Health Insurance

advertisement

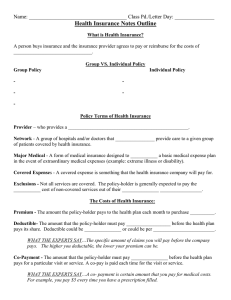

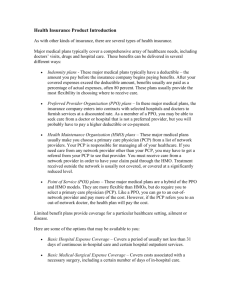

Health Insurance Consumer Health Unit Objectives: -TSWBAT differentiate between types of insurance programs and terms. -TSWBAT analyze which health insurance plan available would best fit the students’ needs. Health Insurance Basics A contract between you and your insurance company You buy a plan, and the company agrees to pay part of your medical costs when you get sick or hurt Protects you from high, unexpected costs How Health Insurance Works – fixed amount you pay to your insurance plan, usually every month (even if you don’t use medical care that month) Deductible – the amount you pay for care before the insurance company starts to pay its share Copayment – fixed amount you’ll pay for a medical service after you’ve met your deductible Coinsurance – it’s a percentage of costs you pay Premium Group vs. Individual Insurance Group Policies – provided by employer Your employer pays for all or most of your insurance plans cost All employees at work have the same health insurance options as you do (may have some choices) Commonly called “benefits” Individual Policies – you buy the policy yourself Very similar to the way you get car insurance Health Insurance Terms – provides a health care service Example: dermatologist, orthopedic Network – group of hospitals and/or doctors that jointly provide care to a given group of patients covered by health insurance Provider Health Insurance Terms Major Medical - form of medical insurance designed to supplement a basic medical expense plan in the event of extraordinary medical expenses Example - extreme illness or disability Health Insurance Terms Expense – something that the insurance plan will pay for Covered –Not all services are covered. The policy-holder is generally expected to pay the full cost of non-covered services out of their own pocket. Exclusions Health Insurance Terms Pre-existing Condition – A health problem that a person has before they are covered by a certain policy The policy may or may not pay for expenses associated with these conditions Health Insurance Terms Waiting Period – Predetermined amount of time between when your employment begins and when your insurance coverage actually begins You are not covered during this time!!! Managed Care Organized system of health care services designed to control health care costs Use of a panel or network of health care providers to provide care to enrollees Holds down costs by limiting patients’ choices (standards for selecting providers) and encourages preventive care Two main kinds of Managed Care Insurance – Health Maintenance Organization PPO – Preferred Provider Organization HMO HMO – Health Maintenance Organization Manage patients' health care by reducing unnecessary services Lower premiums and/or copayments Most HMOs require members to select a primary care physician (PCP) PCP = physician acts as a gatekeeper to medical services PCP authorizes referrals to specialists or other doctors if deemed necessary. Emergency medical care does not require prior authorization from a PCP Typically provide no coverage for care out of network PPO – Preferred Provider Organization Organization of medical doctors, hospitals and other health care providers “network” or “preferred provider” Network is contracted with an insurer to provide health care coverage at a reduced rate (substantial discount) Some surgeries or procedures may need to require preapproval by the insurance company May reimburse some of your costs if you go out of network More flexibility, network is large, higher premiums Other Types of Medical Insurance / “Add On’s” • Dental Insurance – required to have if age 18 or younger / helps totally or partially cover dental cleanings and other procedures needed (fillings, root canals, crowns, etc.) • Vision Insurance – not required to have / helps partially cover eye check-ups, contacts or glasses • Hospitalization Insurance- Specifically pays for hospitalization • Surgical Insurance – Specifically pays for fees associated with surgery • Disability Insurance – Pays for loss of income due to accident or illness; Usually only a percentage of your salary Federal Programs for Health Coverage Medicaid – Health insurance for people with lower incomes Funded by state and federal government Eligibility rule varies state to state • Example of Medicaid requirements A family of four making $23,225 a year or less qualifies. Your family's assets are less than $2,000 Federal Programs for Health Coverage Medicare – Government health coverage for people 65 years or older In many cases Medicare pays a portion of the person’s health care cost. The rest is paid by the person or supplemental insurance plan. WIC – Women, Infants & Children Government program that helps mothers and children with medical bills Examples: prenatal care, immunizations, medication CHIP – Children’s Health Insurance Program (PA) Children and teens that are not eligible for Medicaid have access to affordable, comprehensive health care coverage Once enrolled, 12 months of CHIP is guaranteed unless they no longer meet the requirements Families must renew their coverage each year in order for coverage to continue COBRA – Consolidated Omnibus Budget Reconciliation Act Developed in 1985 If you lose your job, you may continue to pay your insurance premium and maintain your health coverage Also applies to children that loses full-time student status Obama Care Health care plan for America President Obama signed the Affordable Care Act in March of 2010 The law puts in place comprehensive health insurance reforms for four years and beyond (for example, by 2014 all Americans will have access to affordable health insurance options) The political issues behind this law caused the government to shut down in 2013 Affordable Care Act Coverage: Ends pre-existing condition exclusions for children (plans can no longer limit or deny benefits to children under 19 due to pre-existing condition) Keeps young adults covered (if you are under 26, you may be eligible to remain on your parent’s plan) Ends arbitrary withdrawals of insurance coverage (no cancellations because of a honest mistake) Guarantees your right to appeal (you have the right to ask that your plan reconsider its denial of payment) Affordable Care Act Care: Covers preventive care at no cost to you Protects your choice of doctors (choose the PCP from your plan’s network) Removes insurance company barriers to emergency services (you can seek emergency care at a hospital outside of your health plan’s network) Affordable Care Act The health insurance marketplace helps uninsured people find health coverage You are considered covered if you have Medicare, Medicaid, CHIP, job-based plan, COBRA, plan you bought yourself, retiree coverage, etc. The deadline to enroll at Healthcare.gov for 2016 was January 31, 2016 If you missed the deadline, you may have to wait another year to sing up for coverage and you’ll risk being required to pay a penalty of $695 or more when you file your federal income taxes