Chapter 5- McConnell,Brue

advertisement

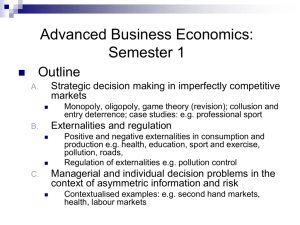

Chapter 5 Public Spending and Public Choice Three areas of concentration 1. Explain how market failures, such as externalities, might justify economic functions of government 2. Distinguish between private and public goods and explain the nature of the free-rider problem 3. Describe the political functions of government that entail its involvement in the economy When the market fails… it is a double edge sword Market Fails if not optimal mix. * Optimal Mix of Output…… “Most desirable combination of output attainable with existing resources, technology and social values.” Market Failure *“An imperfection in the market mechanism that prevents optimal outcomes.” Market Failure Is this evident in today’s market? *market moves resources from one industry to another. (price directs resources) (demand responds) (price moves the resources then to another demand choice) (at this point (competition begins to prevail to level the prices) P P Q D1 D2 Q What a Price System Can and Cannot Do (cont'd) • Market Failure – A situation in which the unrestrained market economy leads to too few or too many resources going to a specific economic activity • Prevents economic efficiency and individual freedom • Is addressed by public policy (government) In real words? Not enough public parks… Not enough care for environment… Not enough welfare… Not enough healthcare… Too much separation between top 10% income earners and median income earners… Not adequate security within our borders…. Too many immigrants…. Socially Optimal Amount (Output) Sometimes, the socially optimal amount is referred to as the efficient amount. Correcting for Externalities (cont'd) • Market failure: an example – Market failure occurs • Steel mill does not pay for the clean air • Costs of production have “spilled over” to the residents (third parties) • Lower production cost – More steel is produced than would otherwise be the case Market failure = (forces of S & D not leading us to BEST point on ppc… Who decides what is defined as BEST? Enter…. Government intervention! Did you hear the words tax and subsidy? Will they perform magic? Correcting for Externalities • Externalities – Occur when the consequences of an economic activity spill over to affect third parties • Third Parties – Parties who are not directly involved in a given activity or transaction • Property Rights – Rights of an owner to use and exchange property Correcting for Externalities (cont'd) • Externalities are examples of market failures. • Pollution is an example of a negative externality. • Inoculations generate external benefits. Correcting for Externalities • Resource misallocations of externalities – External costs—market overallocates – External benefits—market underallocates • Government can correct negative externalities – Special taxes (i.e. a pollution tax or “effluent fee”) – Regulation Correcting for Externalities (cont'd) • How the government can correct positive externalities – Government financing and production – Subsidies – Regulation There are two main types of economic instruments used in environmental policy, both of which aim to provide an incentive to use resources sustainably: • Price-based measures use charges, taxes and subsidies to persuade polluters to reduce their discharges. • Rights-based measures "create rights to use environmental resources, or to pollute the environment, up to a pre-determined limit, and allowing these rights to be traded" Other Economic Functions of Government • Providing a legal system • Promoting competition • Providing public goods • Ensuring economy wide stability The Other Economic Functions of Government (cont'd) • Providing a legal system – Enforcing contracts – Defining and protecting property rights – Establishing legal rules of behavior The Other Economic Functions of Government (cont'd) • Promoting competition – Market failure may occur if markets are not competitive. • Antitrust legislation • Monopoly power The Other Economic Functions of Government • Antitrust Legislation – Laws that restrict the formation of monopolies and regulate certain anticompetitive business practices • Monopoly – A firm that can determine the market price, in the extreme case is the only seller of a good or service The Public Sector:Government’s role. Questions to ponder: • What is Public Sector? • When do markets fail? • Should government step in? • Can people “ride free” in public sector? • Governments Enter the Market to assure: 1. Public Goods 2. Externalities (positive or elimination of negative) 3. Market power 4. Equity Two concepts to remember • Public goods… can be equally consumed by all… no restrictions Skateboarding in the park… Terrorists… can also go to the park… Illegal immigrants can go to school… • Private goods… consumption by one person excludes consumption by another.. ( my doughnut… my car… etc) But, if mix of output gets totally out of whack…. Government takes over. Translation If government and/or the consumer was not acting as a watchdog…. Would corporations be diligent about utilizing the proper mix of resources…If they are, can they compete? Telecommunications Industry? Does that always mean regulation increased? Could it mean that consumer sovereignty switches to another desire… BUT… what about things like energy… would we really know if the provider was efficient? What about government-driven choices? Methods to Reduce Pollution Government sets pollution standards Market environmentalism – Government allocates pollution permits and then allows them to be bought and sold Government Allocates Pollution Permits (allows market to operate) Agreement that a certain area can handle “acceptable” amt of pollution. The amount is quantified, then parceled into permits that “polluters” bid for in auction. Can buy and sell pollution rights among companies bidding. Allows some companies to pollute more than others… ones that are really “good” sometimes get perks like tax benefits… others have opportunity to pass on to their consumers (TXU) Government reallocates resources if 1) market produces “wrong” amount of certain g&S and 2) market fails to allocate resources to some g&s that are in best interest of society. What are externalities? “costs or benefits of a market activity borne by a third party.” Spillovers…an action when one individual or group harms the property of others without their consent. Examples of spillovers Throwing trash in someone’s back yard Burning ties in the alley Playing your stereo loudly at 3:00 a.m. Businesses dumping wastes, sludge into rivers People trashing the beach or highway. Electric Companies burning phosphorous fuels Spillover Examples that perpetrate on others Calling police when loud party of teenagers next door (actions of teens imposing unwanted cost on neighbor) Living in downstairs apartment.. Having upstairs neighbors doing Tai Bo when they get off work at 4:00 a.m. Calling the city when a neighbor doesn’t keep his yard mowed on regular basis. Externalities can be positive or negative Homeowners keep lawns immaculate (benefits the neighborhood) Scientific study for polio vaccine (others benefit beyond scientists’ recognition) Education……. How would this be a benefit? How can spillovers be corrected? Most obvious way is Legislation. 1. To prohibit 2. To heavily tax the specific product and manufacturer. Tax would be derived to allow for off-setting the clean-up cost. (Super Fund is example) 3. Subsidize both consumers or producers 4. ***Tax incentives… if reduction of pollution and compliance adhered to, taxes reduced. A Corrective Tax Gone Wrong Government may miscalculate external costs and impose a tax that moves the supply curve from S1 to S3 instead of from S1 to S2. As a result, the output level will be farther away from the socially optimal output than before the “corrective” tax was applied. Q3 is farther away from Q2 than Q1 is from Q2. Federal Government Spending Compared to State and Local Spending Sources: Budget of the United States government; government finances. 2008 FY category – Tax + Policy Center 2008 FY- Tax Policy Center Public Spending and Transfer Programs • Publicly subsidized healthcare – Medicare • Began in 1965 • Pays hospital and physicians’ bills for U.S. residents over 65 with public monies • 2.9% of earnings taxed/ no cap • Second biggest domestic program in existence – Medicaid • Subsidizes people with lower incomes The Economic Effects of Medicare Subsidies Subsidy M = customers pay Pd for quantity Qm Providers receive price Ps for supply the good. Collective Decision Making: The Theory of Public Choice • Government or Political Goods – Goods (and services) provided by the public sector • Majority Rule – Collective decision making, decisions based on more than 50% – Proportional Rule – If 10% of “dollar votes” cast for blue cars, 10% of output is blue Equity or perhaps better stated as Inequity.(ensuring market economy) 1)Inadequate income (redistribute to havenots) 2) Merit goods (everyone entitled to some minimum of food,clothing, shelter) In-kind transfers in food stamps, housing vouchers, health clinics) 3)Social Security and unemployment compensation protect people’s economic security by providing money when they retire or are unable to work. Opportunity cost… if government provides health care, private sector cannot compete. Government “crowds” out the private . **** Remember, the largest opportunity cost of an item supplied by government is the best alternative use that could have been made of the resources required to provide that good. We are at a crossroadsWhich path should the U.S. take? Free Markets? Private markets? Government Regulated Markets? Government Driven Markets? Government Run Markets?