Forecasting

advertisement

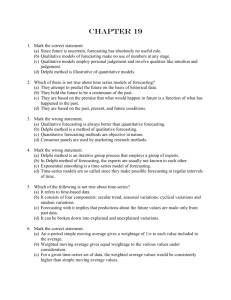

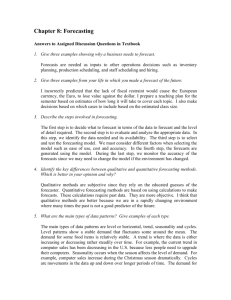

Forecasting Professor Ahmadi Slide 1 Learning Objectives Understand when to use various types of forecasting models and the time horizon. Understand qualitative and quantitative tools of forecasting. Compute moving averages and exponential smoothing models. Analyze trends and seasonality in time-series data. Compute variety of forecasting error measures. Use variables in linear regression model. Use Excel to analyze variety of forecasting models Slide 2 Eight Steps to Forecasting 1. Determine use of forecast - what objective are we trying to obtain? 2. Select items or quantities to be forecasted. 3. Determine time horizon of forecast: • Short-range (less than three months) • Medium-range (3 months to 3 years) • Long-range (3+ years) 4. Select forecasting model or models. 5. Gather data needed to make forecast. 6. Validate forecasting model. 7. Make forecast. 8. Implement results. Slide 3 Types of Forecasts Slide 4 Qualitative Models • Qualitative models attempt to incorporate judgmental or subjective factors into forecasting model. • Opinions by experts, individual experiences and judgments, and other subjective factors may be considered. • Qualitative models are especially useful when subjective factors are expected to be very important or when accurate quantitative data are difficult to obtain. • Qualitative models are also useful for long-term forecasting. Slide 5 Measuring Forecast Error Mean Absolute Deviation (MAD): • MAD = |forecast error| / T = |At - Ft| / T Mean Squared Error (MSE): • MSE = (forecast error)2 / T = (At – Ft)2 / T Mean Absolute Percent Error (MAPE): • MAPE = 100 (|At - Ft|/ At) / T Slide 6 Time - Series and Causal (Associative) Models 1. Time-series Models: • Time-series models attempt to predict future by using historical data. • Models make assumption that what happens in future is a function of what has happened in past. 2. Causal Models: • As with time-series models, causal models also rely on quantitative data. • Bivariate and multivariate regression models are examples of associative models. Slide 7 Moving Average MA is a series of arithmetic means Used if little or no trend Used often for smoothing • Provides overall impression of data over time Equation: MA = (Actual value in previous k periods) / k Slide 8 Weighted Moving Averages Used when trend is present • Older data usually less important Weights based on intuition Equation: k-period weighted moving average = (weight for period i) (actual value in period i) (weights) Slide 9 Exponential Smoothing A form of weighted moving average • Weights decline exponentially • Most recent data weighted most Requires smoothing constant () ranges from 0 to 1 is subjectively chosen Equation: Ft= Ft-1 + ( At-1 - Ft-1 ) Slide 10 Time series Components The four Components of Time Series are: 1. Trend 2. Seasonal 3. Cyclical 4. Random The time series can be decomposed into its four components. Slide 11 General Forms of Time-series Models There are two general forms of time-series models: • Most widely used is multiplicative model, which assumes forecasted value is product of four components. Forecast = (Trend) . (Seasonality) . (Cycles) .( Random) • Additive model adds components together to provide an estimate is also available. It is stated as: Forecast = Trend + Seasonality + Cycles + Random Slide 12 Causal Models Goal of causal forecasting model is to develop best statistical relationship between dependent variable and independent variables. Most common model used in practice is regression analysis. In causal forecasting models, when one tries to predict dependent variable using single independent variable it is called a simple regression model. When one uses more than one independent variable to forecast dependent variable, it is called a multiple regression model. Slide 13