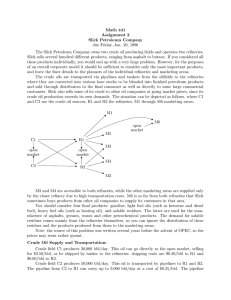

Oil Price Factors

advertisement

Oil Price Factors If you use these images, please credit L. A. Starks, author 13 DAYS: THE PYTHAGORAS CONSPIRACY lastarksbooks.com Ja n0 M 4 ay -0 Se 4 p04 Ja nM 05 ay -0 Se 5 p0 Ja 5 nM 06 ay -0 Se 6 p0 Ja 6 nM 07 ay -0 Se 7 p0 Ja 7 n08 $/BBL Crude Oil Price Crude Oil Price 120.00 100.00 80.00 60.00 40.00 20.00 0.00 WTI RAC Four Macro Factors 1) US Dollar Weakness; Oil denominated in Dollars 2) Oil as Inflation Hedge 3) Demand for ALL Commodities (Real Assets Excluding Real Estate) 4) Oil is Single-Source Fuel for Transportation; Undiversified Dollar Weakness and Oil Price 120.00 1.000 100.00 0.800 80.00 0.600 60.00 0.400 40.00 0.200 20.00 0.000 0.00 Month $/BBL 1.200 Ja n Fe -0 7 b M - 07 ar Ap - 07 M r- 0 ay 7 Ju -07 n Ju -0 7 Au l-07 g Se - 0 p- 7 O 07 ct No - 07 De v-0 c- 7 Ja 0 7 n Fe -0 8 b M - 08 ar -0 8 EU/$ Exchange Rate Dollar Weakness and Oil Price EU/$ WTI Oil Supply Demand Inflection Point 2-2.4 MMBPD of spare supply capacity, 3% of total All in Saudi Arabia OPEC not meeting until September Short-term marginal cost of supply is very large ($110-$120/bbl) “Rut of Upward Momentum” Short Term Disruptions Fog on the Houston Ship Channel; GOM hurricanes Weekly oil and gasoline inventory changes Conflict involving oil assets anywhere Forties pipeline shutdown due to Scottish refinery strike Nigerian bombings and strike Attack on Japanese oil tanker Longer Term Supply Estimates 3.4 to 6 trillion bbls; used 1 trillion Total geologic estimates don’t matter; political & economic limits frame availability Practical peak or plateau; 65% of reserves owned by NOCs IOCs have “full access” to 7% NOCs revenue-rich; resources as patrimony; different development incentives some starved of capital by govt (Venezuela, Nigeria, Iran) January 2008 Oil Production January 2008 Oil Production, Source: Oil and Gas Journal 10,000 8,000 6,000 4,000 2,000 R ud uss i A ia ra bi a U S Ira C n hi M na ex ic o U A Ku E w C ai an t Ve a ne da zu N el a or wa y Ir N aq ig er ia 0 Sa Thousand BPD 12,000 US Crude Oil Imports US Crude Oil Imports, Largest Sources 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Aug-07 Sep-07 Oct-07 Nov-07 Dec-07 Jan-08 Aug-07 Sep-07 Oct-07 Nov-07 Dec-07 Jan-08 Canada 1,950 1,960 1,889 1,919 1,784 1,944 Saudi Arabia 1,468 1,441 1,370 1,530 1,675 1,479 Mexico 1,381 1,293 1,322 1,484 1,234 1,198 Nigeria 1,184 1,137 1,184 1,245 1,210 1,163 Venezuela 1,138 1,146 1,221 1,227 1,246 1,135 Angola 400 578 342 408 439 566 Iraq 520 603 490 508 378 543 Algeria 572 503 213 184 348 366 Ecuador 240 234 222 154 195 247 Kuwait 139 143 150 154 158 239 Colombia 152 165 164 197 113 171 Brazil 250 213 172 78 171 169 Impediments Oil Reserves, Political Limits, 2004 Est. 300 250 200 150 100 50 0 BBOE Saudi Iran Iraq Venezuela Russia Nigeria 263 133 115 77 72 35 BBOE Reserves (less available or costly) Projects coming on this year w/total peaks 3 MMBPD Saudi Arabia not above 12.5 MMBPD - Al-Naimi Russia—changing terms, (New Cold War), production plateau Mexico (Constitution), Cantarell declining from 2.0 to 1.3 MMBPD Venezuela (political), declining Iraq (War) Nigeria (MEND, tax regime) Other Reserves (less available or costly) cont. 40 billion barrels in US off limits (political) US Alaska Prudhoe declining Some Brazil (hostile geology) Canadian tar sands, $65/bbl Ultra Deepwater GOM Arctic seabed (hostile geology) Lack of good field data for Saudi Arabia, Russia Reserves (more available) US-Bakken Shale Some Brazil Saudi Arabia Khurais Iraqi discussions with IOCs Kashagan USGC (Jack field; Lower Tertiary play) Drilling and Transport Costs All drilling costs much higher (Rig shortage for deepwater GOM like Jack field) Credit crunch has limited access to capital Transport more expensive: Russia 2007 cutoff through Belarus Ethanol (US, Brazil Esso news) Oil sands to USGC Alaskan gas to US; KEY to Alaska oil field development; TransCanada only licensee Refining Oil without refining is a swimming pool without water Supply of refining capacity is 2nd-level effect most miss US refining at capacity; no new refineries NIMBY, long payback, regulatory step function changes Debottlenecking secret Port Arthur Motiva (Shell-Aramco), 275 to 600 KBPD Change in crude quality Increasing imports of gasoline, other petroleum products Demand Forecast reduced, 86.6 MMBPD Level of effect from US economic weakness *Price signals in US are key Increasing fuel efficiency (rolling stock turnover) Story is China, India, Middle East *No price signals, Middle East and Asia Western consumption a target Increasing Asian Car Demand Asian Demand Potential India at US levels China at US levels India (2003) China (2005) Japan (2006) US (2005) 0 100 200 300 400 Number of Cars 500 600 Alternatives Ethanol: hero to zero Food prices up 83%; law of unintended consequences BP’s prescience Ethanol mandate Higher CAFÉ standards Biofuels not from foodstocks (no drinkable jet fuel) Hybrids & Electric Factors That Could Bring Down Oil Prices (Short Term) Change in Fed monetary direction (stop rate drop) Move of speculative/investment funds away from commodities Corn-derived ethanol Price signals are powerful; invisible hand (millions) US conservation, consumer and industrial Transport substitutes: videoconferencing, carpooling, mass transit Factors That Could Bring Down Oil Prices (Long Term) Short-term factors plus capital investment Drop levy on imported ethanol Non-food biofuels Other non-petroleum transport fuel and cars that can use it US fleet meeting higher CAFÉ standards Meaningful number of hybrids and electric Other countries reduce subsidies Oil Price Predictions $50-$80 If dollar strengthens to level of euro, $70/bbl Rubin’s estimate of $120/bbl Traders betting own money; NYMEX collected wisdom NYMEX Forward Price Curve NYMEX Crude Oil Futures, 4-29-08 100.00 50.00 0.00 08 -08 -08 r-09 -09 -09 -09 r-10 -10 -10 -10 r-11 -11 -11 -11 c a c a c a c n p n p n p n p Ju Se De M Ju Se De M Ju Se De M Ju Se De Jun- Jul- Aug- Sep- Oct- Nov- Dec- Dec- Dec- Dec- $/BBL 115.6 114.7 114.0 113.4 112.8 112.2 111.6 107.5 106.0 105.5 $/BBL