20-4

advertisement

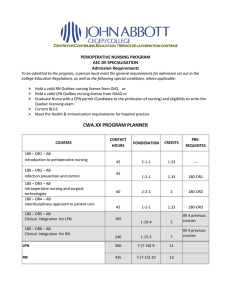

20-4 Health Insurance HEALTH INSURANCE COVERAGE Hospital insurance pays for most of your charges if you are hospitalized with and illness or injury. Because of high cost hospitalization, people purchase hospital insurance more than any kind of health insurance. SURGICAL INSURANCE • Surgical insurance covers all or part of the surgeon’s fees for and operation’s. • The typical surgical policy lists the types of operations that it covers and the amount allowed for each. • Surgical Insurance is often bought in combination with hospital insurance. REGULAR MEDICAL INSURANCE • Regular medical insurance cover fees for nonsurgical car given in the doctor’s office, the patients home, or a hospital. • Some Plans may provide payment for diagnostics and laboratory expenses. • Regular medical insurance is usually combined in one policy with hospital and surgical insurance. MAJOR MEDICAL INSURANCE • Long illnesses and serious injuries can be expensive. • Major medical insurance provides protection against the high costs of serious illnesses or injuries. • It covers the cost of treatments in and out of the hospital, special nursing car, X rays and many other health care needs. COMPREHENSIVE MEDICAL POLICY • Insurance providers have developed comprehensive medical policy that combines the features of hospital, surgical, regular, and major medical insurance. • This coverage retains the features of each separate coverage. • A combination of coverage's will likely be less expensive. DENTAL INSURANCE • Dental Insurance usually includes -examinations -X-rays -cleanings and fillings VISION CARE INSURANCE • Some Vision Care plans cover the cost of laser eye surgery. • These policy’s cover -eye examinations -prescription lenses -frames - and contact lenses HEALTH INSURANCE PROVIDERS • Health insurance is available from several sources. • These options include group health insurance, individual health insurance, health maintenance organizations, preferred provider organizations, and even government programs GROUP HEALTH INSURANCE • The most popular way to buy health insurance is through a group. • Companies that sponsor group policies often pay part or all of the premium costs for their employee's. • The cost of group health insurance is lower per insured than the cost of comparable individual policy. INDIVIDUAL HEALTH INSURANCE • Individual health insurance are usually rather expensive. • They require a physical exam and have a waiting period before the policy takes affect. MANAGER CARE PLANS • Health Maintenance Organization (HMO) • (HMO) is a type of care plans. If you join it you usually have a fixed monthly fee and you are entitled to a wide range of prepaid health care services even hospitalization. MANAGER CARE PLANS • Then there's Preferred Provider Organization (PPO). • This system involves several health care providers, such as a group of physicians, a clinic, or a hospital. • These providers agree to charge set fees for services. STATE GOVERNMENT ASSISTANCE • An important health insurance program by state government is workers compensation. This insurance provides medical and survivor benefits for people injured, disabled, or killed on the job. • State government also administer a form of medical aid to low income families called Medicaid. FEDERAL GOVERNMENT ASSISTANCE • The national Social Security laws provide a national program of health insurance known as Medicare. This insurance is suppose to help people 65 and disabled people pay for health care. • Medicare has two basic parts. -hospital insurance and medical insurance. • Hospital insurance covers- hospital care, service in approved nursing homes, and home health care to certain visits. • Medical insurance covers- doctor services, medical services, supplies, and home health services. COST CONTAINMENT • Health insurance price is made up of four main factors: extent of the coverage, number of claims filed by policy holders, and number of dependents. • You can make sure you buy only the kind you need. And make sure you don’t use your medical benefits unnecessarily and stay health and your price will stay low. DISABILITY INCOME INSURANCE • One form of health insurance provides periodic payments if the policy holder becomes disabled. • Disability income insurance protects you against loss of income caused by a long illness. • The insured receives weekly or monthly payments. LONG-TERM CARE INSURANCE • With people living long-term care insurance is the fastest growing type of protection. • This covers long-term care which is daily assistance needed because of a long term illness or disability. • This may involve a stay in a nursing home.