Powerpoint slides for Chapters 5, 6, 7, and 8

advertisement

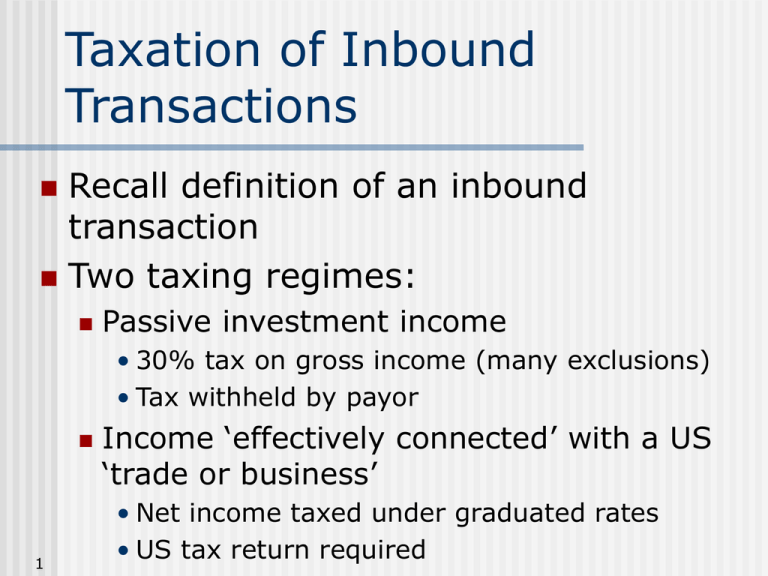

Taxation of Inbound Transactions Recall definition of an inbound transaction Two taxing regimes: Passive investment income • 30% tax on gross income (many exclusions) • Tax withheld by payor 1 Income ‘effectively connected’ with a US ‘trade or business’ • Net income taxed under graduated rates • US tax return required Passive Investment Income ‘Fixed or determinable’ income Taxed under the passive investment rules if not ‘effectively connected income’ Interest, dividends, rents, royalties, annuities, prizes, found money, etc. All gross income measurable by the payor Wages, salaries, other compensation are ‘fixed and determinable’ but are often also ‘effectively connected income’ Gains from property sales not included 2 Investment Income Excluded from US Taxation US source interest income Deposits in US financial institutions Portfolio interest • Interest on debt held by identifiably foreign persons • Interest paid on any obligation either • In registered form with a foreign owner, or • If in bearer form, issued with restrictions on US ownership 3 Exceptions to Nontaxability of Interest Income US-source interest received by ‘10percent shareholder’ of the issuer is subject to flat tax 10% or more of combined voting power 10% or more partner in a partnership Attribution rules apply in determining ownership 4 Example 1: Investment Interest Exclusion In each case below, is interest earned by Guy, a foreign person with no ‘effectively connected’ income, subject to US tax? 5 Guy earns $200,000 of interest from deposits of funds held in US banks What if the interest was paid by a US corporation of which Guy is not a shareholder? What if Guy owns 1% of the US corporation’s outstanding common stock? 10%? 50% of its nonvoting preferred stock? What if the interest is paid by a foreign corporation? Example 2: Planning without the 10% Shareholder Rule Kim, a foreign person with no ‘effectively connected’ income, wishes to invest in a US business What are Kim’s tax consequences without the 10% shareholder rule? With the rule? 6 She forms a corporation to buy the US business The business issues Kim 1 share of common stock and bonds with a face amount of $1 million paying 12% interest Does it matter if the corporation is a US corporation or a foreign corporation? Other Exceptions to Nontaxability of Interest Income US-source interest income of foreign banks on the extension of credit in the ordinary course of its trade or business Contingent interest based on Sales, receipts, cash flow, income, or profits of the debtor Change in value of property of the debtor Dividends or similar payments by the debtor 7 Income from Intangible Property Royalties considered ‘fixed or determinable’ and sourced to country of use of the property Income from sale of intangible property sourced to residence of seller Sale versus license Sale must transfer all substantial rights Contingent payments treated as royalties 8 Trade or Business Direct ownership of income-producing property with related risks and responsibilities Ownership of rental real estate and mineral interests may or may not qualify Depends on level of owner’s control and involvement in operations Can elect to treat income as ‘effectively connected’ 9 Example 3: Rental Income Li, a foreign person, owns rental real estate generating $200,000 of rental income per year on which he pays $120,000 of expenses If Li’s rental activities are not considered a trade or business, how will he be taxed? Should Li elect to treat his rental activity as effectively connected? Why or why not? 10 Other Trade or Business Activities Income from performing services Income from sale of inventory 11 But not income from sale of investment assets Income from manufacturing US Trade or Business Requires economic activity in the US, but no clear threshold as to how much presence is a ‘US trade or business’ Insufficient activity includes • Promotional activity alone • Purchase of goods in US for sale elsewhere • Sales through independent contractors/brokers 12 US trade or business can be imputed between agent and principal, from partnership to partners ‘Effectively Connected’ Income Only a foreign person who at some time has been engaged in a US trade or business can have effectively connected income US source ‘fixed or determinable’ income and capital gains may be effectively connected under two tests • ‘asset use’ • ‘activities’ 13 ‘Effectively Connected’ Income continued ‘Asset use’ test ‘Activities’ test 14 Income from the use of assets is effectively connected if the rental operation is a trade or business Interest income is effectively connected if earned on funds supporting current business operations Income is effectively connected if the ‘activities’ of the business are a ‘material factor’ in its realization Captures income from performance of services Other ‘Effectively Connected’ US Source Income All other US source income of a foreign person engaged in a US trade or business is ‘effectively connected’ Includes sales of inventory and other US source business profits Applies beyond US source income directly from the US trade or business in which the foreign person is engaged 15 Example 4: Other US Source Income Euro Inc., a foreign corporation with no permanent US place of business, manufactures products sold by mail to US catalogue customers Is Euro’s income from such sales ‘effectively connected’? Now suppose Euro opens a store in NYC. Is income from the store ‘effectively connected’? What about income from the catalogue sales? 16 ‘Effectively Connected’ Foreign Source Income If a foreign taxpayer has an office or other fixed place of business in the US (directly or through a dependent agent), certain foreign source income of that business is considered ‘effectively connected’ 17 Rents and royalties for the use of intangible property outside the US Financial gains from a US banking business or active securities investment company Gains from the sale ‘through’ the US office of inventory, unless sold for use outside the US and a foreign office of the taxpayer participates materially in the sale Example 5: Foreign Source Income Recall example 4 in which Euro sells products by mail to US customers 18 Would the treatment of income from these sales change if Euro establishes a sales office in NYC to market its products, which are still manufactured and shipped from a foreign country? Sale of US Real Property Gains/losses of foreign persons from sale of ‘US real property interests’ are considered ‘effectively connected’ with a US trade or business ‘US real property interest’ includes • Direct interest in real property located in the US or the US Virgin Islands • Interest in a ‘US real property holding company’ (USRPHC) • Does not include less than 5% ownership of stock in a publicly traded US corporation 19 Real Property Land, buildings Mineral deposits, natural resources All permanent structures on land Structural components Furnishings and other personal property associated with the use of the real property 20 ‘Interests’ in Real Property Fee ownership, co-ownership, leasehold, options Interest in any domestic corporation qualifying as a USRPHC at any time during the shorter of The period of time the interest was held by the foreign person, or Five years ending on the date of disposition of the interest 21 USRPHC Any corporation for whom the FMV of its US real property is 50% or more of the FMV of its combined worldwide real property and assets used in the conduct of a trade or business 22 Passive investment assets not included in this test Example 6: USRPHC Rap Inc. owns assets with the following values on 1/1/2002: 23 US real property $4 million Foreign real property 2 million Foreign business assets 1 million Investments 2 million Is Rap a USRPHC? If Ted, a foreign person, sells his 10% interest in Rap during 2002, how will any gain or loss be treated for US tax purposes? Example 7: Interest in USRPHC Refer to Example 6. Suppose that the value of Rap’s foreign assets increases to $5 million by 1/1/2003. How long would Ted need to wait before selling his stock in order to avoid US taxation? If Joan, another foreign person, buys Rap stock on 2/1/2003, and sells it on 12/31/2003, how will her gain or loss be treated for US tax purposes? 24 Foreign Corporations Owning US Real Property An ownership interest in a foreign corporation owning US real property is not a US real property interest Sales of such shares will not trigger ‘effectively connected’ income However, when the foreign corporation sells the real estate, it has sold a US real property interest and is taxed on the gain in the US 25