MBA-FM-101

advertisement

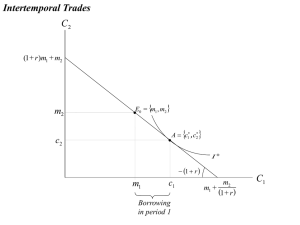

Writing anything except Roll Number on question paper will be deemed as an act of indulging in unfair means and action shall be taken as per rules. Roll No._________________ MBA Semester III MBA FM – 101 – SECURITY ANALYSIS & PORTFOLIO MANAGEMENT MODEL PAPER Time: 3 Hrs MM: 80 Note: 1. All Questions are compulsory in Section A. Section A carries 20 marks. 2. Attempt FIVE questions in all from Section B, selecting ONE question either A or B from each question. Answer of each question shall be limited up to 250 words. Each question carries 6 marks. 3. Attempt any 3 questions in all from section C. Answer of each question shall be limited up to 500 words. Each question carries 10 marks. 1. SECTION A India Times Ltd. is evaluating rate of return on two assets A and B. The asset ‘A’ was purchased a year ago at Rs. 4, 00,000/- and since its generated cash flow was of Rs. 16,000/-. Presently it can be sold at 4, 30,000/-. Asset ‘B’ was purchased few years back and its market value in the beginning and at the end was Rs. 2,40,000/- and 2,36,000/- respectively. The asset ‘B’ has generated cash Rs. 34,000/- during the year. Find out the rate of return on these assets. SECTION B 2. A Discuss in detail the security forms of investment. OR B Write short notes on: a. Underwriting b. Private Placement c. Prospectus d. Merchant Banker 3. A Define Risk and the factors contributing Total Risk. Explain different types of Risk in brief. OR B Monthly return data (in %) for RELIANCE stock and the NSE index for a 12 month period are presented below: PTO Month 1 2 ONGC - 5.4 0 . 7 5 0 . 3 5 NSE - 3 4 5 3.4 3 . 0 5 0 . 4 9 5 9.1 1 1.6 1 . 0 3 6 2.3 3 6.6 4 7 6 1.1 7 8 5.5 0 . 4 2 0.7 3 6.8 1 0.8 2 10 9 2.6 0 4.0 4 11 0 1.2 5 12 -1.91 3 . 8 1 0.29 -1.96 1 Calculate alpha and beta for ONGC stock. 4. A What is Industry Analysis? Discuss in detail Industry Life Cycle. OR B The following data are extracted from the published accounts of two companies in an industry. Particulars ABC Ltd. XYZ Ltd. Sales 32,00,000 30,00,000 Net Profit After Tax 1,23,000 1,58,000 Equity Capital (Rs. 10 Per Share Fully 10,00,000 8,00,000 Paid) General Reserves 2,32,000 6,42,000 6% Long- Term Debt 8,00,000 6,60,000 Creditors 3,82,000 5,49,000 Tax Paid 50,000 60,000 Bank Credit (Short Term) 60,000 2,00,000 Fixed Assets 15,99,000 15,90,000 Inventories 3,31,000 8,09,000 Other Current Assets 5,44,000 4,52,000 You are required to prepare a statement of Comparative Ratios showing liquidity, profitability, activity and financial position of the two companies and give suitable interpretations. (Calculate any 10 ratios from the above mentioned ratios) 5. A What is portfolio selection? Explain the concept of efficient frontier in context of portfolio selection. OR B Estimate the stock return by using Capital Asset Pricing Model and Arbitrage Pricing Model. The particulars are given as under: Expected return on the market is 15%, equity’s beta is 1.2 and risk free return is 8%. PTO Default Factors Market Price of Risk Sensitivity Index (beta) Inflation 6% 1.1 Industrial Production 2% .8 Risk Premium 3% 1.0 Interest Rate 4% -.9 What explanation can you offer to explain the difference into estimates? 6. A What is portfolio revision? Explain in detail the constraints in portfolio revision. OR B information regarding two mutual funds and a market index are given below: Fund Return % Standard Beta Deviation (%) Gold 7 15 .72 Platinum 16 35 1.33 Market index 10 24 1.0 Assuming the risk-free return as 5 %, calculate the differential return for the two funds. SECTION C “Investment is well grounded and carefully planned speculation.” Discuss. 7. Distinguish between investment and speculation. The following portfolios are available to an investor: 8. Portfolio Expected Return Risk A 14.0% 2% B 18.0% 5% C 30.5% 9% Find out whether these portfolios are efficient or not, given that the risk free interest rate is 8%. Return of market portfolio is 18% and the risk of the market portfolio is 4%. “Fundamental analysis provides an analytical framework for rational 9. investment decision making.” Explain Define Diversification. Explain in detail effect of diversification and types of 10. diversification. “Portfolio evaluation essentially comprises two functions, performance 11. measurement and performance evaluation.” Discuss. PTO