Objectives of Internal Control

advertisement

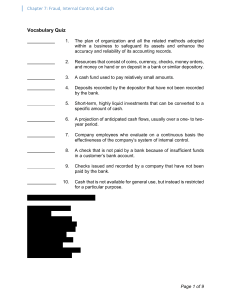

CASH Group 5 2-CFM Jigs Parco Niña Malagueño Mikael Agbayani Lance Rivera Internal Control Defined as the procedures and processes used by a company/firm to: Safeguard its assets Process information accurately through the Financial Statements Ensure compliance with laws and regulations to the (BIR, SEC, BSP and IC) Integrated Framework- The standard by which companies design, analyze and evaluate internal control Objectives of Internal Control- are used to provide reasonable assurance that: Assets are safeguarded and used for business purposes and strategies Business information is accurate Employees and managers comply with the laws and regulations of the company Elements of Internal Control Control Environment- the overall attitude of the management and employees about the importance of internal controls. This is the tone at the top which is a gauge on how the management is firm in implementing controls. This includes the following: Management’s Philosophy and operating style (Emphasis on Internal Controls) The company’s organizational structure (Planning and Controlling) The company’s personnel policies (hiring, training, evaluation, compensation and promotion) Risk Assessment- Identifying & Assessing risks and their impact on their organization Customer requirements, competitive threats, regulatory changes and changes in economic factors. Management should identify such risks, analyze their significance, assess their likelihood of occurring and take necessary actions to minize them. Credit risk- the risk that the borrower can’t pay off his/her financial obligations Control Procedures- provide reasonable assurance that business that business goals will be achieved, includes the prevention of fraud Competent personnel, rotating duties and mandatory vacations. 2. Separating responsibilities for related operations 3. Separating operations, custody of assets and accounting 4. Proofs and security measures Mechanisms/Practices/Procedures Address risks identified 1. Monitoring- used to locate weakness and improve controls. Monitoring often includes observing employee behavior and the accounting system for indicators of control problems Internal Auditor- responsible for day-to-day monitoring controls Warning Signs of Internal Control Problems (From People) 1. 2. 3. 4. 5. Abrupt change in lifestyle( without winning the lottery) Close relationships with the suppliers Refusing to take a vacation Frequent borrowing from other employees Excessive use of alcohol and drugs Warning Signs of Internal Control Problems (From the Accounting System) 1. 2. 3. 4. 5. Missing documents or gaps in transaction numbers (fraud transactions) Unusual increase in customer refunds Differences between daily cash receipts and bank deposits (could mean receipts are being pocketed before deposited) Sudden increase in slow payments Backlog in recording transactions (possibly an attempt to delay detection of fraud) Information and Communication Information about the control environment, risk assessments control procedures and monitoring is used by management for guiding operations and ensuring compliance with reporting, legal and regulatory requirements. Used to dissimilate information throughout the company Communication from top-level to the bottomlevel or vice versa Makes a firm a cohesive unit Management also uses external information to assess events Cash Includes coins, currency, checks and money orders, notes, bills Money on deposit with a deposit with a bank that is available for withdrawal Most liquid asset Most likely asset to be stolen or used improperly Can be On hand or In Bank Available for immediate and general use Internal Controls Related to Cash Segregation of Duties – Accounting/Recording Function or Cash Custodianship Voucher System– Disbursement Functions -Represented by a voucher- Legal documents that serves as proof of authority to pay cash or issue EFTs Electronic Funds Transfer --- Payments or Withdrawals Issuance of Official Receipts– Deposits to bank -made when cash is received Common Fraud Related to cash Kiting- Happens when someone has 2 or more bank account. Employed at the end of the month Lapping- Process of Theft. Wrong declaration of cash collections Window Processing- Applies also with Financial statements. Makes Financial statements appear better Cash Received from Sale Is an important control to protect cash received in over –the-counter sales is a cash register. The use of a cash register to control cash is shown: Cash Received in the Mail Cash is received in the mail when customers pay their bills. This is usually in the form of checks and money orders Cash Received by EFT Cash may be also be received from customers through electronic funds transfer (EFT). Electronic funds transfer (EFT) is the electronic exchange, transfer of money from one account to another, either within a single financial institution or across multiple institutions, through computerbased systems. Bank Reconciliation Comparison of: Two independently maintained records of a business’s cash Differences between the two records generally arise because of timing differences. The company’s Cash account (T-Account, the book balance) The bank statement Deposits were made but after the bank statement was printed and mailed. Checks were written but have not cleared the bank when the bank statement was printed mailed. Reconciliations ensure that the two records agree. Bank Reconciliation Items for reconciliation: Items RECORDED by the company but not yet recorded by the bank: Deposits in transit Outstanding checks Bank Reconciliation Items for reconciliation: Items recorded by the bank BUT NOT YET recorded by the company. Bank collections Electronic funds transfers deposits received directly by the bank from customers Both payments and deposits Service charges and the cost of printed checks Interest revenue earned on checking account Errors by the company or the bank Bank Reconciliation The adjusted bank balance must equal the adjusted books balance Book Balance = Ending Cash Account This is how we ensure Control over Cash Reconciling Items Bank Balance Add deposits in transit Subtract outstanding checks Add or subtract corrections of bank errors, as appropriate Book Balance Add bank collection items, interest revenue, and EFT receipts Add or subtract corrections of book errors, as appropriate. CASH EQUIVALENT Cash equivalents are investments that can be readily converted to cash. Common examples of cash equivalents include commercial paper, treasury bills, short term government bonds, marketable securities, and money market holdings. An item should satisfy the following criteria to qualify for cash equivalent. The investment should be short term. They should mature in less than three months. If they mature in more than three months they will be classified as other investments. They should be highly liquid. This means that they should be easily sold in the market. The buyers of these investments should be easily available. They should be convertible to known amounts of cash. This means that their market price should be available and this market price should not be subject to significant fluctuations. They should not be too risky. There should be very little risk of changes in their value. This means that equity shares cannot be classified as cash equivalents. But preferred shares purchased shortly before the redemption date can be classified as cash equivalents. Examples Treasury bills: These items are debt instruments the U.S. Department of Treasury issues that mature in less than one year. Commercial paper: This term refers to notes receivable with no collateral to back up the debt. Commercial paper has a maturity date of less than 270 days. Money market funds: Money market accounts are similar to checking accounts, except they generally pay a higher interest rate on deposited funds than regular checking. However, they also usually require maintaining minimum balances. CASH DISBURSEMENT Cash outflow or payment of money to settle obligations such as operating expenses, interest payments for loans and accounts receivables during a particular order to carry out business activities. Cash disbursement is a process by which a business pays out money to a person or organization typically related to operating expenses for that business. While the name implies this type of payment is made out in cash, which is possible, it is common for payments to be made as checks or credit transactions. Forms of Cash Disbursement Cash Plastic Money Check Warrants Electronic Fund Transfer Petty Cash Fund Petty cash is a small amount of discretionary funds in the form of cash used for expenditures where it is not sensible to make any disbursement by check, because of the inconvenience and costs of writing, signing and then cashing the check. As expenditures are made, the custodian of the fund will reimburse employees and receive a petty cash voucher with a receipt/invoice attached in return. At any given time the total of cash on hand plus reimbursed vouchers must equal the original fund. Resources http://www.readyratios.com/reference/a ccounting/cash_and_cash_equivalents.ht ml http://www.wisegeek.com/what-is-cashdisbursement.htm http://en.wikipedia.org/wiki/Petty_cash http://www.cliffsnotes.com/moresubjects/accounting/accountingprinciples-i/cash/the-petty-cash-fund Resources Accounting Principles Using Excels for Succes Author: James Reeve, Johan Duchac, Carl Warren Financial Accounting Volume one 2013 edition Author: Conrado Valix, Jose Peralta, Christian Aris Valix