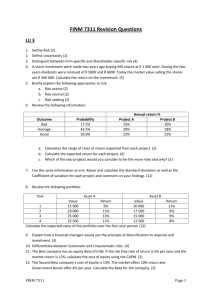

Investing in Fixed Income Securities Powerpoint Lexis Nexis

advertisement

CHAPTER 6

Investing in Fixed Income Securities

OVERVIEW

• Fixed income securities represent borrowing by

governments and corporations

• Ratings agencies assess the quality of various offerings

• Investing in fixed income securities involves some risk

• Prices of fixed income securities depend on the terms of

the security and prevailing interest rates

Fixed Income Securities

• Fixed income securities are a group of

investment products that offer a fixed

periodic return

• Some forms offer contractually

guaranteed returns while others have

specified, but not guaranteed, returns.

• Because of their fixed returns, fixed

income securities tend to be popular

investments during periods of high

interest rates when investors seek to lock

in high returns

Fixed Income Securities

The main forms of fixed income securities

are:

• Bonds

• Hybrids, which have characteristics of

both bonds and shares

— preference shares, and

— convertible securities

Characteristics of Bonds

• Bonds are the long-term debt

instruments (that is, IOUs) of corporations

and governments that offer a fixed

periodic return.

• A bondholder has a contractual right to

receive a fixed interest return (known as

the coupon rate) plus the return of the

bond’s face value (the stated value given

on the certificate) at maturity (typically

three to 10 years).

• Long-term debt instruments issued by

corporations (the Corporate Bond Market)

can be classified as debentures or

unsecured notes.

Characteristics of Bonds

• Coupon payments are generally made

semi-annually

• Once a bond is issued it can (usually) be

traded in what is called the secondary

market

• As interest rates change, the price of the

bond changes, but in the opposite

direction

Types of Bonds

• Main issuers

— Commonwealth Government;

Commonwealth Government

Securities (CGS) mainly Treasury

Bonds

• Fixed coupon

• Capital indexed

— Semi-government; state

government authorities

— Corporate; debentures and

unsecured notes

Yields

• The yield or internal rate of return of an

investment is the compounded annual

rate of return earned. It can also be

viewed as the discount rate that produces

a present value of benefits from the

investment just equal to the cost of the

investment.

• The current interest rate for a bond

compared with its market value is known

as the running yield on the bond.

Yields

• The total return from a bond over the

whole of its remaining term, including

both interest payments and capital gains

or losses, is known as the yield to

maturity (YTM).

• The term ‘yield’, used alone, usually

refers to the yield to maturity.

Bond Ratings

• Both Moody’s and Standard and Poor’s

(S&P) have ratings for the various bonds

and preference shares on issue

• Both agencies have 9 categories, which

are equivalent

— Moodys: Aaa, Aa, A to Caa, Ca, C

— S & P: AAA, AA, A to CCC, CC, C

Bond Risks

• Interest rate risk; values decline when

interest rates rise

• Credit risk; the borrower might default

on repayment

• Inflation risk; the real value of fixed

interest payments may decline

• Liquidity risk; buyers might not be

present on the secondary market when a

sale is desired

Bond Risks

• Interest rate risk; values decline when

interest rates rise

• Credit risk; the borrower might default

on repayment

• Inflation risk; the real value of fixed

interest payments may decline

• Liquidity risk; buyers might not be

present on the secondary market when a

sale is desired

Calculating Bond Prices

• Bond prices are calculated as the

Present Value of the sum of the future

interest payments and the redemption

value at maturity

• PV = FV / (1+i)n

PV is present value

FV is future value

i is the interest rate required

n is the term

Calculating Bond Prices

A single formula includes all these

individual present value calculations that

otherwise would need to be added

together

Price = C/i x {1-1/(1+i)n}+F/(1+i)n

C = Coupon value

F = Face value

Preference Shares

• Like ordinary shares, preference shares

represent an ownership interest in a

corporation and are a form of equity

funding, though they have a number of

features in common with debt. Like

ordinary shares, preference shares

represent an ownership interest in a

corporation.

• Like debt securities, and unlike ordinary

shares, preference shares have a stated

dividend rate and payment of this

dividend is given preference over other

share dividends of the same firm.

Preference Shares

• Preference shares have no maturity

date and holders of preference shares

often have no voting rights.

• Preference shares are typically issued by

companies which need money but don’t

want to issue debt to get it.

• Investors typically purchase them for

the dividends they pay, but preference

shares may also provide capital gains.

• Companies like to issue preference

shares because they don’t count as

ordinary shares and so don’t affect

earnings per share.

Convertible Securities

• Either a convertible note or a

convertible preference share

• Key feature is that under stated

conditions the convertible note or the

convertible preference share can be

‘converted’ to ordinary shares

• The strategy is to invest in these more

defensive assets when market conditions

are unfavourable, and then covert to

ordinary shares when the share market is

expected to rise

Summary

This chapter has covered:

• Characteristics of bonds and the

markets in which they are traded

• The rating of bonds by the ratings

agencies

• The risks involved in bond investment

• The calculation of bond prices, given the

yield required

• Some types of hybrid securities