markets • Properly functioning competitive markets achieve economic efficiency. • Two conditions must hold for competitive markets to produce efficient outcomes: i. The demand curve in the market must reflect consumers’____ willingness to pay for the good or service produced ii. The supply curve in the market must reflect all the costs of ______________. • Under the above two conditions, the market will maximize the amount of benefits shared between consumers and producers. Page 2 of 15 Market Failure Market failure is the inability of a market to produce a desirable product or produce it in the “right” amount. • Market failure occurs when the competitive market system _________________ certain goods or services compared to what would be best for society or _____ to provide economic desirable goods at all. • These situations represent a market failure to achieve the outcome that is best for the society. • Whenever there is a market failure, there might be a role for a government to intervene in the economy. • Two common cases in which market failures arise are: • Production of _________goods (and services) • Production of goods and services that involve ____________ Private goods • Characteristics of private goods – Private goods are provided through a ___________ market system. E.g. clothing, cars – ____: if one person consumes a private good, another cannot – __________: only those who pay for goods enjoy their benefits – Bought and consumed by people _____________. – Produced and allocated efficiently by competitive markets Page 3 of 15 • Profitable provision of private goods – Market demand for a private good is a ___________ sum of individual demands: quantities demanded at each price are added up. – Consumers demand private goods and profit seeking firms provide those goods to satisfy the demand – Firms provide goods with the objective of making profits • Efficient allocation of private goods – In a competitive market: • Society’s resources are allocated _________. • Producers are forced to use the best technology. • If not they will be out competed by rivals. • A competitive market results in productive efficiency • Production of a good in the ______ costly way. Page 4 of 15 Public goods • Characteristics of public goods – Everyone can simultaneously consume these goods and no one can be excluded from their consumption. E.g. national defense, environmental protection – __________: one person’s consumption of a public good does not preclude others from consuming it too – ___________: there is no efficient way to prevent people from enjoying a public good without paying – Subject to a __________ problem – arises when non-payers can enjoy benefits of a public good once the producer has provided it – Not produced or are under-produced by competitive markets. • Because of the free-rider problem, government provides public goods and finances them through taxes. Examples of public goods Page 5 of 15 Market Demand for Public Goods and Optimal Quantity • Market demand for a public good is a ______ sum of individual demands: individuals’ willingness to pay (per unit) for each given quantity of a public good are added up. • The optimal quantity of a public good is where the marginal benefit of this good (market demand) is equal to the marginal cost of producing it (supply). • It is difficult to figure out demand for a public good – We need society members to reveal their demand for a public good. • The government uses surveys or public votes to try and estimate demand for a public good The optimal quantity of a public good Demand for Public Goods: An Example with Two Individuals Quantity of public good 1 2 3 4 5 Sam’s willingness to pay $4 $3 $2 $1 $0 Lorraine’s Collective willingness to willingness pay to pay $5 $4 $3 $2 $1 Marginal Cost $3 $4 $5 $6 $7 What is the optimal amount of the public good that should be provided? Page 6 of 15 The optimal amount occurs where marginal benefit _________ marginal cost. Remember from Chapter 1, society’s scarce resources are allocated efficiently when MB=MC. • What happens if we cannot figure out a point where MB=MC? – We provide the amount of a public good with the highest __________ Net Benefit. – Net Benefit is the difference between MB and MC. – _________ Net Benefits are not economically justifiable. Graphically, Page 7 of 15 Cost-benefit Analysis (source: Principles of Microeconomics by Gregory Mankiw) Cost-benefit analysis is the formal comparison of marginal costs and marginal benefits of a project to decide whether it is worth doing and to what extent resources should be devoted. Imagine that you have been elected to serve as a member of the Duluth city council. The city engineer comes to you with a proposal: The city can spend $10,000 to build and operate a traffic light at a city intersection that now has only a stop sign. The benefit of the traffic light is increased safety. The engineer estimates, based on data from similar intersections, that the traffic light would reduce the risk of fatal accidents over the lifetime of the light from 1.6 to 1.1 percent. Should you spend the money for the new light? To see if this is worthwhile, we may need to figure out the costs and benefits of this project to decide whether it is worth doing. We know the cost is $10,000, and the benefit is the possibility of saving a person’s life. Obstacle: the costs and benefits must be measured in the same units if you are to compare then meaningfully. To make your decision, you have to put a dollar value on a human life. A. How much is life worth? Page 8 of 15 Private Goods vs. Public Goods: Examples Examples of private goods Examples of public goods • Externalities (spillovers): – Externalities occur when some of the benefits or costs of production are not fully reflected in market demand or supply curves. Some of the benefits or costs of a good may “spill over” to third parties. • Negative externalities or spillover costs – ______ imposed on third parties without compensating them. – An example of a negative externality (or external cost) is ___________, which allows polluters to enjoy lower production costs because the firm is passing along the cost of pollution damage or cleanup to society. Because the firm does not bear the entire cost, it will _______-allocate resources to the production of goods. Page 9 of 15 • Positive externalities (spillovers): – Spillovers that are external benefits to others – In other words positive externalities refer to production or consumption benefits that are received or enjoyed by third parties who in turn pay __________ for those benefits. • The provider has _____mechanism to make these third parties pay for her effort. – Examples of positive externalities • People drive around neighborhoods enjoying the beauty of ___________ put up by homeowners but the homeowners are not compensated for their effort • ________ usually benefits society more than it benefits you as an individual • An airport security system invention by one educated individual may change the lives of billions of people in the whole world Externalities: Equilibrium Output vs. Optimal Output • With ________ externalities, the producers’ supply curve is below (to the right of) the full-cost supply curve, therefore – equilibrium output is ________than optimal output, i.e. over-allocation of resources. Page 10 of 15 Graphically, • With positive externalities, the market demand curve is ______ (to the left of) the full-benefit demand curve, therefore – equilibrium output is _________ than optimal output, i.e. under-allocation of resources. Graphically, Page 11 of 15 Coase Theorem and Individual Bargaining • University of Chicago economist Ronald Coase – Argued that as long as Property ownership is clearly defined, the number of people involved is small, and bargaining costs are negligible, market system can take care of negative and positive externalities. – The government is ____needed to correct for externalities. • Government’s role is to __________ bargaining between affected individuals. • Real world externalities involve: – a _____ number of affected parties. – ____ bargaining costs. – _______________ property e.g. water and air Therefore the Coase theorem is not applicable in the real world. Externalities: Government intervention • Because of this government intervention maybe needed • Government tools for negative externalities – ___________________ – ____________________ • Government tools for positive externalities – _________________________ – ________________________ Page 12 of 15 Correcting for negative externalities requires that government get producers to _______________ these costs. • Direct controls: Legislation can limit or prohibit pollution, which means the producer must bear costs of antipollution effort. • Clean Water Act of 1972: controls the amount of pollution by animal feeding operations. • Clean-air legislation: reductions in use of CFCs e.t.c. • Specific taxes on the amounts of pollution can be assessed, which causes the firm to cut back on pollution as well as provide funds for government cleanup. • Correcting for positive externalities requires that the government somehow increases demand to increase benefits to socially desirable amounts. – ________ to buyers: Government can increase demand by providing subsidies like food stamps and education grants to subsidize consumers. – ___________ to producers: subsidies reduce a producer’s cost. This corrects under-allocation of resources – Government provision of quasi-public goods: goods that could be produced and delivered in a way that exclusion is possible. – Government can provide the product for free or at a minimal charge. E.g. education (head start), public health, streets and highways, bridges Page 13 of 15 Market based approach • Market-based approach-cape-and-trade: The government can create a market for externality rights. • A pollution ______________ pollution level is set by a pollutioncontrol agency. – The set amount of pollution will maintain the resource quality at an acceptable level. • __________ can then trade pollution rights in the market. A market for pollution rights Page 14 of 15 • Advantages – __________ society’s costs by allowing pollution rights to be bought or sold. – ____________ save money by not polluting. – ___________________ can buy all pollution rights and withhold them. Taxation: Apportioning the Tax Burden The tax burden is the total cost of taxes imposed on society. • To finance government provision of public goods and subsidies and government provision in case of positive externalities, government is levying taxes on households and businesses. • How is this tax burden distributed? – Benefits-received principle: People who receive the benefit from government-provided goods and services should pay the taxes required to finance them. – Ability-to-pay principle: People who have greater income should pay a greater proportion of it as taxes than those who have less income. Progressive, Proportional, and Regressive Taxes • A progressive tax: average tax rate increases as the taxpayer’s income increases. • A regressive tax: average tax rate decreases as the taxpayer’s income increases. Page 15 of 15 • A proportional tax: average tax rate remains constant as the taxpayer’s income increases. • Average tax rate is the total tax paid divided by total taxable income, as a percentage. • Marginal tax rate is the tax rate paid on each additional dollar of income. Tax Progressivity in the U.S. • The majority view of economists is as follows: – The Federal tax system is progressive. – The state and local tax structures are largely regressive. A general sales tax and property taxes are regressive with respect to income. The overall U.S. tax system is slightly progressive. Government’s Role In addition to correcting externalities and providing public goods, government also sets the rules and regulations for the economy, redistributes income when desirable, and takes macroeconomic actions to stabilize the economy. The end.