Private renting in Britain after the global financial crisis

advertisement

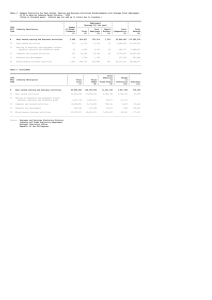

Private renting after the global financial crisis Peter A. Kemp Overview 1. 2. 3. Key points about the PRS (in the advanced economies) Private renting and GFC: a case study of GB Implications for policy Key points about the PRS 1. The PRS varies cross-nationally 2. The institutional & policy & context also varies Hence need for caution when importing policy design 3. The internationalisation of financial markets has affected the PRS Hence so has the GFC 4. The PRS is growing in some advanced economies Private renting in Britain: brief overview 1. 2. 3. 4. 5. 6. Growth in private renting began before the GFC Free market rents and weak security of tenure Very high tenant mobility 1 in 4 private tenants receive housing benefit Predominance of ‘sideline landlords’ Tax bias in favour of owner-occupation New housing completions (UK: 1970/71 to 2013/14) 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Housing tenure in England Year (% households) Owner occupiers Private renters Social renters Total 1981 57 11 32 100 1991 68 9 23 100 2001 70 10 20 100 2007 70 13 18 100 2013/14 63 19 17 100 The Buy-to-Let boom: Lending New BTL mortgage market: 1. New willingness to lend to landlords 2. Innovation in mortgage products 3. Easier credit conditions Facilitated by: 1. 2. 3. 4. International integration of financial markets Global savings glut Increased lender competition Low interest rate regime The Buy-to-Let boom: Landlords Emergence of BTL landlords: 1. 2. 3. 4. Rising house prices Low interest rates Poor stock market returns Pension concerns The Buy-to-Let boom: Tenants Rising demand for private renting: 1. 2. 3. 4. Increase in single person households Growth in higher education * Change to student funding Immigration (2004+) 5. Falling supply of social housing * Emergence of student housing companies BTL and the credit crunch BTL lending 1999 to 2013 (£bn) 50 45 Collapse & recovery of BTL lending 40 35 30 Increase in BTL arrears & possessions – now falling 25 20 15 10 Shift to low interest rates (2009+) 5 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Private renting after the crisis 1. 2. 3. 4. Accelerated growth in private renting Rising private rents (esp. London) Cuts in housing benefit (2011+) Increased homelessness (2010+) After the crisis: Landlords 1. 2. 3. 4. 5. ‘Search for yield’ Cash and BTL-financed landlords Overseas property investors Emerging institutional investment Housing associations as private landlords After the crisis: Tenants Changing rental market: 1. Increase in ‘reluctant renters’ 2. 3. 4. Frustrated FTBs Increase in social housing waiting lists More longer term renting Families renting privately More in-work poverty Policy concerns 1. The majority of private tenants are satisfied. 2. But: Insecurity of tenure (families & long-term renters) Affordability of rents Access barriers (low-income tenants) Letting agents fees Substandard property and management (bottom end of the market) 3. The policy response: England v Scotland Concluding points 1. Growth of private renting likely to continue 2. PRS has not adapted to its new roles 3. Policy dilemmas: How to address insecurity of tenure & high rents without undermining the supply of rental homes? Tackling causes v symptoms?