More Evidence of Retrenchment as Cost Cutting Bites

advertisement

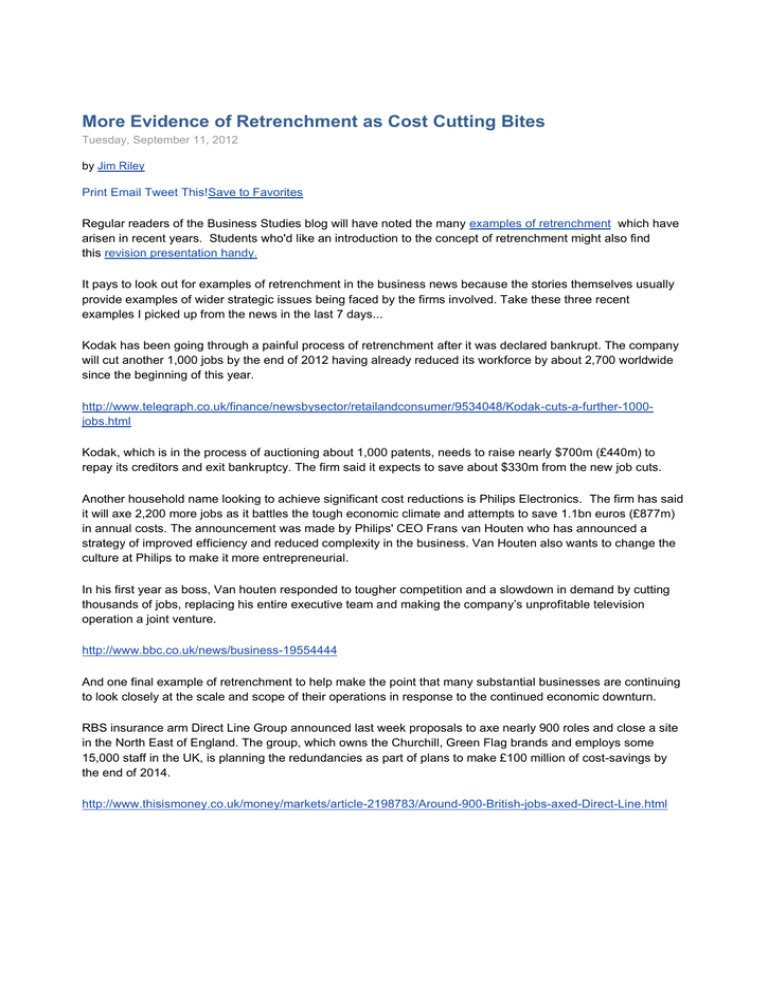

More Evidence of Retrenchment as Cost Cutting Bites Tuesday, September 11, 2012 by Jim Riley Print Email Tweet This!Save to Favorites Regular readers of the Business Studies blog will have noted the many examples of retrenchment which have arisen in recent years. Students who'd like an introduction to the concept of retrenchment might also find this revision presentation handy. It pays to look out for examples of retrenchment in the business news because the stories themselves usually provide examples of wider strategic issues being faced by the firms involved. Take these three recent examples I picked up from the news in the last 7 days... Kodak has been going through a painful process of retrenchment after it was declared bankrupt. The company will cut another 1,000 jobs by the end of 2012 having already reduced its workforce by about 2,700 worldwide since the beginning of this year. http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/9534048/Kodak-cuts-a-further-1000jobs.html Kodak, which is in the process of auctioning about 1,000 patents, needs to raise nearly $700m (£440m) to repay its creditors and exit bankruptcy. The firm said it expects to save about $330m from the new job cuts. Another household name looking to achieve significant cost reductions is Philips Electronics. The firm has said it will axe 2,200 more jobs as it battles the tough economic climate and attempts to save 1.1bn euros (£877m) in annual costs. The announcement was made by Philips' CEO Frans van Houten who has announced a strategy of improved efficiency and reduced complexity in the business. Van Houten also wants to change the culture at Philips to make it more entrepreneurial. In his first year as boss, Van houten responded to tougher competition and a slowdown in demand by cutting thousands of jobs, replacing his entire executive team and making the company’s unprofitable television operation a joint venture. http://www.bbc.co.uk/news/business-19554444 And one final example of retrenchment to help make the point that many substantial businesses are continuing to look closely at the scale and scope of their operations in response to the continued economic downturn. RBS insurance arm Direct Line Group announced last week proposals to axe nearly 900 roles and close a site in the North East of England. The group, which owns the Churchill, Green Flag brands and employs some 15,000 staff in the UK, is planning the redundancies as part of plans to make £100 million of cost-savings by the end of 2014. http://www.thisismoney.co.uk/money/markets/article-2198783/Around-900-British-jobs-axed-Direct-Line.html Kodak cuts a further 1,000 jobs The creators of the digital camera, Eastman Kodak, have announced plans to cut a further 1,000 jobs by the end of the year. Kodak has cut its global workforce by around 2,700 since the beginning of the year Photo: AP By Philippa Hattersley 6:30PM BST 10 Sep 2012 The decision comes amid efforts to repay its $700m debts to creditors. The expected savings from Monday's cutback is approximately $330m. Kodak also revealed that chief financial officer Antoinette McCorvey and president Philip Faraci are both leaving the company. Mr Faraci has been credited with having played an important role in helping to transform the group. Antonio Perez, chairman and chief executive, hailed Mr Faraci's "outstanding contribution" to the company. Rebecca Roof, a managing director at AlixPartners, has been named interim CFO in the hope of aiding the final restructuring of the company. BUSINESS 11 September 2012 Last updated at 08:16 GMT Philips Electronics cuts another 2,200 jobs Philips is cutting costs after making a loss last year Philips Electronics has said it will shed another 2,200 jobs as it looks to cut additional costs from the business. The Dutch group had already announced an 800m-euro ($1bn; £640m) costcutting programme, which has now been increased to 1.1bn euros. The cuts are being made in light of tough economic conditions and high pension costs, the company said. Last year, Philips cut thousands of jobs as new chief executive Frans van Houten looked to overhaul the business. The company made a loss of £1.3bn euros last year, but has recorded two consecutive quarters of profit since. "The company has identified additional opportunities, among others in the healthcare and lighting sectors, to further decrease inefficiency and complexity," Philips said in a statement. It added that the cuts would be completed by 2014. Philips said business had slowed noticeably in both China and Europe. "The identified additional overhead cost reduction measures will help us mitigate the effects of macro-economic headwinds and changes in pension-cost accounting," said Mr van Houten. Philips currently employs about 116,000 people. Around 900 British jobs being axed by Direct Line in a two-year costcutting programme By Peter Campbell PUBLISHED: 21:07 GMT, 5 September 2012 | UPDATED: 21:16 GMT, 5 September 2012 Around 900 British jobs are being axed by Direct Line as the Churchill insurer embarks on a two-year cost-cutting programme. The group’s 13-year-old Teesside call centre will be mothballed with the loss of 500 posts, while each of the company’s 14 other UK offices have been told to expect redundancies. Direct Line, which is in the process of being offloaded by taxpayer-backed Royal Bank of Scotland, needs to make £100m of yearly cost savings by the end of 2014. Bosses at the group aim to streamline its operations and make the business more profitable ahead of a potential public listing, which could happen as early as next month. Yesterday’s announcement is the ‘first phase’ of the cuts, the group said. It is not known whether future stages will include further job losses. Direct Line, which has 15,000 staff, said that 891 employees had been put on notice. The majority are expected to be forced to leave the group after the 90-day consultation is completed. Chief executive Paul Geddes said: ‘We have not made these proposals lightly and fully understand the impact this will have on our people.’ Direct Line owns the Churchill, Green Flag, Privilege and NIG brands as well as its self-titled operation. RBS has been ordered by European regulators to sell the insurance group after being bailed out by the taxpayer during the financial crash. Earlier this week Direct Line reported that six-month pre-tax profit had dropped 43 per cent from £187.5m to £106.5m. Yesterday, Sheila’s Wheels insurer ‘esure’ reported that six- month operating profit had risen by 46 per cent to £60.2m. The group, which has more than 1.5m motor and home policies, said the amount it was paying out compared to the value of policies had fallen from 71.7 per cent to 70.4 per cent.