Stock Analysis Project Doc

advertisement

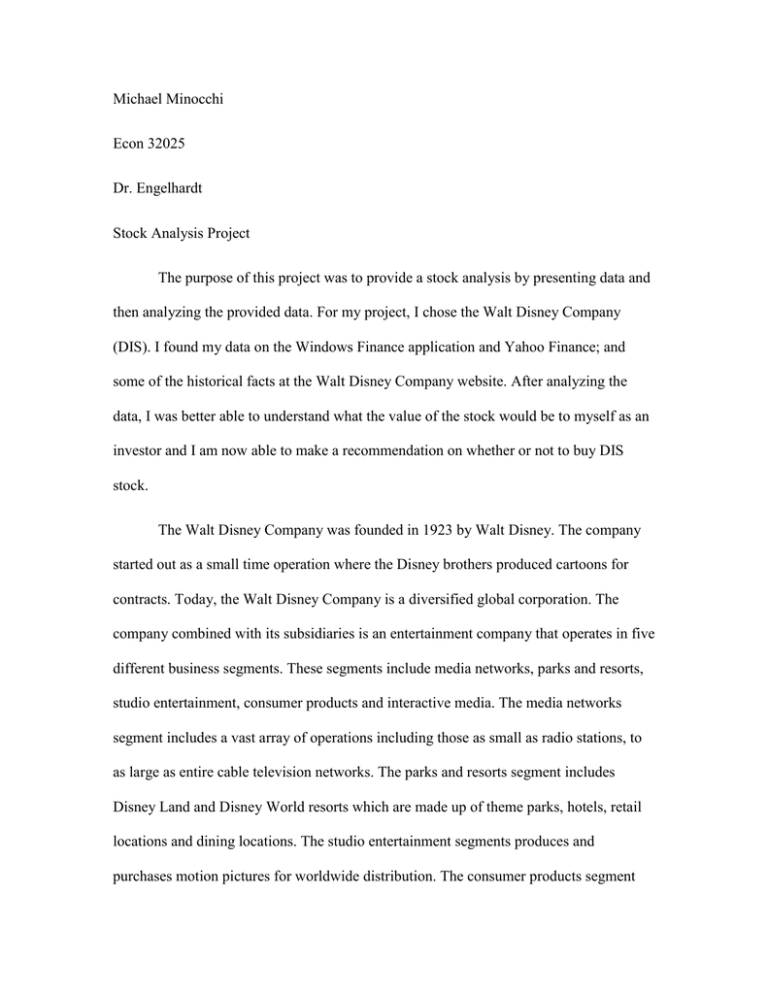

Michael Minocchi Econ 32025 Dr. Engelhardt Stock Analysis Project The purpose of this project was to provide a stock analysis by presenting data and then analyzing the provided data. For my project, I chose the Walt Disney Company (DIS). I found my data on the Windows Finance application and Yahoo Finance; and some of the historical facts at the Walt Disney Company website. After analyzing the data, I was better able to understand what the value of the stock would be to myself as an investor and I am now able to make a recommendation on whether or not to buy DIS stock. The Walt Disney Company was founded in 1923 by Walt Disney. The company started out as a small time operation where the Disney brothers produced cartoons for contracts. Today, the Walt Disney Company is a diversified global corporation. The company combined with its subsidiaries is an entertainment company that operates in five different business segments. These segments include media networks, parks and resorts, studio entertainment, consumer products and interactive media. The media networks segment includes a vast array of operations including those as small as radio stations, to as large as entire cable television networks. The parks and resorts segment includes Disney Land and Disney World resorts which are made up of theme parks, hotels, retail locations and dining locations. The studio entertainment segments produces and purchases motion pictures for worldwide distribution. The consumer products segment licenses Disney products to manufacturers, retailers, and publishers throughout the world. They also operate their own retail and distribution through The Disney Store. The interactive media segment creates and delivers branded entertainment across interactive platforms. They do so by making and distributing games for consoles, online, and mobile games. This helps to perpetuate their brand both in the United States and around the globe. The Walt Disney Company’s business around the world is affected by its historic ability to protect its trademarks, copyrights, patents and trade secrets. The Walt Disney Company exploits this strength in a global economy that closely monitors and regulates what the worldwide leader in entertainment is doing. Market Cap 143.62B Current Price 80.67 Earnings/Share 3.65 P/E Ratio 22.47 Dividends/Share 0.86 Dividend Yield 1.05 Return on Assets 8.05 Return on Equity 15.45 Book Value/Share 25.3 Projected Yield % 1.06 Value Calculations Total Return Calculations To better understand the value of the DIS stock, I calculated the value of the stock based upon the current growth rate of revenue, my required rate of return, and earnings per share. For comparisons sake, I calculated a worst case scenario, baseline scenario and a best case scenario. According to the calculations, the DIS stock would increase in value in both the baseline and best case scenario. It would decrease in value in the worst case scenario. To understand whether the DIS stock would be a good investment based upon my required rate of return, I calculated the total value of the stock based on today’s stock price, a future stock price (based upon the previously calculated values), and any dividends. My calculations showed that in a best case scenario, DIS would far exceed my required rate of return. However, in a baseline and worst case scenario, DIS would underperform based upon my required rate of return. My research yielded predictable results for a large company like the Walt Disney Company. Large corporations can expect around 10% growth in earnings. Large, very stable, mature organizations can usually expect growth around 5%. Based upon my calculations, the growth that is currently projected for the Walt Disney Company. However, matching or even exceeding expected growth rates do not always equate to a good investment. For someone who is willing to take a smaller return, DIS stock might be a good investment. For me, while it might be a safe investment, it would not yield the type of returns that I am looking for. Therefore, in conclusion, I would like to make a recommendation to not buy DIS stock. Based upon my required rate of return of 11%, I believe that there are other more attractive options on the market at this point in time. Works Cited Disney History. (2014). Retrieved from http://thewaltdisneycompany.com/aboutdisney/disney-history Windows (2014). Windows Finance App. [Mobile Application Software]. Retrieved from http://windows.microsoft.com Yahoo Finance. Walt Disney Company (DIS). (2014, March 12). Retrieved from http://finance.yahoo.com/q;_ylt=Ar4Xw87dMz3ByyJ_cFuh_QiiuYdG;_ylu=X3o DMTBxdGVyNzJxBHNlYwNVSCAzIERlc2t0b3AgU2VhcmNoIDEx;_ylg=X3o DMTBycTIxMmwyBGxhbmcDZW4tVVMEcHQDMgR0ZXN0AzUxMjAwNw-;_ylv=3?s=DIS&uhb=uhb2&type=2button&fr=uh3_finance_web_gs