Accounting and Accountancy I - Fall 2007

advertisement

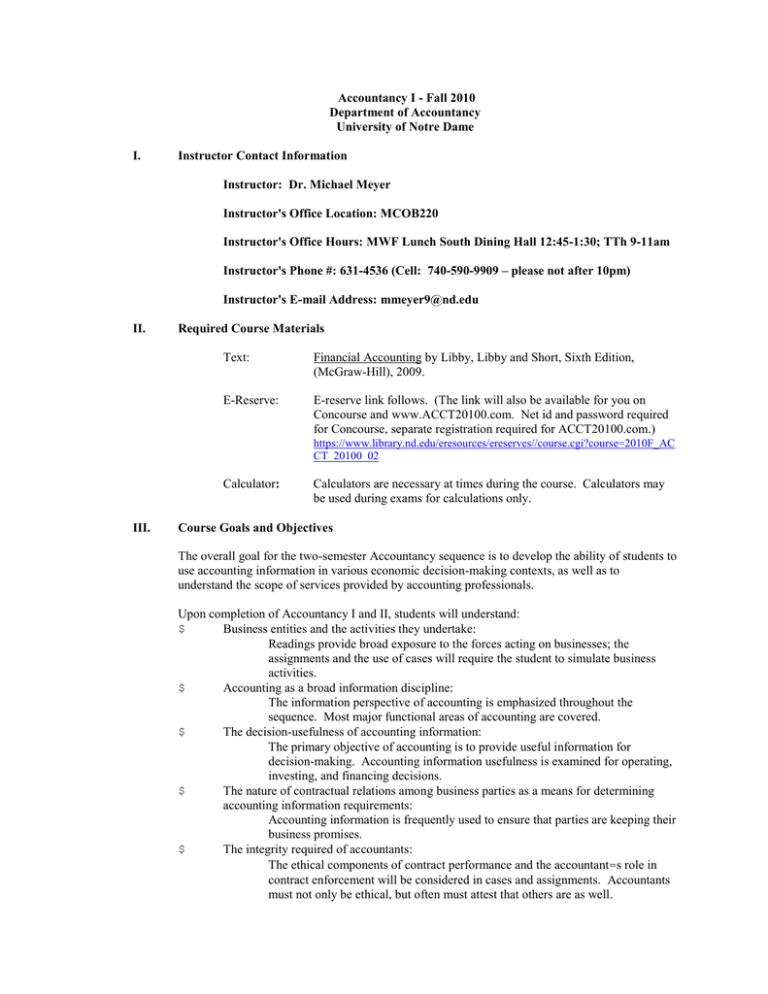

Accountancy I - Fall 2010 Department of Accountancy University of Notre Dame I. Instructor Contact Information Instructor: Dr. Michael Meyer Instructor's Office Location: MCOB220 Instructor's Office Hours: MWF Lunch South Dining Hall 12:45-1:30; TTh 9-11am Instructor's Phone #: 631-4536 (Cell: 740-590-9909 – please not after 10pm) Instructor's E-mail Address: mmeyer9@nd.edu II. Required Course Materials Text: Financial Accounting by Libby, Libby and Short, Sixth Edition, (McGraw-Hill), 2009. E-Reserve: E-reserve link follows. (The link will also be available for you on Concourse and www.ACCT20100.com. Net id and password required for Concourse, separate registration required for ACCT20100.com.) https://www.library.nd.edu/eresources/ereserves//course.cgi?course=2010F_AC CT_20100_02 Calculator: III. Calculators are necessary at times during the course. Calculators may be used during exams for calculations only. Course Goals and Objectives The overall goal for the two-semester Accountancy sequence is to develop the ability of students to use accounting information in various economic decision-making contexts, as well as to understand the scope of services provided by accounting professionals. Upon completion of Accountancy I and II, students will understand: $ Business entities and the activities they undertake: Readings provide broad exposure to the forces acting on businesses; the assignments and the use of cases will require the student to simulate business activities. $ Accounting as a broad information discipline: The information perspective of accounting is emphasized throughout the sequence. Most major functional areas of accounting are covered. $ The decision-usefulness of accounting information: The primary objective of accounting is to provide useful information for decision-making. Accounting information usefulness is examined for operating, investing, and financing decisions. $ The nature of contractual relations among business parties as a means for determining accounting information requirements: Accounting information is frequently used to ensure that parties are keeping their business promises. $ The integrity required of accountants: The ethical components of contract performance and the accountant=s role in contract enforcement will be considered in cases and assignments. Accountants must not only be ethical, but often must attest that others are as well. Upon the completion of Accountancy I, the student will be expected to understand: $ How to record transactions that measure a business= economic activity. $ How to process and summarize transactions into financial statements that communicate the results of an entity’s activities to its users. $ How to prepare and interpret the four basic financial statements: Statement of Financial Position (Balance Sheet) Statement of Operations (Income Statement) Statement of Stockholders’ Equity Cash Flow Statement In the process of learning to use accounting information in decision-making, students will: $ $ $ $ IV. Improve oral and written communication skills through daily participation and assignments that require analysis and written feedback. Improve group interaction and team-building skills by completing the assigned group projects. Enhance critical thinking skills in the learning process by actively participating in group and classroom activities. Apply major concepts, ideas and tools to problem solving situations. Grading Students’ grades will be determined based on the total points earned on the following items: Three Group Projects: Instructor Points: Midterm Exam 1: Midterm Exam 2: Final Examination: Total: 75 pts. 100 pts. 125 pts. 125 pts. 150 pts. 575 pts. The course instructors collaborate to assure consistency in grading across sections. However, each instructor will determine the grades for his or her sections. V. Course Organization & Administration Attendance & Participation: The course is organized around three 50-minute sessions per week. The instructors expect active student involvement in the learning process. Regular attendance and class participation are included in the final grade at the discretion of each instructor. Cellular Devices: Cellular phones must be set to “off” or “silent” during examinations and class. Text messaging during class is not permitted. Laptops are not to be used during class. These devices must not be used as calculators or clocks and must be out of sight during exams. Group Assignments: Groups of students will be organized by the instructor early in the semester. Projects will be distributed in class; due dates are listed in the Syllabus. Honor code requirements: each group is to work independently of all other groups. Late Work: Work submitted to the instructor after the due date without official Notre Dame Approval will be assigned a penalty by the instructor. No work will be accepted via e-mail. Computer problems are not an excuse for late work. Expect technology to fail and prepare for that possibility. Peer Evaluations: The instructors will announce their policy regarding peer evaluations of group work. Exams: Common exams will be given. The instructors evaluate their sections’ exams. It is course policy that students must document sufficient official Notre Dame Approval before taking an exam at an alternative time for full credit. If a student arrives late to an exam and is unable to finish by the exam’s conclusion, the student may be allowed additional time at the instructor’s discretion. Work completed after the exam’s conclusion will be assessed a 20% penalty. If a student misses an entire exam without the aforementioned approval, the instructor will use his or her discretion to decide whether or not to give the exam at a later time on the exam date. In this case, there will be an automatic penalty of 20% of total exam points. Instructor Points: • • • • VI. Attendance: Total of 30 points available. – You will receive 30 points if you miss 3 or fewer classes (unexcused absences). If you miss more than 3 classes you will receive zero of these points. Attendance will be taken every day based on your seating assignment. Homework: Total of 30 points available – Homework will be collected almost every day. A total of 35 homework assignments will be collected. You may miss up to 5 assignments and still get the full 30 points (you will not receive more than 30 points if you do more than 30 assignments). Excel Assignments: Total of 25 points available – You will be required to complete FIVE Excel assignments. These assignments are created by your instructor and will be available on-line at ACCT20100.com. The assignments and templates for these assignments will be available at this website. These are individual assignments. Assessment Pre-test and Post-test: Total of 15 points available – You will be required to take an on-line assessment during the first week of class and a second the last week of class. To receive the 15 points, you must complete both the pre-test and post-test. The Academic Code of Honor: “As a member of the Notre Dame community, I will not participate in or tolerate academic dishonesty”. Expectations with regard to Academic Integrity follow: Students will not give or receive aid on exams. This includes, but is not limited to, viewing the exams of others, sharing answers with others, using books or notes while taking the exam, and use of cell phones or programmable calculators in unauthorized usage. It also includes discussing the exam in order to help those who are taking it later. For case assignments involving groups, groups must work completely independently of other individuals, or groups. Each member of a group has an obligation to ensure that the workload is shared by all members for each assignment. Students are expected to avoid plagiarism, including the use of material from previous semesters. See http://www.nd.edu/~writing/resources/AvoidingPlagarism.html for rules on appropriate citations. Notre Dame’s Writing Center is an excellent resource for researching and structuring written assignments. The honor code requires that a student, with knowledge of the above violations, report such occurrences. If a perceived honor code violation occurs, the procedures outlined in the Student Guide to the Academic Codes of Honor, www.nd.edu/~hnrcode, will be followed. * * * * * * * * * * * * * * * * * * * * * * To the extent possible, the instructors will adhere to the following schedule of assignments. The schedule may be altered (add, delete, change timing, etc.) in order to enhance student learning opportunity or for other reasons. Abbreviations used: (CP) identifies readings from the electronic course packet. See E reserves link. GP = Group Project In-Class Activities Session 1 (W 8-25) Introduction - Instructor, course structure, textbook, Concourse or courseware server Syllabus: Course policies, Instructor Points & Daily Schedule Session 2 (F 8-27) Chapter 1: Financial Statements and Business Decisions Turn In: Student Information Sheet Understanding the Business The Four Basic Financial Statements: An Overview Session 3 (M 8-30) Chapter 1: Financial Statements and Business Decisions Responsibilities for the Accounting Communication Process Global Convergence of Accounting Standards Types of Business Entities Employment in the Accounting Profession Today Session 4 (W 9-1) Chapter 2: Investing and Financing Decisions and the Balance Sheet Overview of Accounting Concepts What Business Activities Cause Changes in Financial Statement Amounts? How Do Transactions Affect Accounts? How Do Companies Keep Track of Account Balances? Session 5 (F 9-3) Chapter 2: Investing and Financing Decisions and the Balance Sheet How is the Balance Sheet Prepared and Analyzed? Session 6 (M 9-6) Chapter 3: Operating Decisions and the Income Statement Explain requirements for Financial Statement Case (GP #1, due 9-15) How Do Business Activities Affect the Income Statement? How Are Operating Activities Recognized and Measured? Session 7 (W 9-8) Chapter 3: Operating Decisions and the Income Statement How Are Operating Activities Recognized and Measured: Cash Basis vs. Accrual Basis The Expanded Transaction Analysis Model Session 8 (F 9-10) Chapter 3: Operating Decisions and the Income Statement How Are Financial Statements Prepared and Analyzed Session 9 (M 9-13) Chapter 4: Adjustments, Financial Statements, and the Quality of Earnings Adjusting Revenues and Expenses Session 10 (W 9-15) Chapter 4: Adjustments, Financial Statements, and the Quality of Earnings Turn in: Financial Statement Case (GP #1) Adjusting Revenues and Expenses Session 11 (F 9-17) Chapter 4: Adjustments, Financial Statements, and the Quality of Earnings Preparing Financial Statements Closing the Books Session 12 (M 9-20) Chapters 1-4 Unscheduled day for catch up and review for exam. Exam 1 (T 9-21) 7:45 – 9:15 AM Location: Reading Assignments (To be completed prior to beginning of session) Prepare Questions, Exercises and Problems as Assigned by your Instructor Textbook’s website: (www.mhhe.com/libby6e) Complete Student Information Sheet – On-line READ Chapter 1, pp. 2-18 Q3, Q4 E1-3, E1-5, E1-11, P1-1(eXcel) READ Chapter 1, pp. 18-24; Supplement A&B, pp. 26-27; Opportunities in the Accounting Profession (handout); SEC Moves to Pull Plug on U.S. Accounting Standards (CP) CP1-5, CP1-6 SEC Moves to Pull Plug article discussion questions Q19 Q20 READ Chapter 2, pp. 46-68 Q1 P2-1 E2-2, E2-4, E2-5 E2-6, E2-7, E2-8, E2-16, E2-17 READ Chapter 2, pp. 68-73 E2-10, E2-15, P2-5 (eXcel) READ Chapter 3, pp 102-116 Q1, Q2 E3-3 c, d, e, g, h, i, k, m; E3-4 a, c, d, e, f, g, h, k, l READ Chapter 3, pp. 116-121 E3-2, E3-10 E3-5, E3-8, E3-18 READ Chapter 3, pp. 122-127 E3-13, E3-14, P3-4 (eXcel) READ Chapter 4, pp. 162-175 Q1, M4-3, #4-18, P4-1 Complete Financial Statement Case (GP #1) Beta Alpha Psi HW Help Session Sunday, 9-5, 7-9 PM, MCoB LL050 Beta Alpha Psi HW Help Session Sunday, 9-12, 7-9 PM, MCoB LL05 E4-3, E4-4, E4-5, E4-12, E4-14, P4-2, P4-4 (eXcel) READ Chapter 4, pp. 175-186 P4-7 E4-2, P4-9 Beta Alpha Psi Exam 1 Study Session Monday, 9-20, 7-9 PM, MCoB LL050 Reading Assignments (To be completed prior to beginning of session) Prepare Questions, Exercises and Problems as Assigned by your Instructor In-Class Activities Session 13 (W 9-22) Chapter 5: Communicating and Interpreting Accounting Information Players in the Accounting Communication Process The Disclosure Process Session 14 (F 9-24) Chapter 5: Communicating and Interpreting Accounting Information Explain requirements for Accounting Cycle Case (GP #2, due 10-1) A Closer Look at Financial Statements Formats and Notes Return on Equity Analysis: A Framework for Evaluating Company Performance Session 15 (M 9-27) Chapter 6: Reporting and Interpreting Sales Revenue, Receivables and Cash Accounting for Sales Revenue Measuring and Reporting Receivables Session 16 (W 9-29) Chapter 6: Reporting and Interpreting Sales Revenue, Receivables and Cash Measuring and Reporting Receivables Session 17 (F 10-1) Chapter 6: Reporting and Interpreting Sales Revenue, Receivables and Cash Turn In: Accounting Cycle Case (GP #2) Measuring and Reporting Receivables Reporting and Safeguarding Cash Session 18 (M 10-4) Chapter 7: Reporting and Interpreting Cost of Goods Sold and Inventory Nature of Inventory & Cost of Goods Sold Inventory Costing Methods Session 19 (W 10-6) Chapter 7: Reporting and Interpreting Cost of Goods Sold and Inventory Inventory Costing Methods Valuation at Lower of Cost or Market Evaluating Inventory Management Session 20 (F 10-8) Chapter 7: Reporting and Interpreting Cost of Goods Sold and Inventory Inventory Methods and Financial Statement Analysis Session 21 (M 10-11) Chapter 7: Reporting and Interpreting Cost of Goods Sold and Inventory Control of Inventory READ Chapter 5, pp. 230-243 P5-1 E5-3 READ Chapter 5, pp. 243-256 Session 22 (W 10-13) Chapter 8: Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Acquisition and Maintenance of Plant and Equipment Use, Impairment and Disposal of Plant and Equipment Session 23 (F 10-15) Unscheduled day for catch up ************************ FALL BREAK**************************************** Session 24 (M 10-25) Chapter 8: Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Use, Impairment and Disposal of Plant and Equipment Session 25 (W 10-27) Chapter 8: Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Natural Resources and Intangible Assets Session 26 (F 10-29) Chapter 8: Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Changes in Depreciation Estimates Chapter 8 Review Problem Session 27 (M 11-1) Chapters 5 – 8 Unscheduled day for catch up and review for exam. READ Chapter 8, pp. 396-419 P5-6 (eXcel) E5-17, P5-7 READ Chapter 6, pp. 282-296 E6-4, E6-6, P6-1 Q7, Q8, E6-11, E6-13 Beta Alpha Psi HW Help Session Sunday, 9-26, 7-9 PM, MCoB LL050 E6-15, E6-16, E6-18, P6-5 Complete Accounting Cycle Case (GP #2) READ Chapter 6, pp. 297-301; 305-306; Better Credit-Card Statistics? E6-20, AP6-2, Better Credit-Card Statistics discussion questions Q11, Q12, Q13 READ Chapter 7, pp. 336-352 E7-2, E7-4 Beta Alpha Psi HW Help Session M7-5, E7-5, E7-6 Sunday, 10-3, 7-9 PM, MCoB LL050 READ Chapter 7, pp. 353-357 E7-9, P7-3 (eXcel) E7-12 E7-13 READ Chapter 7, pp. 358-360 E7-16, P7-8 READ Chapter 7, pp. 361-363 Q12, E7-19, P7-9 (eXcel) Beta Alpha Psi HW Help Session Sunday, 10-10, 7-9 PM, MCoB LL050 M8-3, E8-2 E8-4, E8-8, E8-11, P8-3 (eXcel) E8-12, E8-13, E8-15, P8-7 No Beta Alpha Psi Session 10-24 READ Chapter 8, pp. 419-425; Supplement A, pp. 428-429 E8-16, E8-17, P8-9, P8-10 READ Chapter 8 Supplement A pp. 428-429 E8-22 P8-8 Reading Assignments (To be completed prior to beginning of session) Prepare Questions, Exercises and Problems as Assigned by your Instructor In-Class Activities Exam 2 (T 11-2) 7:45 – 9:15 AM Location: Session 28 (W 11-3) Chapter 9: Reporting and Interpreting Liabilities Liabilities Defined and Classified Current Liabilities Session 29 (F 11-5) Chapter 9: Reporting and Interpreting Liabilities Long Term Liabilities Present Value Concepts Session 30 (M 11-8) Chapter 10: Reporting and Interpreting Bonds Characteristics of Bonds Payable Reporting Bond Transactions Session 31 (W 11-10) Professional Presentation Session 32 (F 11-12) Chapter 10: Reporting and Interpreting Bonds Reporting Bond Transactions Session 33 (M 11-15) Chapter 10: Reporting and Interpreting Bonds Interpreting Bond Transactions Early Retirement of Debt Beta Alpha Psi Exam 2 Study Session Monday, 11-1, 7-9 PM, MCoB LL050 READ Chapter 9, pp. 458-472 P9-2 Requirements 1-4; P9-3 Requirement 1 E9-4, E9-5, P9-4, P9-5, P9-6, P9-7 READ Chapter 9, pp. 473-481 E9-18, E9-22, P9-11 (eXcel), P9-12 (eXcel) READ Chapter 10, pp. 512-528 E10-2 E10-4, E10-9, E10-11, P10-7 Beta Alpha Psi HW Help Session Sunday, 11-7, 7-9 PM, MCoB LL050 READ Chapter 10, pp. 528-531 E10-16, P10-12 (eXcel), E10-6 READ Chapter 10, pp. 532-534; Borrowing for Dividends Raises Worries (CP) Borrowing for Dividends discussion questions E10-21 Beta Alpha Psi HW Help Session Sunday, 11-14, 7-9 PM, MCoB LL050 Session 34 (W 11-17) Chapter 11: Reporting and Interpreting Owners’ Equity Ownership of a Corporation Common Stock Transactions Session 35 (F 11-19) Chapter 11: Reporting and Interpreting Owners’ Equity Dividends on Common Stock Stock Dividends and Stock Splits Session 36 (M 11-22) Chapter 11: Reporting and Interpreting Owners’ Equity Explain requirements for Equity Case (GP #3, due 12-3) Preferred Stock *********************THANKSGIVING BREAK******************************** Session 37 (M 11-29) Chapter 13: Statement of Cash Flows READ Chapter 11, pp. 556-566; Small Investor, Bigger Voice (CP) E11-4, E11-6; Small Investor article discussion questions E11-9, E11-11, E11-13, E11-15 READ Chapter 11, pp. 566-571 E11-14, E11-27, P11-10 E11-22, E11-24, P11-7, P11-9 READ Chapter 11 pp. 571-574 E11-18 Beta Alpha Psi HW Help Session Sunday, 11-21, 7-9 PM, MCoB LL050 READ Chapter 13 pp. 652-661; pp. 72, 73, 125, 126, 179-181, 298, 299, 355-357, 423-425, 471, 472, 533–534, 573, 574 (pages from prior chapters) Classifications of the Statement of Cash Flows Session 38 (W 12-1) Chapter 13: Statement of Cash Flows Reporting and Interpreting Cash Flows from Operating Activities Reporting and Interpreting Cash Flows from Investing Activities Reporting and Interpreting Cash Flows from Financing Activities Completing the Statement and Additional Disclosures Session 39 (F 12-3) Chapter 13: Statement of Cash Flows Turn in: Equity Case (GP #3) Preparing a Statement of Cash Flows, Indirect Method Comparison of indirect method and direct method Session 40 (M 12-6) Unscheduled day for catch up Session 41 (W 12-8) Chapters 9, 10, 11, 13 and selected material from Exams 1 & 2 Review for Final Exam Final Exam (M 12-13) 7:30 – 9:30 PM Location: _______ E13-1, E13-3 No Beta Alpha Psi Session, 11-28 READ Chapter 13 pp. 661-675 E13-7, E13-13 E13-11, E13-12 E13-14, E13-16 E13-17 Complete Equity Case (GP #3) READ Cash Flow Statements Offer the Juiciest Corporate Dirt P13-1 (eXcel), P13-2, CP13-4, Justin Inc. Indirect Method Exhibit 13.8, p. 680 Beta Alpha Psi HW Help Session Sunday, 12-5, 7-9 PM, MCoB LL050 Beta Alpha Psi HW Help Session Sunday, 12-12, 7-9 PM, MCoB LL050