Homework 6 1. Richard is interested in acquiring a long equity

advertisement

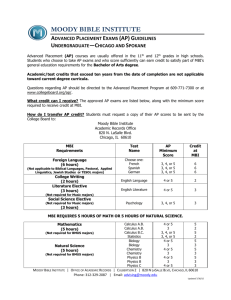

Homework 6 1. Richard is interested in acquiring a long equity position in Online Dating and Matchmaking Company, hypothetical ticker ODM. He is looking to buy 1,500 shares of ODM. Currently, ODM trades at $60 per share. Richard feels this is a little expensive. He would prefer an entry point at $55. Instead of entering a limit order in the equity market to buy ODM at $55 or better, he chooses to write November ODM puts with a strike price of $55 giving $1 of premium at the market. Please answer the following questions to explain why Richard chooses to do this and what the benefits and drawbacks might be. How will Richard give his broker the order to execute these puts? (make sure to specify the number of contracts.) Short/Write 15 November ODM $55 Puts to open at the market. ODM Stock Price $35 $40 $45 $50 $55 $60 $65 Remember that exchange traded equity options contracts generally control 100 shares of the underlying. Therefore, 15 options contracts on ODM control 1,500 shares. This is Richard’s desired position. Does Richard pay or collect the premium? How much will the total premium be? When selling options contracts, premium is received. This goes for shorting/writing puts as well as calls. In this example, Richard is writing 15 contracts and receiving $1 of premium. The total premium he collects is $1,500. (=15 contracts * 100 shares per contract * $1 of premium per share). Complete the chart and graphical payoff profile for Richard’s put transaction below. (In other words, draw the “hockey stick” diagram that depicts the profit or loss result on the put given the price of ODM.) ODM Stock Short Nov ODM $55 Put Option Price $35 $40 $45 $50 $55 $60 $65 Short Nov ODM $55 Put Option -19 -$14 -$9 -$4 $1 $1 $1 When writing naked puts, the worstShort Nov ODM $55 Puts 5 0 Profit ($) 35 40 45 50 -5 -10 case scenario is a bankruptcy in the underlying where the share price goes to zero. The minimum return of a short put is the strike price less the 55 60 65 premium collected. In this example, Richard can lose $54 if ODM goes to zero. (= $55 strike - $1 premium collected). Short Nov ODM $55 Put Option -15 -20 Stock Price ($) Describe what happens in terms of profit or loss per share on expiration if ODM is trading between $54-$55 per share? (It might be helpful to utilize an algebraic expression describing the profit or loss.) Short Nov ODM $55 Puts 5 0 Profit ($) $35 -5 -10 -15 -20 $40 The price distribution in this question focuses on what happens between the breakeven price, $54, and the exercise price. The breakeven price of the $45 $50 $55 $60 $65 underlying at maturity describes the inflection point where the options position provides $0 of profit or loss. Richard’s profit in Nov thisODM example is Short $55price Put Option equal to ODM’s at expiration less the strike price plus the premium collected. Stated as an equation, Profit = ODM’s price at maturity - $55 strike price + $1. Restated, the Profit = Stock Price ($) ODM’s price at maturity - $54. What is the most amount of money per share that Richard can make on the ODM Put? When selling an option, the maximum return is the premium. In this example, the most Richard can make is $1 per share. What is the most amount of money per share that Richard can lose on the ODM Put? Richard is attempting to use a put writing strategy to collect income while he is waiting to take a long equity position in ODM. What will happen if ODM drops to $54 during the option term but settles at $56 on the 3rd Friday of November at expiration? Richard’s option will not be exercised and the shares of ODM will not be put to him. He will keep the premium collected. At the end of the day, Richard does not end up with the long ODM equity position he desired even though his price target was touched. This is the scenario an investor needs to be aware of before using put writing strategies in an attempt to build a long equity position. Will Richard need to post and maintain margin when he enters into this put transaction? Richard’s short put on ODM is naked. Margin will be required to insure he makes good on the trade. 2. Dana has been doing extensive research on the retailing industry. She feels strongly that handbag sales will be extremely high over the next 6 months. In Dana’s opinion, Designer Handbag Company, hypothetical ticker DHC, is in the best position to profit if her underlying thesis is correct. Currently, DHC trades at $20 per share. Dana feels DHC will be much higher than $25 after 6 months. She considered buying DHC in the equity market but wants to investigate a simple equity options transaction to gain upside leverage. Which transaction might Dana choose to engage in? A. Long 5 February $20 DHC Puts at $0.50. B. Long 5 February $25 DHC Hurdles at $0.25. C. Short 5 February $17.50 DHC Calls at $3. D. Long 5 February $27.50 DHC Calls at $0.30. A long position generally corresponds with an extremely bullish viewpoint. Long call options allow Dana to participate in upside with a limited cash outlay. Choice D is the best answer. (Choice B is fictitious. Hurdles occur in track in field. There is no options strategy that your professor is aware of that is called a hurdle.) Complete the chart and graphical payoff profile for the transaction above that makes the most sense for Dana to trade given her viewpoint on handbag sales and DHC. DHC Stock Price $15.00 $17.50 $20.00 $22.50 $25.00 $27.50 $30.00 $32.50 $35.00 DHC Stock Price $15.00 $17.50 $20.00 $22.50 $25.00 $27.50 $30.00 $32.50 $35.00 Options Position Long Feb DHC $27.50 Calls -$0.30 -$0.30 -$0.30 -$0.30 -$0.30 -$0.30 $2.20 $4.70 $7.20 per share upfront. Each contract controls 100 shares so the total premium outlay is $150. (= 5 contacts * 100 shares per contract * $0.30 premium per share). In short, the most Dana can lose is $150. 10 Profit ($) 5 0 15 20 25 3. Review Figure 8.5 in Hull on page 190. The chart depicts the graphical payout profiles for a long call, a short call, a long put, and a short put. It is imperative that you 30 35 thoroughly understand these concepts. 4. Judith Z. Oscar generated her wealth as an executive at MBI company, a hypothetical firm. Mrs. Oscar owns 70,000 shares of MBI Long Feb DHC $27.50 Calls at $0.30 which currently trades at $80 per share. This equates to $5.6 million of $10.00 ownership in MBI. MBI pays a quarterly dividend of $0.25. As you can imagine, Judith is concerned that a sell off in the price of MBI will $5.00 severely impact her retirement in a negative way. However, MBI has been very profitable for Judith and she $0.00 wants to continue to participate in its $15.00 $20.00 $25.00 $30.00 upside. $35.00 potential In the past, Judith has not hedged her MBI equity position with Long long Feb putDHC options because $27.50 Calls -$5.00 she feels the premium outlay is too Stock Price ($) expensive. Judith’s private banker has come back with a suggestion. Judith’s What is the most amount of private banker knows that Judith can money Dana can lose based on retire comfortably provided her MBI the options position that best position is always worth more than fits the viewpoint outlined in $4.2 million, or $60 per share. The this question? private banker suggests that Judith engages in the following hedging To acquire, or get long, an options transaction: position, the trader pays a premium upfront. The premium paid up front is Continue to hold 70,000 the most that an option buyer can shares of MBI lose. In this example, Dana buys 5 Write 700 March MBI Calls that require a $0.30 premium $100 calls at $2 Profit ($) -5 Stock Price ($) puts at $2 Buy 700 March MBI $60 Complete the following chart describing the payoff profile for the private banker’s suggestion. MBI Stock Price $40 $50 $60 $70 $80 $90 $100 $110 $120 MBI Stock Price $40 $50 $60 $70 $80 $90 $100 $110 $120 Long MBI Equity Position Short MBI $100 Call @ $2 Long MBI $60 Put @ $2 Net Position $0 $2 -$2 $0 Long MBI Equity Position -$40 -$30 -$20 -$10 $0 $10 $20 $30 $40 Short MBI $100 Call @ $2 $2 $2 $2 $2 $2 $2 $2 -$8 -$18 Sketch out the long equity position, the short call, and the long put on the same graph. Long MBI $60 Put @ $2 $18 $8 -$2 -$2 -$2 -$2 -$2 -$2 -$2 Net Position -$20 -$20 -$20 -$10 $0 $10 $20 $20 $20 Hedging MBI with a Collar Hedging MBI with a Zero Co 20 $20 10 $10 0 40 50 60 70 80 90 Profit ($) $30 Profit ($) 30 $0 100$40 110$50 120$60 -10 -$10 -20 -$20 -30 Stock Price ($) $70 $80 $90 -$30 Stock Price ($) Sketch out the net payoff profile for the suggested transaction. In other words, what does the final result look like? (This is the graph of the net position in the chart above.) $100 $1 Hedging MBI with a Collar Hedging MBI with a Zero Co 20 $20 10 $10 0 40 50 60 70 80 90 Profit ($) $30 Profit ($) 30 $0 100$40 110$50 120$60 -10 -$10 -20 -$20 -30 Stock Price ($) $70 $80 $90 -$30 Stock Price ($) How much premium will Judith have to pay up front to engage in this transaction? This is a zero cost collar so there is no premium paid. The short call generates $2 of premium. The long put costs $2 of premium. The net result is zero (=$2 collected from the call - $2 paid to buy the put). What would Judith’s worst and best case outcome be at expiration in terms of price per share of MBI if she engages in this transaction? In other words, how would you describe Judith’s floor and ceiling in terms of MBI’s price? This zero cost collar provides downside protection for Judith at $60 $100 $1 per share. Judith will be able to participate in MBI’s potential upside to $100 per share. What happens at expiration if MBI is trading at $75 per share? What is the value of Judith’s net position in this scenario? $75 is within the collar established by this strategy. The net options position expires worthless and Judith remains long 70,000 shares of MBI with a market value of $75. Judith’s total position in MBI would be worth $5.25 million (70,000 shares x $75 per share). At expiration, Judith may consider engaging in another zero cost collar to hedge against a worst case outcome while still being able to participate in some of MBI’s potential upside. Assuming that Judith places this series of options transactions around her MBI equity position, will she receive MBI’s dividend? Yes. The option positions have nothing to do with the Judith’s ownership in MBI equity until expiration.