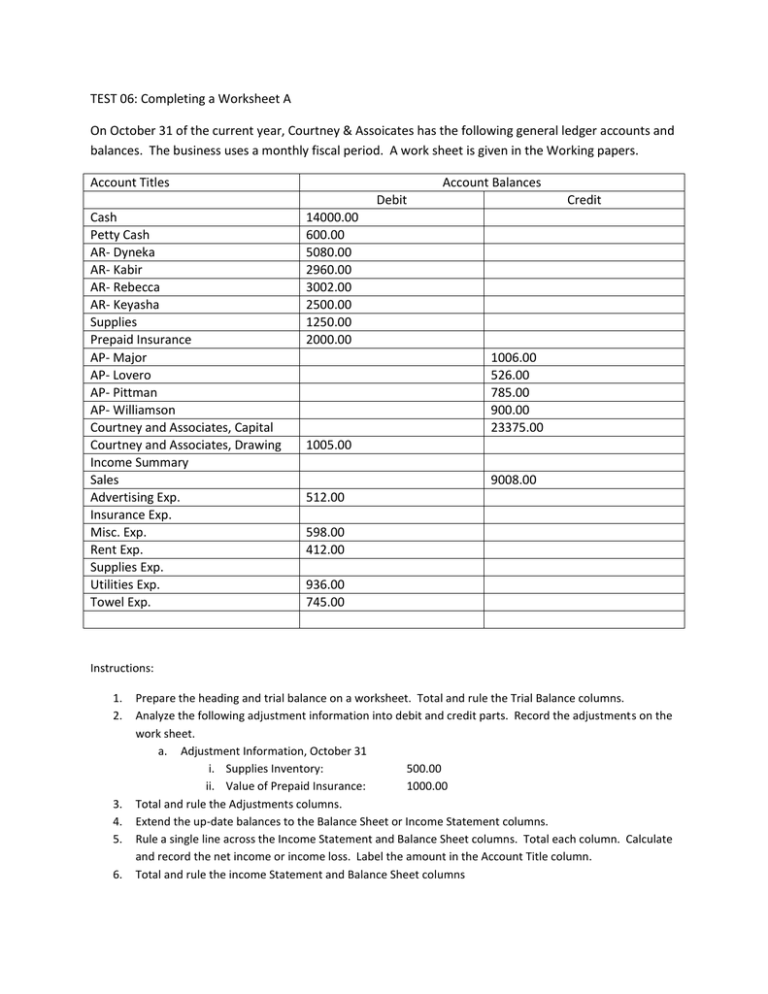

TEST 06: Completing a Worksheet A On October 31 of the current

advertisement

TEST 06: Completing a Worksheet A On October 31 of the current year, Courtney & Assoicates has the following general ledger accounts and balances. The business uses a monthly fiscal period. A work sheet is given in the Working papers. Account Titles Account Balances Debit Cash Petty Cash AR- Dyneka AR- Kabir AR- Rebecca AR- Keyasha Supplies Prepaid Insurance AP- Major AP- Lovero AP- Pittman AP- Williamson Courtney and Associates, Capital Courtney and Associates, Drawing Income Summary Sales Advertising Exp. Insurance Exp. Misc. Exp. Rent Exp. Supplies Exp. Utilities Exp. Towel Exp. Credit 14000.00 600.00 5080.00 2960.00 3002.00 2500.00 1250.00 2000.00 1006.00 526.00 785.00 900.00 23375.00 1005.00 9008.00 512.00 598.00 412.00 936.00 745.00 Instructions: 1. 2. 3. 4. 5. 6. Prepare the heading and trial balance on a worksheet. Total and rule the Trial Balance columns. Analyze the following adjustment information into debit and credit parts. Record the adjustments on the work sheet. a. Adjustment Information, October 31 i. Supplies Inventory: 500.00 ii. Value of Prepaid Insurance: 1000.00 Total and rule the Adjustments columns. Extend the up-date balances to the Balance Sheet or Income Statement columns. Rule a single line across the Income Statement and Balance Sheet columns. Total each column. Calculate and record the net income or income loss. Label the amount in the Account Title column. Total and rule the income Statement and Balance Sheet columns TEST 06: Completing a Worksheet B On January 31 of the current year, Honesty Law Office has the following general ledger accounts and balances. The business uses a monthly fiscal period. A work sheet is given in the Working papers. Account Titles Account Balances Debit Cash Petty Cash AR- Dyneka AR- Kabir AR- Rebecca Supplies AR- Keyasha Prepaid Insurance AP- Major AP- Lovero AP- Pittman AP- Williamson Courtney and Associates, Capital Courtney and Associates, Drawing Income Summary Sales Advertising Exp. Insurance Exp. Misc. Exp. Rent Exp. Supplies Exp. Utilities Exp. Towel Exp. Credit 30000.00 4500.00 6080.00 7360.00 9602.00 2250.00 2980.00 5600.00 8006.00 626.00 1085.00 8500.00 62305.00 18005.00 21008.00 1512.00 2598.00 2412.00 9136.00 1745.00 Instructions: 1. 2. 3. 4. 5. Prepare the heading and trial balance on a worksheet. Total and rule the Trial Balance columns. Analyze the following adjustment information into debit and credit parts. Record the adjustments on the work sheet. a. Adjustment Information, October 31 i. Supplies Inventory: 1895.00 ii. Value of Prepaid Insurance: 3285.00 Total and rule the Adjustments columns. Extend the up-date balances to the Balance Sheet or Income Statement columns. Rule a single line across the Income Statement and Balance Sheet columns. Total each column. Calculate and record the net income or income loss. Label the amount in the Account Title column. Total and rule the income Statement and Balance Sheet columns