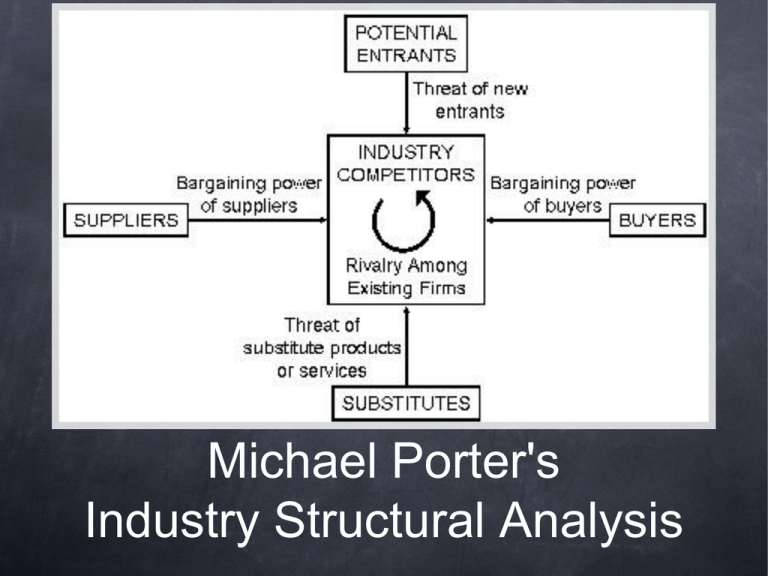

Michael Porter's Industry Structural Analysis

advertisement

Michael Porter's Industry Structural Analysis 5 Forces of Competition Competition drives the return down to that which would be earned by the economist’s “perfectly competitive” industry. All five competitive forces jointly determine the intensity of industry competition and profitability. Different from short-run factors that can affect competition and profitability in a transient way. 5 Forces and Strategy The goal is to find a position in the industry where the company can best defend itself against these competitive forces or can influence them in its favor. Since the collective strength of the forces may well be apparent to all competitors, the key for developing strategy is to analyze the sources of each. Force 1. THREAT OF ENTRY Depends on extant barriers to entry, coupled with the expected reaction from existing competitors. Barriers of Entry Economies of Scale. Product Differentiation. Capital Requirements. Switching Costs. Access to Distribution Channels. Cost Disadvantages Independent of Scale. Government Policy Force 2. INTENSITY OF RIVALRY AMONG EXISTING COMPETITORS Firms are mutually dependent. Some forms of competition, notably price competition, are highly unstable and quite likely to leave the entire industry worse off from the standpoint of profitability. Intense rivalry is the result of interacting structural factors. Numerous or Equally Balanced Competitors. Slow Industry Growth. High Fixed or Storage Costs. Lack of Differentiation or Switching Costs. Capacity Augmented in Large Increments. Diverse Competitors. High Strategic Stakes. High Exit Barriers. Notes on Exit Barriers Economic, strategic, and emotional factors that keep companies competing in businesses despite low or even negative returns on investment. Major sources of exit barriers Specialized assets Fixed costs of exit Strategic interrelationships Emotional barriers Government and social restrictions Force 3. PRESSURE FROM SUBSTITUTE PRODUCTS Industry’s overall elasticity of demand. Limits profits in normal times and also reduce the bonanza an industry can reap in boom times. Position vis-à-vis substitute products may well be a matter of collective industry actions. Substitute products that deserve the most attention are those that (1) are subject to trends improving their priceperformance tradeoff with the industry’s product, or (2) are produced by industries earning high profits. Force 4. BARGAINING POWER OF BUYERS... is high if... The industry is concentrated or purchases large volumes relative to seller sales. The products it purchases from the industry represent a significant fraction of the buyer’s costs or purchases. The products it purchases from the industry are standard or undifferentiated. It faces few switching costs. It earns low profits. Buyers pose a credible threat of backward integration. The industry’s product is unimportant to the quality of the buyers’ products or services. Force 5. BARGAINING POWER OF SUPPLIERS ... is high if ... Industry is is dominated by a few companies and is more concentrated than the industry it sells to. Suppliers are not obliged to contend with other substitute products for sale to the industry. The industry is not an important customer of the supplier group. Suppliers’ product is an important input to the buyer’s business. Supplier group’s products are differentiated or it has built up switching costs. Supplier group poses a credible threat of forward integration. BTW... labor must be recognized as a supplier as well, The principles re the potential power of labor are similar to those of suppliers. The key additions are labor's degree of organization, and whether the supply of scarce varieties of labor can expand. Summary of 5 Forces 1. 2. 3. 4. 5. If the Threat of New Entrants is High, prices can be bid down and/or incumbents' costs inflated, reducing profitability. If the Intensity of Rivalry Among Existing Competitors is High, tactics like price competition, advertising battles, product introductions, and increased customer service or warranties are common, having noticeable effects on all competitors. If the Pressure from Substitute Products is High, it limits the potential returns by placing a ceiling on the prices firms in the industry can profitably charge. The more attractive the alternative, the firmer the lid on industry profits. If the Bargaining Power of Buyers is High, Buyers compete by forcing down prices, bargaining for higher quality or more services, playing competitors against each other, reducing profitability. If the Bargaining Power of Suppliers is High, Suppliers can exert bargaining power over participants in an industry by threatening to raise prices or reduce the quality of purchased goods/services.