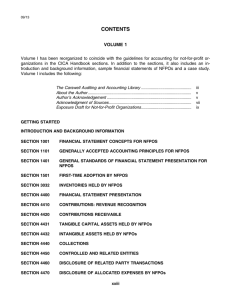

Chapter 19

Not-for-Profit

Entities

McGraw-Hill/Irwin

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

Learning Objective 19-1

Understand financial

reporting rules and make

basic journal entries for

private, not-for-profit

entities.

19-2

Types of Not-for-Profit Organizations

Colleges and Universities

Health Care Organizations

Voluntary Health and Welfare

Organizations

Certain (or “all other”) Nonprofit

Organizations

19-3

Excluded Entities

The following entities are not NPOs

because they solely serve the economic

interests of their owners, members,

participants, or trust beneficiaries:

Credit unions and mutual banks

Employee benefit and pension plans

Mutual insurance companies

Farms and rural cooperatives

Trusts

19-4

Characteristics of NPOs

No outside ownership interest

A mission to provide services

To their users, patients, society as a

whole, or members

But NOT at a profit

A dependence on significant levels of

contributions

A significant level of assets that are

restricted as to use because of donor

stipulations

Tax-exempt status. IRS Form 990, 990A, or 990PF

19-5

Dependence on Contributions and

Federal Funding

Nonprofit religious, charitable, and

educational groups receive roughly $40

billion annually in federal government

grants.

19-6

Tax-Exempt Status

Advantages to Tax-Exempt Status for U.S.

Income Tax Reporting Purposes (in most

states):

No state income tax

No local property taxes

No sales taxes on purchases

19-7

Tax-Exempt Status

Private NPOs are exempt from U.S. income

taxes if the NPO:

Serves some common good.

Does not make an accounting profit.

Does not primarily benefit its own executives.

Does not function for political purposes.

19-8

Tax-Exempt Status

IRS Audits of Tax-Exempt Groups:

Annually, the IRS audits approximately 11,000

of the 1.2 million tax-exempt groups.

The IRS assesses taxes & penalties

of over $100 million per year.

Such taxes are on business-related income

(which is taxable at the highest corporate rate).

19-9

Differences between NPOs and Businesses

Revenues and support are often

compared to expenses. However,

remember that

Expenses are incurred to provide services

(rather than to generate revenues as in

commercial accounting).

The purpose of NPOs is not to maximize return

on an ownership interest.

ROE = Not Applicable

19-10

The Reporting Model: Private NPOs

The reporting model

Focuses on the flow of all economic resources

Uses the accrual basis of accounting

Recognizes depreciation expense in the

operating statement

The use of this reporting model reveals

The improvement or deterioration in the NPO’s

financial condition for the period, and

Is similar to the model used in the commercial

sector.

19-11

Who Makes the Rules for

Not-for-Profits Entities?

The accounting and

financial reporting for

governmental

nonprofit entities

GASB

Accounting and

financial reporting for

nongovernmental

nonprofit entities

FASB

19-12

Financial Reporting for Private,

Not-for-Profit Entities

Private, not-for-profit entities must

report their net assets in accordance with

FAC 6.

FAC 6 specifies three mutually exclusive

classes of net assets:

Unrestricted net assets

Temporarily restricted net assets

Permanently restricted net assets

19-13

Financial Reporting for Not-for-Profit Entities

ASC 958, “Accounting for Contributions Received

and Contributions Made,” provides guidance

specific to not-for-profit entities. It covers five

important accounting issues:

(1) depreciation,

(2) accounting for contributions,

(3) accounting for investments,

(4) financial display

(5) accounting for transfers of assets to a not-for-profit

organization that raises or holds contributions for

others.

19-14

Financial Reporting for Not-for-Profit Entities

Some not-for-profit entities use a fund

structure to account for each type of net

asset class.

Other not-for-profit entities maintain

only an accounting record to show the

amounts in each net asset class.

The specific identification of any restricted

asset must be made when the asset comes into

the entity, generally by donation or bequest.

19-15

Financial Reporting for Not-for-Profit Entities

Mergers and acquisitions—Exposure drafts

The proposed standards

Require the recognition of identifiable assets

acquired and liabilities assumed at their fair values

at the date of the acquisition

Require that intangible assets other than goodwill

and goodwill be assigned to reporting units that are

acquired

Approaches to evaluating goodwill impairment

Qualitative Evaluation Method

Fair-Value-Based Evaluation

19-16

Contributions: Scope of ASC 958

ASC 958 guidance on contributions applies

to ALL 4 types of Private NPOs.

Health Care Organizations

ASC

958

Colleges and Universities

Voluntary Health and Welfare

Organizations

Certain Nonprofit Organizations

19-17

Contributions: Defined

Contribution

An unconditional (no strings attached) transfer

of

1. Cash or

2. Other Assets

In a voluntary, nonreciprocal transfer.

By a person or entity acting other than as an

owner of the NPO

Examples of Other Assets: Equipment,

vehicles, land, and promises of cash.

19-18

Contributions: “Promises, Promises”

“Unconditional transfers” include

“unconditional promises” to give cash or

other assets in the future.

Promises may be

Oral or

Written

Unconditional promises result in reporting

“Contributions Receivable” in the balance

sheet (subject to an allowance for

uncollectibles).

19-19

Contributions: Recognizing Unconditional

Promises

Recognizing unconditional promises in

the financial statements requires

having sufficient evidence

in the form of verifiable documentation

that a promise was made

19-20

Contributions: “Conditional” Promises to Give

Conditional promises

The conceptual opposite of unconditional

promises to give

Not contributions (as defined by ASC 958)

Depend on the occurrence of a specified future

and uncertain event that

Must occur to bind the promissor, and

Thus transform the promise from conditional to

unconditional status.

19-21

Contributions: “Conditional” Promises That

May Be Deemed “Unconditional”

A conditional promise may be deemed

unconditional if:

“The possibility that the future event will not

be met [occur] is remote.”

Event not likely to occur =

Event likely to occur

=

Conditional

Unconditional

19-22

Contributions: “Conditional” Use of Assets

Received

If assets have been received and the

retention and use of such assets is

conditional upon a future event that is

not likely to occur,

The offsetting credit is to a Refundable

Advance account (a liability)

Until the conditional event occurs.

19-23

Contributions: Manner of Reporting By

Category

Contributions are reported in the

Statement of Activities (the operating

statement) by category

Unrestricted

Temporarily restricted

Permanently restricted

19-24

Contributions: Manner of Reporting By

Category

Donor-restricted contributions whose

conditions are fulfilled in the same period

in which the contribution is recognized

May be reported in the unrestricted category of

the operating statement (O/S) if the entity:

Consistently follows this policy, and

Discloses this policy.

Note: This option negates the need to show

transfers between categories in the

Operating Statement.

19-25

Contributions: Endowments

Endowments

A contribution that cannot be spent.

The unspendable amount is called the

principal—it is invested in perpetuity.

Income on Endowments

Donor stipulations dictate the reporting

classification (unrestricted, temporarily

restricted or permanently restricted).

19-26

Contributions: Temporary Restrictions

Contributed Assets

that are restricted as to either

Purpose

or

are classified as

Time Period

Temporarily

Restricted

Assets

19-27

Contributions: Expirations of Restrictions

Manner of Reporting Expirations

of Restrictions:

Where: In the statement of activities.

How: As a separate line item reclassification as

shown below.

Expirations of restrictions

Unrestricted

Temporarily

Restricted

$77,000

$(77,000)

19-28

Financial Statements: Scope of ASC 958

ASC 958 guidance on financial

statements applies to ALL 4 types of

Private NPOs.

Health Care Organizations

ASC

958

Colleges and Universities

Voluntary Health and Welfare

Organizations

Certain Nonprofit Organizations

19-29

Financial Statements: ASC 958—The Basic

Requirements

ASC 958 specifies:

What financial statements are to be presented.

What specific information, as a minimum, is to

be shown.

19-30

Financial Statements: Which Financial

Statements

ASC 958 requires for the NPO as a whole:

A Statement of Financial Position

A Statement of Activities

A Statement of Cash Flows.

VH&WOs must also report

In a separate statement

Expenses by Natural Classification in a matrix

format.

19-31

Financial Statements: The Three

Classifications of Net Assets

The three mandated classifications of net

assets are:

Unrestricted.

Temporarily restricted.

Permanently restricted.

Note that these are the same three

classifications used for reporting

contributions.

19-32

Contributions: Additional Issues

Contributions of monetary and

nonmonetary assets are valued at the fair

value of the assets received.

Determining the fair value may require

Obtaining quoted market prices.

Using independent appraisals.

Using other appropriate methods.

19-33

Contributions: Additional Issues

Use of Present Value Procedures:

Can use for estimated future cash flows on

unconditional promises to contribute that are

expected to be collected over a period of longer

than one year.

If used, subsequent recognition of

the interest element is reported as contribution

income—not as interest income.

19-34

Contributions: Additional Issues

Contributed Services

Recognize as revenues only if:

Nonfinancial assets are created or enhanced.

Specialized skills are provided by individuals

possessing these skills (e.g., carpenters, electricians,

plumbers, lawyers, CPAs).

Required Disclosures for Contributed Services:

A description of the nature and extent

The amounts recognized as revenues

The programs or activities in which the services were

used

19-35

Contributions: Additional Issues

Contributed Services:

Recognizable contributed services are usually

recorded as revenues at the fair value of the

services contributed.

Allowed alternative valuation method for the

creation or enhancement of nonfinancial assets:

May value at the fair value of

the asset created or

asset enhancement

19-36

Contributions: Additional Issues

“Collection items” (the exception):

Consist of contributed works of art, historical

treasures, and similar assets.

Need not be recognized in the financial

statements if three conditions are satisfied [how

used, how cared for, and use of proceeds upon

sale].

Cannot be capitalized on a selective or arbitrary

basis.

19-37

Practice Quiz Question #1

How do not-for-profit entities differ from forprofit businesses:

a. Not for profit entities are prohibited from

charging more than cost for goods or

services provided while for-profit

businesses may include a mark up.

b. Both for-profit businesses and not-forprofit organizations are tax exempt.

c. Not-for-profit entities rely heavily on

contributions and grants while for-profit

businesses rely on profitable operations for

survival.

19-38

Learning Objective 19-2

Understand financial

reporting rules and make

basic journal entries for

not-for-profit colleges and

universities.

19-39

Colleges and Universities

Special conventions of revenue and

expenditure recognition

Tuition and fee remissions/waivers and

uncollectible accounts

The full amount of the standard rate for tuition and

fees is recognized as revenue

Accounting for university-sponsored scholarships,

fellowships, tuition and fee remissions or waivers

depends on whether the recipient provides any

services to the university

19-40

Colleges and Universities

Special conventions of revenue and

expenditure recognition

Tuition and fee reimbursements for

withdrawals from coursework

Accounted for as a reduction of revenue

Academic terms that span two fiscal periods

Accounted for as revenue in the fiscal year in which

the term is predominantly conducted, along with all

expenses incurred

NACUBO recommended the use of the accrual basis

of accounting

19-41

Colleges and Universities

Board-designated funds

The board may designate unrestricted current

fund resources for specific purposes.

ASC 958 specifies that these funds may not be

reported as restricted net assets because only

external, donor-imposed restrictions can result

in restricted net assets.

19-42

Colleges and Universities

Public colleges and universities

Accounting and reporting is specified by the

GASB.

GASB 35 requires that they follow the standards

for governmental entities as specified in GASB 34.

Most public institutions will be special-purpose

government entities engaged in only businesstype activities.

These entities present only the financial

statements required for enterprise funds and

then are included as component units of the state

government.

19-43

Colleges and Universities

Private colleges and universities

The FASB specifies the accounting and financial

reporting standards.

The three financial statements required are:

The Statement of Financial Position

The Statement of Activities

The Statement of Cash Flows

They are free to select any account structure that

best serves their management and financial

reporting needs.

19-44

Colleges and Universities

Overview of the Accounting and Reporting of Colleges and Universities

19-45

Colleges and Universities

Overview of the Accounting and Reporting of Colleges and Universities

19-46

Practice Quiz Question #2

Which of the following statements accurately

describes differences between the accounting

public and private universities?

a. Both public and private universities follow

FASB rules.

b. Both public and private universities follow

GASB rules.

c. Public universities follow GASB rules while

private universities follow FASB rules.

d. Public universities follow FASB rules while

private universities follow GASB rules.

19-47

Learning Objective 19-3

Understand financial

reporting rules and make

basic journal entries for

not-for-profit health care

providers.

19-48

Health Care Providers

Hospital accounting

Investor-owned hospitals provide the same

types of financial reports as commercial entities.

Not-for-profit hospitals present their financial

results using a specific format required by the

FASB.

Governmental hospitals follow the GASB’s

accounting and reporting requirements and are

considered special-purpose entities engaged in

business-type activities.

19-49

Health Care Providers

Hospital fund structure

Although not required to do so, many hospitals

have used a fund accounting structure for

accounting purposes.

Operating activities are carried on in the general

fund, and a series of restricted funds can be used

to account for assets whose use has been

restricted by the donor.

19-50

Health Care Providers

Overview of the Hospital Accounting and Reporting

19-51

Health Care Providers

Financial statements for a not-for-profit

hospital

Separate, not-for-profit hospitals issue four basic

financial statements

The Balance Sheet

The Statement of Operations

The Statement of Changes in Net Assets

The Statement of Cash Flows

19-52

Health Care Providers

Not-for-profit hospital: The Balance Sheet

Presents the total assets, liabilities, and net

assets of the organization as a whole

Major accounts

Receivables

Investments

Initially recorded at cost if purchased or at fair value

at the date of receipt if received as a gift

Plant assets

Property, plant, and equipment reported with any

accumulated depreciation

19-53

Health Care Providers

Not-for-profit hospital: The Balance Sheet

Assets whose use is limited

Long-term debt

Separate disclosure should be made for assets that

have restrictions placed on their use

The hospital must also account for its long-term debt

and pay the principal and interest as it becomes due

Net Assets

1. Unrestricted net assets available

2. Temporarily restricted net assets available for use

3. Permanently restricted net assets

19-54

Health Care Providers

Not-for-profit hospital: The Statement of

Operations

Also often termed “the statement of activities”

Includes the revenues, expenses, gains and

losses, and other transactions affecting the

unrestricted net assets during the period

Only general fund transactions are reported

Should report an operating performance

indicator

19-55

Health Care Providers

Not-for-profit hospital: Major accounts in

The Statement of Operations

Net patient service revenue

Contractual adjustments

Income from ancillary programs

Interfund transfers

General fund expenses

Donations

19-56

Health Care Providers

Not-for-profit hospital: The Statement of

Changes in Net Assets

It presents the changes in all three categories of

net assets

Unrestricted

Temporarily restricted

Permanently restricted

Statement of Cash Flows

Its format is similar to that for commercial

entities

19-57

Health Care Providers

Summary of hospital accounting and

financial reporting

Major operating activities take place in the

general fund.

The restricted funds are holding funds that

transfer resources to the general fund for

expenditures upon satisfaction of their

respective restrictions.

General fund uses the accrual basis of

accounting.

Patient services revenue is reported at gross

amounts measured at standard billing rates.

19-58

Health Care Providers

Summary of hospital accounting and

financial reporting

A deduction for contractual adjustments is then

made to arrive at net patient services revenue.

Other revenue is recognized for ongoing

nonpatient services.

Charity care services are presented only in the

footnotes; no revenue is recognized for them.

19-59

Health Care Providers

Summary of hospital accounting and

financial reporting

Operating expenses in the general fund include

depreciation, bad debts, and the value of recognized

donated services that are in support of the basic

services of the hospital.

Not all donated services are recognized.

Donated property and equipment are typically recorded

in a restricted fund until placed into service, at which

time they are transferred to the general fund.

Donated assets are recorded at fair values at the date of

gift.

19-60

Practice Quiz Question #3

Which of the following is false with respect

to not-for-profit hospital accounting?

a. Not-for-profit hospitals follow FASB rules.

b. Not-for-profit hospitals usually use fund

accounting.

c. Not-for-profit hospitals do not prepare a

statement of cash flows.

d. The general fund of not-for-profit

hospitals uses the accrual basis of

accounting.

19-61

Learning Objective 19-4

Understand financial reporting

rules and make basic journal

entries for not-for-profit

voluntary health and welfare

organizations.

19-62

Voluntary Health and Welfare Organizations

Voluntary health and welfare

organizations (VH&WOs) provide a

variety of social services

They solicit funds from the community at large

and typically provide their services for no fee.

VH&WOs are typically audited.

The federal government normally provides them

tax-exempt status.

19-63

Voluntary Health and Welfare Organizations

Accounting for a VH&WO

Similar to other not-for-profit organizations

except for special financial statements that

report on the important aspects of VH&WOs.

The accrual basis of accounting is required.

VH&WOs have been free to use fund accounting

in their accounting and reporting processes.

19-64

Voluntary Health and Welfare Organizations

Financial statements for a VH&WO

Statement of Financial Position

Statement of Activities

Statement of Cash Flows

Statement of Functional Expenses

The statements are designed primarily

for those who are interested in the

organization as “outsiders.”

19-65

Voluntary Health and Welfare Organizations

The Statement of financial position for a

VH&WO

Major balance sheet accounts:

Pledges from donors

Investments

Land, buildings, and equipment

Liabilities

Net assets

19-66

Voluntary Health and Welfare Organizations

Statement of activities

The overall structure of the statement of

activities for voluntary health and welfare

organizations and other not-for-profit entities

should be very similar as a result of ASC 958.

19-67

Voluntary Health and Welfare Organizations

Statement of activities

Public support

Revenues

The primary source of funds is likely to be

contributions from individuals or organizations that

do not derive any direct benefit from the VH&WO for

their gifts.

Funds received in exchange for services provided or

other activities

Gains

Gain or loss on sale of investments and other assets

19-68

Voluntary Health and Welfare Organizations

Statement of activities

Donated materials and services

Expenses

Should be recorded at fair value when received

Information about the major costs of providing

services to the public, fund-raising, and general and

administrative costs

Costs of informational materials that include

a fund-raising appeal

Many VH&WOs prefer to classify such costs as

program rather than fund-raising

19-69

Voluntary Health and Welfare Organizations

Statement of Cash Flows

The format of this statement is similar to that for

hospitals.

Statement of Functional Expenses

Details the items reported in the expenses

section of the statement of activities

19-70

Voluntary Health and Welfare Organizations

Summary of Accounting and Financial

Reporting for VH&WOs

Reporting requirements are specified in ASC 958

and the AICPA Audit and Accounting Guide for

Not-for-Profit Organizations.

The accrual basis of accounting is used.

Primary activities are reported in the

unrestricted asset class.

19-71

Voluntary Health and Welfare Organizations

Summary of Accounting and Financial

Reporting for VH&WOs

Resources restricted by the donor for specific

operating purposes or future periods are

reported as temporarily restricted assets.

Assets contributed by the donor with permanent

restrictions are reported as permanently

restricted assets.

19-72

Practice Quiz Question #4

Which of the following is false with respect

to the accounting for voluntary health and

welfare organizations?

a. VH&WOs solicit funds from the

community and typically provide their

services for no fee.

b. VH&WOs use the modified accrual basis

of accounting.

c. VH&WOs must provide a statement of

cash flows.

d. VH&WOs primary activities are

reported in the unrestricted asset class.

19-73

Learning Objective 19-5

Understand financial reporting

rules and make basic journal

entries for other

not-for-profit organizations.

19-74

Other Not-for-Profit Entities

Examples of other not-for-profit organizations

(ONPOs):

Cemetery organizations

Civic organizations

Fraternal organizations

Labor unions

Libraries

Museums

Other cultural institutions

Performing arts

organizations

Political parties

Private and community

foundations

Private elementary and

secondary schools

Professional associations

Public broadcasting stations

Religious organizations

Research and scientific

organizations

Social and country clubs

Trade associations

Zoological and botanical

societies

19-75

Other Not-for-Profit Entities

Accounting for ONPOs

In addition to ASC 958, the AICPA Audit Guide

for Not-for-Profit Organizations provides

guidance for accounting and financial reporting

standards.

While accrual accounting is required for all

ONPOs, some small organizations operate on a

cash basis during the year and convert to an

accrual basis at year-end.

19-76

Other Not-for-Profit Entities

Accounting for ONPOs

With the adoption of ASC 958, the procedures

used by ONPOs and VH&WOs may move away

from the traditional funds used.

They may account for all transactions in a single

entity or by establishing separate accounts for

unrestricted, temporarily restricted, and

permanently restricted net assets.

19-77

Other Not-for-Profit Entities

Financial Statements of ONPOs

Explains how the available resources have been used to

carry out activities.

They should disclose the nature and source of the

resources acquired, any restrictions on the resources,

and the principal programs and their costs.

They should also provide information on the ability to

continue to carry out objectives.

ASC 958 requires

1. A Statement of Financial Position

2. A Statement of Activities, and

3. A Statement of Cash Flows

19-78

Other Not-for-Profit Entities

Summary of Accounting and Financial

Reporting

Accounting is similar to that for VH&WOs.

The accrual basis of accounting is used when a large

number of programs or a number of very different types

of programs are part of the operations.

It may be desirable to prepare a statement of expenses

by functional area or major program as well.

As a result of ASC 958, the reporting requirements of

ONPOs are substantially the same as VH&WOs.

19-79

Practice Quiz Question #5

Which of the following is false with respect to

the accounting other not-for-profit

organizations?

a. While accrual accounting is required for all

ONPOs, some small organizations operate on

a cash basis during the year and convert to an

accrual basis at year-end.

b. Accounting is similar to that for VH&WOs.

c. ONPOs may account for all transactions in a

single entity or by establishing separate

accounts for unrestricted, temporarily, and

permanently restricted net assets

d. ONPOs follow GASB rules.

19-80

Conclusion

The End

19-81